JPMorgan is leading the way in the adoption of AI in banking 🤖🏦; Super Bowl 👉 Crypto Bowl 👉 FinTech Bowl 🏈; NFT market is showing signs of recovery 📈

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Adyen is the fastest-growing global payments platform 🚀 [a deep dive into the payments giant you can no longer ignore]

Alternative asset investing: the multitrillion-dollar opportunity 🤑 [this could be the next big thing in FinTech]

Tougher times ahead? Visa and Mastercard see revenue growth slowing down 📉 [analysis of their latest results, what’s ahead & some solid bonus reads on both Visa & MC]

Social Investing just got a lot more interesting 💸 [what the second generation of trading apps is all about]

Apple Pay Later is almost here, and it can be huge 🚀 [why + a deep dive into Apple Bank's strategy]

BNPL payments surge as the rising cost of living hits shoppers 🛍

Google started rolling out a feature that could kill a hundred FinTech startups 🤯

Lightning Network just hit the Bitcoin record. But does it matter? 🤔

Can Web3 disrupt the music industry? 🎶 [+ who are the real winners in NFTs]

As for today, here are the 3 FinTech stories that were making a tremendous difference this week. It was the spiciest week in 2023, so definitely check out all the above stories.

JPMorgan is leading the way in the adoption of AI in banking 🤖🏦

The news 🗞 It’s JPM again. But this time it’s about artificial intelligence.

A new index that tracks banks’ implementation of AI puts banking behemoth JPMorgan JPM 0.00%↑ at the top of the list, according to TechCrunch.

More on this 👉 UK-based startup Evident created the index, which ranks the 23 largest banks in North America and Europe by their ability to develop and deploy AI-powered solutions.

The index scores the bank across four factors: AI-focused talent, AI innovation, leadership in AI strategy and implementation, and transparency of responsible AI practices.

The winner 🥊 Based on the inaugural rankings, North American banks seem to have a clear lead over European banks - 7 of the banks in the top 10 were North American.

JPMorgan, which is known for its heavy spending on AI technology, tops the list with a score of 65%. Solid play again 👏

✈️ THE TAKEAWAY

The AI wars in banking ⚔️ Even today it’s clear that the implementation of artificial intelligence (AI) in the banking sector will only accelerate in 2023. Banks aim to enhance their digital capabilities, streamline work for employees, and provide personalized customer experiences. AI can help with all of that, especially if you account for all the latest developments in generative AI like the viral chatbot ChatGPT. Although currently the technology still has limitations and potential risks, the AI Index by Evident provides an unbiased assessment of which banks are prioritizing AI and their investment in the technology for the future. The AI wars in banking are only starting and JPMorgan is leading the pack.

Bonus: Revolut, N26, and other challenger banks have a new competitor… JPMorgan 👀

Super Bowl 👉 Crypto Bowl 👉 FinTech Bowl 🏈

Crypto Bowl no more 🙅♀️ In 2022, crypto companies were battling for airtime during the Super Bowl — splashing out at least $6.5 million for a 30-second ad. Yet, this year will be completely different.

More on this 👉 Crypto giants Coinbase COIN 0.00%↑, Crypto.com, eToro, and FTX all flooded the Super Bowl ads zone last year. The crypto-sphere was in high spirits, and the firms spent a whopping $54M on ads.

Now, with companies feeling crypto winter's chill, Fox says there are no crypto ads scheduled to air during this year’s Bowl. That leaves plenty of room for other giants to fill the gap.

✈️ THE TAKEAWAY

The FinTech Bowl opportunity 🏈 The Super Bowl is the most-watched event in US sports (and one of the most-watched sports events globally), making it a top marketing opportunity. 100M+ people are expected to watch Super Bowl LVII. Despite the recessionary fears, Fox, the broadcaster, said it sold some 30-second spots for a record $7M+, and that all in-game ad slots are booked. Nevertheless, with crypto giants out this year, there’s plenty of room to fill the gap, and I’d argue that FinTech should take this opportunity. Especially consumer ones. Think here Venmo, Cash App, Klarna, Affirm, or others. If done right, this could be a massive growth opportunity and a solid brand boost. If you need some inspiration, remember what Coinbase did last year:

NFT market is showing signs of recovery 📈

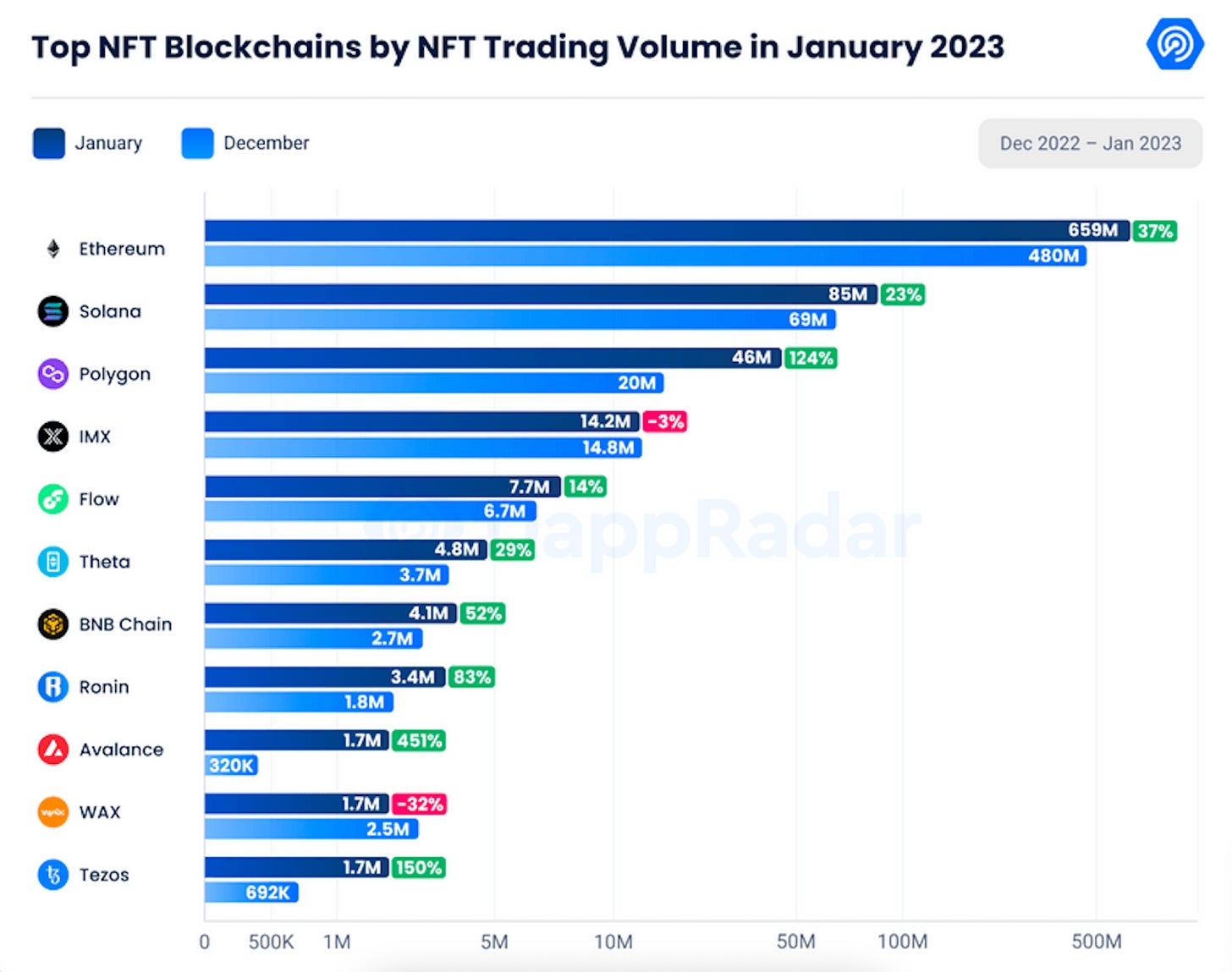

New data 📊 The NFT market seems to be on the path of recovery. Trading volumes rose for two months straight, with January scoring the highest volumes since June last year, according to the latest data from the Dapp Industry Report.

More on this 👉 The growth in January marked a stark difference from the trend of the past few months (October was brutal while in November, the market halted the downward trend). Volumes then recovered in December, rising slightly to $683 million, and increasing 38.5% from that number to $946 million in January.

Ethereum continues to be the leading blockchain for NFTs with over $36 billion in all-time sales.

✈️ THE TAKEAWAY

Looking ahead 👉 Recovering NFT volumes might suggest that non-fungible tokens weren’t only a zero interest rate phenomenon. Nevertheless, I would still give them a few more months so we could see if this is actually a pattern and not a coincidence. Looking ahead, I really hope that this will also give a boost to NFT adoption beyond just digital art. Because that’s where the most exciting opportunities are.

Reread: NFT lending as the next BIG thing in non-fungibles? 🤑

🔎 What else I’m watching

On sale!🚨 Digital Currency Group (DCG) has started selling holdings in several investment vehicles run by its subsidiary, digital assets manager Grayscale, at a steep discount, according to a Financial Times report citing U.S. securities filings. Grayscale operates the Grayscale Bitcoin Trust (GBTC), which has $10 billion-plus in assets under management and was late last year trading at a record discount to the net asset value. The discount has narrowed a bit in 2023, but remains above 40%. Reread: Genesis files for bankruptcy. Here's why it's alarming🚨

SoftBank does it again 😳 SoftBank, the Japanese tech investor posted a $5.8 billion loss across its Vision and Latin American funds in the final quarter of last year. Previously, SoftBank, which has also backed crypto firms such as FTX, Sorare, and ConsenSys, posted a $10 billion loss in the third quarter, per a Wall Street Journal report. Reread: SoftBank is an elephant that keeps falling over 🐘

More crypto cuts ✂️ Protocol Labs, the startup behind Filecoin and IFPS, laid off 21% of its staff. Protocol Labs cut 89 roles across teams, according to a note from founder Juan Benet. Benet cited a difficult macroeconomic environment contributing to a prolonged “crypto winter.” The company has also lowered costs over the past few quarters by reducing team budgets, infrastructure spending, and investments. Bonus: Kraken's brutal layoffs: why nobody’s safe & one key lesson 😳

💸 Following the Money

EigenLayer, an Ethereum restaking protocol, is raising $50M in Series A funding.

French InsurTech Garantme has raised €15M in a round featuring state-backed investor Bpifrance.

Habitto, a Tokyo-based startup looking to change money habits through a mobile bancassurance platform, has raised $3.9M in a pre-Series A financing round. Co-led by Saison Capital and Cherubic Ventures, the round was joined by new investors DG Daiwa Ventures, GMO Ventures, Kyokuto Securities, Epic Angels, and discrete angel investors.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: