Bitcoin refuses to stop climbing 🤯📈; Revolut's valuation takes a massive hit amid endless licensing delays 📉😳; Paytm's path to survival: securing vital license amid regulatory shutdown threat ✅🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Stripe's growth continues as it passes $1 trillion in payments volume 😳 [how big is the $1 trillion milestone, what does it tell us & what’s next + bonus deep dives into Adyen, PayPal & more]

Crypto frenzy ignites Coinbase's resurgence: a meteoric rise and new frontiers ahead 🚀💸 [what are the key drivers behind this meteoric rise & what’s next + a deep dive into Coinbase and their latest numbers & why I’m super bullish]

Navigating the crowded merchant payment provider landscape 🧭💳 [a deeper dive into the latest analysis of the leading PayTechs + lots of bonus reads inside]

PayPal goes all-in on crypto remittances 🚀 [what it’s all about & what it means + what’s next & some bonus deep dives]

Pix is dominating & reshaping Brazil's payment landscape 🇧🇷 [how Pix became such a success story & what’s next + a bonus deep dive into Nubank]

N26 turbocharges European expansion with high-yield savings accounts 💸 [what it’s all about & why it makes sense + bonus dives into N26 and their strategy]

Ethereum's Dencun upgrade: a seismic shift towards scalability & affordability ♢♦️ [what it’s all about & why it’s a pivotal moment for Ether + some more bonus reads inside]

Public Square acquires Credova to expand BNPL options for conservative customers 💸

Klarna co-founder acquires large stake through offshore entity 👀

As for today, here are the 3 fascinating FinTech stories that were changing the world of finance as we know it. This is definitely the most interesting week in 2024 thus far, so make sure to check all the above stories.

Bitcoin refuses to stop climbing 🤯📈

The news 🗞️ Bitcoin has smashed through its previous all-time high, surging past $72,000 and continuing its record-breaking rally.

As noted earlier, this has been fueled by several factors, including institutional adoption, the launch of spot Bitcoin ETFs, and the anticipation of the upcoming Bitcoin halving event.

Let’s take a closer look at this.

