Latin America's digital banking giant Nubank is poised for profit explosion despite margin pressures 😤🏦; How Stripe built AI but for payments 🤖💳

FinTech is Eating the World, 15 May

Hey Everyone,

Good morning & happy Thursday! Today all eyes are on Nubank, which continues to dominate the digital banking arena despite margin pressures (deep dive into NU’s Q1 2025 financials, unpacking the most important numbers, what they mean & why you should be bullish on LatAm’s FinTech gem + bonus deep dive into its closest competitor Revolut), and Stripe that literally just built AI but for payments (what it’s all about, why it could change everything & what it means for the future of FinTech + bonus collection of AI Strategy Playbooks to build lasting moats & the Ultimate Beginners Guide to AI). Let’s just jump straight into the industry-transforming stuff 🌶️

Latin America's digital banking giant Nubank is poised for profit explosion despite margin pressures 😤🏦

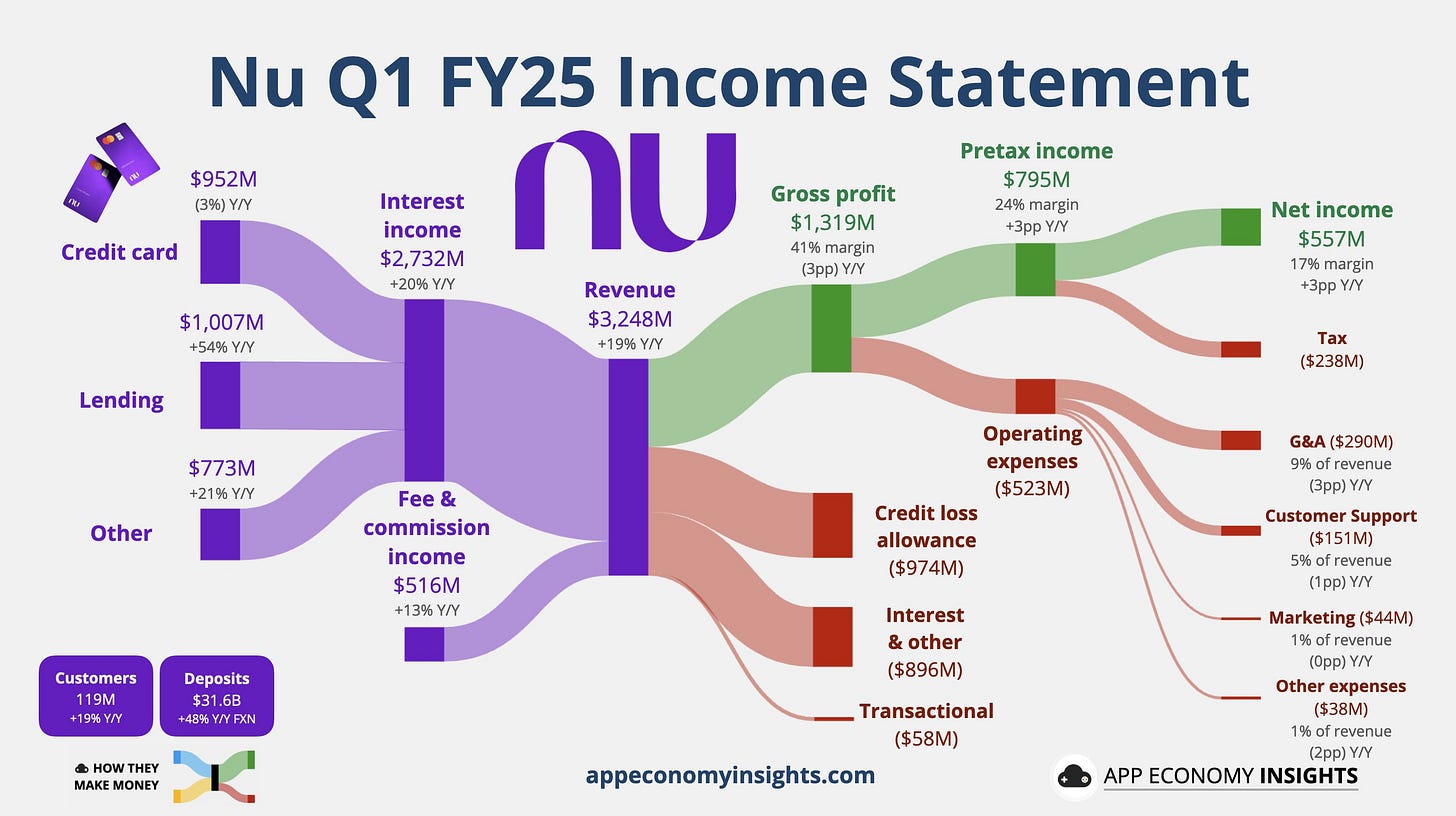

Earnings time ☎️ FinTech giant Nu Holdings aka Nubank NU 0.00%↑ just reported mixed Q1 2025 results. While the banking behemoth missed consensus EPS estimates ($0.12 vs $0.13 expected) and revenue targets ($3.2B vs $3.23B expected), the challenger’s fundamental growth story remains intact with revenue surging 40% YoY on an FX-neutral basis.

With a massive 118.6 million customer base across Brazil, Mexico, and Colombia, industry-leading efficiency metrics, and significant untapped monetization potential, NU still presents a very compelling long-term investment opportunity.

Let’s take a deeper dive on this, unpack Nubank’s most important numbers, see what they mean and what’s next for the LatAm’s digital banking powerhouse.