Goldman Sachs democratizes high-end investing 💸📈; Stripe leads FinTech funding resurgence in Q2, signaling renewed investor confidence 😤💰; Klarna's growing IPO ambitions & 2025 US listing 🤑🔔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Citi’s Q2 2024: transformation pains mask underappreciated global finance powerhouse 📈🏦 [unpacking the most important numbers that show an underappreciated global powerhouse + a bonus deep dive into their biggest competitor JPMorgan]

Bank of America’s Q2 2024: fortress balance sheet meets margin pressure 👀🏦 [breaking down the most important numbers, what they mean & what’s next for BoA in 2024 + bonus deep dives into other banking giants]

Wise continues its cross-border FinTech dominance 📈😤 [analyzing Wise’s latest trading update & what it tells us from investment POV + a bonus dive into this FinTech champion]

Goldman Sachs in Q2 2024: Wall Street giant navigates choppy waters with resilience, but headwinds persist 🌊💸 [unpacking the Wall Street giant’s most important numbers, understanding what they mean & what’s next + some bonus deep dives inside]

State Street’s Q2 2024: asset management giant navigates shifting tides with Alpha Strategy and tries bridging traditional finance & digital assets 🏦 [analyzing their Q2 2024 financials and the quest to bridge traditional finance & digital assets]

American Express’ Q2 2024: premium profits in a slowing economy, but valuation remains questionable 🤔💸 [breaking down their Q2 2024 numbers, what they mean to see whether AmEx is worth your time and money in 2024 + some bonus deep dives into AmEx]

Stripe's valuation soars to $70B as Sequoia offers liquidity to early investors 😳💰 [what it’s all about & what it means + a bonus deep dive into Stripe]

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This is one of the most intense and packed weeks this year so far, so make sure to check all the above stories.

Goldman Sachs democratizes high-end investing 💸📈

The news 🗞️ Goldman Sachs GS 0.00%↑, the Wall Street giant known for catering to the ultra-wealthy, is making a strategic move to tap into the mass-market investment space.

In a partnership with robo-adviser Betterment, Goldman is offering sophisticated tax-optimized investment portfolios previously reserved for its high-net-worth clients to everyday investors.

Let’s take a look at this.

More on this 👉 This initiative allows individuals with annual incomes of around $190,000 to access investment strategies designed by the same teams that manage over $1 trillion for institutional clients like corporate pensions and sovereign wealth funds. The new portfolios aim to help investors save money on taxes by shifting funds from low-risk bank accounts to fixed-income ETFs holding short-term Treasurys, municipal, and investment-grade corporate bonds.

The move comes as part of Goldman's broader strategy to boost fee revenue and offset volatility in its traditional investment banking and trading businesses. By leveraging Betterment's platform, which requires only a $10 minimum investment, Goldman can reach a much wider audience than its typical private wealth clients, who have an average of $70 million with the bank.

This partnership expands on Goldman's existing relationship with Betterment, which began in 2016. It also follows Goldman's recent sale of its Marcus Invest accounts to Betterment, signaling a shift in how the bank approaches the retail investment market.

✈️ THE TAKEAWAY

What’s next? 🤔 By democratizing access to sophisticated investment strategies, Goldman is blurring the lines between traditional wealth management and digital investing platforms. So for Goldman, this partnership is all about a low-risk way to capture a share of the growing retail investment market without the overhead of maintaining its own direct-to-consumer platform. It also positions the bank to benefit from the ongoing trend of wealth transfer to younger, more tech-savvy generations who are comfortable with digital investment tools. Looking ahead, this could accelerate the democratization of complex financial products and strategies, making them accessible to a much wider range of investors. More importantly, we may see further integration of AI and machine learning into these platforms to provide even more personalized investment advice and tax optimization strategies.

