Stripe’s quiet M&A 👀; Coinbase fights back against the SEC 😤; Revolut Mafia is now bigger than Revolut itself 🦄

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a regular 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

10 FinTech and Finance stocks to include in your portfolio for 2024 💼 | Part II [Capitalize on the growth and innovation driving Finance & FinTech forward]

Circle IPO is not (only) about Circle 🔔 [why it matters & why it’s not only about Circle + some bonus reads]

Wise continues strong growth with upgraded 2024 guidance 🚀 [a look at their solid numbers & what they mean + what’s next & some bonus reads]

Paradigm shift: Apple opens mobile payments to rivals after EU antitrust pressure 📲

N26 expands into stock trading as part of profitability push 💸

Fraud cost $500 billion while illicit money topped $3 trillion in 2023 😳

Bitcoin surpasses silver to become the second-largest ETF commodity 🤯

As for today, here are the 3 fascinating FinTech stories that were transforming the world of finance as we know it. This week was super intense in the financial technology space, so make sure to check all the above stories.

Stripe’s quiet acquisition 👀

The news 🗞️ Payment processing giant Stripe is aggressively teaming up with companies to boost its offerings in subscription billing and simplify payments.

Stripe recently quietly acquired Octane, a consumption-based billing platform, to support diverse pricing models and iterative billing.

Let’s take a quick look.

More on this 👉 These partnerships exemplify Stripe's strategy of collaborating with specialized firms to enhance its products. The Octane deal furthers Stripe's capabilities in managing subscription-based pricing. As consumption-based models become more prevalent, automation is key to efficiently handling high volumes of billing transactions.

✈️ THE TAKEAWAY

Looking ahead 👀 For Stripe, these partnerships and M&As are accelerating innovation across billing, payments, and global expansion. Tapping into partners' expertise allows Stripe to rapidly deploy new features to solve customer pain points. As Stripe seeks to cement itself as a leader in online financial services, its openness to strategic alliances & M&As gives it an edge in tailoring solutions to emerging business models and regional payment preferences. Ultimately, Stripe's focus on platform enhancements positions it to better serve merchants worldwide.

ICYMI: Investors bet on Stripe IPO in 2024 🔔 [what’s happening & what it’s telling us + a bonus dive into Stripe]

Coinbase fights back against the SEC 😤

The news 🗞️ Crypto exchange giant Coinbase COIN 0.00%↑ is pushing back against a lawsuit filed by the Securities and Exchange Commission (SEC) that alleges the trading platform allowed transactions of tokens that should have been registered as securities.

Let’s take a look.

More on this 👉 In a Manhattan court hearing on January 18th, Coinbase argued that cryptocurrencies do not fall under the SEC's jurisdiction, as they are not akin to stocks. The SEC disagrees, claiming tokens meet the criteria of investment contracts under securities law because their value is tied to the blockchain networks they are built on.

U.S. District Judge Katherine Polk Failla questioned if the SEC was overstepping by trying to expand the definition of a security. She noted that following the regulator's logic, even collectibles like Beanie Babies could be deemed securities.

Coinbase contends crypto tokens do not grant holders rights over a network in the same way that stocks do. Its lawyers invoked the "major questions doctrine," which states that Congress does not empower agencies to make politically/economically significant decisions.

✈️ THE TAKEAWAY

Why this matters? 🤔 This court battle represents a pivotal moment for crypto regulation in the U.S. If Coinbase wins, it would limit the SEC's ability to regulate digital assets as securities without Congressional approval. However, an SEC victory could force Coinbase to delist tokens deemed securities, hampering crypto innovation. The outcome of this case will likely set an important precedent on the SEC's remit over cryptocurrencies. All eyes are on Judge Failla as her ruling could have resounding impacts on Coinbase and the wider crypto industry's ability to operate free from the threat of securities violations. So watch it out!

