Klarna’s AI-powered efficiency masks growing credit concerns 📊🤖; Kraken to launch 24/7 tokenized stock trading 😳💸; AI-native stablecoins bank? 🤔🏦

FinTech is Eating the World, 23 May

Hey Everyone,

Good morning & happy Friday! Another incredible FinTech week is about to end, and I couldn’t have wished for a better issue to wrap it up with 🍰 Today we’re looking into Klarna, whose AI-powered efficiency masks growing credit concerns (deep dive into Klarna’s Q1 2025 results, unpacking the most important numbers, what they mean & what’s next + bonus dive into its biggest competitor Affirm, Klarna’s S-1 and Agentic AI Playbook for Finance), Kraken, which is set to launch 24/7 tokenized stock trading (what it’s all about & what it means for the future of FinTech + more reads on Kraken inside), and the AI-native stablecoins bank (what it’s all about & why it could be huge + 110 real-world stablecoin uses cases & why most banks won’t survive the AI revolution). Let’s just jump straight into the transformative stuff 🌶️

Klarna’s AI-powered efficiency masks growing credit concerns 📊🤖

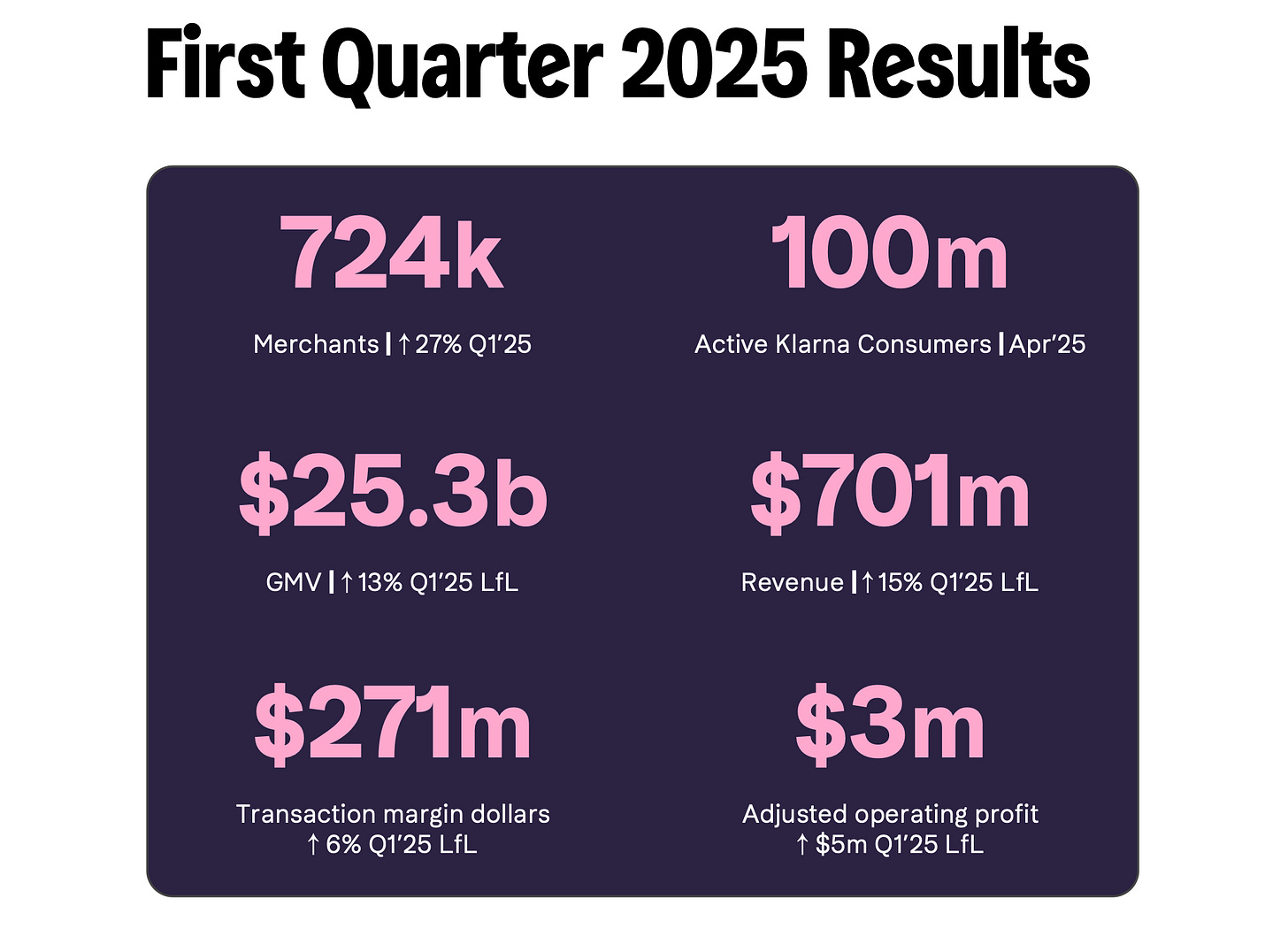

Following the money 💸 European FinTech giant Klarna just posted its latest financial results.

Swedish BNPL pioneer’s Q1 2025 results present a tale of two companies: a rapidly scaling FinTech leader demonstrating impressive operational efficiency gains, yet simultaneously grappling with deteriorating credit quality that threatens its fundamental unit economics.

Let’s take a closer look at this, unpack the most important numbers, what they mean, and see what’s next for Klarna.