Finally: Revolut's path to a UK Banking License likely clears 🇬🇧📱; Crypto fundraising hits new lows 📉😔; Another FinTech M&A: Shift4 acquires SpotOn unit for $100M 💸

FinTech is Eating the World, 6 October

Hey Everyone,

TGIF! Today’s issue is the best one this week as we’re going to look at Revolut which finally has a clearer path to a UK Banking License (why this is a big deal + what’s next), crypto fundraising hitting new lows (a look at the latest data + startup resources to get you funded in no time), and yet another FinTech M&A as Shift4 acquires SpotOn unit for $100M (what it’s all about + M&A resources as a bonus). Let’s jump straight into the hot stuff 🌶

Finally: Revolut's path to a UK Banking License likely clears 🇬🇧📱

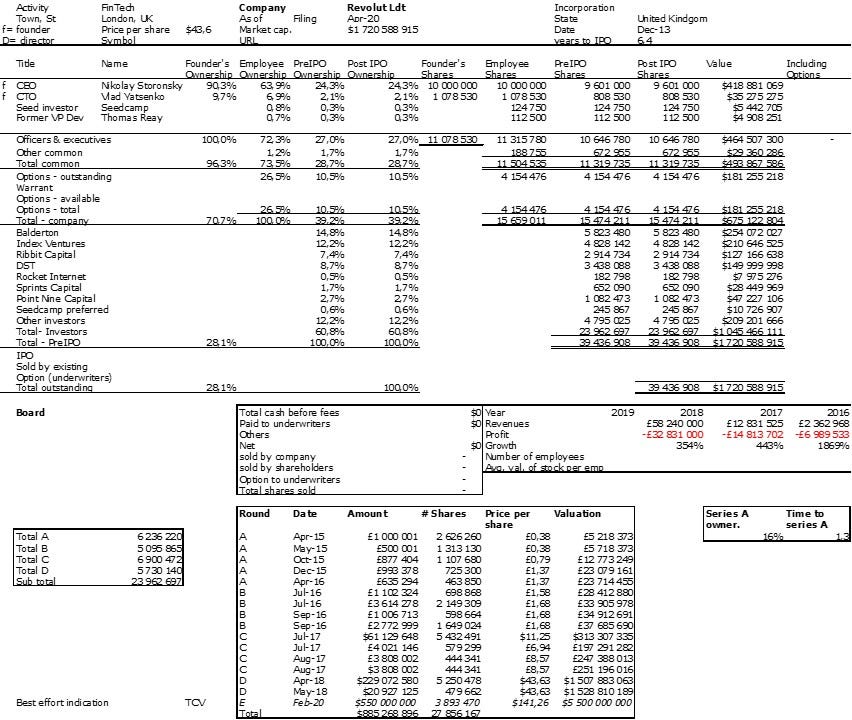

The news 🗞️ London-based FinTech giant Revolut has moved one step closer to obtaining a long-sought UK banking license after reaching an agreement with key investor SoftBank to simplify its shareholder structure.

This is a big and strong move for Revolut, so let’s take a look.

More on this 👉 The Bank of England has made streamlining Revolut's complex ownership a precondition for granting a full UK banking license, which the company first applied for in early 2021. We can remember that Revolut currently operates in Britain under an EU banking license from Lithuania (this is where they originally started as a bank - first a specialized one and then transitioned to a proper one).

According to reports, the stumbling block has been Revolut's largest backer, SoftBank, which has resisted giving up preferential rights attached to its stake without significant compensation. After months of talks, the two sides have now struck a deal that will see SoftBank's shares converted into a single class along with other investors, removing a key obstacle.

The agreement does not involve any new share issuance to SoftBank nor has a financial impact on Revolut, indicating the Japanese investment giant will not receive special treatment.

Other major Revolut shareholders, including Tiger Global Management, Ribbit Capital, and Balderton Capital, have reportedly already agreed to the share conversion or are in final discussions.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, gaining a UK banking license would allow Revolut to provide the full suite of services offered by traditional banks, including overdraft protections, personal loans, and deposit accounts (aka new revenue streams). It would thus represent a major step in Revolut's maturation since its 2015 founding and allow it to better compete with incumbent banks on its home turf. However, Revolut still faces lingering questions about its financial reporting and compliance procedures. Earlier this year, auditor BDO raised red flags related to Revolut's 2021 accounts. Revolut also recently drew scrutiny from regulators over money released from accounts flagged as suspicious. It doesn’t look good…

ICYMI: Red Flags at Revolut: FCA investigates suspicious account activity 🚩🚩 [what FCA investigation of suspicious account activity is all about + more bonus reads]

On top of that, we must also mention that the approval process for a UK banking license requires sign-off from both the Bank of England's Prudential Regulation Authority and the Financial Conduct Authority (FCA). The lengthy procedure and ongoing questions hanging over Revolut suggest licensing approval may still be months away. Looking at the big picture, securing a UK banking license would definitely boost Revolut's reputation and credibility as it continues rapid expansion across Europe. Also, by being a bank in the UK, Revolut could finally proceed with the long-awaited US bank charter. But similar to Monzo, I just cannot see how they could win in the States…

ICYMI [+ lots and lots of bonus reads]: