Game-changer: Revolut finally receives its long-awaited UK banking license 😳🏦; Coinbase UK slapped with £3.5M fine 👀🇬🇧; Capital One-Discover merger faces legal challenge 🤕🔎

FinTech is Eating the World, 25 July

Hey Everyone,

Happy Thursday! Today’s issue is super packed as we’re looking at Revolut finally receiving its long-awaited UK banking license (why it’s a game-changer that paves the way for the new era + lots of deep dives into Revolut & its competition), Coinbase UK that just got slapped with £3.5M fine (what it’s all about & why it matters + bonus deep dives inside), and Capital One-Discover merger which is now facing legal challenges (what it’s all about & what’s next + a deep dive into Discover & their latest financials). Let’s just jump straight into the solid stuff 🌶

Game-changer: Revolut finally receives its long-awaited UK banking license paving the way for the new era 😳🏦

The BIG news 🗞️ After a three-year journey, London-based FinTech giant Revolut has finally secured a UK banking license from the Prudential Regulation Authority (PRA).

This milestone marks a significant step in the company's evolution and its ability to compete with traditional banks in its home market.

Let’s take a quick look at this and see why it matters.

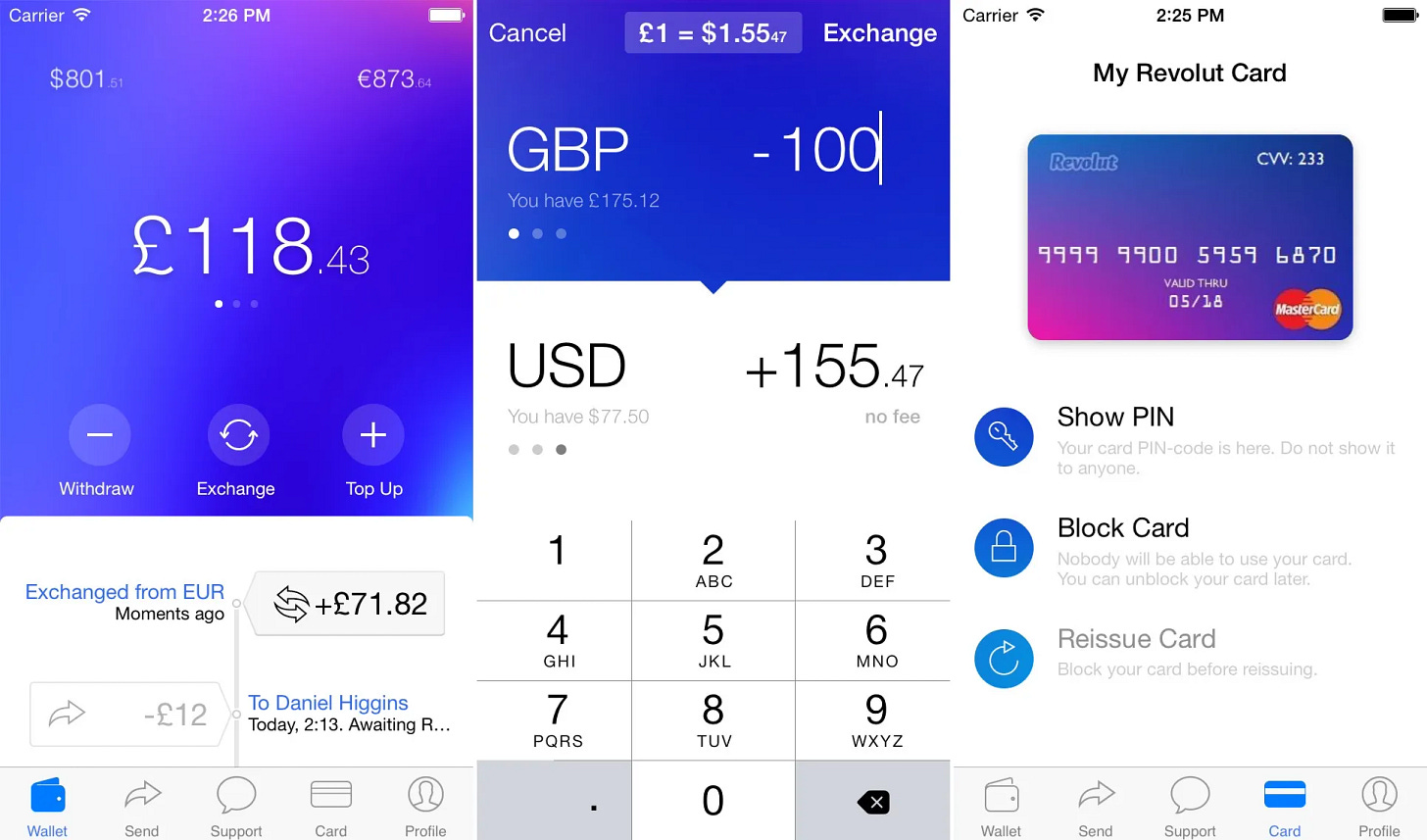

More on this 👉 We can remember that founded in 2015, Revolut has rapidly grown to serve 45 million customers globally, with 9 million in the UK alone.

The company, which started as an e-money institution offering services like checking accounts and foreign currency exchange, can now expand into traditional banking services such as lending and savings products.

The license comes with initial restrictions, a common practice for new banks in the UK. Revolut will thus enter a mobilization phase, allowing it to build out its banking infrastructure before fully launching these new services. This process could take up to a year and means the following:

Revolut can hold only £50,000 of total customer deposits.

Customers will remain with its Financial Conduct Authority-approved e-money entity until a full UK bank launches.

But more importantly, this means that the neobank last valued at $33 billion can now offer overdrafts, loans, and savings products to more than 9 million of their consumers in the United Kingdom.

For the perspective, the biggest competitor Monzo has $9.7M while Starling Bank counts ~4M customers in the UK.

ICYMI: Starling Bank’s latest financials: soaring profits, but gathering clouds 🌤️ [breaking down their latest annual report, uncovering the most important numbers & what’s next for Starling + a bonus deep dive into Monzo & why it’s super exciting]

Monzo’s first profitable year and high-growth opportunities ahead 🚀 [breaking down the key numbers & what they mean, looking at what’s ahead + a few bonus dives into Monzo]

JPMorgan Investor Day 2024: positioning for strength, & roadmap for dominance in the digital age 🚀 [breaking down the key takeaways from the massive event & how the firm's strategic vision positions it for unparalleled success in the future + some bonus deep dives into JPM]

The approval follows a period of scrutiny and challenges, including concerns about the company's share structure and a warning from auditors about revenue verification in its 2021 accounts.

Revolut has since addressed these issues, restructuring its ownership and improving its financial reporting.

ICYMI: Revolut’s 2023 financials: a FinTech rocket with astronomical growth, but regulatory asteroids loom 🚀☄️ [breaking down the key facts & figures, uncovering the most important numbers & what’s next for Revolut + bonus deep dives into Starling Bank, Monzo and JPMorgan]

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Revolut can now more directly challenge traditional banks, potentially forcing them to innovate and improve their services to retain customers. Again. On top of that, with the ability to offer a full range of banking services, Revolut may introduce new products tailored to the UK market, such as mortgages and personal loans. Furthermore, the UK banking license brings Revolut under the Financial Services Compensation Scheme, potentially boosting customer confidence in the platform and bringing in another lever for growth. But most importantly, the success in obtaining a UK license may help Revolut in its efforts to secure banking licenses in other key markets, such as the United States (they have huge ambitions there). The next phase in Revolut’s journey begins today 🚀

ICYMI: HUGE: Revolut aims for a $40 billion valuation in a share sale 😳📈 [what it’s all about & why it’s huge + unpacking the most important numbers and data so we could see the bigger picture here & some bonus reads on Revolut and its biggest competitors]