Orange bets on Africa with new Super App "Max It" 🟠📲; HSBC doubles down on Embedded Finance 💸; Crypto-corns stumble after FTX Fallout 🌽

FinTech is Eating the World, 28 October

Hey Everyone,

Happy Tuesday! Today we’re going to look at Orange which is betting on Africa with a new Super App (why it matters & could be BIG + more bonus reads on Africa, the Next BIG Thing), HSBC which is doubling down on Embedded Finance (why it makes sense + a bonus reminder that the future of finance is embedded), and crypto-corns stumbling after FTX fallout (what’s happening + some solid bonus dives). Let’s jump straight into the intriguing stuff 🌶

Orange bets on Africa with new Super App "Max It" 🟠📲

The launch 🚀 French telecom giant Orange is making a bold bet on Africa and the Middle East with the launch of its new super app Max It, which brings together telecom, financial, and e-commerce services in one platform. Classical super app with a rather odd name…

The company aims to sign up 45 million active users by 2025 - more than double its current 22 million daily app users. That’s pretty ambitious…

Let’s take a look at this and see why it could be BIH.

More on this 👉 Unveiled this month, Max It consolidates Orange's previous My Orange and Orange Money apps into a single interface. Users can manage their mobile accounts, send money locally and abroad via Orange Money, and access digital content ranging from online games to news and videos.

It also offers e-ticketing for concerts and transportation.

The roll-out 📱 The app launches first in Cameroon, Senegal, Mali, Burkina Faso, and Botswana before rolling out across Orange's entire African and Middle Eastern footprint. Localized versions will cater to country-specific needs and preferences.

Driving adoption is the rising smartphone and mobile internet penetration in the region. With over 60% of subscribers expected to use smartphones by 2025, Orange is leveraging its strong existing customer base and brand recognition.

An open platform strategy also allows the integration of third-party local and global services over time.

✈️ THE TAKEAWAY

What’s next? 🤔 If successful, Max It could increase consumer spend and loyalty for Orange while reinforcing its image as a digital innovator. This in turn should drive revenues and further strengthen Orange’s already solid numbers in the Middle East & Africa:

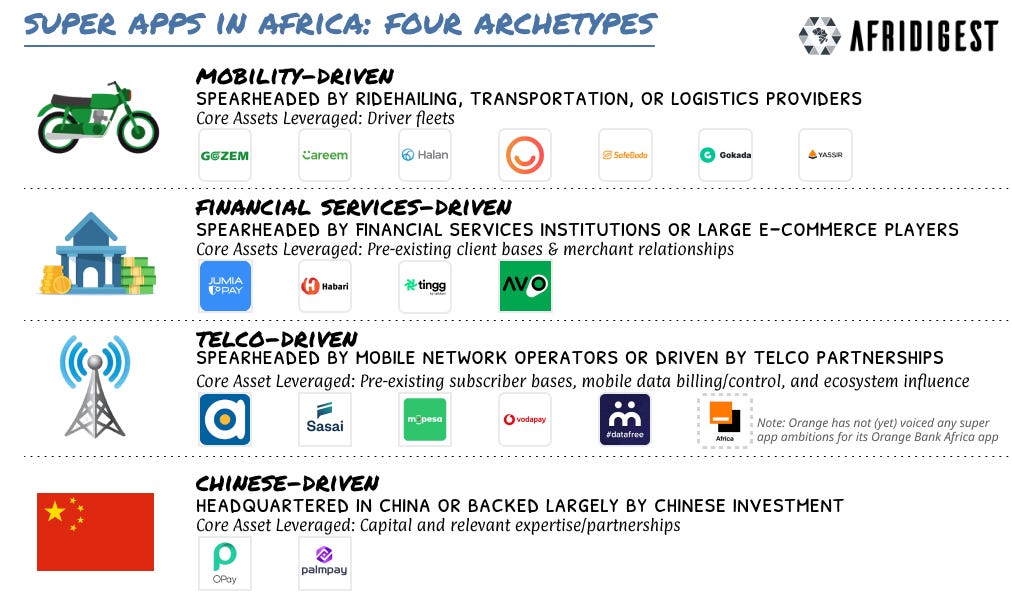

Different than in the US or Europe, the super app model - already popularized by WeChat in China - appears to be well suited to the mobile-first population of Africa and the Middle East.

More importantly, seamless mobile financial services within Max It could boost financial inclusion and cashless transactions for the large unbanked and underbanked population across emerging markets (especially in Africa). This thus represents a significant revenue opportunity in payments and transfers alone and probably explains why Orange took this move in the first place. Looking at the big picture, Max It might even evolve into a marketplace for Orange and partners to sell all kinds of digital services and products across MEA. Given how massive the TAM is, it might end up as a pretty big deal.. But for now, hitting the ambitious user target could cement Orange's pole position in Africa's rapidly growing digital economy.

ICYMI: Africa rising: Mastercard buys minority stake in MTN’s FinTech biz 💸

Visa knows that Africa is the world's next superpower. You should pay attention too💡 [+ more bonus reads]