Is Revolut now worth 45% more?! 🤔; Hong Kong approves spot Bitcoin and Ethereum ETFs, positioning itself as a crypto hub 🇭🇰; Nubank ventures into telco business 📞🟣

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

No IPO soon? Stripe raises $694 million in a share sale 🤑💸 [what it’s all about & why IPO won’t happen soon + bonus deen dives into Stripe and their latest numbers]

Wise demonstrates robust growth, but the stock is down 😔 [unpacking the latest numbers and what they mean & what’s next for Wise + some more bonus reads]

Klarna doubles down on the US with a credit card launch 💳🇺🇸 [why it makes sense & what’s Klarna’s unfair advantage + a solid deep dive into the BNPL giant]

Telegram to allow Tether payments 🪙 [why it makes sense, a quick look at Telegaram’s insane numbers + a deeper dive into why messaging & crypto/payments are so interesting]

The impact of Bitcoin's upcoming halving 💎⚒️ [what it’s all about, what can we expect + some bonus reads]

Convergence of TradFi & Crypto: Germany's largest state bank partners with Bitpanda 🤝

Credit card delinquencies rise in Q1 2024, signaling prolonged recovery 💳📈

State Street explores the acquisition of Societe Generale's custody arm 👀 [what it tells us + a look into some FinTech M&A predictions for 2024 & some extra resources]

Goldman Sachs reports strong Q1 📈 [a quick recap of the most important things & profit drivers + some deeper dives into GS failed FinTech plays]

As for today, here are the 3 awesome FinTech stories that were transforming the world of financial technology as we know it. This is one of the most intense and rewarding weeks this year thus far, so make sure to check all the above stories.

Is Revolut now worth 45% more?! 🤔

The news 🗞️ UK-based FinTech giant Revolut has seen its valuation recently rise by 45% according to one of its investors, Schroders Capital Global Innovation Trust.

Let’s see what it’s all about and whether or not it means something.

More on this 👉 The trust revalued its stake in Revolut from £5.44 million to £7.88 million, implying an overall valuation of $25.7 billion for the company, up from $17.7 billion last year. This increase comes after a challenging period for the FinTech sector, which saw valuations peak in 2021 before concerns about profitability and higher interest rates led to a downturn.

Despite the recent uptick, Revolut's current valuation remains below its 2021 peak of $33 billion. The company has made significant progress over the past year, with revenue growing to just over $1 billion in 2022 and the addition of approximately one million new customers per month. Solid stuff!

Revolut is also awaiting a decision on a UK banking license, which would allow it to expand its services in its home market. This has been SQ for a while now though…

✈️ THE TAKEAWAY

What’s next? 🤔 At first glance, the 45% increase in Revolut's valuation by Schroders appears to be a positive development for the company and the FinTech sector. But even with the increase in valuation, which is for sure significant, it does not necessarily reflect a fundamental shift in the company's prospects and Revolut still has much to prove as it seeks to establish itself as a leading player in the global financial services industry. But let’s look at the bigger picture here. At the core, the valuation of a company by a single private investor should always be viewed with caution for 3 main reasons:

First, limited stake. Private investors often hold a small percentage of a company's overall shares. In Revolut's case, Schroders' stake is relatively small, and their valuation may not accurately reflect the company's true worth or the views of other investors.

Second, is subjectivity. Valuations by private investors are often based on their own subjective assessments, which may be influenced by factors such as personal beliefs, investment strategies, and risk tolerance. These valuations may not always align with market sentiment or the company's actual performance.

Third, lack of transparency. Private companies are not required to disclose the same level of financial information as public companies. This lack of transparency makes it difficult for external parties to verify the accuracy of a private investor's valuation.

At the end of the day, the best judge often is public markets. And they have been quite brutal for FinTechs as of late…

ICYMI: Revolut secures RBI approval for prepaid payment instruments in India 🇮🇳 [why this matters + a view of the Indian payments market & why Revolut hasn’t conquered it]

Hong Kong approves spot Bitcoin and Ethereum ETFs, positioning itself as a crypto hub 🇭🇰

The news 🗞️ Hong Kong has just approved the first batch of spot Bitcoin and Ether exchange-traded funds (ETFs). This development comes as part of the city's drive to establish itself as a leading hub for digital assets.

Let’s take a look at this, see why it’s significant, and how could it reshape the global cryptocurrency landscape

More on this 👉 Several major asset management firms, including China Asset Management, Harvest Global Investments, Bosera Asset Management, and HashKey Capital, have received in-principle approval from the Hong Kong Securities and Futures Commission (SFC) to launch spot bitcoin and ether ETFs. These ETFs will allow investors to gain direct exposure to the two largest cryptocurrencies by market capitalization.

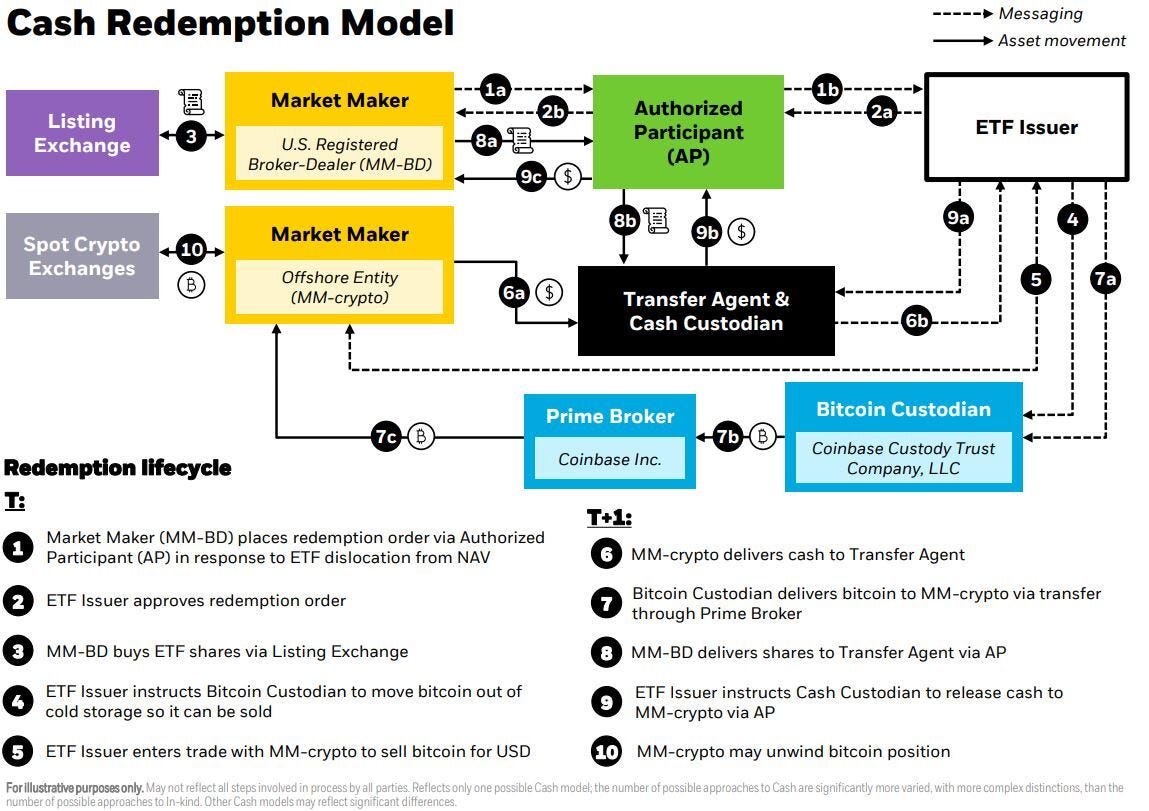

We must note that Hong Kong's approach to spot crypto ETFs differs from that of the United States. The SFC is likely to allow in-kind creations and redemptions, meaning that the underlying assets (BTC and ETH) can be directly exchanged for ETF shares. This contrasts with the cash-only redemptions required by the U.S. Securities and Exchange Commission (SEC) for its spot bitcoin ETFs.

Zooming out, another important thing to note is that Hong Kong will launch spot ether ETFs ahead of the United States as the SEC continues to delay decisions on similar applications from BlackRock and Fidelity.

This first-mover advantage could thus attract significant capital flows from other regions, further solidifying Hong Kong's position as a leading crypto hub.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that these developments come as part of Hong Kong's broader efforts to create a comprehensive regulatory framework for digital assets. We can remember that back in June 2023, the city implemented a licensing regime for virtual asset trading platforms, demonstrating its commitment to fostering a secure and regulated environment for cryptocurrency trading. Coming back to the recent approval of spot bitcoin and ether ETFs in Hong Kong, it’s clear that this move could have far-reaching implications for the cryptocurrency market. By providing a regulated and accessible avenue for investors to gain exposure to BTC and ETH, these ETFs could potentially drive increased institutional and retail adoption. This, in turn, may lead to greater liquidity and stability in the market, as well as a reduction in the volatility often associated with cryptocurrencies. Moreover, the successful launch of these ETFs in Hong Kong could serve as a catalyst for other jurisdictions (including the US) to follow suit, potentially leading to a more widespread acceptance of cryptocurrencies as a legitimate asset class. That said and given the global race to launch spot crypto ETFs intensifies, Hong Kong's proactive approach and clear regulatory framework position the city to emerge as a key player in the future of digital asset investing. Well done!

ICYMI: BlackRock's assets soar to a record $10.5T. Thanks to Bitcoin 😳 [a quick recap of BlackRock’s Q1 2024 + some more bonus reads]

Bitcoin breaks records again: the relentless rally fueled by institutional demand 📈💸 [analyzing the latest data, thinking about what’s next + two investment thesis for Bitcoin]

Nubank ventures into telco business 📞🟣

The news 🗞️ In a move to expand its services beyond just banking, Nubank, the Brazil-based FinTech giant and Super App, has announced plans to launch its own mobile virtual network operator (MVNO).