ICYMI: BTC ETF wars will have one big winner - it’s not what you think 😎 [+ more reads]

Revolut Mafia is now bigger than Revolut itself 🦄

Following the money 💸 Digital FinTech challenger and Super App wannabe Revolut is (still) not only one of the hottest European startups. Also, it’s a very productive and successful founder factory.

Let’s take a look.

More on this 👉 According to research by Vladislav Solodkiy, ex-Revolut employees founded 100+ startups and raised a whopping $2.2 billion in funding, surpassing the $1.7 billion raised by Revolut itself. In just ~5 years.

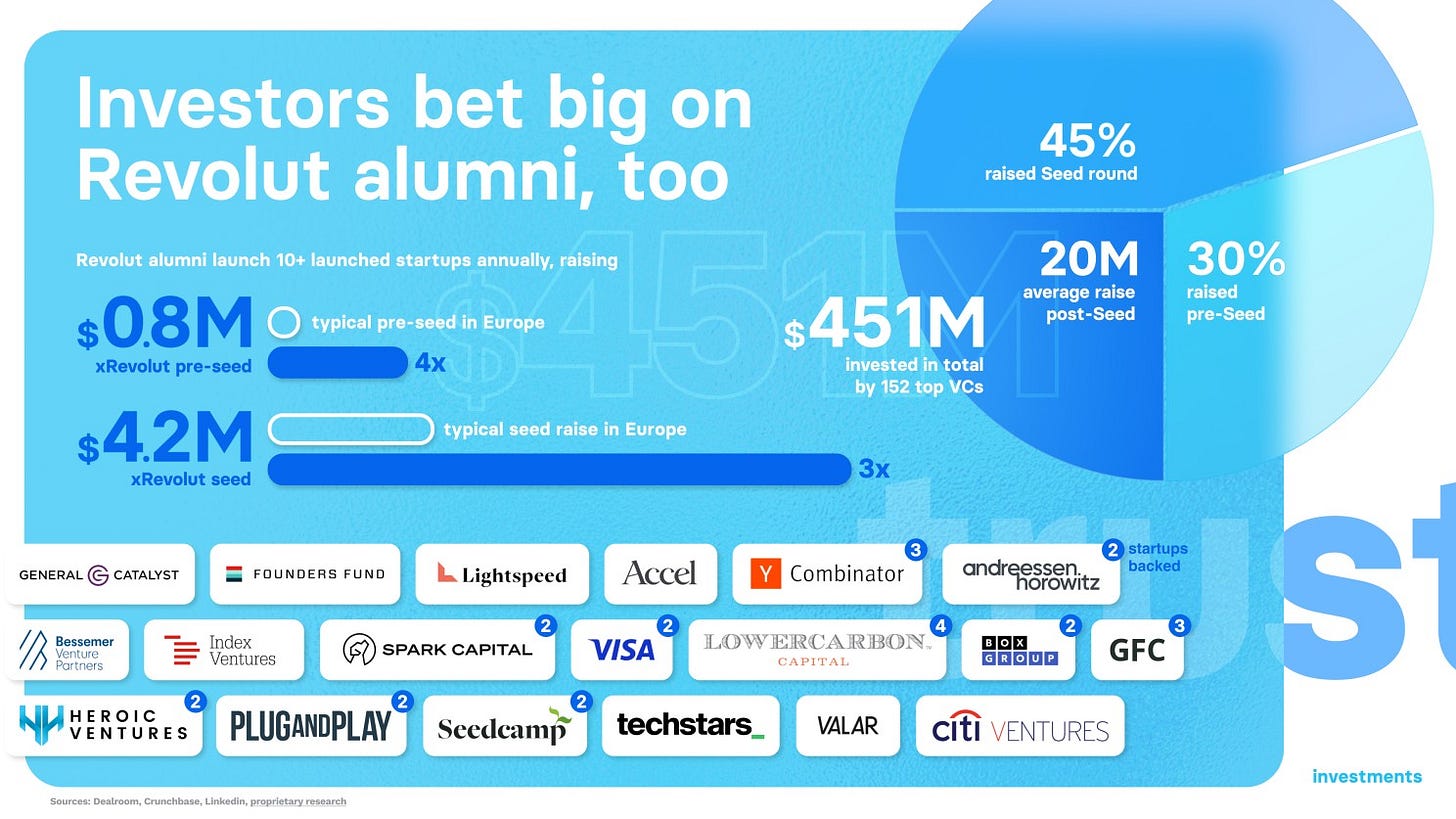

Among these, 67 startups launched by Revolut alumni have raised an impressive $451 million from 152 VCs, including top firms like a16z, Visa V 0.00%↑ , and Accel.

The money💰 The crazy part? They raise 4X larger pre-seed rounds and 3X larger seed rounds than European averages 🤯

Accelerators like Y Combinator and TechStars have easily accepted many of these startups.

The top Revolut mafia startups by funding are Shares ($89.8M), Tesseract ($78M), Sardine ($75.6M), and Belvo ($56M). Though FinTech dominates with 36% of startups, the diversity of ventures highlights the wide-ranging capabilities alumni gain at Revolut.

ICYMI: Shares wants to be the ‘Louis Vuitton’ of trading apps 👀 [+ one more read]

The Revolut Mafia yet again demonstrates the power of connections and skills gained at high-growth FinTechs and technology startups.

✈️ THE TAKEAWAY

Why this matters? 🤔 Startup mafias are no joke. From PayPal PYPL 0.00%↑ to Google GOOGL 0.00%↑, Skype, N26 & Revolut, and even OpenAI, the startup mafia phenomenon demonstrates the power of transformative work cultures in fostering innovation and cultivating future leaders that end up building the businesses of tomorrow. Thanks to strong personal connections and shared experiences, members of startup mafias validate their ideas faster, build core teams more easily, and can ship products & services quicker. That's the key to driving economic growth and innovation.

ICYMI: Revolut's HR Platform is gaining traction 🚀

Christmas present from Revolut: delayed 2022 accounts are finally here 🎁 [latest numbers & what they mean + what’s next & some bonus reads]

🔎 What else I’m watching

Wise vs. Banks 🏦 Wise reports that major UK banks charge high hidden fees on foreign currency exchanges. For GBP to EUR, HSBC has the highest fee (3.7%), followed by Lloyds (3.6%), Barclays (2.75%), and others (2.5%). Similarly for GBP to USD, HSBC again has the highest fee (3.7%), while the rest range from 3.6% to 2.3%. In contrast, digital banks Wise, Starling, Monzo, and HSBC's Zing have no hidden fees. The banks don't clearly communicate these fees upfront as required by regulations. An independent survey found only 22% of Britons think their bank gives them a fair deal, and 90% said banks tend to mark-up rates. Wise argues this lack of transparency by banks has led to a breakdown in consumer trust. ICYMI: Wise continues strong growth with upgraded 2024 guidance 🚀 [a look at their solid numbers & what they mean + what’s next & some bonus reads]

Profitability unlocked 💰 South African digital bank TymeBank has reached profitability just 5 years after launching, making it one of the fastest-growing and profitable neobanks globally. It now has over 8.5 million customers thanks to no monthly fees, low transaction costs, and distribution partnerships with major retailers. TymeBank onboards 150,000 new customers per month and its Retail Capital division is the largest SME funder in the sector. With profitability achieved quicker than neobanks like Nubank and Monzo, TymeBank now aims to become a top 3 South African bank. It is backed by investors including African Rainbow Capital, Apis Growth Fund, Tencent, and British International Investment.

💸 Following the Money

Egypt-based fintech and customer loyalty app Zeal has announced the rise of a $4M funding round to increase its footprint in the wider MENA market.

10x Banking, the core operating supplier founded by former Barclays CEO Antony Jenkins, has picked up $50M in fresh funding from existing investors Blackstone and JPMorgan Chase.

Pomelo, an Argentinian payments infrastructure firm, has raised $40M in a Series B funding round led by VC Kaszek.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

What about N26 Mafia?

Thanks for an informative read.