Apple Intelligence and the future of P2P payments 🤖💸; Synapse's collapse exposes risks in FinTech's Banking-as-a-Service model ⛔️; Brex and Ramp but for banks 💳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Deal of the year: Affirm partners with Apple Pay to expand BNPL reach 👏😎 [why it’s a deal of the year, what it means for both giants + a bonus deep dive into Affirm and why it’s about time to be very bullish on them]

Early summer gift: Wise shares dip despite strong fundamentals and massive growth potential 🎁📈 [uncovering and understanding the latest numbers & why the recent stock drop is a brilliant opportunity to increase your holdings of this FinTech giant]

Payment FinTechs show resilience amid challenges in Q1 2024 📈 [holistic view of the latest performance of top PayTechs & what can we expect next + bonus deep dives into 8 FinTech giants and why you should be bullish on them]

Starling Bank’s latest financials: soaring profits, but gathering clouds 🌤️ [breaking down their latest annual report, uncovering the most important numbers & what’s next for Starling + a bonus deep dive into Monzo & why it’s super exciting]

eBay partners with Venmo, catering to next-gen shoppers 🤝 [what’s the USP here & why it makes sense + some bonus reads inside]

Banking on AI: the potential and pitfalls of Artificial Intelligence in Finance 🏦🤖 [a quick recap of some fresh data + more bonus reads and dives into how AI is eating finance]

As for today, here are the 3 awesome FinTech stories that were transforming the world of financial technology as we know it. This is one of the most interesting and intense weeks this year thus far, so make sure to check all the above stories.

Apple Intelligence and the future of P2P payments 🤖💸

The news 🗞️ At Apple's AAPL 0.00%↑ annual WWDC event, the tech giant unveiled a suite of groundbreaking features powered by artificial intelligence (AI) and some really innovative payment solutions.

These advancements, integrated into iOS 18, iPadOS 18, and macOS Sequoia, promise to transform the way users interact with their devices and handle financial transactions.

Let’s take a closer look at this and see why it matters.

More on this 👉 Let’s talk about AI first. Apple's new personal artificial intelligence system is deeply integrated into iOS 18, iPadOS 18, and macOS Sequoia. It combines generative AI models with personal context to deliver useful and relevant intelligence while maintaining user privacy.

Here are the coolest AI features Apple just announced:

Free ChatGPT in every iPhone & Mac 🖥️

You can access OpenAI's ChatGPT right from Siri and ask questions about your files, documents, or photos

Share photos with ChatGPT and get suggestions

Create images and texts within documents with ChatGPT

New, AI-powered Siri 2.0 🤖

Apple has partnered with OpenAI to enable Siri to utilize ChatGPT for some requests

The updated Siri can determine intent, decipher complex queries, and respond to multiple questions in a row

It is integrated into core apps and supports typed requests

Photos app upgrades 📸

The Photos app gains AI-powered editing tools to make elaborate adjustments, remove unwanted objects/people from photos, and improve organization by recognizing people from contacts

Apple Intelligence also enhances the Memories feature, allowing users to create personalized movies by simply describing what they want to see

Proactive AI assistance 👋

Apple Intelligence takes a proactive role within apps to streamline tasks and optimize user interactions

This includes features like notification recaps, AI-enhanced autocorrect, browser summarization, speaker labeling in voice transcriptions, and more

These subtle AI enhancements aim to blend seamlessly into the user experience

What's interesting is that 99% of Apple Intelligence is powered by Apple's own proprietary foundational models (FMs). They built a host of their own FMs and used licensed content to train and fine-tune those models.

On top of that, Apple is using Apple Silicon in its own data centers - not NVIDIA NVDA 0.00%↑ chips - to power Apple Intelligence

The best part?

Private cloud compute allows Apple to draw on larger server-based models while protecting your privacy. Your data is never stored or sent to Apple 👏

FinTeech updates 📲 In addition to the AI advancements, Apple also introduced some really cool FinTech updates.

