Monzo Magic: UK challenger bank reaches 9M customer milestone 🪄; Ripple is playing the long game: acquires crypto custody provider in the US 🤝💸; Plaid appoints first president as it eyes IPO 🔔

FinTech is Eating the World, 14 February

Hey Everyone,

Good morning! Although I’m still fighting with my schedule, today’s issue is definitely worth the wait. We are going to look at the Monzo Magic (how Monzo hit the 9M customer milestone & what’s next + lots of deep dives & bonus reads about this FinTech gem); Ripple that’s playing the long game (recent M&A & why it makes sense + more reads), and Plaid that recently appointed its first president as it eyes IPO (it’s about time + more dives into Plaid & some priceless IPO resources). Let’s jump straight into the captivating stuff 🌶

Monzo Magic: UK challenger bank reaches 9 million customer milestone 🪄

Achievement unlocked 🏆 Digital bank Monzo has just crossed the landmark of 9 million personal UK current account customers, cementing its position as the country's largest challenger bank.

The crazy part? Two million customers (!) joined just last year, with growth largely attributed to word-of-mouth 🤯

Let’s take a look and see what’s next for Monzo.

More on this 👉 This exponential increase now makes Monzo the 7th largest retail bank in the UK by customers. With 1 in 7 UK adults and 1 in 16 businesses choosing Monzo, it continues to disrupt the traditional banking space.

ICYMI: Monzo is on track to be the most downloaded UK banking app in 2024 🇬🇧🚀

The mobile-only bank is loved by millennials for its innovative features like real-time spending notifications, easy money management, and products like its pay-over-time credit service Flex, among other things.

CEO TS Anil described the 9 million figure as a "testament to the magic of Monzo and the customer-centricity that is part of our DNA."

Indeed, the bank's customer obsession and clever targeting of digitally-native youth has fueled impressive organic growth. Something that other neobanks should take as a case study.

Future growth 🚀 While deposits have lagged behind customer sign-ups, Monzo hopes to expand its product suite to drive engagement. It now offers investments, savings accounts, and business banking, and will likely venture into insurance soon.

ICYMI: The foray into wealth is finally here: Monzo launches investments 💸 [a deeper dive unpacking this pivotal move for Monzo + more bonus reads]

Combined with strong customer retention rates and its loyal Gen Z user base coming of financial age, Monzo seems poised for even faster growth.

The profitable future looks promising too. Despite years of losses, Monzo is expecting to finally achieve profitability in 2024 due to surging income. Last year, it reported £214.5 million in revenue, even though it still posted a £116 million overall loss.

ICYMI: Monzo hits monthly profitability for the first time ever 🥳

✈️ THE TAKEAWAY

Looking ahead 👀 With game-changing disruption and current momentum, Monzo’s “magic” may well make it a front-runner to become a top 5 UK bank. Rival Starling Bank also boasts a strong following, but at 3.6 million customers, is still playing catch-up. As customer trust in digital finance soars, Monzo looks set to continue winning market share from risk-averse traditional banks. Its genius has been making complex money management simple and intuitive. And with more digital-first innovations in the pipeline, the neo-bank shows no signs of stopping. Looking at the big picture, the key next milestone will be converting its wildly popular platform into a profitable and sustainable business model. If achieved, Monzo would demonstrate that modern mobile finance can compete head-on with centuries-old banks - all while keeping the customer truly at the heart.

ICYMI: Monzo’s second attempt to conquer US: here’s why the British neobank is more likely to fail than succeed 🇺🇸🏦 [a deep dive with lots of bonus reads]

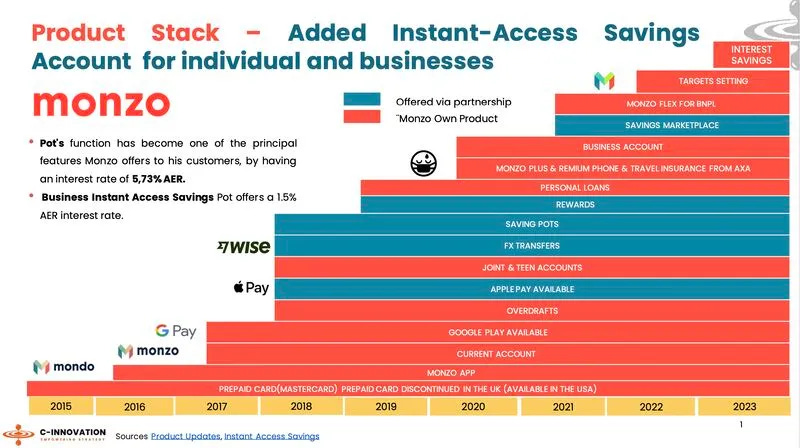

The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