Nubank goes Bitcoin Lightning ⚡️; Klarna Plus gains traction as the BNPL giant hits 100,000 subscribers in the US 📈🇺🇸; Target supercharges its marketplace with a Shopify partnership 🎯🛍️

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Understanding Nasdaq: a global financial powerhouse poised for sustainable growth 🏦📈 [a deep dive into this global financial powerhouse & whether it should be worth your time and money in 2024]

Goldman Sachs leverages AI to reshape finance 💸🤖 [what it’s all about & why it makes sense + a bonus dive on Goldman & their latest numbers]

Klarna is “checking out” from the Checkout Business to focus on partnerships 🏷️😳 [what it’s all about & why it’s a brilliant move + a bonus deep dive into this BNPL giant & why it’s poised for huge growth in the AI Era]

Nubank acquires Hyperplane to accelerate its AI-first strategy 🚀🤖 [what it’s all about & why it’s a brilliant M&A + a bonus deep dive in NU & why you just can’t ignore it]

American Express expands dining services with the acquisition of Tock 🤝💸 [what’s the USP here & how it plays into AmEx’s long-term strategy + a bonus deep dive into the finance giant, unpacking their latest numbers & everything that matters]

Shopify unveils AI-powered Sidekick in a bid to revolutionize e-commerce for merchants 🤖🛍️ [unpacking all their latest AI products & features and what they mean for the future + a bonus deep dive into Shopify & why I’m bullish]

Apple Pay partnership could boost Affirm’s payment volume by 35% 😳

Banking giants vie for Baltic Prize: UniCredit & OTP in bid war for Luminor 😳💶

Flipkart enters FinTech arena with Super.money App, challenging PhonePe and aiming to reshape digital payments 📲🇮🇳

Ethena's meteoric rise that’s reshaping the stablecoin landscape 🚀😳

As for today, here are the 3 awesome FinTech stories that were transforming the world of financial technology as we know it. This is one of the most fascinating and rewarding weeks this year so far, so make sure to check all the above stories.

Nubank goes Bitcoin Lightning ⚡️

The news 🗞️ Brazilian neobank and super app Nubank NU 0.00%↑ has partnered with blockchain solutions provider Lightspark to integrate the Bitcoin Lightning Network into its platform, potentially transforming financial services for its 100 million customers across Latin America.

This strategic move aims to enhance transaction speed, reduce costs, and improve scalability for Nubank's users in Brazil, Mexico, and Colombia.

Let’s take a look at this.

More on this 👉 The integration of the Lightning Network, a layer-2 solution built on top of the Bitcoin blockchain, will enable Nubank's customers to conduct near real-time fiat and Bitcoin transactions at lower costs. This development aligns with Nubank's mission to offer more efficient services through blockchain technology.

In addition to the Lightning Network, Nubank will implement Universal Money Addresses (UMAs), which function like email addresses for sending and receiving money. This feature is expected to simplify financial transactions for users, making it easier to transfer both cryptocurrencies and fiat currencies. Awesome 👏

It’s worthwhile to note that Lightspark's role in this partnership extends beyond just providing the Lightning Network infrastructure.

The company will offer AI-based tools to optimize liquidity requirements and routing in real-time, aiming to achieve the highest transaction success rates. This collaboration therefore allows Nubank's product and engineering teams to focus on creating seamless end-to-end experiences for their customers without getting bogged down in the complexities of managing a large-scale Lightning implementation.

Win-win.

✈️ THE TAKEAWAY

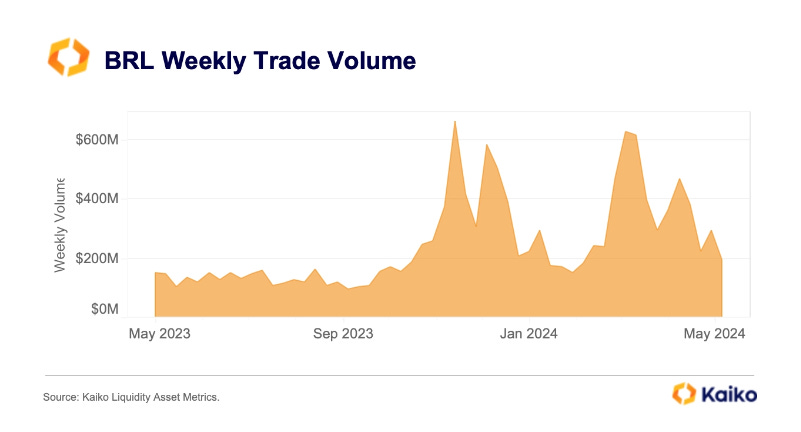

What’s next? 🤔 First and foremost, the integration of the Bitcoin Lightning Network by Nubank represents a significant milestone in the adoption of this BTC technology by mainstream financial institutions. This move has the potential to accelerate the adoption of Bitcoin and other cryptocurrencies in Latin America, a region that has shown increasing interest in digital assets. Having said that, for Nubank, this partnership could solidify its position as a leader in digital banking innovation, potentially attracting even more customers and increasing user engagement. The ability to offer fast, low-cost international transactions could be particularly appealing in a region where cross-border payments are often expensive and time-consuming. Not to mention the fact that Brazil loves crypto:

Brazilian real-denominated crypto trading volumes reached $6 billion from January to early May 2024. This growth positions Brazil as a leading player in the Latin American crypto market and highlights the increasing interest in stablecoins, Bitcoin, and other cryptocurrencies.

ICYMI: Nubank acquires Hyperplane to accelerate its AI-first strategy 🚀🤖 [what it’s all about & why it’s a brilliant M&A + a bonus deep dive in NU & why you just can’t ignore it]

Klarna Plus gains traction as the BNPL giant hits 100,000 subscribers in the US 📈🇺🇸

The news 🗞️ Buy Now, Pay Later (BNPL) pioneer Klarna, has announced that its Klarna Plus subscription service has reached 100,000 members in the United States since its launch in January.

This $7.99 monthly subscription offers benefits such as waived service fees, exclusive discounts, and rewards. Subscribers have reportedly saved an average of $18 in the first month, with subsequent months averaging $16 in savings.

Sounds good enough? Well, not really…

Let’s see what it actually tells us.

More on this 👉 First and foremost, we must note that while reaching 100,000 subscribers in five months is noteworthy, it represents only about 1.25% of Klarna's reported 8 million monthly active US users in 2023.

This conversion rate therefore raises questions about the broader appeal of BNPL subscription models 🥶

More importantly, we must realize that the introduction of Klarna Plus is part of the company's recent innovations, which include the Klarna Card, an AI shopping assistant, and a Sign-in With Klarna feature.

These developments come as Klarna refocuses its business strategy. One of the very recent illustrations of that is selling its online checkout solution, Klarna Checkout (KCO), for $520 million.

ICYMI: Klarna is “checking out” from the Checkout Business to focus on partnerships 🏷️😳 [what it’s all about & why it’s a brilliant move + a bonus deep dive into this BNPL giant & why it’s poised for huge growth in the AI Era]

Zooming out, it’s getting more and more clear that Klarna appears to be shifting its focus towards commerce enablement rather than direct payment processing (hence, why I’ve been calling it the Google of Shopping 👀).

And that’s exactly why it’s strengthening partnerships with payment service providers like Adyen and Stripe, potentially reducing conflicts of interest in its business model.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, for Klarna, the success of its subscription service is crucial as it attempts to diversify beyond its traditional, low-margin BNPL business. If Klarna Plus fails to gain substantial traction, the company may face challenges in fully transitioning to its desired commerce enablement focus. This could thus potentially slow down Klarna's growth in other business lines and impact its overall strategy. Alternatively, if Klarna struggles to accelerate subscription growth, it may signal a limited consumer appetite for BNPL subscription services. This could hence discourage other BNPL providers from pursuing similar models, pushing them to explore alternative revenue streams. But ultimately, the success or failure of Klarna Plus could shape the future direction of the BNPL industry, influencing how these companies approach revenue diversification and customer engagement in an increasingly competitive financial services landscape.

Target supercharges its marketplace with a Shopify partnership 🎯🛍️

The news 🗞️ Retail giant Target TGT 0.00%↑ has announced a strategic partnership with e-commerce and FinTech heavyweight Shopify SHOP 0.00%↑ to expand its third-party marketplace, Target Plus.

This collaboration allows select Shopify merchants to apply for inclusion in Target's curated online marketplace, potentially reaching millions of new customers.

Let’s take a quick look at this.

More on this 👉 The move comes as Target seeks to reinvigorate its sales growth and compete more effectively with e-commerce powerhouses like Amazon AMZN 0.00%↑ and Walmart WMT 0.00%↑.

Launched in 2019, Target Plus currently features over 2 million products from approximately 1,200 sellers. The partnership with Shopify is expected to introduce new and trendy brands to Target's platform, enhancing its product offerings across various categories including apparel, sporting goods, and home decor.

Unlike some competitors' more open marketplaces, Target maintains an invitation-only approach to seller selection, emphasizing quality and brand fit. This curated strategy aims to build consumer trust and complement Target's existing product assortment.

The USP 🥊 The collaboration clearly offers benefits for both parties. Target gains access to Shopify's extensive network of merchants, potentially discovering popular items that could also be featured in physical stores. Shopify sellers, in turn, can leverage Target's established customer base and perks such as free shipping on qualifying orders.

This partnership is particularly significant given Target's recent financial performance. The retailer has faced declining comparable sales for four consecutive quarters and struggled with e-commerce growth.

By expanding its marketplace, Target thus hopes to stimulate online traffic and boost overall sales.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this partnership is all about Shopify and its expanding influence. The deal thus yet again underscores Shopify's growing role in the e-commerce ecosystem. We may soon see Shopify forge similar alliances with other major retailers, further solidifying its position as a key player in online retail infrastructure. Looking at the big picture, it also speaks about the marketplace growth. As more traditional retailers expand into third-party marketplaces, we can expect increased competition in this space. This trend may lead to further innovation in marketplace models and seller services. Which is again good news for Shopify.

ICYMI: Shopify unveils AI-powered Sidekick in a bid to revolutionize e-commerce for merchants 🤖🛍️ [unpacking all their latest AI products & features and what they mean for the future + a bonus deep dive into Shopify & why I’m bullish]

🔎 What else I’m watching

Wise and Qonto Partner to Enhance International Payments for SMEs 🌐💰Qonto, a European business finance solutions provider, has partnered with Wise Platform to improve international payment services for over 500,000 SMEs and freelancers. The collaboration aims to simplify and expedite cross-border transactions, addressing challenges like complexity, slow processing times, and high costs. Integrating Wise's technology into Qonto's infrastructure enables users to conduct international payments swiftly and transparently across 24 currencies and 130 countries. This development aims to improve efficiency and cost-effectiveness for Qonto's clients. ICYMI: Wise's price-led growth strategy is all that matters 📉💸 [why their price-led growth strategy is all that matters + a bonus deep dive into Wise & why their current stock price could be an early gift for us]

Strike Launches Bitcoin Payments App in UK 🇬🇧📱 Strike, a popular Bitcoin payments app, has launched in the UK, allowing eligible users to buy, sell, send, withdraw, and make global payments using Bitcoin and the Lightning Network. The app offers free unlimited GBP deposits, automatic conversion, and recurring purchases. Users can also leverage Strike's global peer-to-peer transfers via Lightning for instant, low-cost remittances. The UK launch follows Strike's European rollout, making it available in 100 countries. To comply with UK regulations, users must pass a knowledge test and provide investor classification during signup.

Evolve Bank Confirms Data Breach by LockBit Ransomware Gang 💻🔒 Evolve Bank & Trust has confirmed it is investigating a cyber-attack after the Russia-linked LockBit ransomware gang posted stolen customer data on the dark web. The bank stated that "bad actors" appeared to have posted illegally obtained data online. LockBit released the data after Evolve failed to meet ransom demands. This incident follows an order from regulators for Evolve to improve its risk management and partnership approvals. The bank has worked closely with fintechs, including Synapse, which collapsed earlier this year, leading to a dispute with Evolve over client funds. The Federal Reserve and Arkansas State Bank Department found shortcomings in Evolve's fintech partnership oversight and anti-money laundering requirements.

💸 Following the Money

Uzbek mobile bank TBC secures $10M credit from impact investor responsibility. TBC Bank aims to expand its microlending business and promote financial inclusion in Uzbekistan, Central Asia’s largest country by population.

Chift, a Belgian startup that helps SaaS companies integrate with other financial applications and tools via APIs, has raised €2.3M in seed funding.

Digital asset trading technology firm Crossover Markets has raised $12M in a Series A funding round led by Illuminate Financial and DRW Venture Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Brilliant as always! Thanks.