Key takeaways for FinTech leaders from Warren Buffett’s favorite CEO letter 🧠; Stablecoins surge, challenging traditional payment giants 🚀; 𝕏 secures money transmitter licenses in 25 states now 😳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Coinbase solidifies market leadership despite regulatory headwinds 😤 [unpacking the latest massive numbers to see why it might be worth our time & money in 2024 + some solid bonus deep dives into Coinbase]

Mastercard's global reach and digital dominance drive sustained growth in Q1 2024 📈 [a deeper dive into the most important numbers, what they mean, and what’s next for Mastercard + a bonus deep dive into its biggest rival]

Block’s solid Q1 2024 performance and future potential 🚀 [exploring the most important numbers, what they mean, & what’s next for Block + some bonus reads]

Mercado Libre’s latest financials show that Latin America's e-commerce & FinTech powerhouse is poised for continued growth 📈 [why you can’t ignore the Amazon of LatAm + some bonus reads inside]

PayPal's solid Q1 2024 results show promising signs of transformation amidst the transition year 📈 [analyzing the latest numbers, unpacking what they mean & see why we should continue being really, really bullish on PayPal + a bonus dive into another solid FinTech stock]

SoFi's diversification strategy drives profitability amidst macro uncertainties 💸 [unpacking their latest numbers to see whether SoFi might be worth our time and money in 2024]

Wallet-as-a-Service startup Ansa raises $14M to empower small businesses with digital wallets 👛

As for today, here are the 3 amazing FinTech stories that were transforming the world of financial technology as we know it. This is one of the most intense and exciting weeks this year thus far, so make sure to check all the above stories.

Key takeaways for FinTech leaders from Warren Buffett’s favorite CEO letter 🧠

Earlier in April, Warren Buffett’s favorite CEO letter came out - JPMorgan JPM 0.00%↑ Chairman & Chief Executive Officer Jamie Dimon published his annual letter to shareholders.

The Oracle of Omaha once said that Jamie Dimon is the best banker in the world and that Dimon's shareholder letters should be mandatory reading for every investor. As

has beautifully put it, it reads like a manifesto for the future of the banking industry, economy, and the United States.I’ve finally managed to sit down and read the whole 60-page and 30,000+ word long letter. Here are the key takeaways from one of the best thinkers and writers in finance:

Jamie Dimon starts his annual letter by reminding us of the key principles used to run one of the biggest banks in the world.

These are universal and can (sometimes - even should) be applied to virtually every company in the world:

I especially like the second one:

Shareholder value can be built only if you maintain a healthy and vibrant company, which means doing a good job of taking care of your customers, employees and communities. Conversely, how can you have a healthy company if you neglect any of these stakeholders? As we have learned over the past few years, there are myriad ways an institution can demonstrate its compassion for its employees and its communities while still strengthening shareholder value.

Brilliant.

Who does that well? Probably Nubank NU 0.00%↑.

ICYMI: ICYMI: Nubank delivers strong growth & profitability, and is positioned to unlock substantial value for investors 🟣🚀 [going in deep to analyze NU’s latest performance, the most important numbers, uncover what they mean, & see how NU is perfectly positioned to unlock substantial value for investors + more reads and bonus dives]

Dimon later went on to share his insights on the global landscape. Here are the three big themes worth watching closely:

Geopolitical tensions, particularly with China and in Ukraine and the Middle East, pose significant risks to the global economy and financial system.

The U.S. economy remains resilient but faces potential headwinds from inflationary pressures, quantitative tightening, and ongoing wars.

Effective government policies and public-private partnerships are crucial for addressing challenges like infrastructure investment, workforce development, and the transition to a low-carbon economy.

When it comes to JPMorgan Chase's strategic priorities, here’s where the giant banking will be focusing on:

Maintaining a fortress balance sheet and strong risk management practices to withstand economic uncertainties.

Investing in technology, data, and analytics to enhance customer experiences, improve efficiency, and drive growth.

Expanding its presence in key markets and businesses, such as wealth management, digital banking, and sustainable finance.

Fostering a diverse, inclusive, and engaged workforce to drive innovation and better serve clients and communities.

But here comes the interesting part.

Jamie Dimon's annual shareholder letter is also a good resource for every financial technology professional or pretty much anyone passionate about the intersection of finance and technology.

Here are my favorite takeaways that can help guide your focus and decision-making in the rapidly evolving world of FinTech.

Embrace AI and Cloud Computing:

JPMorgan Chase's investments in artificial intelligence and cloud computing remind us of the critical role these technologies will play in driving innovation and efficiency in the financial sector.

JPMorgan now has more than 2,000 AI/machine learning (ML) experts and data scientists and continues to attract some of the best and brightest in this space, not to mention having an exceptional firmwide AI/ML and Research department with deep expertise.

More importantly, JPM has been actively using predictive AI and ML for years — and now has over 400 use cases in production in areas such as marketing, fraud, and risk — and they are increasingly driving real business value across various businesses and functions.

ICYMI: AI is eating Finance: JPMorgan is getting into LLMs 😳 [what it’s all about & why it makes sense + more reads on how AI is eating finance]

Dimon believes that GenAI will reimagine entire business workflows.

That said, now it’s more important than ever before to stay at the forefront of AI and cloud computing developments that will be essential for creating cutting-edge solutions that meet the needs of financial institutions and their customers.

ICYMI: JPMorgan doubles down on growing the old-fashioned way: branches 🏦 [why it makes sense + a deep dive into JPM and how it recently made history]

Prioritize Cybersecurity and Risk Management:

Given the increasing reliance on digital technologies in finance, now it’s crucial to prioritize the importance of robust cybersecurity and risk management practices.

FinTech professionals should thus prioritize the development of secure, resilient systems that can withstand ever-evolving cyber threats and comply with regulatory requirements.

Foster Collaboration and Partnerships:

JPMorgan Chase's emphasis on public-private partnerships and collaboration highlights the need for everyone in FinTech to engage with a wide range of stakeholders, including financial institutions, regulators, and technology providers. Going forward, collaboration will be the key.

More importantly, building strong relationships and fostering open communication will be crucial for developing effective FinTech solutions that address the needs of all parties involved.

Anticipate and Adapt to Changing Customer Preferences:

As customer expectations evolve in the digital age, Jamie Dimon also reminds us that we must stay attuned to shifting preferences and behaviors.

Therefore, developing customer-centric solutions that prioritize ease of use, personalization, and transparency will be key to success in the highly competitive FinTech landscape.

Looking ahead 👀

As the lines between traditional finance and technology continue to blur, FinTechs who can effectively bridge these two worlds will be well-positioned to drive the future of the industry. By paying close attention to these areas and learning from the insights of industry leaders like Jamie Dimon, fintech professionals can position themselves at the forefront of the ongoing digital transformation in finance. Staying adaptable, innovative, and focused on delivering value to customers and stakeholders will be essential for thriving in the fast-paced and constantly evolving world of financial technology.

P.S. if you want to dive into the full Dimon’s letter, you can do it here.

Stablecoins surge, challenging traditional payment giants 🚀

Following the money 💸 Stablecoins, the less volatile cousins of cryptocurrencies, are experiencing a renaissance in real-time payments, with transaction volumes hitting record highs and surpassing those of traditional payment providers like Visa.

Let’s take a quick look at this.

More on this 👉 According to recent data, the three largest stablecoins – Tether, USDC, and DAI – processed a combined $1.369 trillion in the past 30 days, exceeding Visa's monthly average of $1.23 trillion in 2023.

Given that in just ~6 years, stablecoins have surged from virtually nonexistent to now surpassing giants like Visa is sure damn impressive 😳

This surge in stablecoin adoption is driven by their ability to provide instant, low-cost, and final settlements, eliminating the need for credit intermediaries. As crypto technology matures, its value proposition becomes clearer, attracting both users and businesses looking to optimize their operating efficiency and profits.

That said, it’s not surprising that major payment providers like PayPal PYPL 0.00%↑ and Stripe are now integrating stablecoins into their platforms, thus effortlessly onboarding users onto the blockchain. This strategic move brings crypto to the mainstream, with users enjoying a familiar interface while benefiting from the advantages of blockchain technology.

ICYMI: Stripe brings back crypto payments with USDC stablecoin 😳 [what it’s all about & why it matters + more bonus reads on Stripe & why we might not see them IPOing anytime soon]

HUGE: PayPal enables PYUSD for international payments 💸 [a closer look at what it’s all about & why it’s a massive move]

Zooming out and looking at the big picture, the potential for stablecoin legislation in the U.S. could further accelerate adoption. If Congress passes comprehensive stablecoin legislation later this year, it could prove to be a significant milestone for the crypto ecosystem, enabling traditional financial institutions to enter the space and introduce millions of people to the benefits of crypto wallets, stablecoins, and blockchain-based payment rails. Huge.

𝕏 secures money transmitter licenses in 25 states, paving the way for Elon Musk's Everything App 😳

The news 🗞️ In yet towards realizing Elon Musk's vision of transforming 𝕏 (formerly Twitter) into the ultimate Super App aka Everything App, 𝕏 Payments LLC has secured Money Transmitter Licenses in 25 U.S. states.

The most recent additions to the growing list are Tennessee and Nevada, with Musk hinting at the impending approval of licenses in California and New York.

Let’s take a quick look at this and see why it’s significant.

More on this 👉 These licenses authorize 𝕏 Payments to transmit money within the approved states, enabling the platform to offer financial services akin to PayPal, Venmo, and Square’s SQ 0.00%↑ Cash App.

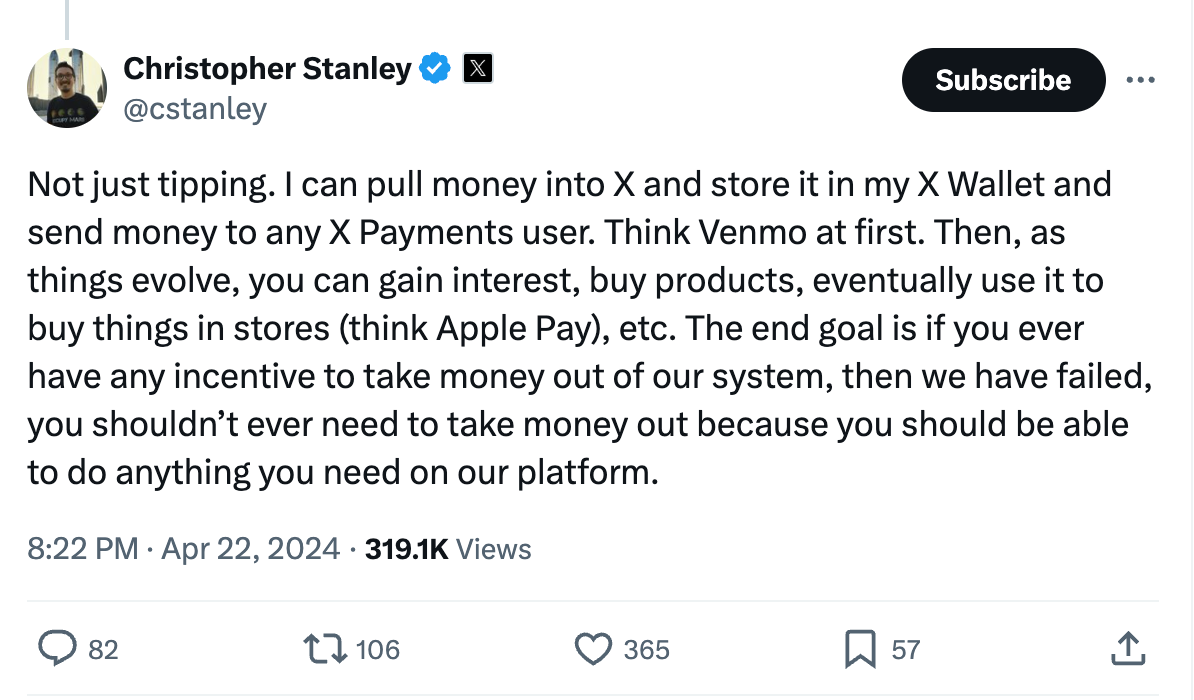

The Chief Information Security Officer at 𝕏 Payments, Christopher Stanley, emphasized the company's aim for self-sufficiency in financial services, envisioning a future where users never feel the need to withdraw money from the platform.