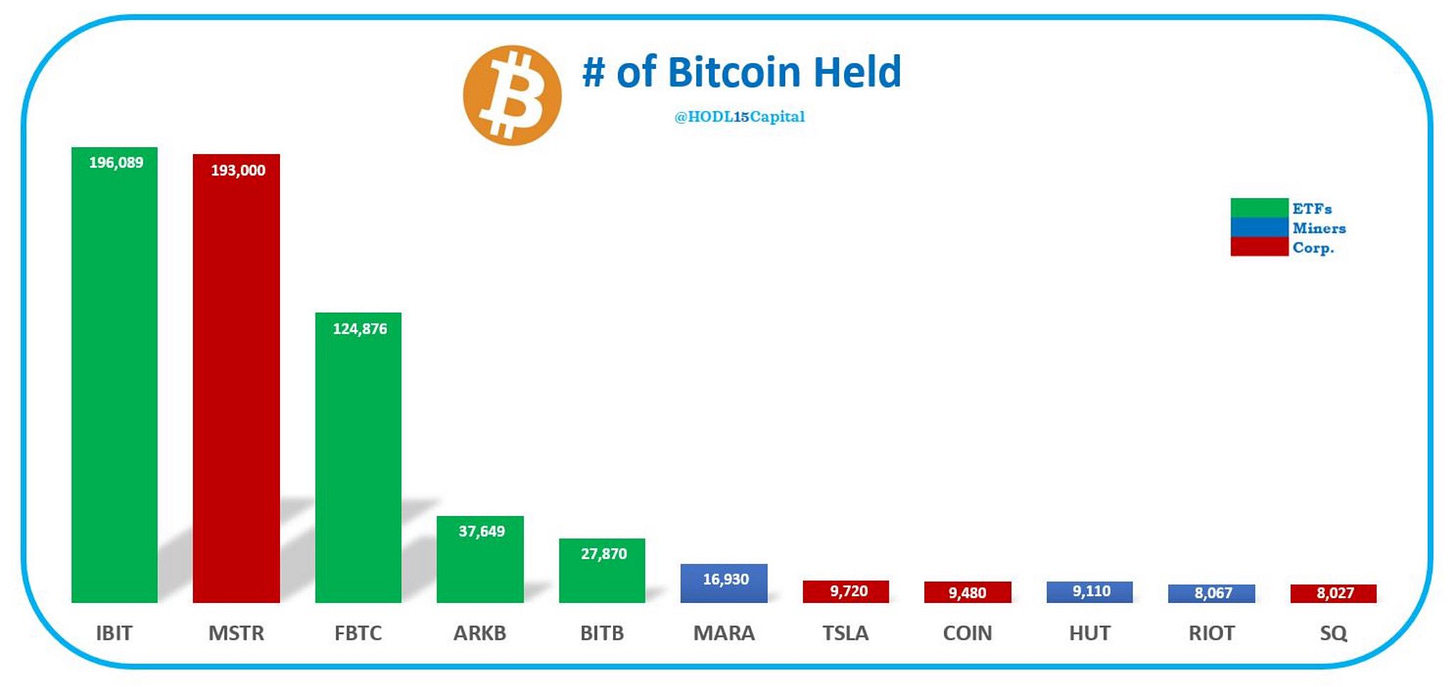

More on this 👉 First and foremost, the impact of the US spot Bitcoin ETFs cannot be overstated. BlackRock's IBIT ETF, which launched in January, has already amassed over $10 billion in assets under management, making it one of the fastest-growing ETFs in history.

This significant influx of capital has thus played a crucial role in sustaining demand and offsetting the sell-side pressure from long-term holders taking profits.

MicroStrategy MSTR 0.00%↑, the business intelligence company led by Michael Saylor, has further exemplified the institutional appetite for Bitcoin. In a massive move, MicroStrategy yesterday purchased an additional 12,000 bitcoins for $821.7 million, increasing its total bitcoin holdings to 205,000 BTC. This figure surpasses the holdings of BlackRock's IBIT ETF, which stands at 197,943 BTC.

The upcoming Bitcoin halving event, scheduled for April, has also contributed to the frenzy surrounding Bitcoin. Historically, halvings have introduced increased volatility and market strength, with downturns in halving years generally limited to around -10%. Analysts at research firm Bernstein are now "more convinced" about their $150,000 bitcoin price target, citing the potential impact of the halving and the continued integration of Bitcoin into traditional asset portfolios.

Bernstein also highlights the potential for Bitcoin miners to benefit significantly from the current market conditions. Analysts at the firm suggest that even if production costs were to double after the halving, miners like Riot Platforms RIOT 0.00%↑ and CleanSpark CLSK 0.00%↑ could still generate gross profit margins of around 70% and 60%, respectively, at current Bitcoin price levels.

Zooming out, while the recent rally has been remarkable, it has not been without its challenges. On-chain data from Kaiko Research suggests that the number of new daily Bitcoin "millionaire" wallets has lagged behind previous bull runs. This could be attributed to large whales taking profits as Bitcoin hits new highs or storing their holdings with custodians rather than personal wallets.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, the future implications of Bitcoin's ascent are multifaceted. The growing institutional adoption and the launch of spot ETFs have undoubtedly brought Bitcoin into the mainstream financial landscape. However, as regulators and policymakers grapple with the implications of this new asset class, further regulatory clarity and guidance will be crucial. Additionally, the upcoming halving event and the potential for increased volatility will likely present both risks and opportunities for traders and investors alike. Those employing momentum and directional strategies will need to carefully navigate this complex landscape, utilizing various on-chain tools and risk assessment frameworks to pinpoint strategic entry and exit points. Zooming out, the rise of Bitcoin has also brought renewed attention to the broader cryptocurrency ecosystem. As investors diversify their interests and explore altcoins beyond the established giants, the maturation of the market and the exploration of new use cases and applications will be a trend to watch.

ICYMI: Bitcoin breaks records again: the relentless rally fueled by institutional demand 📈💸 [analyzing the latest data, thinking about what’s next + two investment thesis for Bitcoin]

Revolut's valuation takes a massive hit amid endless licensing delays 📉😳

The news 🗞️ Revolut, the UK's high-flying FinTech unicorn, has seen its lofty valuation take a major blow due to ongoing delays in securing a crucial UK banking license.

The digital bank's struggles to obtain regulatory approval have caused major investors to slash their assessments of the company's worth by billions.

Let’s take a look.

More on this 👉 The troubling news centers around TriplePoint Venture Growth, a leading U.S. tech investment firm that was an early backer of Revolut. TriplePoint has now cut the value of its Revolut stake by a staggering 18% as of the end of 2023, according to its financial filings. This follows an even bigger 15% writedown the previous year. Ouch.

Collectively, TriplePoint's downward revisions imply that Revolut's overall valuation has plummeted from $33 billion at its 2021 peak to around $23 billion currently - an eye-watering decline of 30%.

The worst part? TriplePoint is not alone in slashing its view of Revolut's worth. Major investment houses like Schroders and Molten Ventures marked down their Revolut holdings by 46% and 54% respectively in 2022.

What’s happening? 👀 The persistent downgrades lay bare the escalating concerns over Revolut's failure to secure a UK banking license more than three years after first applying to British regulators. This has raised doubts about the fintech star's aggressive $33 billion valuation that briefly made it Europe's most valuable startup after an $800 million funding round led by SoftBank in 2021.

While Revolut continues posting impressive revenue growth - it reported a 45% jump to £922.5 million in 2022 - losses are mounting and it remains constrained in its ability to offer full-fledged banking services without a UK license. Reports last year even suggested the Bank of England was preparing to reject Revolut's license bid over financial control shortcomings, though no formal notice has been issued yet.

ICYMI: Christmas present from Revolut: delayed 2022 accounts are finally here 🎁 [latest numbers & what they mean + what’s next & some bonus reads]

TriplePoint's chief investment officer cited the lengthy delay since Revolut's last fundraising as the key factor behind the markdowns, noting that prior funding rounds occurred when valuations peaked across the fintech space versus more modest levels today.

In response, Revolut has lashed out at "extreme bureaucracy" in the UK licensing process while threatening to take its eventual public listing to Wall Street rather than London. Its new UK chief, Francesca Carlesi, however, struck a more conciliatory tone this week, vowing that the company remains "determined" to win regulatory approval.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, Revolut urgently needs to untangle the regulatory gridlock and secure its UK license if it hopes to restore confidence among investors and live up to its once-lofty $33 billion valuation. Failure to do so may result in further brutal markdowns and increasing skepticism over the fintech star’s ability to truly disrupt consumer banking. For now, Revolut's endless licensing saga has transformed one of Europe's brightest startup stars into a cautionary tale about the perils of allowing valuations to outpace business fundamentals and regulatory realities. As rivals like Monzo capitalize on resurging investor enthusiasm for fintech, the clock is ticking for Revolut to get its house in order before its valuation advantage slips away for good.

ICYMI: Revolut to launch advanced crypto exchange 👀 [why it makes sense + more dives into Revolut]

Paytm's path to survival: securing vital license amid regulatory shutdown threat ✅🇮🇳

The (good) news 🗞️ In a last-minute reprieve, Indian digital payments giant Paytm has secured the critical third-party application provider (TPAP) license from the National Payments Corporation of India (NPCI).

This license approval comes just a day before Paytm's banking unit Paytm Payments Bank was mandated to cease operations on March 15th due to regulatory violations.

Let’s take a look at this.

More on this 👉 The TPAP license will allow Paytm to continue facilitating payments through the hugely popular Unified Payments Interface (UPI) rail, though in a more limited capacity than before. Previously, a majority of Paytm's transactions were processed through its own banking arm. With that shutting down, Paytm will now operate similarly to rivals like PhonePe and Google Pay, relying on partnerships with traditional banks.

Axis Bank, HDFC Bank, State Bank of India, and Yes Bank will serve as payment service providers enabling transactions on the Paytm app. Yes Bank will additionally act as the merchant acquiring bank for Paytm's retailers. The "@paytm" UPI handle is being redirected to Yes Bank to minimize disruptions.

✈️ THE TAKEAWAY

Looking ahead 👀 This eleventh-hour approval prevents Paytm from going defunct but comes at a massive cost. The Reserve Bank of India's regulatory crackdown on Paytm Payments Bank had already wiped out over half of the parent firm's market capitalization. Paytm is also downsizing around 20% of the banking unit's staffers across functions like operations. While no longer a complete shuttering, the fundamental change imposed on Paytm's business model underscores the regulators' intensifying scrutiny of digital payments and fintech operations in India. As scale and consumer adoption grow, so do concerns around risk management and regulatory compliance. Looking ahead, Paytm and its peers will likely need to enhance governance while nurturing sustainable partnerships with regulated entities. Innovative digital-first models will continue gaining prominence, but operating under the regulatory lens with secure technology stacks and robust processes will be non-negotiable for building trusted national digital payment ecosystems.

ICYMI: Goodbye, Paytm? Paytm Payments Bank's demise and the future of digital payments in India 💳🇮🇳 [the demise & the future of digital payments in India + some bonus reads]

🔎 What else I’m watching

🇪🇺💰 Klarna fined 🇪🇺💰 Swedish payments group Klarna must pay a fine of 7.5 million crowns ($733,324) for violating the EU's General Data Protection Regulation (GDPR) for not providing sufficient information to its users, according to a Swedish court of appeal ruling. Klarna failed to give clients sufficient information about how it would store their personal data, with the information being unclear or difficult to access. The case concerned privacy notes used between March and June 2020, which have since been updated. Under GDPR, companies are legally obliged to inform users and clients about how and why they handle personal data, including how they collect it and for how long they store it. Sweden's Administrative Court of Appeal raised the penalty back to the 7.5 million crowns originally sought by the Swedish Data Protection Agency (SDPA) after a lower court ruled last year that Klarna should pay 6 million crowns. ICYMI: Klarna's Resurrection: narrowing losses and preparing for the biggest IPO of 2024 🤑🔔 [a deep dive into their latest numbers to see what they mean & what’s next for Klarna + some solid bonus reads & further dives inside]

Wise’s Type 1 Licence in Japan 🇯🇵💸 FinTech giant Wise has obtained a Type 1 license in Japan, enabling it to support higher transaction limits. This achievement makes Wise Payments Japan K.K. one of the first international financial service providers to secure a Type 1 Funds Transfer Service Provider license in Japan. The new license allows both individuals and businesses to conduct transactions of up to 150 million JPY per transaction across various currencies. Wise distinguishes itself by offering transactions at the mid-market rate without undisclosed fees, providing efficient, cost-effective, and transparent solutions. The company has experienced consistent growth in Japan since its establishment in 2016, expanding its local workforce and improving its product portfolio. ICYMI: Wise continues strong growth with upgraded 2024 guidance 🚀 [a look at their solid numbers & what they mean + what’s next & some bonus reads]

Dencun Day One 📉🏦 Some Ethereum layer 2 networks have seen a significant decline in median transaction fees, with some dropping by as much as 99%, after the Dencun upgrade went live. The biggest winners include Optimism, Base, Arbitrum, Zora, and zksync. ICYMI: Ethereum's Dencun upgrade: a seismic shift towards scalability & affordability ♢♦️ [what it’s all about & why it’s a pivotal moment for Ether + some more bonus reads inside]

💸 Following the Money

Copenhagen-based Meo, an anti-money laundering platform that helps compliance teams verify customers and risk assess, raised €1.67M in debt and equity from investors including Scale Capital, EIFO Ventures, and Gilion.

It’s done! UK-based Nationwide Building Society has reached a preliminary agreement to acquire Virgin Money for GBP 2.9B. ICYMI: Nationwide's £2.9 billion bid to reshape UK banking landscape 🇬🇧🏦 [how this will reshape the UK banking landscape & what’s next]

Cambridge, UK-based Theia Insights, an AI-powered platform for investment analysis, raised $6.5M in funding. Unusual Ventures led the round and was joined by investors including Fidelity International Strategic Ventures and Clocktower Ventures.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

$100k next?

Bitcoin to the moon!