Klarna launches subscription service ahead of expected IPO 💳; Towards End-to-End Ownership: Fiserv seeks special bank charter 🏦; Apple's EU concession unlikely to dent Apple Pay's dominance 🍎

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a regular 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Corporate Finance Template Collection for CEOs 📚 [a comprehensive resource for driving business growth and financial health]

Once a FinTech darling, Brex lays off 20% as growth slows & burn rate remains high 😳 [uncovering all the details to see what this tells us about the future of Brex & the broader FinTech ecosystem]

The payments industry faces a pivotal year amid tighter funding and more M&A 💸 [tighter funding & more M&A on the horizon, where the focus should be + some bonus reads]

Why Revolut hasn’t conquered India🇮🇳 yet? 🤔 [status quo & challenges + bonus reads on how India’s disrupting payments globally & PhonePhe is building Indian Google]

PayPal was expected to “shock” the world. Instead, they shot themselves in the foot 🥲

Gen Z investing app aims to democratize wealth management with AI 🤖📈

As for today, here are the 3 awesome FinTech stories that were changing the world of finance as we know it. This was another hot week in the financial technology space, so make sure to check all the above stories.

Klarna launches subscription service ahead of expected IPO 💳

The news 🗞️ As Buy Now, Pay Later (BNPL) giant Klarna prepares for an initial public offering in the US, likely to occur "quite soon" according to CEO Sebastian Siemiatkowski, the company is diversifying its offerings with the launch of a new subscription service called Klarna Plus.

Let’s take a look.

More on this 👉 For $7.99 per month, Klarna Plus subscribers will receive perks like no service fees, double rewards points, and exclusive discounts from popular brands.

The move shows Klarna aiming to add a recurring revenue stream before going public, which could make it more attractive to investors.

Subscription revenue is seen as more stable than relying solely on transaction fees. Rival Affirm AFRM 0.00%↑ is also said to be considering a monthly subscription plan for its users.

ICYMI: Strong growth & profitability: Affirm is becoming a force to be reckoned with 📈

Klarna Plus launches on the heels of a profitable quarter for the company, thanks in large part to rising BNPL usage among US consumers. Klarna now has 37 million customers in the United States.

The subscription service had a six-month pilot test in Utah last year and is now rolling out more widely.

Source: BNN Bloomberg

✈️ THE TAKEAWAY

Why this matters? 🤔 For Klarna, Klarna Plus represents a way to deepen ties with its most loyal users while also proving it can successfully add new revenue streams (obviously, adoption will really decide how successful it is). As the BNPL field gets more crowded, having diverse offerings and predictable income will be key competitive advantages as Klarna heads toward its IPO. Klarna gets it.

ICYMI: Klarna's remarkable comeback: how the FinTech giant went from valuation collapse to potential 2024 IPO 📈 [latest numbers, how we got here, and what’s next + a look at how leveraging AI Klarna is building the Google of Shopping]

Towards End-to-End Ownership: Fiserv seeks special bank charter 🏦

The news 🗞️ Payment processing giant Fiserv FI 0.00%↑ has applied for a limited purpose bank charter in Georgia that would allow it to handle merchant transactions from end-to-end, without needing a bank partner.

If approved, the charter would give Fiserv greater control, cost savings, and pricing flexibility in the highly competitive merchant acquiring market.

Let’s take a look.

More on this 👉 Historically, Fiserv has partnered with banks to provide settlement services for merchant transactions. However, with banks increasingly focused on other areas, Fiserv is taking steps to vertically integrate these capabilities.

The special purpose charter will thus let Fiserv authorize, clear, and settle transactions itself, eliminating third-party risk and fees paid to bank partners.

This move could allow Fiserv to reduce costs and undercut competitors on pricing for payment acceptance services. As margins continue to shrink in the merchant business, scale and efficiency are imperative. Bringing settlement in-house instead of relying on bank partners helps Fiserv improve margins in this low-cost space.

More importantly, having a charter could also provide more control over embedded finance capabilities, as Fiserv looks to retain software partners seeking these services.

