Revolut is taking on trading giants Robinhood & eToro with its standalone retail wealth app 😳📈; Justice Department sues Visa over alleged debit card monopoly 👀💳; Stripe is showing signs of IPO 🤫

FinTech is Eating the World, 24 September

Hey Everyone,

Good morning & happy Wednesday! Today’s issue is the best one yet as we’re looking into Revolut that’s taking on trading giants Robinhood & eToro with its standalone retail wealth app (what it means & why it makes sense + bonus dives in Revolut & Robinhood), Justice Department suing Visa over alleged debit card monopoly (why it matters & what’s next + bonus deep dives both into Visa & Mastercard), and Stripe which is showing signs of IPO (a look into their latest developments & why Stripe IPO matters + more bonus dives into the FinTech giant). So let’s jump straight into the amazing stuff 🌶️

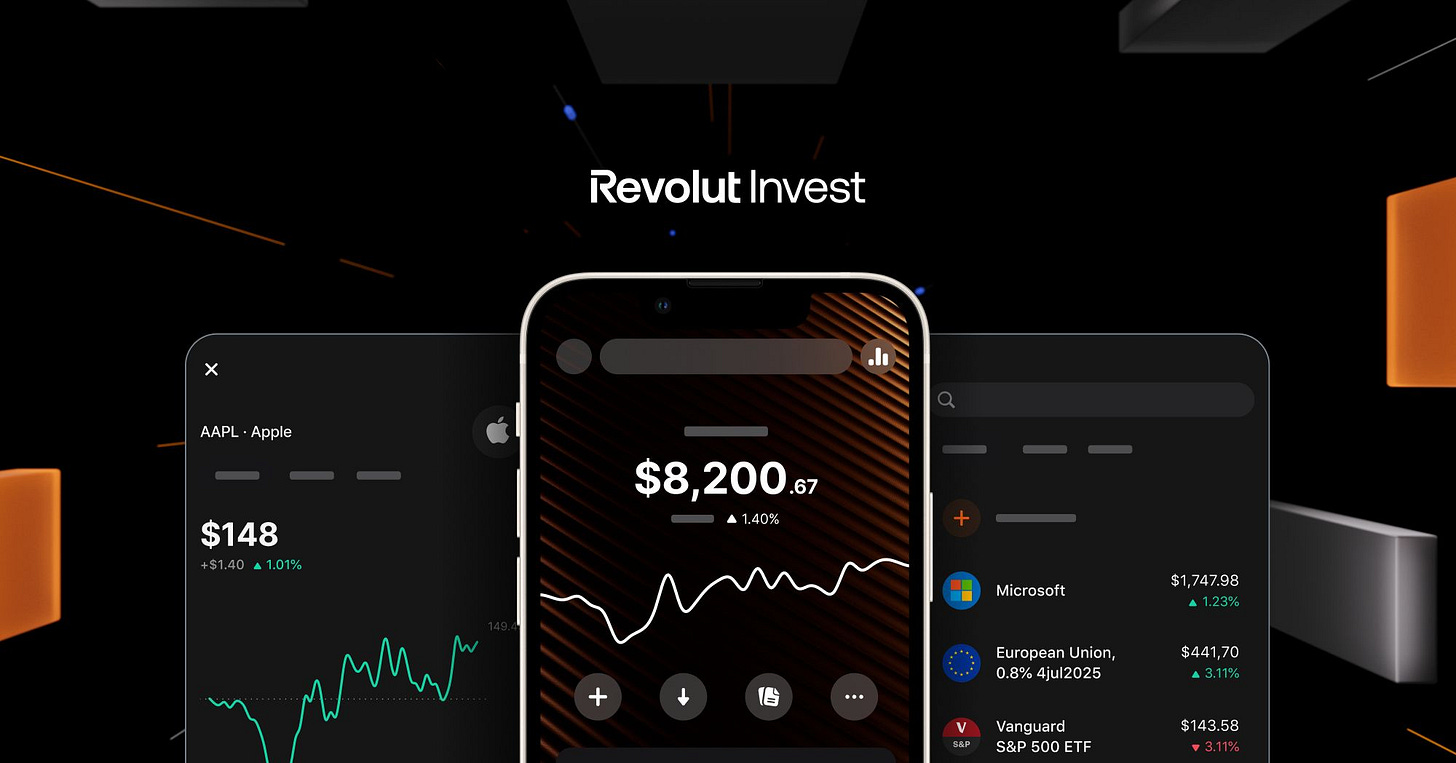

Revolut is taking on trading giants Robinhood & eToro with its standalone retail wealth app 😳📈

The BIG news 🗞️ In a bold move to capture a larger share of the retail investor market, Europe's most valuable FinTech Revolut is launching a standalone wealth management app called Revolut Invest.

This strategic spin-off of its €8.5 billion ($9.5 billion) wealth management offering aims to compete directly with established industry players like Robinhood HOOD 0.00%↑ and eToro.

Let’s take a quick look at this and see why it matters.

More on this 👉 Upon debut, Revolut Invest will:

Offer nearly ~5,000 assets on the launch, including US and European stocks, ETFs, commodities, bonds, and new products such as CFDs.

Equity and bond investments will face a flat fee of either 0.25% or €1 while charges for CFDs may vary.

Currently undergoing testing in Greece, Denmark, and the Czech Republic, the app will be introduced in other European Economic Area countries by the end of the year, as per Revolut.

This move is part of CEO Nik Storonsky's vision to transform Revolut into a "truly global bank" rivaling industry giants like JPMorgan Chase JPM 0.00%↑ and Barclays.

ICYMI: JPMorgan expands small-town presence, bucking branch closure trend 🏠👋 [what it’s all about and why it matters + a bonus deep dive into JPM & how it’s crushing it in AI + Finance]

By creating a standalone app, Revolut thus aims to attract new customers beyond its existing banking user base, potentially opening up a vast new market of retail investors.

✈️ THE TAKEAWAY

What’s next? 🤔 Valued at $45 billion, Revolut aims to be the Global Super App but having a separate WealtTech offering makes a lot of sense: (1) It can tap into the wave of retail investors returning to the markets as central banks around the world start to cut interest rates; (2) Revolut will be able to target new customers who aren’t already using its banking services thus leveraging this as a customer acquisition funnel for the main app while at the same time offering premium services & new subscription tiers (which would bring extra revenue, grow ARPU & potentially even bump their valuation further). Impressively, assets under management in Revolut's wealth offering have almost tripled to €8.5 billion, from €3 billion at the end of 2023 🤯 For the perspective, Robinhood currently holds more than $140B in AUC. Yet, Revolut's size and valuation could give it a significant advantage in this crowded field. The company was recently valued at $45B, more than double the market capitalization of Robinhood. This financial strength, combined with Revolut's existing customer base of 45M users (over 3M already use its investment services), positions the company well for this new venture. Retail trading space is about to get super interesting 🍿

ICYMI:

Robinhood's profitable growth trajectory: a diamond in the rough or fool's gold? 🤔💳 [a deeper dive into their Q2 2024 numbers, what they mean & whether you should be bullish on HOOD 0.00%↑ in 2024 + some bonus reads inside]