Speculation is rife about the potential integration of cryptocurrency payments, given Musk's vocal enthusiasm for digital assets, particularly Dogecoin.

However, despite the positive developments surrounding 𝕏 Payments' licensing, the price of Dogecoin remains bearish, with no official timeline for its integration into the platform.

✈️ THE TAKEAWAY

Looking ahead 👀 First and foremost, we must once again stress that the acquisition of new money transmitter licenses is a crucial step in Musk's grand vision for 𝕏's future. At the core, the introduction of payment services on the platform is expected to unlock new opportunities for commerce and user utility. If they execute well, 𝕏 Payments could not only rival established payment apps, potentially disrupting the FinTec landscape. More importantly, it could become the ultimate Super App and one of the biggest players in digital finance. Looking ahead, if Elon’s vision is met, we will see the lines between social media and financial services getting even more blurry while the potential integration of crypto payments could further legitimize digital assets and drive mainstream adoption.

ICYMI: 𝕏 gears up to offer payments and banking services 📲

Fidelity has marked down the value of 𝕏 by 71.5% since Elon Musk's takeover. Here’s why it’s irrelevant 🙅 [why it’s irrelevant + more reads to help you understand where the focus should be]

🔎 What else I’m watching

Tide Partners with Adyen in the German Market 🇩🇪 Tide, a leading business banking platform, has partnered with Adyen, a global payment company, to expand its services in the German market, according to Finextra. This collaboration will enable Tide to offer its members a seamless payment experience, accepting a wide range of payment methods and currencies. By integrating Adyen's technology, Tide aims to simplify financial management for small and medium-sized businesses in Germany, making it easier for them to grow and manage their operations. ICYMI: Adyen's resilient growth crowned with market selloff: a brilliant buying opportunity for long-term investors? 🤔 [why the current market selloff is a brilliant opportunity for long-term investors + some bonus deep dives into Europan FinTech superstar]

Namibia Adopts India's UPI Tech 🇳🇦🤝🇮🇳 The Bank of Namibia has partnered with NPCI International Payments to develop an instant payments system based on India's successful Unified Payments Interface (UPI). Namibia aims to leverage UPI's technology and expertise to modernize its financial ecosystem and boost accessibility, affordability, and connectivity for domestic and international payment networks. The UPI, launched in 2016, has processed over 100 billion transactions and played a significant role in India's digital payment push for financial inclusion.

Binance Founder Changpeng Zhao Got Sentenced 📰 Changpeng "CZ" Zhao, founder of crypto exchange Binance, has been sentenced to four months in prison in the US after pleading guilty to violating anti-money laundering requirements. Federal prosecutors sought a three-year sentence, while Zhao's lawyers argued for probation. As part of a deal with the Department of Justice, Treasury Department, and CFTC, Binance agreed to forfeit $2.5 billion and pay a $1.8 billion fine. Zhao pleaded guilty to violating the Bank Secrecy Act, paid a $50 million fine, and will step down as CEO, having no further involvement in running Binance.

💸 Following the Money

Hinkal, a zero-knowledge (ZK) protocol enabling institutional investors to trade on-chain privately, has raised $1.4M in a strategic funding round.

Danish accounting software FinTech Ageras is on the acquisition hunt after securing €82M in funding. The oversubscribed private placement round was joined by i.a. the Norwegian state pension fund Folketrygdfondet, Lazard, and Investcorp.

Global blockchain-enabled B2B payments provider Paystand has announced the acquisition of Teampay for the development of the B2B payment landscape.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: