SEC wins ruling allowing a lawsuit against Coinbase 👀; Chime gears up for 2025 IPO 🚀; Binance exec flees Nigeria amidst tax evasion charges & regulatory crackdown 😳🇳🇬

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Robinhood’s new credit card goes after Apple in a push to become the primary financial hub 💳 [unpacking all the details (economics, strategy, etc.) so we could see why it’s such a brilliant move from Robinhood + lots of bonus reads on this undervalued FinTech giant]

Digital remittances poised to transform Latin America's financial landscape 💸🌎 [analyzing & breaking down the latest report + bonus deep dives into Mastercard & LatAm’s FinTech gems Nubank & dLocal]

Visa & Mastercard reach $30B settlement in swipe fee battle, but it’s far from over 😤 [what it’s all about, what will change & why it’s not over yet + some deeper dives into both Visa & MC]

AI is supercharging parametric insurance & transforming risk management 🤖 [what it’s all about, why AI in insurance matters & what’s next]

BlackRock is igniting institutional crypto revolution 📈 [what it’s all about & what’s next + more bonus reads]

Decentralizing data for Web3 & beyond 🕸️ [what’s the USP & why it could be a game-changer]

Western Union copies Revolut as it unveils global eSIM service 😳 [the USP & where’s the money + some more reads on Revolut]

US Treasury raises alarm on growing cyber threats from AI adoption in finance 😳

Qonto expands business banking offerings with new "Pay Later" financing solution 💸

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This is one of the most interesting weeks this year thus far, so make sure to check all the above stories.

SEC wins ruling allowing a lawsuit against Coinbase 👀

The news 🗞️ A federal judge has dealt a significant blow to Coinbase, ruling that the U.S. Securities and Exchange Commission (SEC) can proceed with its lawsuit accusing the cryptocurrency exchange of operating as an unregistered broker, exchange, and clearing agency.

Let’s take a quick look at this.

More on this 👉 U.S. District Judge Katherine Polk Failla determined that the SEC sufficiently argued its case, particularly regarding Coinbase's staking program, which the agency contends involves the unregistered offer and sale of securities.

Despite Coinbase's arguments that existing securities laws are ill-suited for the crypto industry, Judge Failla maintained the stance that the challenged transactions align with the framework courts have used to identify securities for nearly 80 years. The judge did, however, dismiss the SEC's claim that Coinbase Wallet functions as an unregistered broker.

In response to the ruling, Coinbase Chief Legal Officer Paul Grewal expressed a lack of surprise, noting that early motions against government agencies are often denied. Grewal emphasized that clarity remains the ultimate goal and that the decision keeps Coinbase on that path. He also called for Congress to advance comprehensive digital assets legislation in the U.S., deeming it critical for fostering domestic innovation.

The court's decision marks a significant development in the ongoing legal battle between Coinbase and the SEC, which initially filed the lawsuit in June 2023. The case has drawn attention to the regulatory challenges faced by the crypto industry and the debate over how best to oversee digital assets.

✈️ THE TAKEAWAY

What’s next? 🤔 For Coinbase, the ruling presents a setback but not a definitive end to its legal fight. The company is likely to continue challenging the SEC's allegations and may pursue necessary appeals. However, the decision does put pressure on Coinbase to reevaluate certain aspects of its business model, particularly its staking program, which has been a focal point of the SEC's complaint. Looking at the big picture, the outcome of this case could have far-reaching implications for the wider crypto industry. A Coinbase victory could set a precedent that limits the SEC's authority over certain crypto activities, while a loss could embolden the agency to take a more aggressive stance toward other crypto exchanges and platforms. Zooming out, as the lawsuit progresses, the crypto community will be closely watching for further developments and their potential impact on the regulatory landscape. In the meantime, Coinbase will need to navigate the legal challenges while continuing to operate its business and serve its customers. The company's ability to adapt and evolve in the face of regulatory scrutiny will be crucial to its long-term success in the rapidly evolving world of cryptocurrencies.

