Major US banks unite to challenge crypto giants in $246B stablecoin market 🪙🏦; Google’s AI might eliminate traditional online checkout 😳🛍️

FinTech is Eating the World, 27 May

Hey Everyone,

Good morning & happy Tuesday! Today all eyes are on major US banks that are now uniting to challenge crypto giants in $246B stablecoin market (what it’s all about, why it matters & why it could be huge + bonus deep dives into the latest financials of the Wall Street’s giants & the ultimate list of 110+ stablecoin use cases), and Google’s AI that might eliminate traditional online checkout (what this paradigm shift means for both FinTech & e-commerce firms alike + more bonus reads on agentic commerce, resources on AI agents, the Ultimate Beginners Guide to AI & more!). So let’s just jump straight into the solid stuff 🌶️

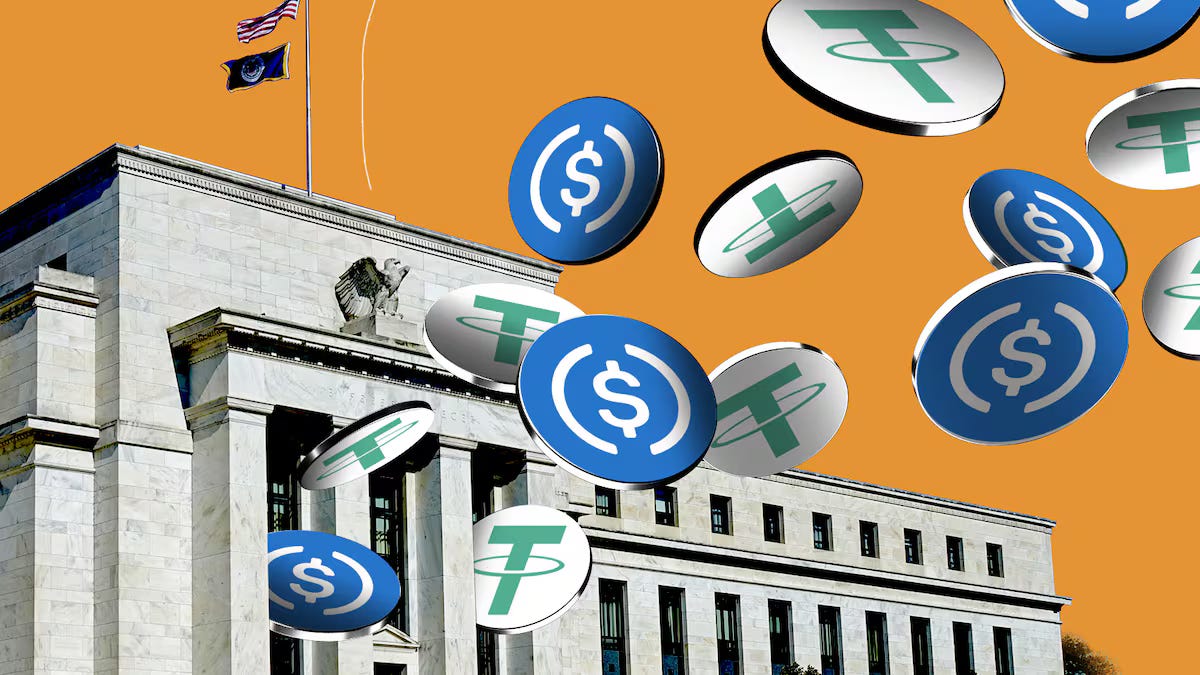

Major US banks unite to challenge crypto giants in $246B stablecoin market 🪙🏦

The news 🗞️ America's largest financial institutions are preparing to enter the digital currency arena through a collaborative approach that could reshape the stablecoin landscape.

According to recent reports, JPMorgan Chase JPM 0.00%↑, Bank of America BAC 0.00%↑, Citigroup C 0.00%↑, and Wells Fargo WFC 0.00%↑ are all engaging in preliminary discussions about jointly issuing a stablecoin through their co-owned payment infrastructure companies, including Early Warning Services and the Clearing House.

Let’s take a closer look at this, understand why it matters, and what’s next.