Fiserv’s Q2 2025: undervalued FinTech infrastructure fortress built for the digital payments revolution 🤑📈; Wall St. giants BNY & Goldman Sachs launch blockchain-based money market fund platform 😳⛓

FinTech is Eating the World, 24 July

Hey Everyone,

Good morning & happy Thursday! Today, all eyes are on Fiserv, which just posted its latest Q2 2025 financials (breaking down key financial facts & figures, what they mean, what’s next and why Fiserv represents one of the most compelling opportunities available in public markets today), and Wall Street giants BNY Mellon & Goldman Sachs that just launched tokenized money market fund platform (what it’s all about, why it’s huge and what it means for the future of finance). So let’s just jump straight into the amazing stuff 🌶️

Fiserv’s Q2 2025: an undervalued FinTech infrastructure fortress built for the digital payments revolution 🤑📈

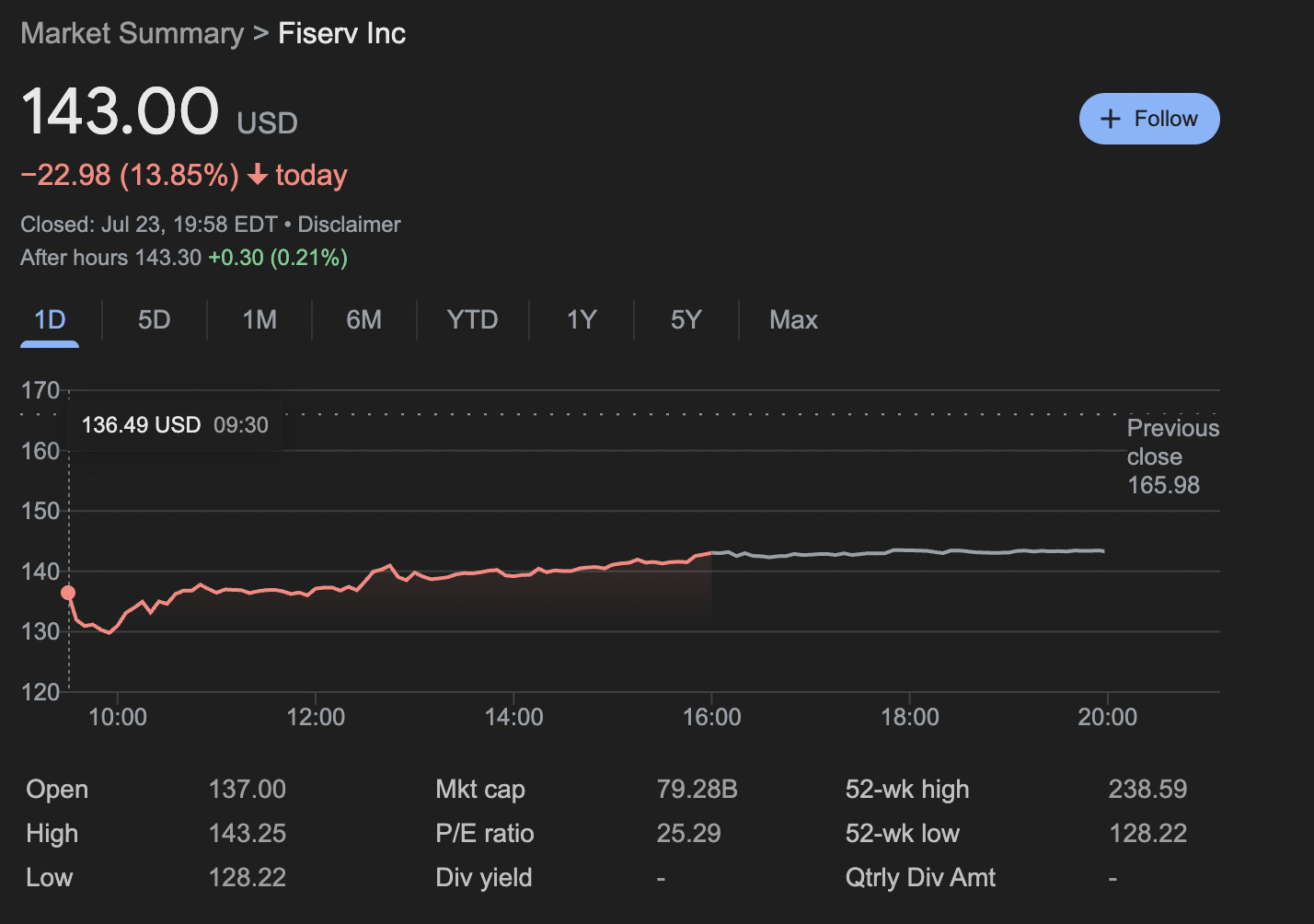

Earnings calling 📞 Finance giant Fiserv FI 0.00%↑ just posted another strong quarter. Given the market had a strong negative reaction to continued softness in growth at Fiserv, the FinTech pioneer now emerges as an exceptional investment opportunity that combines the defensive characteristics of critical financial infrastructure with the growth potential of a technology disruptor.

Our fair value estimates, coupled with the company's dominant market position and predictable cash flow generation, create a compelling risk-adjusted investment thesis that’s difficult to ignore for any long-term investor.

Let’s take a deeper dive into Fiserv’s latest Q2 2025 financials, uncover the most important facts and figures, and see why it’s hard not to be bullish on the FI 0.00%↑ stock.