Grayscale's legal victory paves way for Spot Bitcoin ETF approval 💸; FinTech M&A is accelerating: 2 deals in 1 day 🤑; JPMorgan aims to tap into one of the world's largest retail banking markets 🏦

FinTech is Eating the World, 31 August

Hey Everyone,

Happy Thursday! Today’s issue is really hot as we’re looking at Grayscale's legal victory that paves the way for Spot Bitcoin ETF approval (it’s a huge win with huge implications), European FinTech M&A that’s accelerating (it’s the best time for cash-rich FinTechs, so bonus is M&A resources to nail the deals), and JPMorgan that increases stake in Brazil’s C6 (it aims to tap into the lucrative LatAm market + some deeper dives into Microsoft of Banking). Let’s jump straight into the spicy stuff 🌶

HUGE Win: Grayscale's legal victory paves way for Spot Bitcoin ETF approval 💸

The news🔥 Asset manager Grayscale Investments has emerged victorious in its lawsuit against the U.S. Securities and Exchange Commission (SEC).

Grayscale’s legal victory regarding the conversion of the Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin exchange-traded fund (ETF) is a monumental development for the cryptocurrency industry.

Let’s take a look.

More on this 👉 In a unanimous ruling, the U.S. Court of Appeals ordered the SEC to review and explain its previous rejection of Grayscale's ETF application. The court stated the SEC failed to adequately justify why it approved bitcoin futures ETFs but denied Grayscale's spot bitcoin ETF given the similarities between the two.

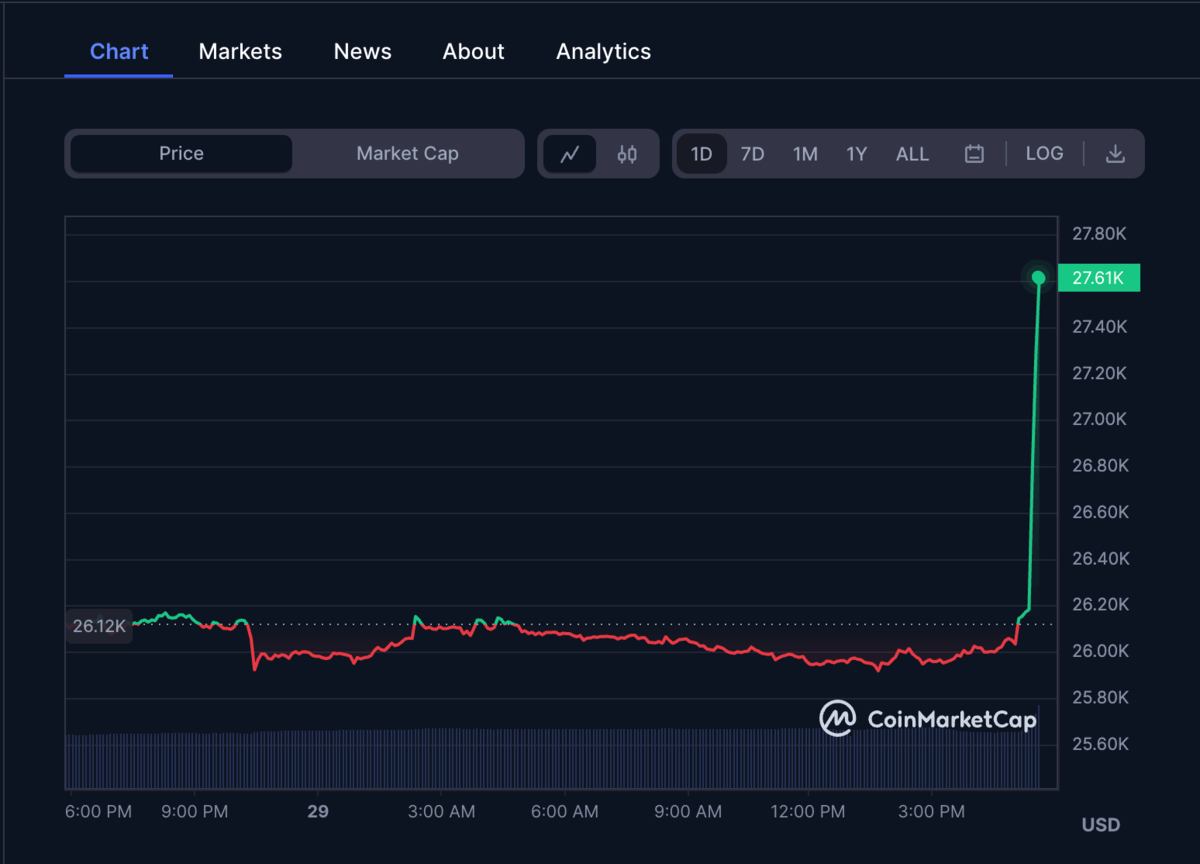

Following the positive news of Grayscale's lawsuit victory, Bitcoin experienced a surge in price. BTC jumped immediately from $26.2k to $27.5k.

✈️ THE TAKEAWAY

BIG win with BIG implications 👀 This is a precedent-setting ruling that opens the door for the likely approval of not only GBTC's conversion to an ETF but also other spot bitcoin ETF applications by major financial institutions like Fidelity FNF 0.00%↑and BlackRock BLK 0.00%↑. The elimination of GBTC's discount could pour billions into Bitcoin and validate it as a mature investable asset class. Zooming out, this also means greater mainstream adoption, less volatility, and more regulatory clarity for cryptocurrencies. ETF approval may also influence the SEC to become more accommodating toward other crypto-based investment vehicles. This favorable ruling affirms the maturation of Bitcoin as an investable asset. Bullish.

ICYMI: BlackRock’s Bitcoin ETF: a game-changer or just hype? 🤔

More Big names follow BlackRock in filing for a Bitcoin ETF 👀