Monzo's 'Flex' Card captures 20% of UK's BNPL market 😳; Franklin Templeton enables peer-to-peer transfers for tokenized treasury fund 💸; Regional banks face profitability challenges 🏦

FinTech is Eating the World, 26 April

Hey Everyone,

Good morning & happy weekend! Another fascinating FinTech week is about to end, so let’s make sure we’re getting the most from it 💪😎 On today’s radar we have Monzo Flex that’s taking the UK's BNPL market by storm (what it’s all about & why it matters + some bonus deep dives into Monzo), Franklin Templeton that now enables peer-to-peer transfers for tokenized treasury fund (why it’s a significant move for the digital asset ecosystem + more bonus reads), and regional banks facing profitability challenges (a look at the status quo & what’s next + some more reads inside). Let’s jump straight into the important stuff 🌶

Monzo's 'Flex' Card captures 20% of UK's BNPL market 😳

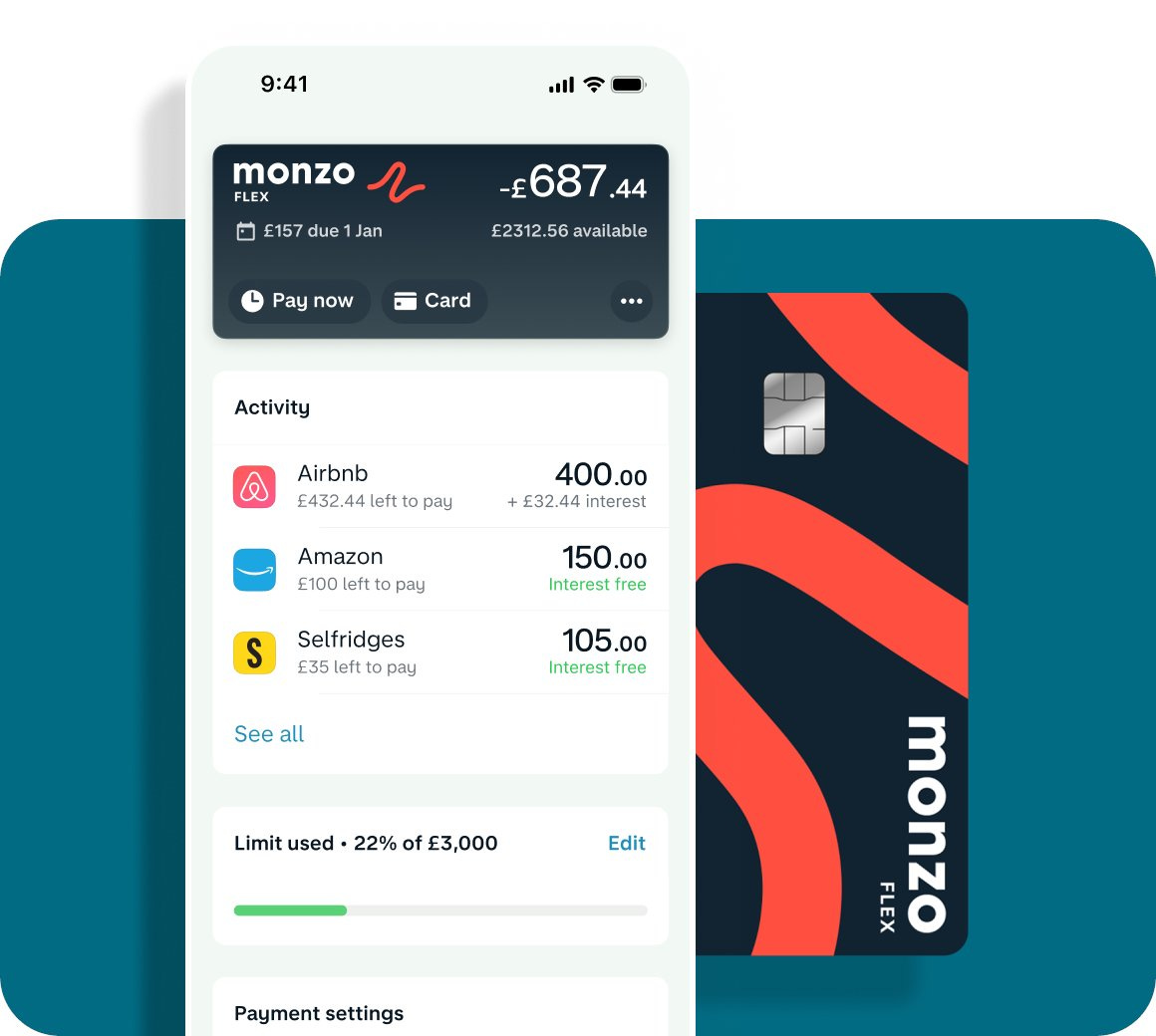

The news 🗞️ London-based FinTech gem Monzo has made significant strides in the UK's Buy Now, Pay Later (BNPL) market with its Flex credit card. Launched in late 2021, the card allows customers to spread the cost of purchases over three months interest-free.

According to research by credit technology company Render, Monzo's Flex card has helped the company capture a 20% stake in the BNPL market in just one year. That’s solid! 👏

Let’s take a quick look at this and see why it matters.

More on this 👉 While Monzo conducts affordability checks and offers credit limits of up to £3,000 when users sign up for Flex, the study also found that BNPL transactions do not consistently appear on credit histories. Over half of the customers analyzed who were known to use BNPL did not have it reported on their credit reports. This raises concerns about the accuracy of customer indebtedness assessments and the potential for debt accumulation.

The Render Report also revealed that the average BNPL transaction count has increased across all age groups, indicating a shift towards funding more routine expenses rather than large single-ticket items.

Monzo maintains the stance that Flex is a fully regulated credit card product, with customers undergoing comprehensive credit and affordability checks that are reported to credit providers. The company also highlights the transparency and flexibility it offers customers regarding repayments, without charging late or hidden fees.

✈️ THE TAKEAWAY

What’s next? 🤔 First, let’s zoom out. The popularity of BNPL products has surged since the start of the pandemic, with an estimated 14 million adults in the UK using these products in 2023. That’s huge! The Financial Conduct Authority (FCA) research found that regular BNPL users were more likely to have missed payments on bills or credit commitments and to have increased their debt on credit products over the past year. Having said that, as BNPL continues to grow, it is crucial to strike a balance between providing valuable benefits to consumers and ensuring adequate protections, especially for vulnerable individuals. Regulators and industry stakeholders must thus collaborate to establish clear guidelines and standards for BNPL products. This may include mandating the reporting of BNPL transactions to credit agencies, enhancing affordability assessments, and promoting financial education to help consumers make informed decisions. Because BNPL is here to stay.

ICYMI: Monzo's fresh $5 billion valuation and ambitious yet questionable US expansion plans 💰🇺🇸 [a recap of the current status, future plans + a deep dive into why Monzo is unlikely to succeed in the US]