Citi's transformation bearing fruit: strong Q1 performance signals turnaround progress despite global uncertainty 📈🏦; AI empowers smaller financial institutions to punch above their weight 🥊🤖

FinTech is Eating the World, 24 April

Hey Everyone,

Good morning & happy Thursday! Today’s issue is really hot as we’re looking into Citi whose transformation is clearly bearing fruit (deep dive into their Q1 2025 financials unpacking the most important numbers, what they mean & what’s next for Citi + bonus deep dives into JPMorgan, Bank of America & co), and see how AI empowers smaller financial institutions to punch above their weight (two interesting success stories & lessons to be learned for other FIs and FinTechs + Agentic AI Playbook for Finance AND more bonus reads inside). So let’s just jump straight into the fascinating stuff 🌶️

Citi's transformation bearing fruit: strong Q1 performance signals turnaround progress despite global uncertainty 📈🏦

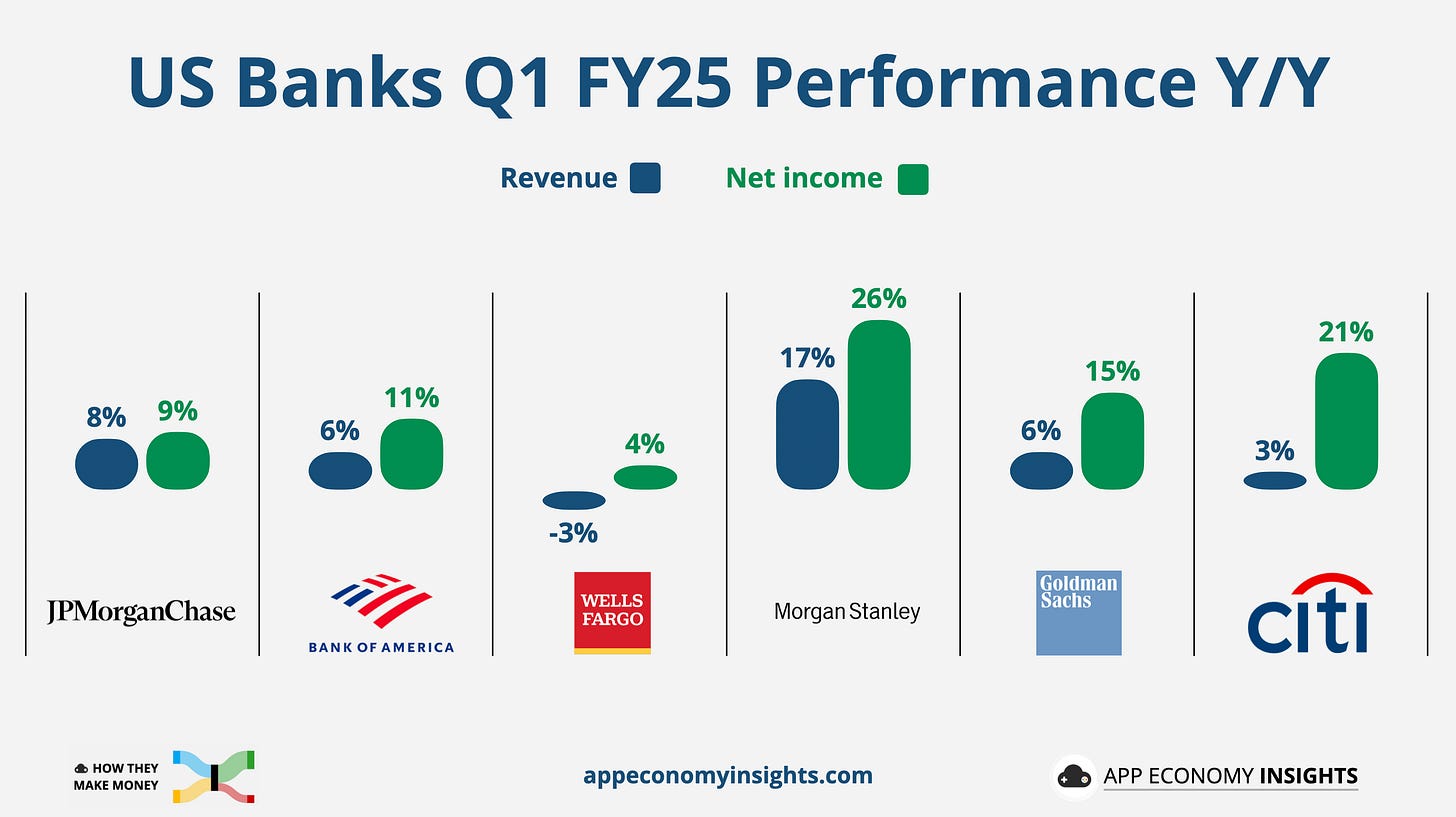

Earnings time 🤑 Banking giant Citigroup C 0.00%↑ just posted its latest financials, beating Wall Street estimates for first-quarter profit and moved closer to its profitability target as its traders reaped a windfall from volatile markets that fueled client activity.

The third-largest US lender's earnings echoed those of Wall Street rivals, including JPMorgan Chase JPM 0.00%↑ and Bank of America BAC 0.00%↑ whose results were also lifted by stronger equities trading.

Let’s take a closer look at this, break down the most important numbers, and see what’s next for Citi.