Revolut launches Swift “challenger” RevTag. Here’s why the disruption is unlikely here 🫤; Lunar doubles revenue in 2023, eyes profitability 👀; Bank branches in the age of digital banking 🏦

FinTech is Eating the World, 19 September

Hey Everyone,

Happy Tuesday! Today we’re looking at Revolut which just launched Swift “challenger” RevTag (why the disruption is unlikely here + more bonus reads on Revolut), Lunar that doubled revenue in 2023 and eyes profitability (so M&A with Monzo is unlikely now?), and bank branches in the age of digital banking (what’s going to change and where to focus?). Let’s jump straight into the good stuff 🌶

Revolut launches Swift “challenger” RevTag. Here’s why the disruption is unlikely here 🫤

The news 🗞️ London-based FinTech heavyweight Revolut just announced the launch of RevTags, a new payments feature aimed at facilitating fast and free cross-border transactions for business customers.

The new feature aims to challenge Swift in cross-border payments.

I believe it will fail to achieve anything even close to meaningful, so let’s take a look.

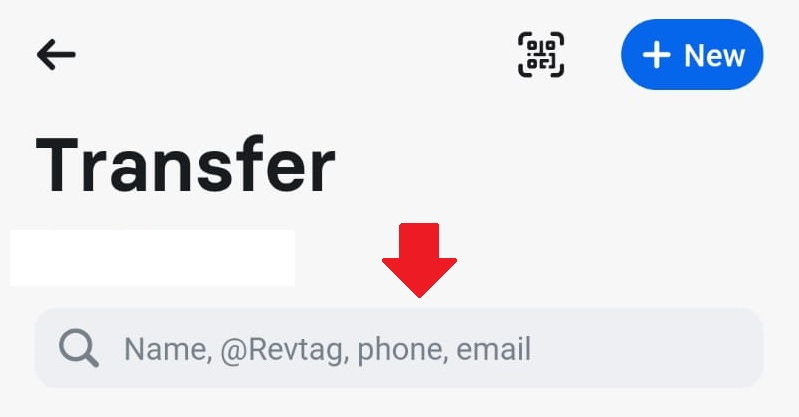

More on this 👉 With RevTags, Revolut users can make international payments by entering a unique RevTag identifier instead of account details like IBANs.

The feature is free and provides businesses with the ability to pay employees and contractors in over 150 countries and regions around the world. It will be immediately available to Revolut Business customers worldwide.

Revolut reports customers will be able to send and receive instant zero-fee cross-border payments in over 29 currencies within the Revolut network, which includes more than 30 million retail users and thousands of businesses around the world.

Zoom out 🔎 In other words, Revolut just opened up its ecosystem beyond P2P use and now calls it a Swift disruptor.

I get the marketing and PR angle here but beyond quick clicks, this is kinda laughable… Here’s why:

✈️ THE TAKEAWAY

What this maens? 🤔 Revolut can frame RevTags as a challenger to the dominant cross-border network SWIFT, but it’s highly unlikely it will make any difference in the global payments infrastructure. SWIFT remains the primary network connecting over 11,000 financial institutions across 200 countries. This probably equals a ~billion(s) customers and enormous amounts of businesses. In contrast, Revolut's network consists mainly of its 30 million retail users and still lacks major institutional adoption. Also, as per Revolut's own survey, high costs and slow processing times are pain points for businesses making international transfers. However, SWIFT already offers various fast payment solutions and plans to expand instant cross-border transfers more broadly (remember: it has just partnered with Wise. And that’s what will really change the game). Hence, Revolut matching SWIFT's speed is therefore not a key competitive advantage. Additionally, Revolut's zero-fee structure for RevTags payments may not be sustainable long-term if transaction volumes increase substantially. The neobank aka Super App would likely have to introduce fees to cover compliance, FX, and other costs at scale. SWIFT's volume-based pricing could ultimately prove more viable. All in all, Revolut has a long way to go before truly challenging the dominance of SWIFT for global business payments. The network effects and entrenched partnerships powering SWIFT are nearly impossible for challengers like Revolut to overcome without major banking relationships. So, if I were Revolut, I would leave SWIFT to control the cross-border infrastructure underpinning global finance while I would focus on how to get my house in order.

ICYMI: Revolut is yet to file a formal US banking license application 😬🇺🇸 [the bad & the ugly + more bonus reads]