Nubank continues strong growth and profitability momentum 🚀; Why did Google cut its remaining stake in Robinhood? 🤔; Adyen launches Capital 💸

FinTech is Eating the World, 16 October

Hey Everyone,

Happy Thursday! Today’s issue is especially interesting as we’re looking at Nubank that continues strong growth and profitability momentum (a closer look at their latest numbers, what’s driving crazy revenues + more bonus reads & deep dives), questioning why Google cut its remaining stake in Robinhood (what’s happening with their biz now + some contrarian takes under the hood), and Adyen that just launched Capital (why it matters + some solid deep dives into the FinTech giant). Let’s jump straight into the fascinating stuff 🌶

Nubank continues strong growth and profitability momentum 🚀

Earnings call 📞 Brazil's FinTech gem Nubank NU 0.00%↑ reported their 3Q 2023 earnings this week. LatAm’s financial powerhouse backed by Warren Buffett's Berkshire Hathaway absolutely crushed them!

The growth and numbers NU is showing makes it the best-run digital bank ever 😳

Let’s take a look.

More on this 👉 Here are the key numbers you must know:

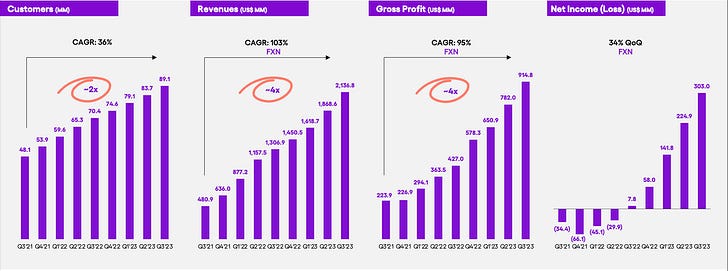

👥 89.1 million customers (+27% Year-over-Year)

🇧🇷 51% of the adult population of Brazil now uses Nubank

🇧🇷 It's now the 5th largest financial institution in Latin America

🇲🇽 In Mexico, Nu’s customer base grew to 4.3 million

🇨🇴 In Colombia, Nu now counts ~800,000 customers

💰 $19.1 billion worth of deposits (+26% YoY)

💸 $2.1 billion in revenues (+53% YoY)

🤑 $303 million in profit (they lost $29.9M in Q2 2022)

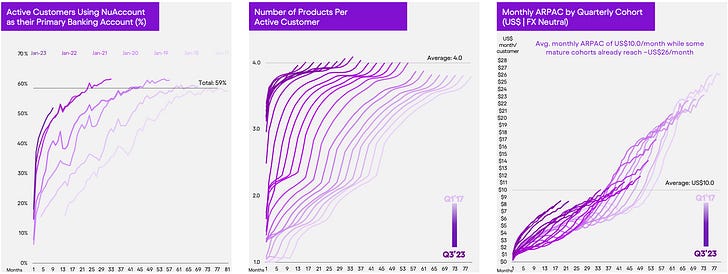

What's even more impressive is that their average customer is now using 4 products 😳

Cross-selling is how you generate high LTVs per customer in FinTech, and NU is cross-selling multiple products like nobody else in the market.

So, in addition to 38.9 million credit cards and ~64.7 million bank accounts, NU now has:

💳 7.3 million personal loans

🛡 1.2 million insurance policies

📈 12.4 million investment customers

📊 10.5 million NuCoin customers (launched just in March 2023)

But here comes the crazy part.

80-90% of Nubank's customers are acquired organically through word-of-mouth or unpaid referrals. That's the power of a brand coupled with amazing user experience.

ICYMI: Customer Intelligence Template💡 [use this to engage with your customers more effectively 👥]

Show me the money 🤑 Taking all the above into account, then comes a natural question - what's the key driver of Nubank's revenue?

The answer is both simple and not.

At the surface of it, it’s the increase in monthly revenue per active customer (ARPAC). It grew by an 18% increase in monthly ARPAC to $10.

The increase in ARPAC is thus attributed to:

More active and primary banking account customers compared to a year ago

These customers using a larger and more profitable set of financial products

The compounding effect of more engagement and cross-selling driving ARPAC expansion

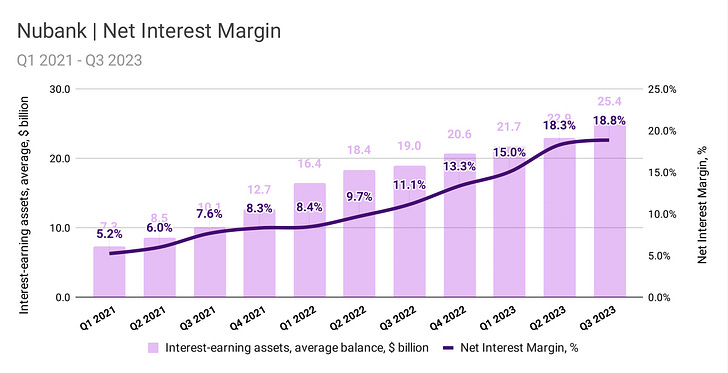

But much more important is Nubank's Net Interest Income (NII) which reached $1.2 billion in Q3 2023, up 111% year-over-year on an FX-neutral basis.

The growth in NII was driven by:

Expansion of the credit card and personal loan portfolios - these grew 46% and 48% respectively year-over-year on an FX-neutral basis.

Increasing the mix of interest-earning installment balances within credit cards to 21% of the total card portfolio. This is up from 10% a year ago.

Improved portfolio yields from things like higher origination yields on personal loans.

The stable cost of funding around 80% of the Brazil CDI rate.

In other words, the higher interest-earning balances and yields are expanding Net Interest Margin, which helps drive NII growth. And NII makes up the majority (~81%) of Nubank's total revenues. Solid.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that seeing this level of growth in a 10-year-old company while maintaining solid profitability and growing customer engagement is just phenomenal. Secondly, Nubank’s NIM (which helps drive NII growth) is what European and US banks can only dream about. And with that, I must only repeat that Nubank is not only one of the best digital banks in the world. It's one of the best-run FinTechs ever. Super bullish.

ICYMI: A path towards $100B FinTech Giant: Nubank applies for a banking license in Mexico 🇲🇽🏦 [why this is a huge step towards building a $100B FinTech goliath + a deeper dive into NU & dLocal]

Disclaimer: this isn’t investment advice and I’m a shareholder of Nu.