Ramp is ramping up M&A: acquires AI Startup to expand further into procurement 💸; Regional banks' struggles open door for FinTech partnerships 🏦; Coatue cuts 2023 deal count 82% from 2021 high 👀

FinTech is Eating the World, 30 January

Hey Everyone,

TGIF! It was a solid week and we’re ending it strong as today we’re looking at Ramp that’s ramping up M&A as it acquires AI Startup (what does this mean, how Ramp is dominating + some deeper dives), regional banks' struggling (yet this is opening door for FinTech partnerships + a deeper dive into the Microsoft of Banking), and Coatue that cuts 2023 deal count 82% from 2021 high (what does this tell us?). Let’s jump straight into the valuable stuff 🌶

Ramp is ramping up M&A: acquires AI Startup to expand further into procurement 💸

The deal 🤝 Finance automation startup Ramp is aggressively expanding its product suite through mergers & acquisitions (M&A).

After two previous purchases aimed at improving customer support and negotiated savings, Ramp has just acquired Venue, an AI-powered procurement platform founded in 2022.

Let’s take a look and see why it matters.

More on this 👉 While financial details were not disclosed, the deal gives Ramp procurement capabilities to add to its existing offerings of corporate cards, expense management, accounts payable automation, and business travel.

Venue specifically helps companies manage vendor relationships and costs - an area ripe for AI implementation to eliminate inefficiencies.

The crazy part? The company sold itself less than 2 years after launching and before even needing to raise a Series A round 🤯 The remarkably fast exit reinforces Venue's ability to solve real pain points and build products people actively want to use. Bravo.

The traction 📈 The acquisition comes on the heels of Ramp launching improved procurement features such as bi-directional contract integration, dynamic intake forms, enhanced purchase orders, collaboration tools, and spend analytics.

With Venue's founding team leading Ramp's new procurement unit, the company aims to further automate workflows like custom approval workflows and PO management.

And even without it Ramp already processes over $10 billion in annualized accounts payable spend, which marks a 10x increase in two years 🤯 Ramp states its goal is to become a "one-stop-shop" for financial operations software.

With Venue under its umbrella, the FinTech giant is definitely one step closer to that.

✈️ THE TAKEAWAY

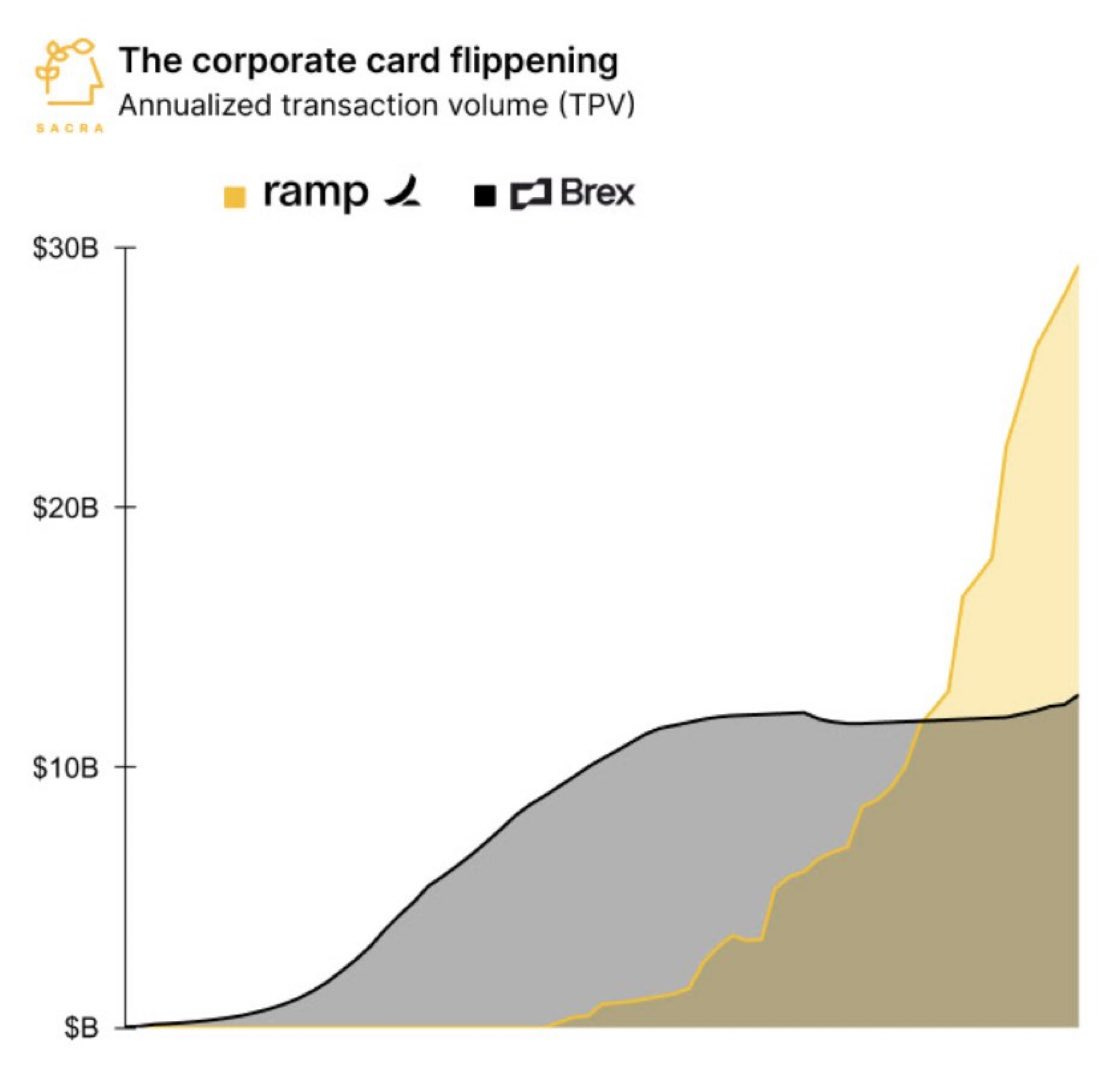

Looking ahead 👀 On a macro level, the procurement enhancements and Venue acquisition indicate Ramp's desire to compete with incumbents in the space such as Coupa and Concur. Additionally, the company's continued investment in AI and automation points to a future where technology eliminates tedious back-office tasks. If successful, Ramp would significantly disrupt legacy providers and potentially emerge as the financial OS for modern businesses. Finally, although this is 100% a payments play, it well coincided with what I wrote about last week about FinTech M&As - incumbents and well-capitalized startups are eager to snap up niche, unique technologies, and talent. On a micro level, this yet again widens the gap between Ramp and Brex:

ICYMI: Once a FinTech darling, Brex lays off 20% as growth slows & burn rate remains high 😳 [uncovering all the details to see what this tells us about the future of Brex & the broader FinTech ecosystem]

The payments industry faces a pivotal year amid tighter funding and more M&A 💸 [tighter funding & more M&A on the horizon, where the focus should be + some bonus reads]