One of the most awesome ones is the Tap to Cash feature, which enables users to transfer money to another Apple Pay user nearby without exchanging personal details:

Apple's Tap to Pay is like PayPal’s Venmo or Square’s SQ 0.00%↑ Cash App but it's absolutely sick. More importantly, with this Apple basically solved P2P payments for 1.5 billion people 👏😎

The Wallet app also saw some updates, allowing users to view and redeem rewards or points balances, access installment financing options, and enjoy redesigned event tickets with integrated guides.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that Apple's AI is finally here and it's actually huge! At the core, Apple Intelligence will empower billions of people to experience AI for the first time, right on their devices, with a privacy-first mindset. Looking at the big picture, one really important thing is becoming very clear now - Apple is basically layering AI on top of the entire OS that will soon make your iPhone the closest thing to an AI agent anyone has done to date. And that’s a potential game changer, and doesn’t even come close to the AI parade & gimmicks that Microsoft or Google have been focusing on as of late. When it comes to FinTech, with Tap to Pay (which isn’t entirely new by the way) Apple basically solved P2P payments for 1.5 billion people. But here comes the crazy part... If you swap Apple Cash with Open Banking, or even better - an L2 protocol like The Lightning Network, you have the ultimate money experience of the 21st century. And that’s truly groundbreaking.

I guess AI-driven finance might be just around the corner…

ICYMI: Towards AI-driven Finance: Apple acquires another AI startup to boost on-device LLM processing 🍎🤖 [what this is, why it’s significant + a deeper dive into how it can power Apple’s lead in building AI-driven finance & more bonus reads]

Synapse's collapse exposes risks in FinTech's Banking-as-a-Service model ⛔️

Following the money 🗞️ The bankruptcy of FinTech middleman Synapse Financial Technologies has exposed significant vulnerabilities in the popular Banking-as-a-service (BaaS) model, leaving thousands of customers unable to access their funds.

Let’s take a quick look at this.

More on this 👉 As a go-between for banks and FinTech providers, Synapse maintained customer deposit ledgers and performed crucial risk management functions. Its collapse has therefore resulted in an estimated $85 million shortfall in customer funds, highlighting the lack of regulatory oversight in this sector. Ouch.

Customers who deposited money through FinTech platforms like Yotta are now struggling to prove ownership of their funds, as Synapse controlled the ledger that has disappeared since its bankruptcy. Federal regulators, including the FDIC and Federal Reserve, have limited authority over FinTech intermediaries, leaving customers with little recourse 🤷♂️

That said, this incident is expected to accelerate changes already underway in the BaaS model, with banks moving away from outsourcing key functions to FinTech middlemen. Instead, banks are likely to favor licensing agreements with FinTechs that provide compliance software, allowing for greater oversight and risk management.

More importantly, the Synapse case underscores the need for a more comprehensive regulatory framework that addresses the unique risks posed by FinTech intermediaries. Even more so, as the financial landscape continues to evolve, striking a balance between innovation and consumer protection will be crucial.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, the implications of Synapse's collapse for the broader finance and FinTech space are going to be significant. Banks will likely become more selective in their partnerships with FinTechs, prioritizing those with robust risk management practices. This increased scrutiny may lead to higher costs and potentially slower innovation in the short term. However, it could also result in a more stable and secure financial ecosystem in the long run. So this is probably worth both the efforts and the costs. Zooming out, as regulators grapple with the challenges posed by the rapidly evolving FinTech landscape, it is clear that a more comprehensive and adaptable regulatory framework is needed. This framework must balance the benefits of innovation with the need for adequate consumer protection and financial stability. That said, the lessons learned from Synapse's collapse will undoubtedly shape the future of banking-as-a-service and the broader FinTech industry. So watch this out!

Brex and Ramp but for banks 💳

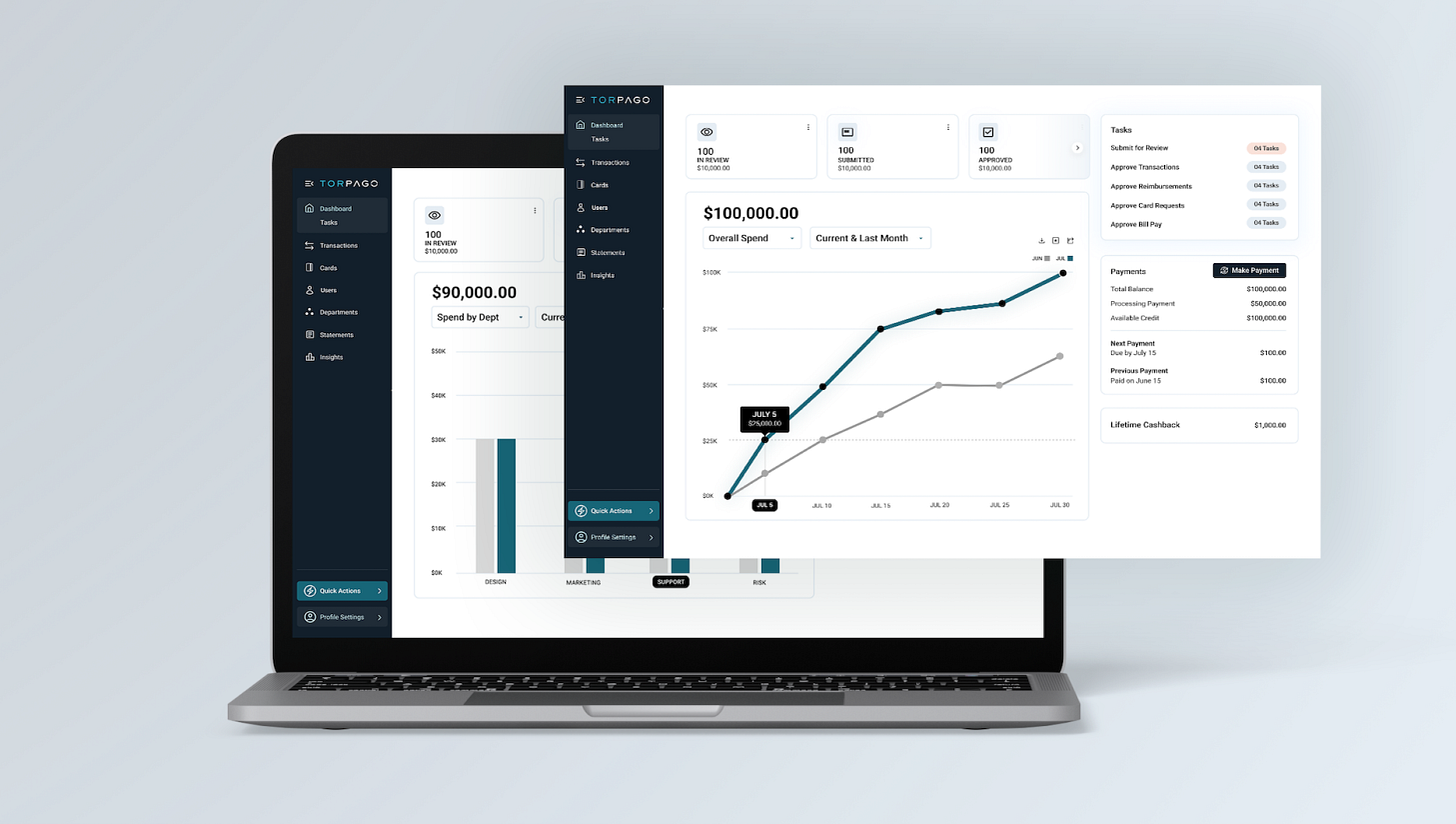

Following the trends 📈 Torpago, a FinTecb company offering commercial credit card and spend management solutions, has taken a unique approach to differentiate itself from competitors like Brex and Ramp.

Instead of vying for the same business customers, Torpago has pivoted to partnering with regional and community banks, providing them with branded, sophisticated fintech tools to enhance their commercial credit card offerings.

Let’s take a quick look at this.

More on this 👉 Through its "Torpago Powered By" product, launched in 2023, Torpago equips banks with fully branded software that integrates with over 200 accounting systems, enables real-time virtual card issuance, and provides a comprehensive dashboard for managing card-related activities.

This partnership allows banks to offer their customers a seamless, cutting-edge experience without leaving the bank's brand domain.

Torpago's strategy thus positions the company as a collaborator with banks, rather than a competitor. By leveraging banks' existing customer base and card volume, Torpago aims to revolutionize the often outdated credit card tools and technology currently offered by these institutions.

The company's transparent data-sharing practices also set it apart, providing banks with valuable insights into their customers' spending habits.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, by empowering community banks with cutting-edge technology, Torpago is democratizing access to sophisticated commercial credit card solutions, which were previously dominated by larger institutions and FinTech startups. This partnership model could therefore pave the way for increased collaboration between traditional financial institutions and FinTech innovators, ultimately benefiting everyone, or in this case - businesses of all sizes. Looking at the big picture, the company’s integration of AI-driven features and the development of new products, such as the AI travel booking engine, demonstrate Torpago's commitment to staying at the forefront of technological advancements in the industry. So keep an eye on them!

🔎 What else I’m watching

Michael Kors Launches Mastercard's GenAI-Powered Shopping Assistant 🛍️Michael Kors has become the first retailer to integrate Mastercard's MA 0.00%↑ generative AI shopping assistant, Shopping Muse, into its US website. Developed by Dynamic Yield, which Mastercard acquired from McDonald's, Shopping Muse aims to replicate the in-store, human shopping experience by translating customers' colloquial language into tailored product recommendations, including suggestions for coordinating products and accessories. Mastercard believes that this personalized approach can boost shopper satisfaction and increase revenue, with initial tests showing a 15-20% higher conversion rate than traditional search queries. Shopping Muse is designed to deliver a satisfying and impactful digital shopping experience that aligns with the brand's aesthetic. ICYMI: Mastercard's global reach and digital dominance drive sustained growth in Q1 2024 📈 [a deeper dive into the most important numbers, what they mean, and what’s next for Mastercard + a bonus deep dive into its biggest rival]

Fireblocks Partners with Coinbase International Exchange 🤝 US-based cryptocurrency custody company Fireblocks has expanded its exchange connectivity by introducing support for Coinbase COIN 0.00%↑ International Exchange. The new integration allows both institutional and retail clients in eligible jurisdictions to access perpetual futures and spot trading features. Through the Fireblocks Network, customers can seamlessly connect to their Coinbase International Exchange accounts and protect exchange operations using Fireblocks' governance and policy rules. Coinbase International Exchange is a regulated exchange aimed at expanding crypto derivatives access to institutions and professional traders, particularly outside the United States. The integration of the Fireblocks Network offers customers improved management and security of their exchange operations, including governance controls for exchange operations and secure deposit, withdrawal, and rebalancing of assets. ICYMI: Coinbase solidifies market leadership despite regulatory headwinds 😤 [unpacking the latest massive numbers to see why it might be worth our time & money in 2024 + some solid bonus deep dives into Coinbase]

Paxos Lays Off 20% of Staff 😳 Digital assets company Paxos has laid off 20% of its staff, according to a Bloomberg report. In a company memo, Paxos CEO Charles Cascarilla stated that the layoffs would allow the company to better focus on the significant opportunities ahead in tokenization and stablecoins. The layoffs have affected 65 staff members. Paxos, which reached a $2.4 billion valuation in April 2021, recently announced plans to exit the Canadian market. The company intends to gradually discontinue its settlement services in commodities and securities to concentrate more on asset tokenization and stablecoins. Paxos is the digital assets partner of PayPal's PYPL 0.00%↑ stablecoin, PYUSD.

💸 Following the Money

Uniswap Labs has acquired Crypto: The Game, an on-chain Survivor-esque competition, for an undisclosed price, Fortune reported on Monday. As part of the deal, CTG’s co-founders are joining Uniswap Labs, where they will continue to work on future seasons of the game.

Danish startup Light exited stealth with $13M in a seed round of funding led by Atomico to reinvent the general ledger.

Egyptian fintech company Sahl has announced the raise of $6M in a Series A funding round to accelerate its expansion in Saudi Arabia.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: