Twitter is officially laying the groundwork for its upcoming Super App 📲; American Express is doing a fantastic job with Embedded Finance 👏; Why the hell Stripe needs $3 billion? 🤔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀 [deep dive & unpacking all the things that Monzo did right]

Amazon's NFT initiative could be the inflection point for Web3 💥 [& why it could be the inflection point for Web3]

PayPal 2.0 in the making? Cash App launches Savings 💸 [or how Cash App is building a FinTech giant]

Revolut, N26, and other challenger banks have a new competitor… JPMorgan 👀 [+ a bonus read on JPM’s badass FinTech strategy]

PhonePe’s surging revenue and path to profitability 💰 [& why Super App play will turbocharge this]

Marqeta acquiring Power Finance is all about Embedded Finance 💸

As for today, here are the 3 FinTech stories that were making a massive difference this week. It was for sure the most intriguing and intense week in 2023, so definitely check out all the above stories.

Twitter is officially laying the groundwork for its upcoming Super App 📲

The news 🗞 Twitter has sought regulatory approval across the US for its new payments architecture that is in the works.

More on this 👉 Elon Musk, the owner of Twitter, is moving ahead with plans to bring payment functionality to Twitter, bringing another revenue stream to the struggling social media giant. Though the technology will primarily be fiat-focused, it will be built so that crypto-functionality can be added in the future.

As reported by the Financial Times, Twitter has employed a small team to map out the architecture for bringing payments to the platform. The company has also been applying for state regulatory licenses across the US to become eligible for the task, after registering with the US Treasury as a payment processor in November 2022. It hopes to complete US licensing within a year, and then expand internationally.

Elon Musk has previously shown interest in bringing a suite of payment services to Twitter, ranging from peer-to-peer transactions to debit/ credit cards, creating an ‘everything app’ that facilitates payments, commerce, and messaging. It would even allow people to buy products directly through the platform.

✈️ THE TAKEAWAY

Twitter 👉 X App 👀 We all know that Elon has a habit of shouting his mouth off and speaking loudly about many things. Also, the fact that Twitter might be pivoting to FinTech has been floating for quite some time. Yet, given his firm is filing the relevant applications might suggest there is a seriousness to this idea, and it might have actually started to lay the ground for Elon’s Super App ambitions. Huge, if true.

More: Twitter can become the Super App PayPal, Klarna, and Revolut always dreamed of 🤯

American Express is doing a fantastic job with Embedded Finance 👏

The launch 🚀 Global card issuer and payments processor American Express (AmEx) AXP 0.00%↑ has recently launched American Express Business Blueprint, a set of digital cash flow management tools for small businesses.

More on this 👉 Business Blueprint evolved out of Kabbage, an alternative lending startup that the company acquired in 2020. With the launch of Business Blueprint, the Kabbage brand is now retired.

The new service provided by AmEx allows any small business in the US to access personalized cash flow insights to determine smarter financial inclusions, free of cost.

At the same time, SMEs can access applications to select different financial products, including new lines of credit, and use the products, once approved, to efficiently manage their cash flows and scale their businesses.

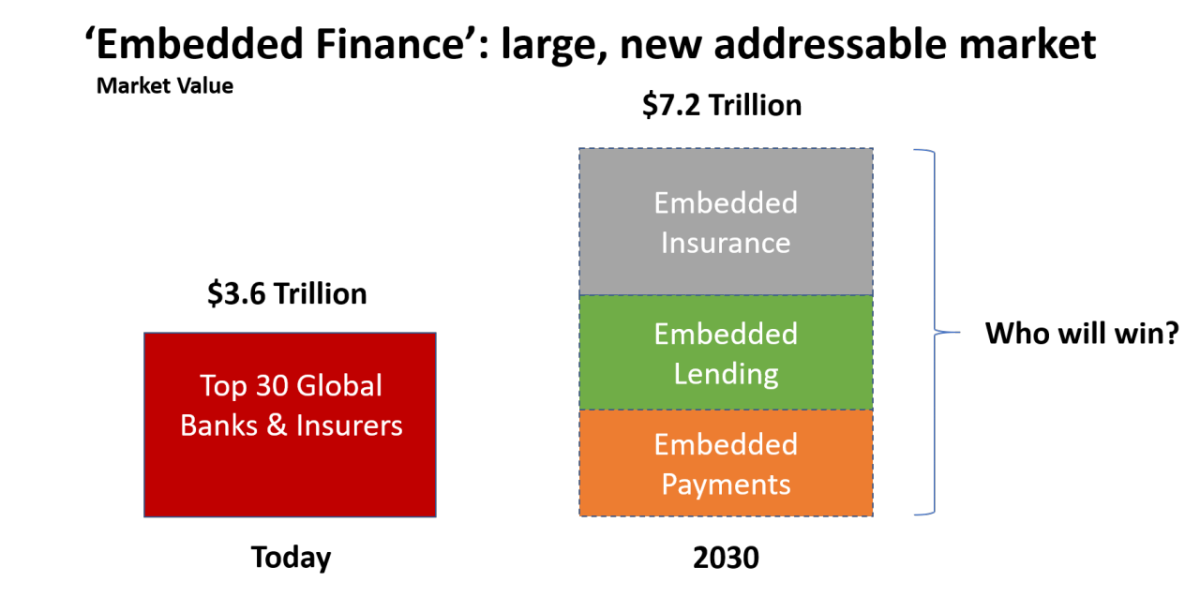

Why it matters? 🤔 With this move, AmEx is not only further doubling down on SMEs. More importantly, it shows that the company is doing a brilliant job with embedded finance.

