The One-Person Unicorn 🦄

I built an AI operating system to run a startup with Claude 🤖

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & the most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 370k+ FinTech leaders:

One person $1 billion startup is no longer a fantasy. And it’s not a prediction either. It’s a statement about what’s now possible with the right architecture.

I spent weeks building a complete startup operating system using Claude’s skills framework. Twelve interconnected skills that cover the entire founder journey, from validating an idea to managing a board.

Then I tested it end-to-end by running a hypothetical startup through the complete sequence. What came out the other side wasn’t generic AI output. It was the kind of specific, actionable guidance that would have cost tens of thousands of dollars to get from consultants, lawyers, and advisors, if you could even find ones who knew what they were talking about.

The counternarrative I’m pushing against is simple: that AI outputs are too generic to be useful. The reframe is equally simple: AI outputs are only as good as the architecture and data behind them.

Change the architecture, and the outputs change completely.

The Problem with How Founders Use AI

Most founders still use AI the way they use spell-check. Draft an email, summarize a document, and generate some marketing copy. The outputs feel generic because they are generic. There’s no accumulated knowledge. No context about the specific decisions founders actually face. No frameworks tested in the real world.

Ask ChatGPT how to validate a startup idea, and you’ll get something that sounds reasonable but doesn’t actually help you make a decision. Ask it for a pitch deck structure, and you’ll get a list that looks like it was assembled from the first page of Google results.

The problem isn’t that AI is stupid. The problem is that surface-level prompting produces surface-level outputs.

The solution is architecture.

What Claude Skills Actually Are

Claude has a feature called skills: essentially folders containing structured knowledge, workflows, templates, and reference files that give Claude deep domain expertise in specific areas. Think of it like giving an extremely smart but context-free assistant a complete playbook before asking them to help with something.

A skill isn’t just a document. It includes diagnostic workflows that help Claude understand where a founder is in their journey, decision trees that route them to the right next step, frameworks distilled from practitioners who’ve actually done the thing, templates that can be immediately customized, and anti-patterns that prevent common mistakes.

When Claude operates with a skill loaded, it stops giving generic advice and starts giving the kind of specific, contextual guidance that comes from deep expertise. The difference is phenomenal.

I built twelve of these skills, each one focused on a core function founders need to execute. Most importantly, these skills aren’t isolated; they reference and build on each other, which is what makes this a system rather than a collection of templates.

The Twelve Skills

Idea Validation uses the Kevin Hale/YC framework and Tom Bilyeu’s 60-minute validation method. Mom Test interview scripts, GO/PIVOT/KILL decision criteria, and case studies from Vanta and Flexport showing how founders actually validated their ideas.

Business Model guides selection among 55 business model patterns, then moves to pricing strategy and unit economics. Complete calculators for LTV, CAC, and payback period. Competitive positioning follows April Dunford’s methodology: map alternatives, identify unique capabilities, connect to value, define best-fit customers.

Fundraising is built on research about how VCs actually make decisions. They prefer cash-on-cash multiples (63%) and IRR (42%), not DCF. The pitch deck follows a 10-slide Sequoia/YC hybrid structure. Outreach hierarchy is explicit: warm intro from portfolio founder beats everything.

Go-to-Market covers pre-launch waitlist through first 100 customers. B2C tactics from Lenny Rachitsky’s research on 40+ companies. B2B product-led vs. sales-led motion selection. Product Hunt launch playbook with specific timing and the Racecar Growth Framework for understanding kickstarts, engines, and turbo boosts.

Product handles PRD writing using Kevin Yien’s Square template, roadmap prioritization with RICE scoring, and user stories with INVEST criteria. Non-goals get as much attention as goals because scope creep kills projects.

Sales covers founder-led selling through scalable sales engine. Methodology matches situation: MEDDIC for complex enterprise, BANT for quick SMB qualification, Challenger for differentiated products. Cold outreach sequences with specific timing and target metrics.

Marketing & Brand focuses on distribution over creation, applying the 80/20 principle to content. Brand voice, pillar content strategy, SEO playbook, and PR templates oriented toward getting work in front of people. Community building frameworks from lurker to ambassador.

Growth & Analytics provides AARRR pirate metrics, North Star selection, and the KPI vs. OKR distinction. A/B testing with sample size calculations. Retention and cohort analysis with SQL templates and the insight that a healthy curve flattens.

Operations covers hiring, OKRs, and board management. Job descriptions lead with outcomes, not tasks. Interview scorecards reduce bias. OKRs follow the Liz Wessel/Google framework. Board decks and investor updates that lead with asks.

Finance & Accounting includes burn rate analysis, runway calculations, cash flow forecasting, and monthly close templates. Decision criteria for when to hire finance help.

Customer Success covers onboarding flows, churn prevention, NPS/CSAT, and health scoring. Time-to-first-value as the core metric. Churn analysis segmented by timing because interventions differ.

Legal & Compliance covers entity selection, founder agreements, vesting, ESOP, SAFEs, and cap tables. The goal isn’t to replace lawyers but to help founders know what questions to ask.

The System in Action

I tested the system with a real idea: a stablecoin-based bank account for freelancers in emerging markets. Complex, regulated, multi-stakeholder. The kind of problem that normally requires months of research and a team of advisors.

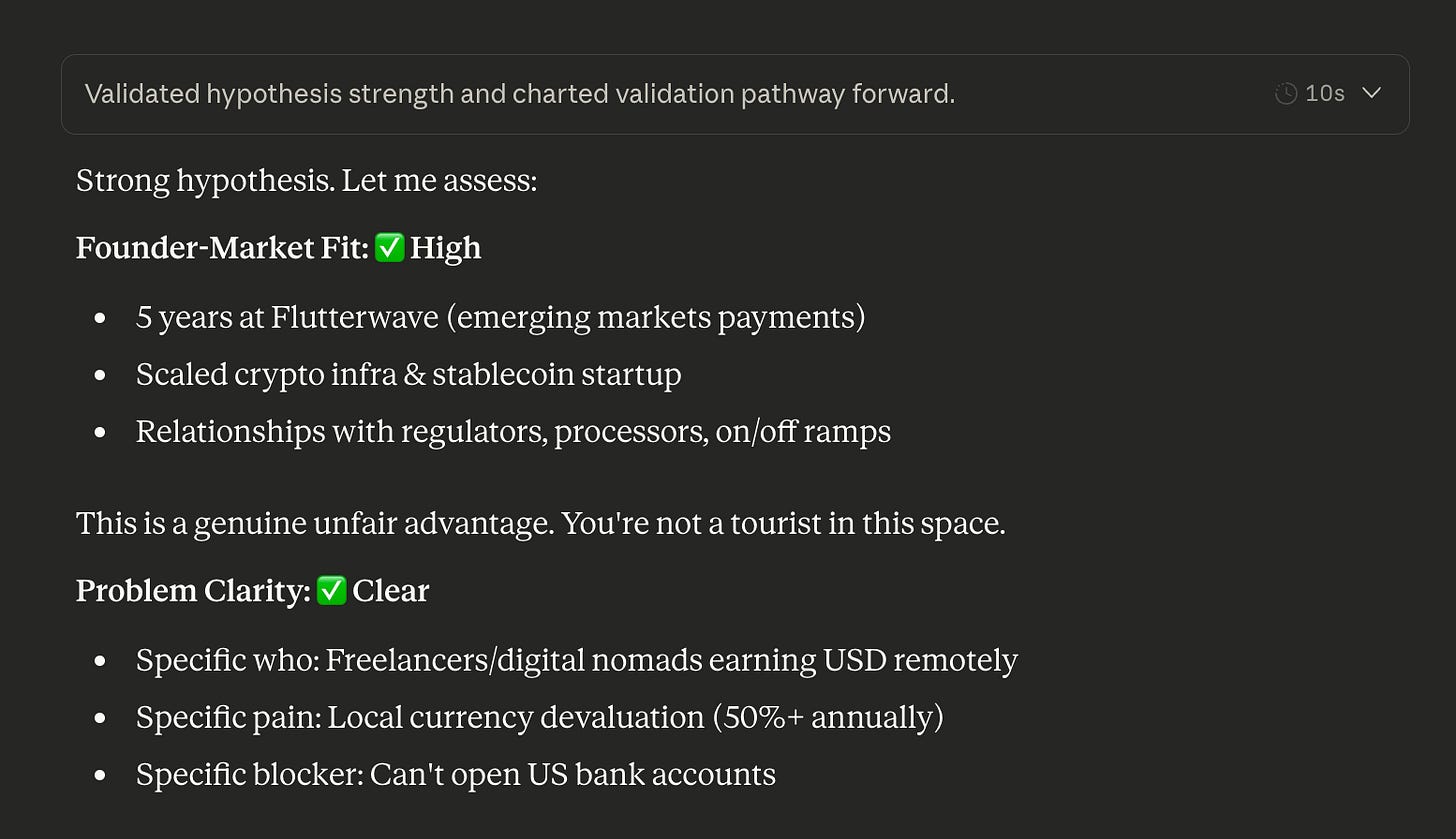

The validation skill assessed founder-market fit first. Five years at Flutterwave, scaled crypto infrastructure at a stablecoin startup, existing relationships with regulators and payment processors. The skill’s verdict: “This is a genuine unfair advantage. You’re not a tourist in this space.”

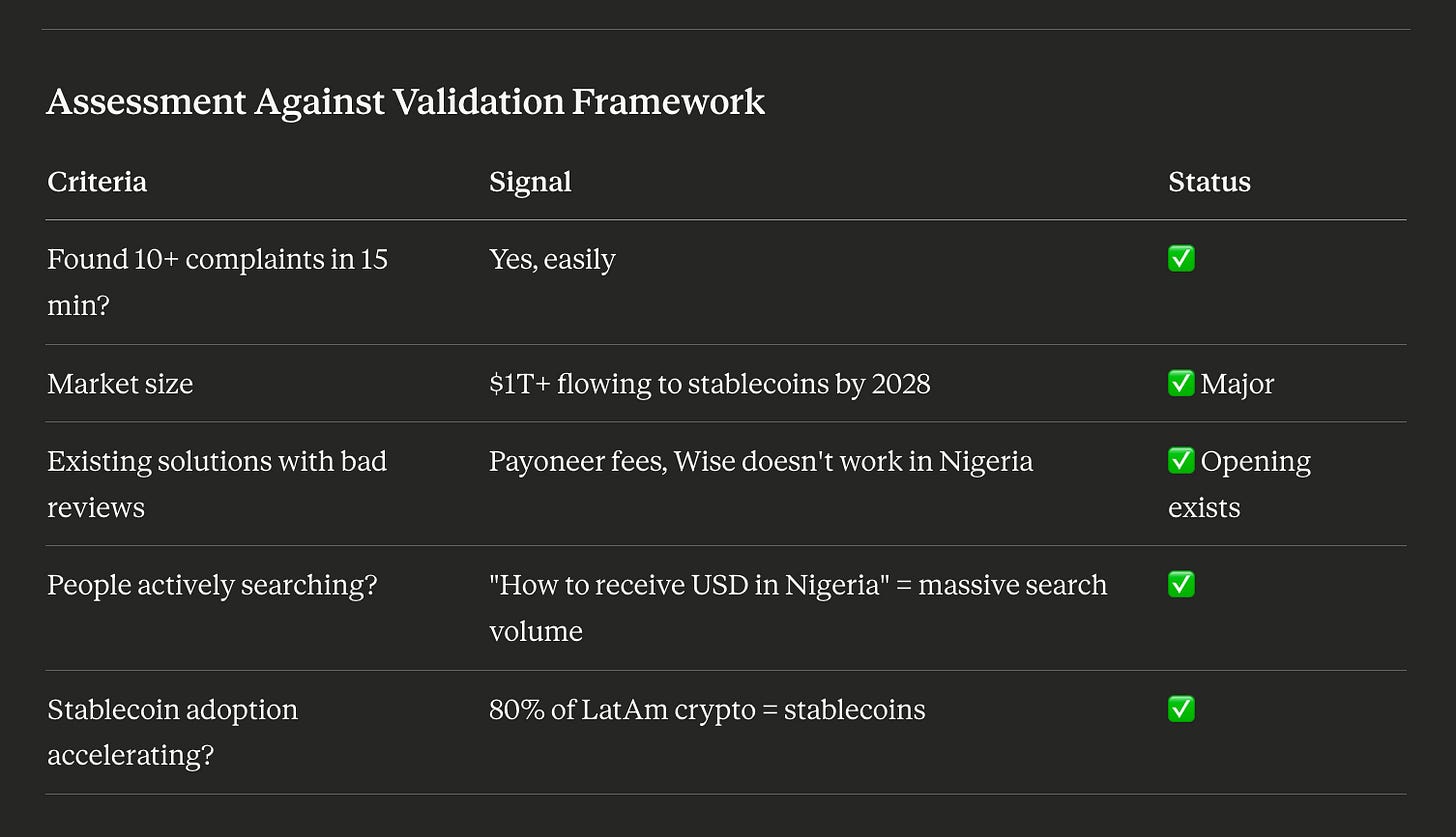

Then the 60-minute validation framework lit up green across every criterion. Found 10+ complaints in 15 minutes? Yes, easily. Market size? $1T+ flowing to stablecoins by 2028. Existing solutions with bad reviews? Payoneer’s fees are brutal, Wise doesn’t work in Nigeria. Search volume for “how to receive USD in Nigeria”? Massive. Stablecoin adoption? 80% of LatAm crypto volume.

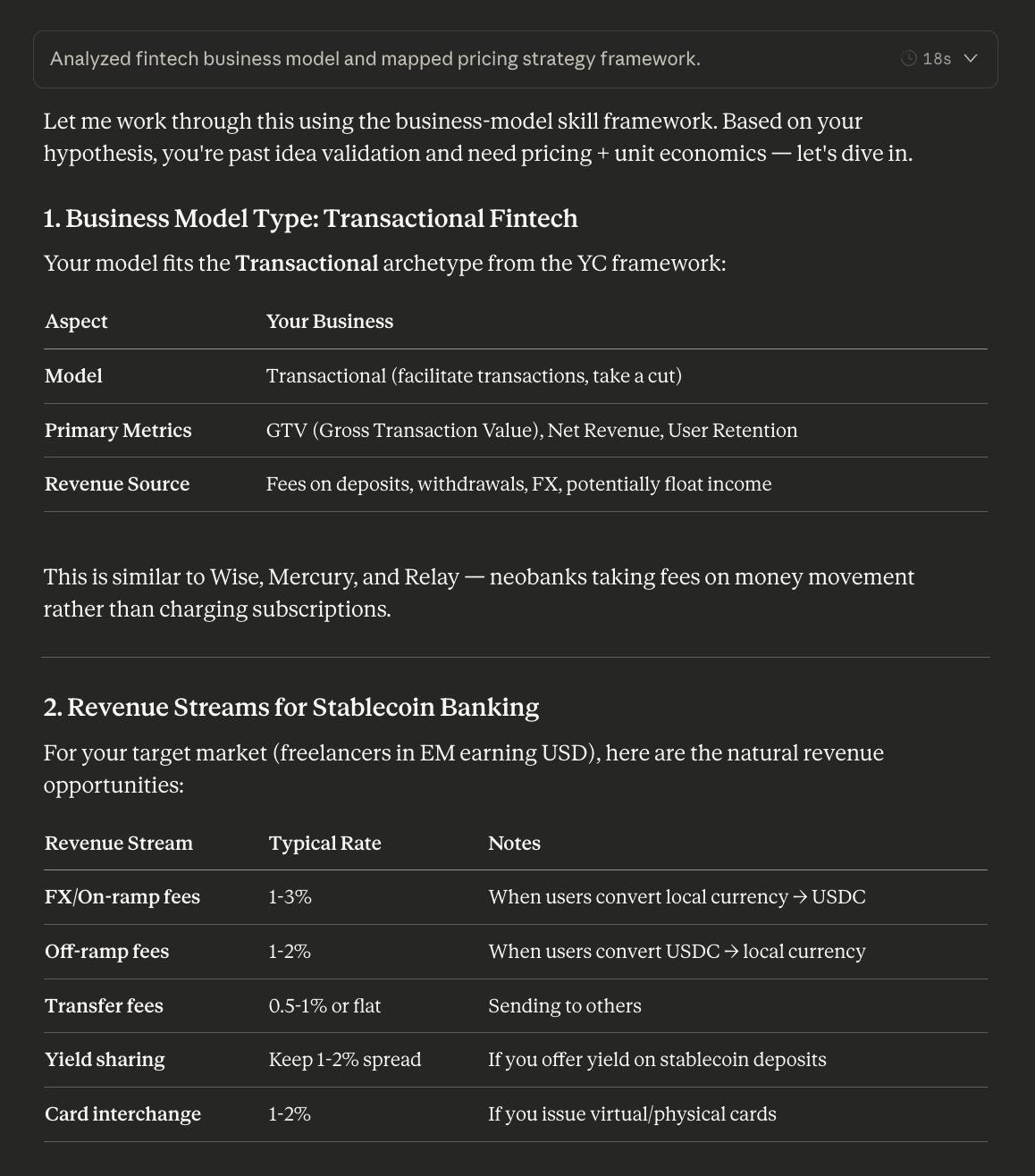

The business model skill identified this as Transactional fintech (like Wise, Mercury, Relay), mapped 5 revenue streams with typical rates, and built out unit economics. The fundraising skill produced a complete pitch deck.

Most importantly, each skill built on what came before. Validation evidence became pitch deck proof points. Business model informed financials. Positioning shaped the PRD. Regulatory assessment influenced GTM sequencing.

That interconnection is what makes this the ultimate startup copilot rather than a collection of templates.

The Counternarrative

“AI outputs are generic and useless.” I’ve heard this from smart founders who tried ChatGPT a few times and gave up. And they’re right about the outputs they got.

The problem is that generic input produces generic output. Ask Claude “how do I validate a startup idea?” and you’ll get something reasonable but not actionable. The response doesn’t know your stage, your business model, your market, or your constraints. It’s pattern-matching on common answers to common questions.

Skills change this equation. When Claude has access to the idea validation skill, it doesn’t start with generic advice. It starts with a diagnostic: where are you in the journey? Raw idea, hypothesis formed, interviews completed, or testing an MVP? Each state routes to a different workflow.

Then it applies specific frameworks. Not “talk to customers” but the Mom Test distinction between asking “would you use this?” (worthless) versus “how have you tried to solve this before?” (valuable). Not “look for product-market fit signals” but specific criteria: unsolicited referrals, interrupted pitches (”wait, you can do WHAT?”), pre-purchase on mockups, inbound after launch.

The skill includes case studies from real companies. When Flexport validated their idea, what did they look for? When Vanta decided to go all-in, what signals gave them confidence? These aren’t invented examples. They’re documented founder stories distilled into pattern recognition.

The output quality is a function of input quality. Not prompt quality (though that helps). Input quality: structured knowledge, proven frameworks, decision trees, and accumulated wisdom encoded in a form Claude can apply.

What This Means

For founders: the math has changed. A solo founder with the right AI architecture can operate at the level of a well-staffed startup. Not by working harder, but by having access to expertise across every functional area. The late-night scramble to figure out how term sheets work, or what a good NRR looks like, or how to structure a board meeting? All of that becomes a conversation with a copilot who actually knows what they’re talking about.

For VCs: due diligence gets easier when portfolio companies can generate institutional-quality documents. But evaluation gets harder because the signal-to-noise ratio changes. The founder who produces a crisp pitch deck might be operating alone with AI assistance, or might have a full team. The artifacts tell you less about organizational capacity than they used to.

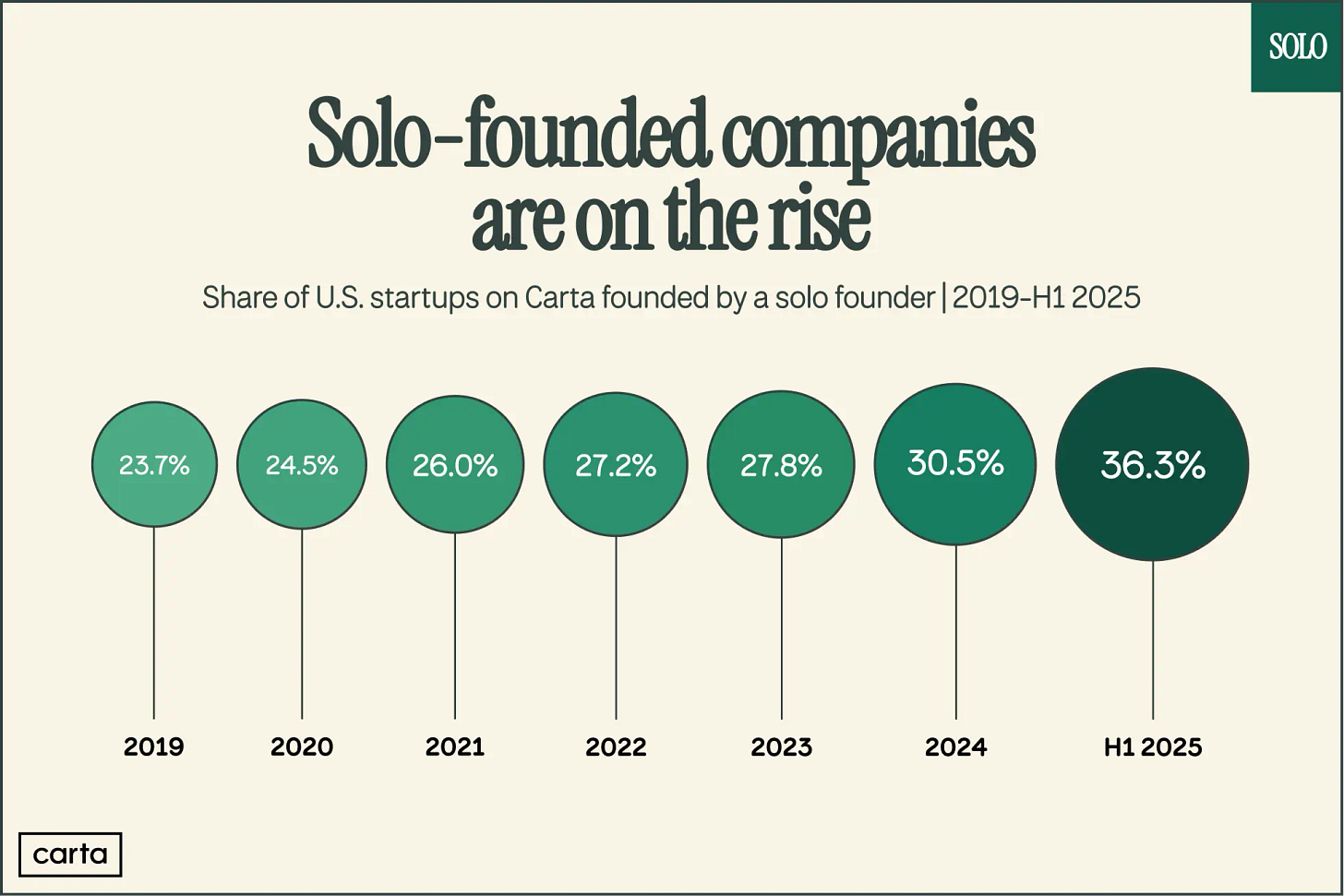

For the startup ecosystem: the minimum viable team is shrinking. This doesn’t mean everyone should build alone. Co-founders provide motivation, complementary skills, and accountability that AI can’t replace. But it does mean the calculus changes. A technical founder who would have been stuck without a business co-founder can now get a meaningful assist on everything from positioning to investor outreach to contract negotiation.

The founders who architect AI as a co-founder will have a structural advantage over those who treat it as a fancy autocomplete. This advantage compounds because each interaction makes the copilot more useful. Context accumulates. The system learns what stage you’re at, what decisions you’ve made, and what frameworks resonate with how you think.

What’s Still Missing

The system I built covers the core founder journey, but gaps remain. Technical architecture decisions (when to use microservices versus monolith, how to design for scale, which cloud provider makes sense) would benefit from their own skill. Recruiting beyond the first few hires deserves deeper treatment, including compensation benchmarking, employer branding, and interview processes for senior roles. International expansion, regulatory compliance beyond the basics, and enterprise sales complexity all perhaps require dedicated skills.

The skills also get better with use. Every time a founder runs through the system, patterns emerge about what works and what doesn’t. The ideal future state is a feedback loop where the skills improve based on real-world outcomes. Did the pitch deck structure actually help founders close rounds? Did the validation framework catch ideas that would have failed? That data doesn’t exist yet.

I’m also curious about what happens when founders bring their own skills into the system. The architecture supports custom skills, which means founders could encode their own hard-won knowledge: industry-specific insights, relationships with particular investor networks, and domain expertise that doesn’t exist in any framework.

The system becomes more valuable as more knowledge gets encoded into it.

The Bottom Line

I started this project to test a thesis: that AI-first founders would have a structural advantage. I ended up convinced of something stronger - that the gap between what’s possible with the right architecture and what most founders are doing with AI is massive.

The outputs I got from this system weren’t generic. They were specific, actionable, and often better than what I would have gotten from expensive advisors. Not because AI is smarter than humans, but because the skills encode the accumulated wisdom of people like Kevin Hale, April Dunford, Lenny Rachitsky, and the YC partners in a form that can be consistently applied.

The one-person unicorn remains rare. Building something truly great requires more than functional expertise - it requires taste, judgment, persistence, and often luck. But the floor has risen. What used to require a team of specialists can now be done by a founder with the right tools.

So the key question isn’t whether AI will change how startups get built. The question is how quickly founders will adapt to what’s now possible.

The complete skill library is available for download below. It includes all 12 skills (Idea Validation, Business Model, Fundraising, Go-to-Market, Product, Sales, Marketing & Brand, Growth & Analytics, Operations, Finance & Accounting, Customer Success, and Legal & Compliance), plus the reference files and templates each skill draws on.

To make building & raising even easier, I’ve also included a list of the top 100 Seed Investors from 2025 and 25 most interesting AI startups (& their pitch decks) as extras.