The company has received approval from Anatel, Brazil's National Telecommunication Agency, for a contract between its subsidiary, Nucommerce Ltda., and Claro, a major telecommunications operator in the country.

Let’s take a look at this and see what it’s all about.

More on this 👉 In short, this partnership allows Nubank to utilize Claro's network infrastructure to provide mobile services to its customers. Notably, the agreement does not restrict Nubank to an exclusive deal with Claro, giving the company flexibility to explore future partnerships in the telecommunications sector.

Nubank's entry into the MVNO market aligns with its broader ambitions to offer comprehensive services to its customer base in a bid to become the dominant Super App across LatAm. So by integrating mobile services with its existing financial offerings, Nubank thus aims to enhance customer engagement and loyalty through bundled services and potential incentives such as cashbacks and exclusive deals.

Brilliant move.

Zoom out 🔎 When you look at the big picture, this move isn’t new or unique but it positions Nubank among other financial institutions, such as Banco Inter, which have ventured into the mobile services market as well to create integrated value propositions for their customers.

Having said that, we must note that this trend just yet again highlights the growing convergence of financial services and telecommunications in the pursuit of delivering more seamless and convenient user experiences. Remember that Revolut and WU ventured into this recently too.

ICYMI: Western Union copies Revolut as it unveils global eSIM service 😳 [the USP & where’s the money + some more reads on Revolut]

What’s different with NU here is that their MVNO initiative is spearheaded by its CFO, Guilherme Marques do Lago. This just shows the importance of this venture to the company's expansion and overall strategy.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, NU’s entry into the telco biz is all about redefining the boundaries of traditional banking and creating a more integrated service ecosystem for their growing and thriving user base. Looking ahead, by diversifying its services and creating a more comprehensive ecosystem, Nubank aims to strengthen its competitive position and unlock new revenue streams. This move also opens up possibilities for innovative cross-selling opportunities and the development of unique, tailored offerings that combine financial and mobile services. As Nubank embarks on this new venture, it will now become increasingly harder for other entrants to compete against the Brazilian FinTech gem. Good move!

ICYMI: Nubank delivers strong growth & profitability, and is positioned to unlock substantial value for investors 🟣🚀 [going in deep to analyze NU’s latest performance, the most important numbers, uncover what they mean, & see how NU is perfectly positioned to unlock substantial value for investors + more reads and bonus dives]

Disclaimer: this isn’t investment advice and I’m a shareholder of Nubank.

🔎 What else I’m watching

OKX's Ethereum Layer-2 launch challenges Coinbase's Base 🔗 OKX, a leading crypto exchange, has launched X Layer, its Ethereum Layer-2 scaling network, on mainnet. Built using Polygon CDK, it leverages Polygon's AggLayer for seamless fund transfers across networks. With over 50 million users, OKX aims to offer faster and cheaper transactions than Ethereum's mainnet. Unlike Coinbase's Base, X Layer embraces zero-knowledge proofs, enhancing interoperability and privacy. ICYMI: Coinbase's Layer 2 network Base thrives as interest in crypto surges 🚀 [looking at the latest numbers, what’s driving the crazy growth & why it matters + a bonus deep dive into Coinbase & why it’s still underrated]

UK to issue new crypto & stablecoin legislation 🇬🇧 The UK government plans to issue new legislation for stablecoins as well as crypto staking, exchange, and custody by June or July this year, according to Economic Secretary Bim Afolami. The Conservative-party-led government aims to make the UK a global hub for crypto and passed legislation last year recognizing crypto and stablecoins as regulated financial activities. The upcoming legislation will cover a range of crypto asset activities, including operating an exchange, taking custody of customers' assets, and staking. Once live, these activities will come within the regulatory perimeter for the first time in the UK.

Mastercard's Virtual Card App 📲 Mastercard has launched a mobile virtual card app, with HSBC Australia and Westpac as the first banks to offer it. The app simplifies travel and business expenses for commercial clients by enabling virtual commercial cards to be added to digital wallets. Utilizing Mastercard's virtual card and tokenization platforms, the app offers enhanced data, security, and spend controls in a single interface.

💸 Following the Money

Ethereum liquid restaking protocol Puffer Finance reached a $200M valuation in the new token funding round.

Finmid, a German financial infrastructure provider targeting B2B marketplaces, has emerged from stealth with €35M in early-stage equity funding. Blossom Capital, Earlybird VC, and N26-founder Max Tayenthal joined the round for Berlin-based finmid, which was founded in 2021 by former N26 staffers.

PayPal Ventures has led an €18M+ Serie A extension for Berlin-based corporate card platform Pliant as it prepares for expansion into the UK. Founded in 2020, Pliant’s credit card platform enables companies to issue physical, virtual, and one-time credit cards that integrate into business back-end enterprise resource planning software.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

+45%, yeah sure. In fantasyland.

HK is doing good stuff, I hope others will follow