Here’s more on this + the takeaway (& a bonus read on how AmEx is building a B2B payments powerhouse):

SME focus 🔎 At the core, Business Blueprint is all about SMEs and SMEs only. With the launch AmEx thus aims to become a one-stop shop for all small businesses’ financial needs - from helping them to make payments and get paid, to giving them access to working capital, among other things.

Why? 🤔 SMEs are the lifeblood of many economies yet historically, they have been pretty much underserved in most parts of the world (especially the US), with many small business owners claiming it was nearly impossible for them to get loans to scale their organizations. This is exactly where American Express is coming in to bridge the gap.

Also, given the company has a long history of supporting SMEs, this seems like a natural fit. By the way, AmEx is the main business credit card issuer in the US.

✈️ THE TAKEAWAY

Focus on embedding finance experiences 💸 AmeEx’s Business Blueprint illustrates the very best of what embedded finance is all about. The embedded payments hub from the credit card giant will not only help entrepreneurs manage their cash flows, but will also allow them to easily and securely take a loan, pay bills and vendors, send wires, check their bank account balance, make mobile check deposits, accept new card payments, and more. Given the growth potential here, it’s a very solid play from AmEx:

Zooming out, this perfectly ties into their big strategy - to build the ultimate B2B payments powerhouse. That could be huge.

Bonus: AmEx is building a B2B payments powerhouse 🚀

Why the hell Stripe needs $3 billion? 🤔

It’s Stripe again 👀 Just a few weeks after slashing its internal valuation for a third time, Stripe is reportedly in talks to raise as much as $3 billion.

More on this 👉 Despite that the FinTech told employees last week that it would evaluate a public offering next year, it is now looking to raise from its existing investors at a valuation between $55B and $60B.

While this is a drastic cut from its last raise in early 2021 which valued the company at $95B, it is not too far from its recent internal drop to $63B.

The most recent internal valuation cut of 11% marked the third for the payments giant in the last six months, following a 28% cut last July and a smaller cut again in October.

✈️ THE TAKEAWAY

Wait, but why? 🤔 In short, the fresh capital would be used to pay tax liabilities associated with employee stock grants. Stripe likely has a large swathe of double-trigger RSUs that will expire if they don’t IPO. Hence, it seems they found some sort of workaround on the liquidity trigger, yet need to pay taxes on all of those RSUs that are now vesting. We must note that stock options are a crucial tool for tech startups to recruit and retain valuable employees, and several veteran members of Stripe have stock units that are set to expire this year. Zooming out, Stripe’s next moves could pave the way for other late-stage, high-value companies grappling with the same problems.

Reread: Stripe: Downround, IPO -- what's happening? 🤔

🔎 What else I’m watching

Samsung goes India🇮🇳 Samsung has announced that it will merge its mobile payment solution, Samsung Pay, and password management application, Samsung Pass, into Samsung Wallet in India. Set to be launched with additional features, the announcement of the Samsung Wallet was made public on Twitter from the Samsung India account, with the tech giant having stated that the solution provides a smarter way to pay in a secure and convenient manner. Following the introduction of the product, users will be enabled to Tap & Pay or UPI with Samsung Pay, store their digital IDs in one place, and make their Wallet their password with Samsung Pass, stated the tweet. Reread: Samsung is taking a page out of Apple's playbook and launching a credit card in India 💳

Ingenico + Splitit 💳 Payments giant Ingenico has partnered with Splitit to bring one-touch Buy Now, Pay Later (BNPL) capability to physical checkouts using the former’s PPaaS and Splitit’s Instalments-as-a-Service solution. The partnership between Ingenico and Splitit aims to deliver a global, white-label, one-touch, no-interest BNPL service embedded into the merchant’s existing POS terminal. The result is an engaging omnichannel customer experience that helps merchants grow their business while driving loyalty and repeat purchases. Reread: BNPL is dead. Long live BNPL! 💸

Digital rupee 🇮🇳 India's CBDC plans have taken a step forward with news that the country's largest retailer, Reliance Retail, has agreed to start accepting digital rupee payments. Reliance has teamed up with Icici Bank, Kotak Mahindra Bank, and fintech Innoviti Technologies to roll out CBDC acceptance at its Freshpik stores. The rest of the giant's locations will follow. Customers that want to pay with the digital rupee, will be given a dynamic digital rupee acceptance QR code that is scanned at checkout. India began piloting a retail digital rupee last month, following up on an earlier wholesale CBDC trial. The central bank hopes that a CBDC will help in its aggressive efforts to move the country away from cash and boost financial inclusion, as well as deter interest in cryptocurrencies.

💸 Following the Money

UK-listed FinTech fund Augmentum has led a funding round into Berlin-based cyber insurance platform Baobab, with a €3M investment. This is Augmentum’s first investment in the InsurTech space and its second in Germany following an investment in the consumer technology subscription platform, Gover.

Weedar, a startup that allows users to buy cannabis in 3D augmented reality and receive NFTs, raised a $1.5M seed funding round, per a report in Benzinga.

Abu Dhabi-based investment fund Venom Ventures Fund made a $5M strategic investment in the Layer 1 blockchain, Everscale. The blockchain uses an "infinite sharding mechanism," which splits up the blockchain among those running the network to adapt to its workloads.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: