Elon Musk gears up for 𝕏 financial revolution 👀💸; PayPal aims to transform online shopping with Fastlane 👀💳; HSBC’s Q2 2024 shows resilience, yet headwinds persist 👀🌊

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Latin America's e-commerce giant MercadoLibre is uniquely poised for continued dominance 😤🚀 [breaking down their key numbers, understanding what they mean so you can see why you just can’t ignore this FinTech giant in 2024]

Shopify continues to dominate both e-commerce and FinTech 😤📱[deeper dive into Shopify’s Q2 2024, unpacking the numbers, what they mean & why you can’t ignore this FinTech & E-commerce giant]

Shift4’s solid Q2 2024 and the quest to become the SpaceX of Payments 💸👨🚀 [analyzing the most important facts & figures so you can see why Shift4 is still one of the most undervalued public FinTechs right now + some bonus reads inside]

Robinhood's profitable growth trajectory: a diamond in the rough or fool's gold? 🤔💳 [a deeper dive into their Q2 2024 numbers, what they mean & whether you should be bullish on HOOD 0.00%↑ in 2024 + some bonus reads inside]

Dave's digital banking revolution reminds us that neobanking can be profitable 🐻🏦 [deep dive and breakdown of the bank’s latest numbers to see why Dave might be worth your time and money in 2024]

Global FinTech investment cools in H1 2024, but AI and RegTech shine amid uncertainty 💸🤖 [holistic view of H1 2024 focusing on the key trends, why they matter & what’s next + bonus reads on Worldpay, Nuvei & extra resources to scale your startup irrespective of the market sentiment]

FinTech M&A is alive as Payoneer expands global reach with strategic acquisition of Skuad 🤝💰 [what it’s all about & why it’s a brilliant move + a bonus dive into Payoneer]

JPMorgan expands small-town presence, bucking branch closure trend 🏠👋 [what it’s all about and why it matters + a bonus deep dive into JPM & how it’s crushing it in AI + Finance]

As for today, here are the 3 incredible FinTech stories that were transforming the world of financial technology as we know it. This is the most intense and thrilling week in the whole of 2024 so far, so make sure to check all the above stories.

Elon Musk gears up for 𝕏 financial revolution with the imminent launch of in-app payments 👀💸

The news 🗞️ 𝕏, the social media platform formerly known as Twitter, is on the brink of a significant transformation as it prepares to launch an in-app payments feature.

This development aligns with Elon Musk's ambitious vision of turning 𝕏 into an "everything app" that could potentially replace traditional banking for many users.

Let’s take a quick look at this.

More on this 👉 Recent findings by app researcher Nima Owji reveal that 𝕏 is working on adding a "Payments" button to its navigation bar. This feature is expected to include functionalities such as transactions, balance checking, and money transfers.

The move comes as 𝕏 struggles to attract advertising revenue, prompting the company to explore alternative income streams.

In parallel, 𝕏 Payments, a subsidiary of 𝕏, has been quietly laying the groundwork for this financial expansion. The company has already secured money transmitter licenses in 33 U.S. states, including recent approvals in North Dakota, Alabama, California, and the District of Columbia.

This regulatory compliance is crucial for 𝕏 to legally engage in money transfers within the United States.

✈️ THE TAKEAWAY

What’s next? 🤔 Musk's vision for 𝕏's financial services is expansive. We can remember that back in an October 2023 meeting with employees, he outlined plans for the platform to handle users' "entire financial life," encompassing not just simple peer-to-peer transfers but also potentially replacing traditional bank accounts. Musk ambitiously targeted the end of 2024 for rolling out these comprehensive financial features.

“When I say payments, I actually mean someone’s entire financial life. If it involves money - it’ll be on our platform. Money or securities or whatever. So, it’s not just like sending $20 to my friend. I’m talking about, like, you won’t need a bank account” - Elon Musk (2023)

The introduction of payment services on 𝕏 could have far-reaching implications for both the platform and the broader FinTech and Finance sectors, potentially disrupting them both. Fascinating watch & fascinating times to be in FinTech 🚀

ICYMI: Elon Musk’s 𝕏 unveils ambitions to dominate digital payments 📲💸 [a deeper dive into this Everything App, uncovering what Elon’s master plan is all about & what’s next for 𝕏 + lots of bonus reads and deep dives inside]

PayPal aims to revolutionize online shopping with Fastlane Checkout 👀💳

The news 🗞️ PayPal PYPL 0.00%↑ just introduced Fastlane, a quick guest-checkout solution now available to all U.S. merchants. This innovative tool aims to streamline the online shopping experience by addressing a common pain point: the lengthy and often frustrating checkout process.

Let’s take a quick look at this.

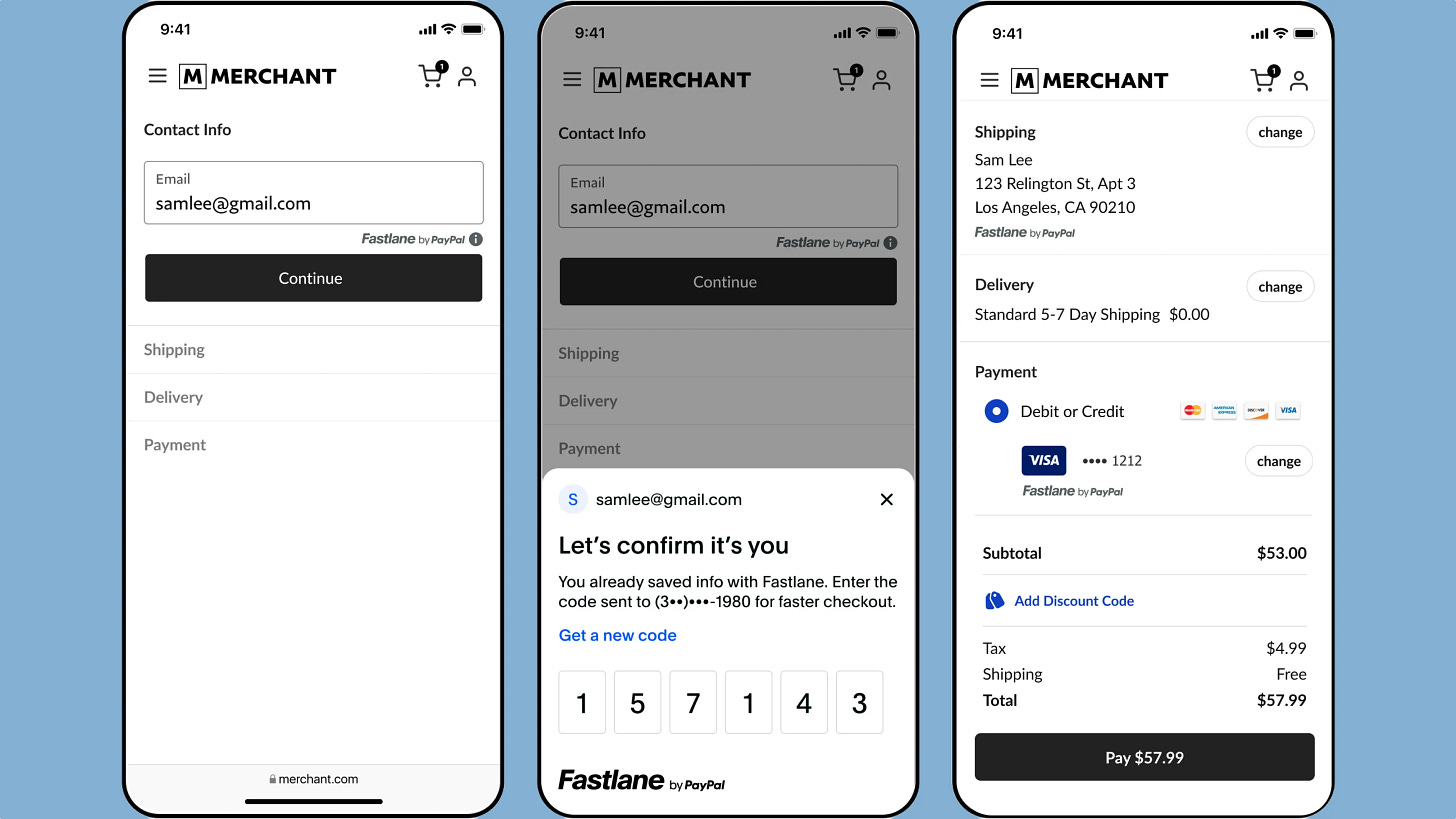

More on this 👉 Fastlane works by securely storing customer data, including names, contact information, shipping addresses, and payment details. When a customer shops on a participating merchant's website, Fastlane can quickly retrieve this information without requiring the user to log in. Instead, customers simply enter a verification code sent via email to autofill their information.

The introduction of Fastlane comes in response to consumer preferences. Studies show that a significant percentage of shoppers prefer guest checkout options to avoid creating accounts on e-commerce sites. PayPal's solution caters to this preference while still offering the speed and convenience of a one-click checkout experience.

During initial testing, PayPal reported impressive results, with guest checkout conversions around 80% and checkouts 32% faster than traditional methods. These improvements could potentially lead to increased sales for merchants and a more satisfying experience for consumers.

Fastlane is currently available to businesses using PayPal's payment processing services, such as PayPal Braintree or PayPal Complete Payments. The company has also announced a partnership with Commercetools, a composable e-commerce platform, which will make Fastlane available to its 500 million users, including major brands like Sephora and Peloton.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, by offering a solution that addresses both merchant and consumer needs, PayPal aims to strengthen its position in the digital payments market, potentially attracting more businesses to its ecosystem. Given the e-commerce landscape continues to evolve, solutions like Fastlane can play a crucial role in shaping the future of online shopping and thus reignite PayPal’s growth. I will be very keen to explore this further in PayPal’s upcoming Q3 report so stay tuned!

ICYMI: FinTech giant PayPal's Q2: profitability push pays off, yet all eyes are on growth challenges 👀💸 [breaking down the key numbers, what they mean & whether PayPal stock is worth your time and money in 2024 + more bonus dives into PayPal and Shopify SHOP 0.00%↑]

HSBC’s Q2 2024: global banking giant navigates stormy waters with resilience, yet headwinds persist 👀🌊

Earnings calling ☎️ Europe’s largest lender HSBC HSBC 0.00%↑ posted a narrow decline in pretax profit in the first half of the year but beat expectations on the back of a high-interest rate environment.

The bank's latest financial reports reveal a mixed picture of resilience and challenges.

Let’s take a look at the key numbers and break them down.

More on this 👉 In the first half of 2024, HSBC reported a stable profit before tax of $21.6 billion, demonstrating its ability to maintain profitability in a challenging environment.

Additionally, the bank's strong capital position, with a CET1 ratio of 15.0%, up from 14.8% at the end of 2023, provides a solid foundation for weathering potential economic storms and pursuing growth opportunities.

HSBC's diversified global footprint remains a key strength, with particular emphasis on its dominant positions in Asia and the UK. The bank's focus on wealth management and commercial banking in these regions has shown promise, with wealth revenue increasing by 12% year-on-year.

This strategic pivot towards high-growth areas could drive future profitability (Zing, anyone? 👀)

ICYMI: HSBC's new FX app Zing shows slow growth 📉😬 [it’s very slow… & what this tells us + some bonus reads inside]

Risks & challenges🛡️ However, HSBC faces significant headwinds. Net interest income declined by 7% compared to the first half of 2023, primarily due to business disposals and deposit migration.

The bank's net interest margin (NIM) of 1.62% decreased by 8 basis points, reflecting rising funding costs. This compression in NIM could continue to pressure profitability if interest rates remain elevated.

The bank's cost-to-income ratio increased to 43.7% from 41.9% in the same period last year, indicating some deterioration in operational efficiency. Management's focus on cost control will be crucial in maintaining competitiveness, especially as technology investments become increasingly necessary to fend off FinTech disruptors (Zing 👋)

Finally, HSBC's exposure to the Chinese property sector and broader economic slowdown in China presents a significant risk. While the bank has taken steps to manage this exposure, any further deterioration in the Chinese real estate market could lead to increased credit losses.

Future outlook 🔮 On the positive side, HSBC's strong liquidity position, with a liquidity coverage ratio of 137%, provides a buffer against potential market stress. Also, the bank's ongoing share buyback program and dividend payments demonstrate confidence in its financial stability and commitment to shareholder returns.

Additionally, the bank's strategic focus on digitization and sustainable finance presents opportunities for long-term growth. HSBC provided and facilitated $45.5 billion of sustainable finance and investments in the first half of 2024, bringing its cumulative total since 2020 to $339.9 billion. This positions the bank well in the rapidly growing ESG market.

From a valuation perspective, HSBC trades at a price-to-book ratio of approximately 0.8x, which is below many of its global peers. This could suggest undervaluation, but it also reflects the market's concerns about the bank's growth prospects and exposure to geopolitical risks.

While HSBC's global scale and strong capital position provide a solid foundation, the bank faces significant challenges in the form of margin pressure, increased regulatory scrutiny, and geopolitical tensions, particularly between the US and China.

✈️ THE TAKEAWAY

What’s next? 🤔 All in all, the risk/reward profile for HSBC appears balanced at current levels. While the bank's strong capital position, global reach, and strategic initiatives in wealth management and sustainable finance offer potential upside, the headwinds from margin pressure, operational inefficiencies, and geopolitical risks cannot be ignored. Looking ahead, HSBC's performance will likely be closely tied to the global economic recovery, particularly in Asia. Thus, the bank's success in executing its digital transformation and capitalizing on the wealth management opportunity in Asia will be critical. If HSBC can navigate the geopolitical tensions and successfully pivot towards higher-growth areas while maintaining cost discipline, it could see improved profitability and valuation. However, the path forward is likely to be bumpy, and investors should closely monitor the bank's progress in addressing its operational challenges and navigating the evolving regulatory landscape. BTW, it’s funny that the bank hasn’t mentioned anything (not even once!) about its Wise, Revolut, etc. competitor Zing 👀 (I guess the numbers might be disappointing, to say the least)

ICYMI: Citi’s Q2 2024: transformation pains mask underappreciated global finance powerhouse 📈🏦 [unpacking the most important numbers that show an underappreciated global powerhouse + a bonus deep dive into their biggest competitor JPMorgan]

Bank of America’s Q2 2024: fortress balance sheet meets margin pressure 👀🏦 [breaking down the most important numbers, what they mean & what’s next for BoA in 2024 + bonus deep dives into other banking giants]

Goldman Sachs in Q2 2024: Wall Street giant navigates choppy waters with resilience, but headwinds persist 🌊💸 [unpacking the Wall Street giant’s most important numbers, understanding what they mean & what’s next + some bonus deep dives inside]

State Street’s Q2 2024: asset management giant navigates shifting tides with Alpha Strategy and tries bridging traditional finance & digital assets 🏦 [analyzing their Q2 2024 financials and the quest to bridge traditional finance & digital assets]

Disclaimer: this isn’t investment advice and you should always do your own research.

🔎 What else I’m watching

US Online Brokerages Face Downtime During Market Rout 📉💻 US online brokerages suffered downtime as the market opened in anticipation of a stock market rout. DownDetector reported multiple problems at top online brokerage firms, including Charles Schwab, Fidelity Investments, Vanguard, and TD Ameritrade. The breakdown comes amid a surge of sell orders as weak market forecasts spooked investors, prompting a rush out of over-hyped market sectors, including AI and crypto. Schwab was down for more than 15,300 users, while outage reports on Fidelity reached over 3,000, according to Downdetector. Vanguard and TD Ameritrade also suffered a rush of reports from frustrated users.

S&P Global Trains 35,000 in GenAI 🧠 S&P Global partners with Accenture to train its entire 35,000-strong workforce in generative AI. The comprehensive program aims to empower employees to leverage AI, transforming the financial services industry. The partnership also includes AI development and benchmarking collaborations.

Mox Bank Offers Crypto ETF Trading 🪙 Hong Kong's Mox Bank, a Standard Chartered subsidiary, now offers spot Bitcoin and Ether ETF trading. With competitive fees, Mox plans to expand crypto services, aligning with Hong Kong's push to become a crypto hub.

💸 Following the Money

Neighborhood loyalty platform Bilt Rewards has lifted its valuation to $3.25B on the back of a $150M funding round.

Vilnius-based BoBo, which allows instant cross-border transactions and safe instant card payments, raised €6.5M in seed funding. Graphit Holding led the round.

Mexican FinTech unicorn Stori has raised $212M in equity and debt financing.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Also interesting news: https://www.ledgerinsights.com/thailand-launches-digital-asset-sandbox/

Thanks, PayPal's fastlane checkout has many similarities with klarna's checkout (like the verification system), doesn't it?