✈️ THE TAKEAWAY

Why this matters? 🤔 As the largest non-bank merchant acquirer in the US, this strategic move allows Fiserv to consolidate its position. With competitors like Stripe and Adyen disrupting the payments landscape, and more and more banks offering direct merchant services, Fiserv is focused on leveraging its scale and driving efficiency. The special purpose charter will therefore help Fiserv stay ahead of the competition. Bullish move.

ICYMI: Adyen just became a bank in the UK 🇬🇧🏦 [why this is huge for the future of Adyen + a deep dive into undervalued FinTech giant]

Apple's EU concession unlikely to dent Apple Pay's dominance 🍎

The news 🗞️ Last week I covered Apple AAPL 0.00%↑ that proposed allowing third-party mobile wallets access to the iPhone's NFC chip in the European Union for 10 years to address EU antitrust concerns

ICYMI: Paradigm shift: Apple opens mobile payments to rivals after EU antitrust pressure 📲

The move aims to increase competition in the mobile payments market where Apple Pay has exclusive access to the technology.

Let’s take a quick look and see why it’s not a big threat to Apple Pay.

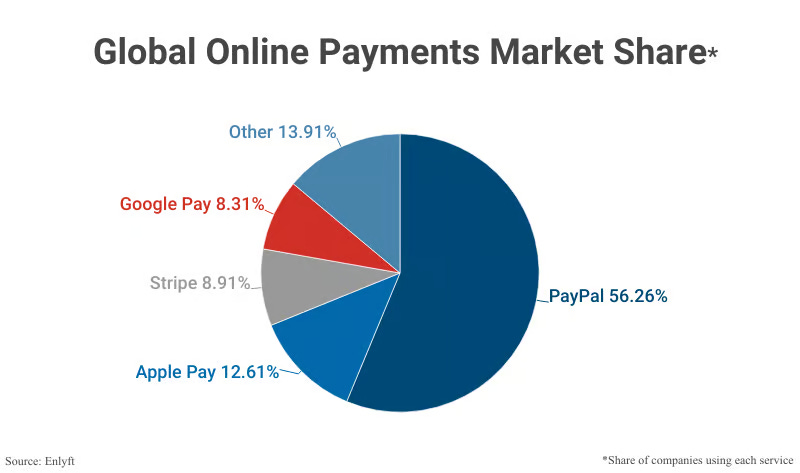

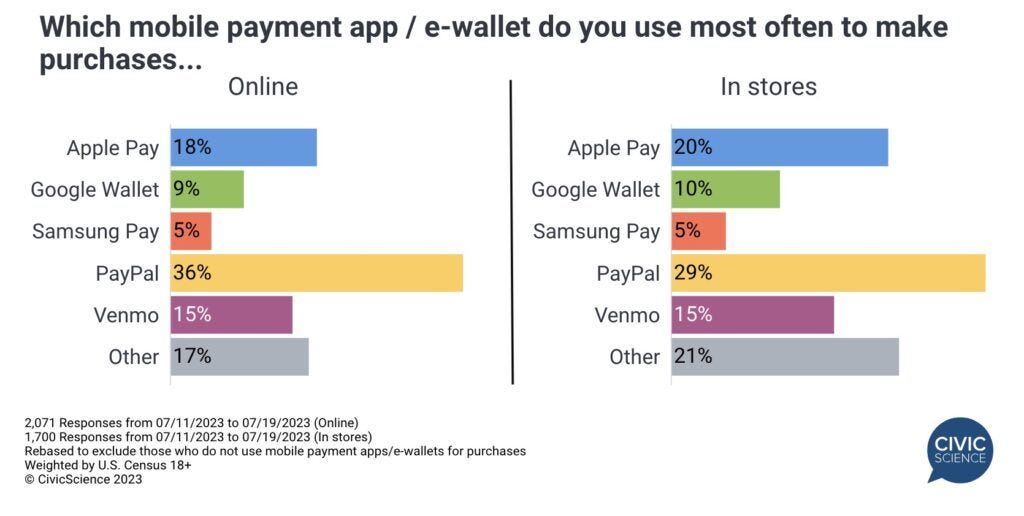

More on this 👉 While the proposal gives a boost to rival services like Google Pay and Samsung Pay in their ability to compete, it likely won't significantly impact Apple Pay's market dominance.

Apple enjoys unrivaled loyalty among its users, especially younger consumers. Over 40% of US teens used Apple Pay in the last month, demonstrating its strong footing.

Additionally, using Apple Pay has become a habit for many users, making it difficult for competitors to change engrained consumer behavior without strong incentives.

More importantly, while services like Google Pay are growing faster by percentage, Apple Pay boasts over half of the US mobile proximity payment user market.

✈️ THE TAKEAWAY

Looking ahead 👀 The EU concession shows Apple's willingness to make calculated moves to satisfy regulators. It likely determined any potential loss in Apple Pay EU market share will have minimal impact on global revenues. With strong brand power and habitual use driving Apple Pay adoption, competitors are still facing an uphill battle even with NFC access. Back to work.

ICYMI: The dawn of AI-driven finance: how Apple can transform smartphones into financial powerhouses 📲💸 [the dawn of AI-driven finance with Apple at the center + more bonus reads]

🔎 What else I’m watching

Revolut’s buffing its finance team 💸 London-based digital bank Revolut has strengthened its finance team with several senior hires, including a former AmEx VP and Citi MD, after a turbulent 2023. John Kerrisk joined as head of financial control from cybersecurity firm Bitdefender. Martin McLeod was appointed CFO of Revolut Australia, having previously spent over 17 years at Citi. The moves follow issues like a $20 million hack and scrutiny of Revolut's finances in 2023, as well as the departure of former CFO Mikko Salovaara. They hint at Revolut aiming to rebuild its finance function under new interim global CFO Victor Stinga, who was previously part of the company's controversial "founders associates" team. ICYMI: Why Revolut hasn’t conquered India🇮🇳 yet? 🤔 [status quo & challenges + bonus reads on how India’s disrupting payments globally & PhonePhe is building Indian Google]

Crypto-linked stocks rise 📈 Crypto-linked stocks rallied on Friday as the price of bitcoin rose over 3% in 24 hours, ending the week on a positive note. Bitcoin mining stocks saw the biggest gains, with companies like Core Scientific, Hut 8, and TeraWulf rising 5-15%. Other crypto stocks like Coinbase and MicroStrategy, which hold bitcoin on its balance sheet, also rose 3-5%. The gains provide some relief after a week of selling triggered by traders treating bitcoin ETF approval as a "sell the news" event and pulling money from Grayscale's bitcoin trust. However, one analyst says this is not the time to turn bearish on Bitcoin given supportive macro conditions and potential positive catalysts like the 2024 US election.

European launch 🇫🇷 US cryptocurrency exchange Gemini has received regulatory approval to offer services to retail and institutional investors in France. The green light from French regulator AMF allows Gemini to launch its trading platform, mobile app, and institutional trading solutions in France over the coming weeks. The expansion aligns with the trend of major US crypto firms turning to the EU amid a regulatory crackdown in the US, including SEC charges against Gemini's Earn product. Crypto regulation in Europe, spearheaded by MiCA, allows licensed companies to passport services across the EU. This contrasts with the lack of federal oversight in the US, although developments like SEC approval of bitcoin ETFs signal a growing embrace of crypto. Gemini opted to establish its EU base in Ireland last year to tap the region's more supportive environment.

💸 Following the Money

Madrid-based neobank MyInvestor raised €45M in funding. Nortia Capitaland Arama Futuro led the round and were joined by investors including Andbank, Casticapital, Aligrupo, and Reig Patrimonia.

Zurich-based Rivero, which digitizes and automates payment processes, raised €6.4M in a Series A round led by 6 Degrees Capital and Inference Partners.

Early-stage investment fund Plural, started by founders for founders, has launched a new €400M fund. The fund comes just 18 months after the investment platform launched a €250M fund with an aim to help founders in Europe gain access to investors who have first-hand experience in building companies.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Good stuff.

How can I invest in Klarna?