ICYMI: Goldman Sachs in Q2 2024: Wall Street giant navigates choppy waters with resilience, but headwinds persist 🌊💸 [unpacking the Wall Street giant’s most important numbers, understanding what they mean & what’s next + bonus deep dives into JPMorgan & Citi]

Stripe leads FinTech funding resurgence in Q2, signaling renewed investor confidence 😤📈

New data 📊 The second quarter of 2023 saw a notable uptick in venture capital funding for payment startups, with global investments reaching $2.2 billion.

This marks an increase from both the previous quarter and the same period last year, according to a recent report by CB Insights. US-based companies claimed the lion's share, securing approximately $1.5 billion in funding.

Let’s take a quick look at this.

More on this 👉 Stripe, the digital payments & FinTech giant, played a pivotal role in this resurgence, raising an impressive $694 million. This substantial investment contributed significantly to the overall increase in funding, despite a decrease in the total number of fundraising events compared to previous quarters.

The broader FinTech sector also experienced a revival, with total funding climbing to $8.9 billion in Q2, representing a 19% increase from Q1 and an 11% rise year-over-year. This trend suggests a renewed interest from investors in the fintech space, particularly for more established companies.

Zoom out 🔎 Stripe's recent fundraising success has further solidified its position as one of the most valuable private FinTechs globally, with a valuation of $70 billion.

Other notable US-based payments firms that secured significant funding in Q2 include Ramp, a corporate card and bill payment company, which raised $150 million, and Guesty, a property management payments processor, which attracted $130 million.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the renewed investor confidence, especially in later-stage companies, may signal a shift in market dynamics. We could see increased competition among established players, potentially leading to more consolidation in the industry. This trend might also encourage innovation, as well-funded companies invest in new technologies and expand their service offerings. For startups, this could mean a more competitive fundraising environment, with investors showing a preference for companies with proven track records. Zooming out, the focus on payments and lending suggests these areas are seen as particularly promising. We may see increased development of specialized financial services, improved cross-border payment solutions, and further integration of AI and machine learning in financial processes. Looking ahead, one thing is clear - as the FinTech landscape evolves, regulatory scrutiny is likely to intensify. Companies will need to navigate complex compliance requirements while continuing to innovate. This will lead to increased collaboration between FinTech firms and traditional financial institutions, as well as a growing emphasis on RegTech solutions.

ICYMI: Stripe's valuation soars to $70 billion as Sequoia offers liquidity to early investors 😳💰 [what it’s all about & what it means + a bonus deep dive into Stripe]

Klarna's growing IPO ambitions: Swedish FinTech giant eyes 2025 US listing 🤑📈

The news 🗞️ Swedish FinTech company Klarna, a pioneer in the buy now, pay later (BNPL) sector, is reportedly gearing up for a potential initial public offering (IPO) in the United States.

The company is in talks with top-tier financial institutions, including Morgan Stanley, JPMorgan Chase, and Goldman Sachs, to serve as advisors for the listing, which could take place as early as the first half of 2025.

Let’s take a look at this.

More on this 👉 First and foremost, we must remember that Klarna's journey to this point has been tumultuous.

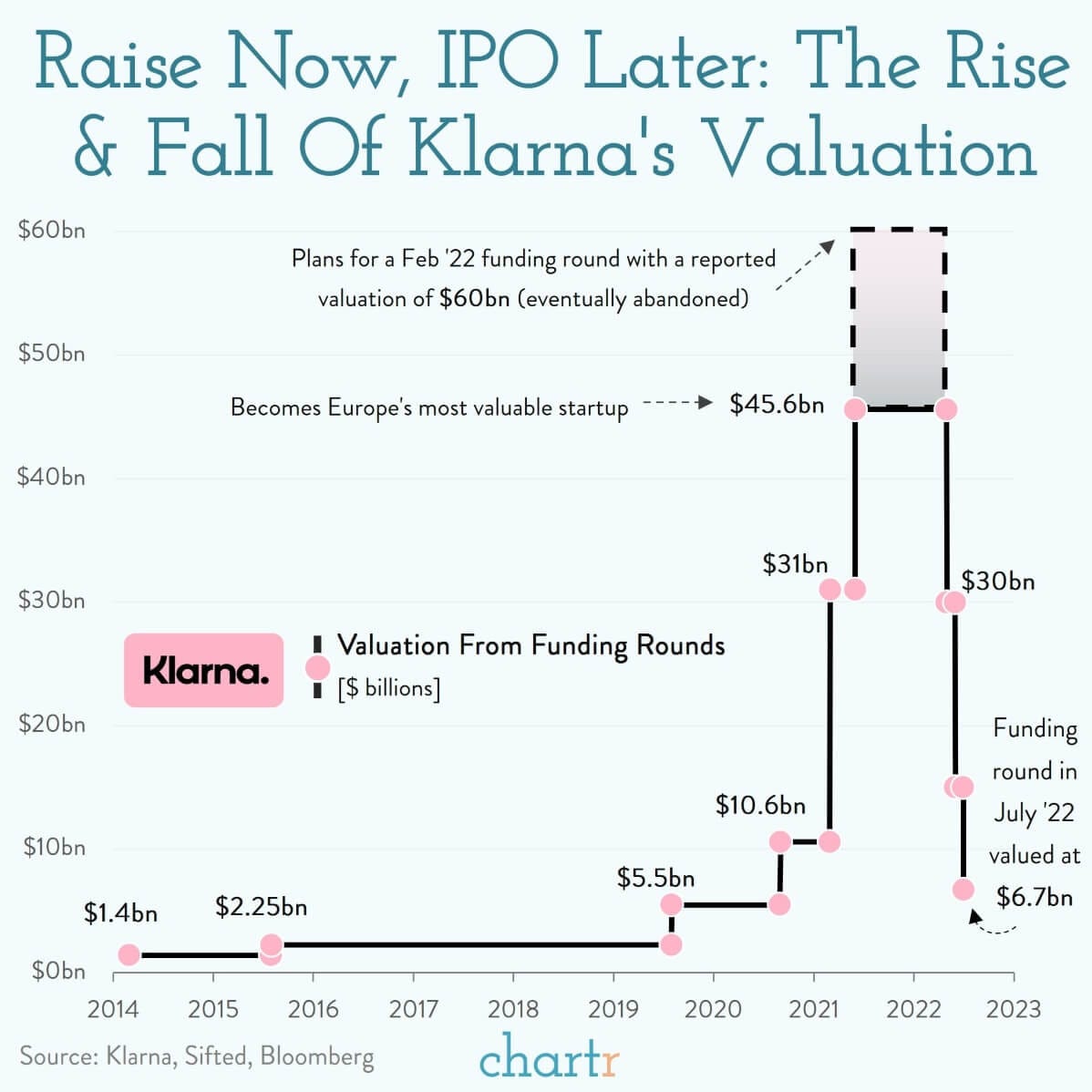

In 2021, the company was valued at a staggering $46 billion, making it Europe's most valuable startup. However, amid rising interest rates and plummeting tech stocks, Klarna's valuation plummeted to $6.7 billion in a 2022 funding round.

Despite this setback, the company and its advisors are optimistic about a potential IPO, believing that market conditions will improve by 2025. And they are probably right…

Zoom out 🔎 The BNPL industry has seen significant growth, with 85% of merchants reporting increased usage during online checkouts in the past year. Consumers, particularly younger generations, have shown a strong affinity for BNPL options, with about half of Gen Z and millennial shoppers using the service at least once in the previous year.

But that doesn’t mean Klarna has no challenges. Quite the opposite…

The company has posted five consecutive annual losses as it pursues aggressive expansion plans, particularly in the US market. Credit losses have also risen in the first quarter of 2024, reflecting the company's growth strategy and ongoing consumer struggles with inflation.

✈️ THE TAKEAWAY

What’s next? 🤔 Challenges aside, it’s pretty clear that Klarna's potential IPO will have significant implications for both the company and the broader FinTech industry. A successful listing would provide Klarna with additional capital to fuel its expansion plans and potentially solidify its position as a leader in the BNPL space. It could also serve as a bellwether for other FinTech companies considering going public (Stripe, anyone? 👀), potentially reinvigorating the IPO market for the sector. However, the company will need to demonstrate a clear path to profitability to attract investors. This may involve striking a delicate balance between growth and financial sustainability, potentially leading to a more cautious approach to expansion or increased focus on improving margins in existing markets. More importantly, we can expect Klarna and other BNPL providers to start diversifying their offerings to reduce reliance on a single revenue stream. In fact, we’re seeing this already:

ICYMI: Klarna is “checking out” from the Checkout Business to focus on partnerships 🏷️😳 [what it’s all about & why it’s a brilliant move + a bonus deep dive into this BNPL giant & why it’s poised for huge growth in the AI Era]

🔎 What else I’m watching

Anne Boden Leaves Starling Bank for New AI Venture 🤖🏦 Starling Bank founder Anne Boden has resigned from the board of the challenger bank to pursue a new AI venture, AI by Boden. Boden stepped down as CEO in May last year due to a potential conflict of interest related to her 4.9% stake in the bank she founded in 2014. After a year as a non-executive director, Boden has now left Starling, which recently reported its third profitable year with a pretax profit of £301.1m. Boden has declined to comment on her plans with AI by Boden. ICYMI: Starling Bank’s latest financials: soaring profits, but gathering clouds 🌤️ [breaking down their latest annual report, uncovering the most important numbers & what’s next for Starling + a bonus deep dive into Monzo & why it’s super exciting]

Tiger Global Eyes $500M Revolut Share Deal, Valuing FinTech at $40B 💼💰Existing investor Tiger Global Management is in talks to lead a $500 million secondary share sale for UK-based fintech giant Revolut, which would value the company at at least $40 billion, according to Sky News. Tiger, which jointly led Revolut's 2021 $800 million funding round at a $33 billion valuation, is one of several parties interested in buying shares. Last month, it was reported that Revolut is working with Morgan Stanley to sell about $500 million worth of existing shares, including those held by employees, to reach the $40 billion valuation. CEO Nik Storonsky is among the staffers likely to sell off shares, with reports suggesting he plans to offload stock worth tens or hundreds of millions of dollars. Earlier this month, Revolut reported a record profit of $545 million in 2023, boosting its long-term quest to secure a UK banking license. ICYMI: Revolut’s 2023 financials: a FinTech rocket with astronomical growth, but regulatory asteroids loom 🚀☄️ [breaking down the key facts & figures, uncovering the most important numbers & what’s next for Revolut + bonus deep dives into Starling Bank, Monzo and JPMorgan]

Cash App to Shut Down in UK as Block Refocuses on US Market 🇬🇧📉 Block SQ 0.00%↑, the company behind Cash App, has announced it will close its P2P payments service in the UK as it "deprioritises global expansion." After a six-year run in the country, Cash App UK will shut down in September. The notice on Cash App's site states that the decision was not made lightly and that the company's strategic approach now prioritizes its focus on the United States. Over the past decade, Cash App has become a major player in the US P2P payments market, competing with PayPal's Venmo and the bank-backed Zelle service, boasting over 50 million monthly active users.

💸 Following the Money

Japan-based SoftBank has announced the acquisition of Graphcore, a UK-based artificial intelligence (AI) chipmaker, with the deal receiving full regulatory approval.

Argentine payment processor Tapi has secured $22M in a Series A funding round aimed at expanding its operations into the Mexican market.

Allium, a blockchain data platform that works with the likes of Visa V 0.00%↑ and Stripe, has raised $16.5M in a Series A funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

I really enjoy your weekly writeups but this one is just too good 🤌 - thank you!