Wealthfront’s IPO filing: a profitable FinTech built on borrowed time 📊🏦

FinTech is Eating the World, 3 October

Hey Everyone,

Good morning & happy Friday! Another fascinating FinTech week is about to end, and we’re finishing it with a cherry on top 🍰 Today, all eyes are on WealthTech challenger Wealthfront that just submitted its paperwork to go public on Nasdaq (breaking down the 324-page S-1 filing, uncovering the key financial facts and figures, why they matter, and what’s next for Wealthfront + lots of bonus dives inside). So let’s just jump straight into the good stuff 🌶️

Wealthfront’s IPO filing: a profitable FinTech built on borrowed time 📊🏦

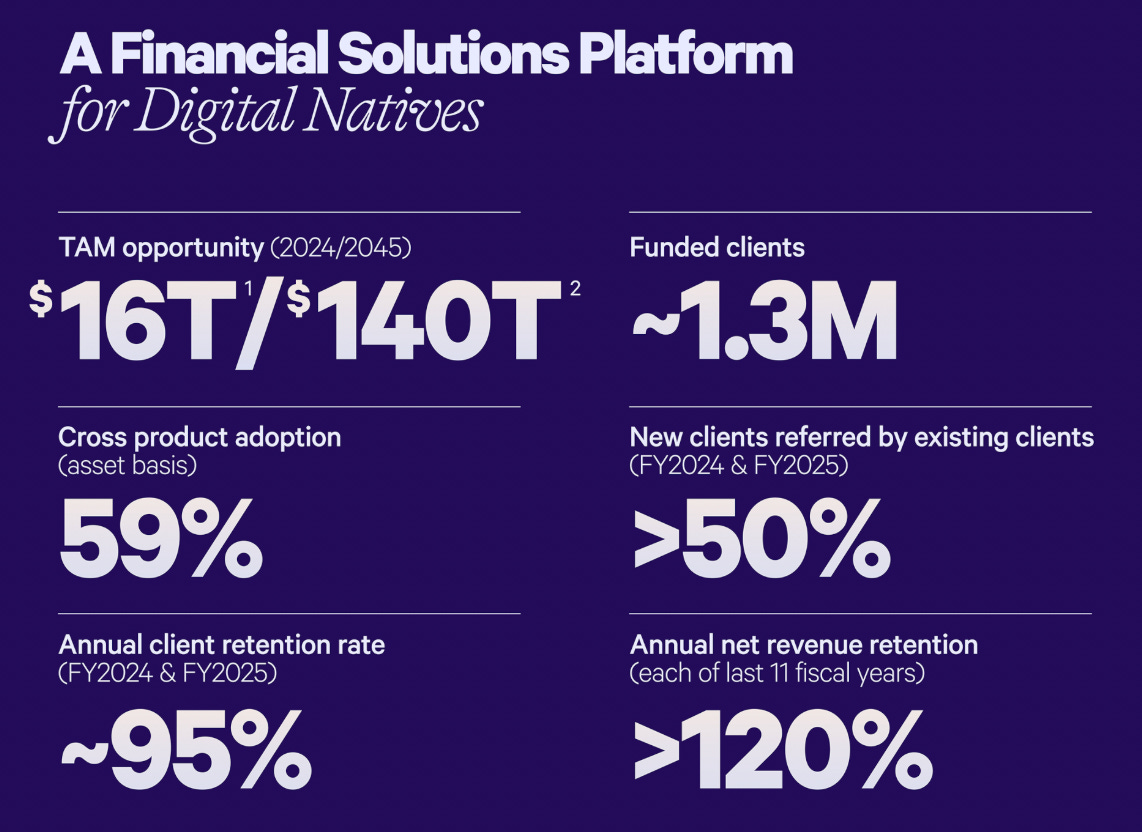

Following the money 💸 Wealthfront, the US-based FinTech startup that helped popularize the robo-advisor style of automated investing, just filed for a US initial public offering on Nasdaq under the ticker symbol WLTH.

The WealthTech pioneer is the latest in a wave of FinTech firms going public this year, including Chime CHYM 0.00%↑ and Klarna KLAR 0.00%↑. And we just dived deep into Wealthfront’s 324-page S-1 filing, so you don’t have to.

What emerges is a paradoxical narrative: a rare FinTech unicorn that has achieved genuine profitability and operational excellence while simultaneously confronting structural vulnerabilities in its revenue model that could undermine its premium valuation thesis.

Let’s take a deep dive into Wealthfront, break down the key numbers, understand what they mean, and see whether this challenger represents a compelling investment opportunity.