The bumpy road ahead for Revolut's global ambitions 🌍; Travel spending still soaring for Visa & Mastercard despite economic uncertainty 💳; Digital assets see the largest inflows in over a year 😳

FinTech is Eating the World, 31 October

Hey Everyone,

Happy Wednesday! Due to a very spooky Halloween, yesterday’s issue has to come out today 🎃 But don’t worry - it’s extra interesting as today we’re looking at the bumpy road ahead for Revolut's global ambitions (holistic view at Revolut’s strategy and moves thus far + lots of bonus reads & deep dives), travel spending which is still soaring for Visa & Mastercard (a brief look at their latest earnings + some solid deep dives), and digital assets that saw the largest inflows in over a year (exciting times ahead?). Let’s jump straight into the fascinating stuff 🌶

The bumpy road ahead for Revolut's global ambitions 🌍

The struggles 👀 Revolut, the digital banking juggernaut, faces mounting scrutiny from investors and regulators that threatens to derail its global expansion plans.

The London-based FinTech has struggled to obtain regulatory approval for a full UK banking license, raising concerns about its financial reporting and compliance standards.

Let’s take a brief yet holistic view of where Revolut is now and what’s next for them.

More on this 👉 Revolut's 2021 financial statements arrived months late and contained qualifications from its auditor about the accuracy of its revenues. That’s never good.

ICYMI: Revolut revenue drama 🎭 [a deeper dive into the numbers]

This in turn sparked unease among investors like Molten Ventures, which wrote down the value of its stake by 40% this year. Other VCs later joined the pack too.

ICYMI: More investors wipe 40% off Revolut valuation 😳 [& why there’s no way Revolut’s worth $33B now + a few more deeper dives into the FinTech giant]

On top of that, the company also admitted delays to its 2022 results, further eroding trust. Unsurprisingly, regulators are now said to be disappointed (if that’s the right word to use here) by Revolut's dismissive stance on the accounts issue.

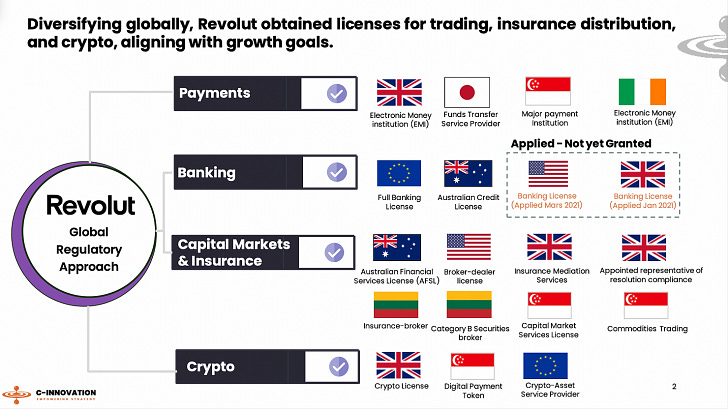

Licensing 🏦 The company's global licensing strategy, which differs from competitors like Nubank's targeted approach, has added even more complexity.

Progress in Australia remains opaque, while Revolut's application for a US charter turned out to be merely a draft. This perceived lack of transparency about its expansion plans has left regulators wanting more clarity and commitment. At the end of the day, it’s getting very unclear as to what Revolut is trying to achieve in the first place…

ICYMI: Revolut is yet to file a formal US banking license application 😬🇺🇸

Super App play 📲 Then there’s the Super App Play. Revolut's rapid growth and ambitions for becoming a leading Super App globally have complicated its path toward compliance across diverse regulatory regimes.

Because the more you do, the more questions the regulators are going to ask. And compliance is non-negotiable in post-Wirecard days.

On top of that, frequent senior staff departures have also concerned regulators assessing its stability (or the lack of thereof). Its board reportedly lacks adequate banking and technology expertise to challenge management, prompting calls for an expanded board.

ICYMI: Tell me Revolut is in trouble without telling me Revolut is in trouble 😨

✈️ THE TAKEAWAY

So what’s next? 🤔 One BIG thing Revolut has managed to resolve recently is its shareholder issues with Softbank. Nevertheless, while this is a strong step forward, major hurdles remain. In essence, restoring investor confidence and satisfying regulators' demands for robust controls, governance, and transparency will determine the viability of its global aspirations. Of course, that won’t be easy. Zooming out, we can once again stress that securing the UK license is pivotal for growth in its home market and later on in the US (though the latter seems very questionable). Hence, Revolut currently faces a very bumpy road ahead, but its ability to steer through the pending storms and navigate challenges will ultimately shape its future as a global FinTech leader. And it sure can become one.

ICYMI: Grab’s slowing growth and brutal layoffs reflect Super App challenges 🫣 [this is relevant to all Super Apps + a bonus deep dive into Apple as potentially the first Super App of the West]