ICYMI: Crypto frenzy ignites Coinbase's resurgence: a meteoric rise and new frontiers ahead 🚀💸 [what are the key drivers behind this meteoric rise & what’s next + a deep dive into Coinbase and their latest numbers & why I’m super bullish]

Chime gears up for 2025 IPO as neobank's growth surges 🚀

The news 🗞️ Chime Financial, a leading FinTech neobank, is reportedly planning to go public in 2025, eyeing a listing on the US stock market.

While the company has not yet engaged investment banks, the potential IPO marks a significant milestone for the rapidly growing digital banking sector.

Let’s take a look at this.

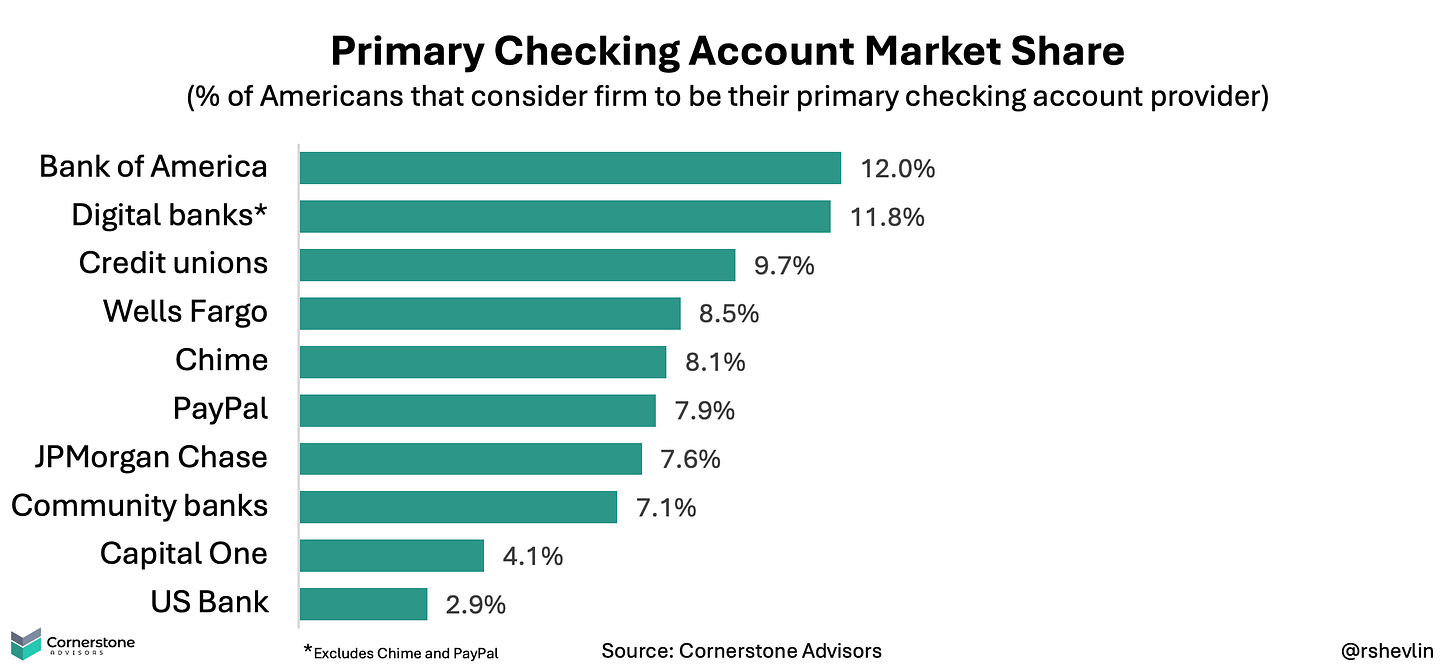

More on this 👉 Chime's journey towards an IPO has been closely watched, as the company has amassed a substantial customer base by offering fee-free services and challenging traditional banks. Recent consumer research by Cornerstone Advisors estimates that Chime now boasts more than 38 million customers, a threefold increase from 2021 estimates 😳

Remarkably, Chime has surpassed the number of checking account and payments customers of several prominent FinTechs combined, including SoFi, Dave, MoneyLion, and Current.

ICYMI: Dave hits profitability: disciplined FinTech disruptor with untapped growth potential 🐻📈 [a deeper dive into their latest numbers, uncovering what they mean + why you should be bullish about this underrated neobank]

The USP 🥊 One of Chime's key strengths lies in its ability to attract primary customers. Approximately half of Chime's customers consider the neobank their primary checking account provider, translating to an impressive 8.1% of all American adults. This market share surpasses that of JPMorgan Chase, the nation's largest bank by assets, which counts 7.6% of Americans as primary checking account customers.

Chime's customer demographics skew towards younger generations, with 75% of its customers under the age of 45. The company's success in capturing emerging young consumers and maintaining a high percentage of primary customers who transact frequently bodes well for its future growth prospects. However, questions remain regarding Chime's ability to retain customers as they age, expand into credit products, and capture more spending wallet share.

To diversify its revenue streams beyond interchange fees, Chime is exploring bundling digitally delivered products and services with its checking accounts. A 2022 study by Cornerstone found that a high percentage of Chime customers express strong interest in services such as roadside assistance, cell phone damage protection, and identity theft protection when bundled with their Chime checking accounts.

✈️ THE TAKEAWAY

Looking ahead 👀 So are we IPO ready? While Chime's valuation reached $25 billion during the 2021 tech boom, market conditions and secondary-market activity suggest a more modest valuation in the $6-8 billion range as of early 2023. Nonetheless, the company's sustained customer growth and strong market position make it a compelling candidate for a public listing. An IPO would provide Chime with access to capital markets, enabling the company to fuel further expansion, invest in product development, and solidify its position in the competitive FinTech landscape. As the demand for digital banking solutions continues to grow, Chime's successful IPO could pave the way for other neobanks to follow suit and reshape the future of personal finance. Will be watching this one closely from now on.

ICYMI: Klarna's Resurrection: narrowing losses and preparing for the biggest IPO of 2024 🤑🔔 [a deep dive into their latest numbers to see what they mean & what’s next for Klarna + some solid bonus reads & further dives inside]

Binance executive flees Nigeria amidst tax evasion charges and regulatory crackdown 😳🇳🇬

The news 🗞️ Nigeria's ongoing dispute with Binance, the world's largest cryptocurrency exchange, has escalated with the escape of Nadeem Anjarwalla, Binance's regional manager for Africa, from Nigerian custody.

Let’s take a look at this and see what it’s all about.

More on this 👉 Anjarwalla, along with his colleague Tigran Gambaryan, Binance's head of financial-crime compliance, had been detained by Nigerian authorities since late February without being formally charged. The detentions came as part of Nigeria's crackdown on crypto exchanges, which the government blames for exacerbating the country's economic crisis and the plunge in value of the naira, Nigeria's national currency.

On Friday, Nigeria's Federal Inland Revenue Service filed charges against Binance and the two executives for alleged tax evasion, including failure to pay value-added tax and corporate income tax, failure to file tax returns, and aiding customers in evading taxes through the platform. The Nigerian government has also accused Binance of facilitating $26 billion in untraceable transactions.

Anjarwalla, a UK and Kenyan citizen, reportedly fled Nigeria using a "smuggled" passport, prompting Nigerian authorities to work with Interpol to obtain an international arrest warrant. Binance has confirmed that they are aware of Anjarwalla's escape and are collaborating with Nigerian authorities to resolve the issue, prioritizing the safety of their employees.

✈️ THE TAKEAWAY

What’s next? 🤔 The ongoing legal battle between Nigeria and Binance yet again highlights the challenges faced by governments in regulating the rapidly growing cryptocurrency industry. If that wouldn’t be enough, Nigeria's economic woes, including a 70% devaluation of the naira against the dollar since last year and a scarcity of foreign currency, have led to increased scrutiny of crypto exchanges as citizens turn to digital assets as an alternative. As the situation unfolds, it remains to be seen how Nigeria will proceed with its case against Binance and whether the exchange will face significant fines or other penalties. The outcome of this dispute could set a precedent for how other countries approach the regulation of cryptocurrency exchanges and their role in the global financial system. Looking ahead, the Binance-Nigeria dispute underscores the need for clearer international regulations and cooperation between governments and crypto exchanges to prevent tax evasion, money laundering, and other illicit activities. As cryptocurrencies gain mainstream adoption, striking a balance between fostering innovation and ensuring compliance with financial regulations will be crucial for the long-term stability and legitimacy of the industry.

🔎 What else I’m watching

Stripe-Amazon colab 🤝 Stripe has partnered with Amazon to power payments for Just Walk Out technology in Australia and Canada. Stripe Terminal will enable in-person payments for retailers and customers using the technology, while Amazon will use Stripe Connect to route payments to businesses. Merchants in these regions can leverage Stripe Terminal's WisePad3 reader, attached to entry gates, for seamless transactions. Stripe will automatically process payments after guests leave the store. This is yet another proof that Stripe is getting aggressive in the enterprise space. ICYMI: Stripe's valuation rebounds to $65 billion as payments giant buys back employee shares 😮💨 [what it’s all about & why it’s rather disappointing + lots of bonus reads into Stripe and beyond]

Chase's Wealth Plan attracts millions of users💰 JPMorgan Chase's free Wealth Plan digital money coach has helped customers create over a million personalized plans in just a year since its launch. Available on the Chase Mobile app and Chase.com, Wealth Plan provides the bank's 54M retail customers with a comprehensive view of their finances and assists them in planning, saving, and investing. Users can set and track short-term and long-term goals in real time, receiving personalized step-by-step guidance and insights. A goal simulator shows customers how different decisions made today can impact their financial future, and they can also schedule to speak to an advisor directly from the tool. In its first year, Wealth Plan has proven popular, with 10 million customers using it to update plans, get assistance to stay on track, and get closer to their goals. ICYMI: JPMorgan doubles down on growing the old-fashioned way: branches 🏦 [why it makes sense + a deep dive into JPM and how it recently made history]

Leadership Change at Bolt 🔄 Justin Grooms, Bolt's global head of sales, has replaced Maju Kuruvilla as interim CEO. Kuruvilla confirmed the change on LinkedIn, with no further details provided. The Bolt board reportedly voted for his removal. Kuruvilla, an ex-Amazon executive, assumed the CEO role in January 2022 after founder Ryan Breslow stepped down. Grooms joined Bolt five years ago, following executive positions at Ultraleap, Datron World Communications, and Qualcomm. Bolt has faced controversies, including a federal probe involving Breslow over potential securities law violations during a 2021 fundraising round. The company also experienced multiple layoffs, affecting a significant portion of its workforce. Under Kuruvilla's leadership, Bolt announced the SEC was no longer investigating and focused on profitability. The company unveiled new features and partnerships with retailers like Saks OFF 5TH and Toys "R" Us. Will the CEO make the right decision? ICYMI: Bolt and Checkout.com team up to make online shopping a breeze. M&A to follow? 👀 [why Checkout.com should acquire Bolt soon + more bonus reads into struggling Bolt & Checkout]

💸 Following the Money

Goalsetter a US financial education platform focused on helping families learn how to spend, save, and invest, has raised $9.6M in a Series A extension round.

Uzbekistan-based digital services ecosystem Uzum has announced that it raised $114M in funding, securing its unicorn status with a post-money valuation of over $1B.

Avalanche-based Gunzilla raised $30M to help release its new game, Off The Grid.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

What will happen to Coinbase stock?

Thank you! Looking forward to this every week.