Citi believes bank tokens will beat stablecoins by 2030 despite $4 trillion crypto surge 😳🏦; OpenAI’s integrated AI ecosystem: Browser, Payments, & Finance all converge in Agentic Commerce push 🤖🛍

FinTech is Eating the World, 23 October

Hey Everyone,

Good morning & happy Thursday! Today’s issue is the best one yet a we’re going to look into stablecoins and why they might be beaten by bank tokens (key takeaways from Citi’s new research, unpacking the key details & future implications + the ultimate list of stablecoin resources inside), and OpenAI that’s now building an integrated AI ecosystem for the Agentic Commerce push (how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside). So let’s jump straight into the finnovative stuff 🌶️

Citi believes bank tokens will beat stablecoins by 2030 despite $4 trillion crypto surge 😳🏦

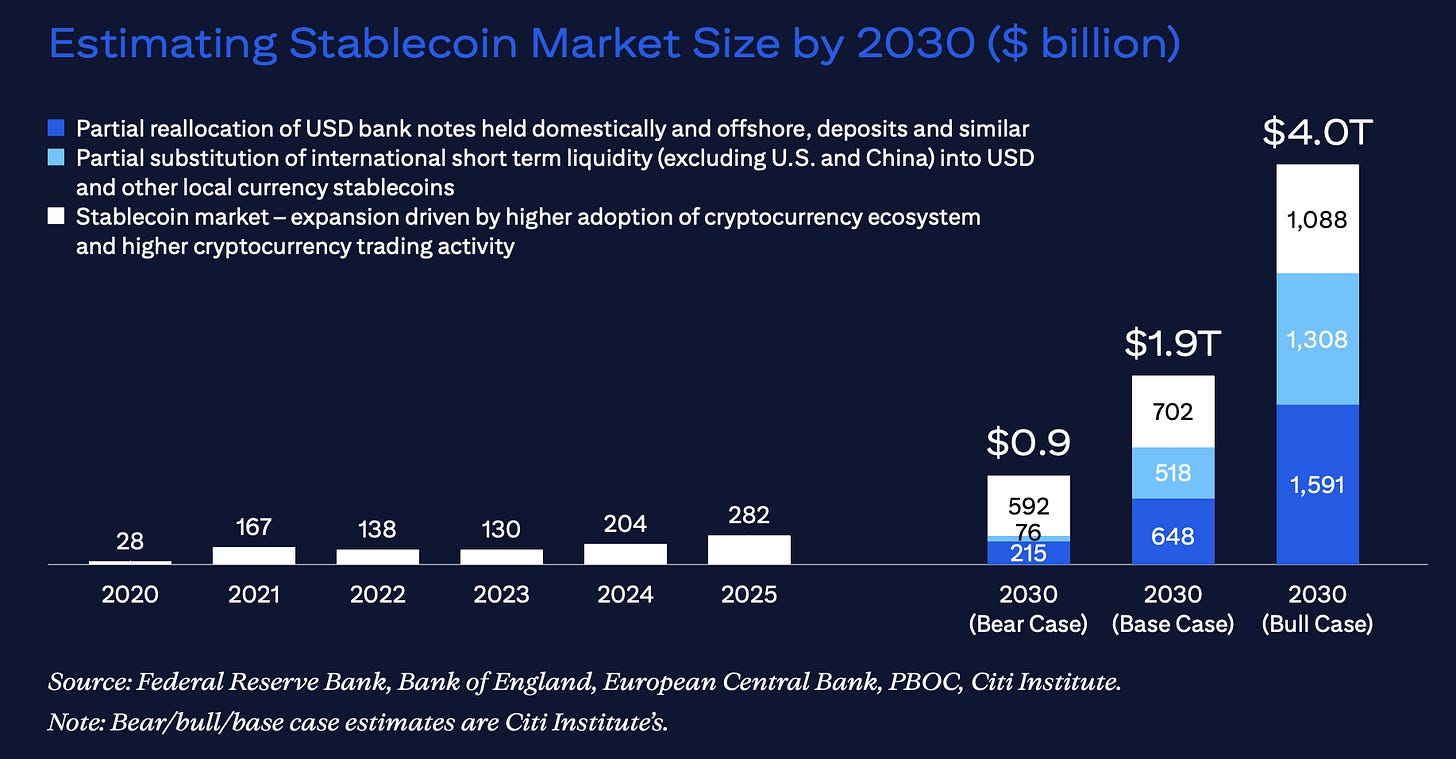

Following the money 💸 Citigroup has significantly increased its projections for the stablecoin market recently. Now, the banking giant is forecasting the sector will reach $1.9 trillion in issuance by 2030 under its base case scenario, with a bull case of a whopping $4 trillion.

This represents a substantial upward revision from the bank’s April 2025 estimates of $1.6 trillion and $3.7 trillion respectively, reflecting accelerating momentum in digital currency adoption.

Let’s take a closer look at the most important numbers from Citi’s recent research, understand what it’s all about, and what we can expect next.