Klarna is shutting down Salesforce & Workday and replacing them with simpler tech stack created by Al 🤖; Brazil's Pix set to dethrone credit cards by 2025 💳; PayPal's offline payments push 👋

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Mastercard's $2.65 billion bet on Cybersecurity: acquiring Recorded Future 💸🛡️ [why snapping Recorded Future for $2.65B is a great move & what it tells us about the future + bonus dives in both Visa & Mastercard]

UBS’s AI tool that can scan 300,000 firms in 20 secs 😳🤖 [why it’s another sign of paradigm shift in banking + bonus reads on JPM that’s crushing it on all things Finance + AI]

Worldline's leadership shakeup amid financial turbulence 🥶📉 [what’s happening & why it matters + a bonus deep dive into Worldline and whether it’s worth your time & money in 20204]

Ant Group’s AI-powered life assistant to revolutionize daily tasks 🤖🐜 [what’s the USP here & why it makes sense + what it tells us about the future of FinTech & AI]

American Express is harnessing vast customer data for dynamic credit decisions 📊💳 [what it’s all about & what it tells us about the future + a bonus deep dive into AmEx]

Revolut's Fraud Dilemma: balancing growth and security 👀🚀 [a recap of what’s happening, why it matters & what are the future implications + a bonus read on Revolut]

HSBC explores landmark merger of commercial and investment banking divisions 👀🏦 [what this is all about & why it makes sense + a bonus deep dive into HSBC & other banking behemoths]

Big Banks' loss could be Smaller Banks' gain in falling rate environment ⚖️🏦 [what’s happening and what it signals about the future + a bonus deep dive into JPMorgan & co]

Another one: PayPal expands partnership with Shopify 🤝💳 [what it’s all about & how to make sense of it + bonus deep dives into PayPal, Shopify & more]

Why Big Banks are losing Gen Z 👋📱[a quick recap of the current state of affairs, what it tells us & what should we expect next]

As for today, here are the 3 incredible FinTech stories that were changing the world of financial technology as we know it. This was one of the most intense and interesting weeks in the whole of 2024 so far, so make sure to check all the above stories.

Klarna is shutting down Salesforce & Workday and replacing them with a simpler tech stack created by Al 😳🤖

The news 🗞️ Swedish FinTech giant Klarna is making waves in the tech industry again. This time by cutting ties with major software-as-a-service (SaaS) providers Salesforce CRM 0.00%↑ and Workday WDAY 0.00%↑.

This bold move is part of a larger initiative to leverage artificial intelligence (AI) for developing in-house tech.

Let’s take a quick look at this and see why it matters.

More on this 👉 In a private investor conference call held a few weeks ago, CEO Sebastian Siemiatkowski announced that Klarna has already shut down Salesforce and plans to discontinue Workday within weeks. The company is embarking on extensive internal projects combining AI, standardization, and simplification to create a more lightweight and efficient tech stack.

This strategic shift shouldn’t be too surprising as it is driven by Klarna's impressive results with AI implementation. The company's AI-powered customer service assistant now handles two-thirds of all customer chats, effectively replacing 700 full-time employees 😳

This has led to a significant 73% year-over-year increase in average revenue per employee for the first half of 2024. Not too shabby!

Klarna's AI initiatives have also yielded remarkable improvements in operational efficiency. Customer service resolution times have been slashed from 11 minutes to just 2 minutes, while maintaining high customer satisfaction levels. Nice!

But that’s not it.

The company's ambitious plans extend beyond software solutions. Klarna aims to reduce its workforce by nearly 50%, bringing the employee count down to around 2,000 in the coming years. This reduction will be achieved through natural attrition and a hiring freeze, rather than layoffs. Hint: this might actually be the AI effect too…

Zoom out 🔎 Looking ahead, Klarna's AI-driven strategy could have significant implications for both the company and the broader Fin(Tech) industry. By developing its own AI-powered tech stack, Klarna is positioning itself as a leader in AI adoption and implementation in the financial sector.

And setting an example…

This move could thus spark a trend among larger enterprises to bring previously outsourced services in-house, potentially disrupting the traditional SaaS model. That said, companies with the resources to develop and maintain their own AI-powered solutions may follow Klarna's lead, seeking greater control, customization, and cost-efficiency.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, This tells us two important things: (1) While many are still skeptical (and we all should be!), Klarna is getting massive leverage from AI. Thanks to AI agents + AI engineers getting prolific, you can rebuild most enterprise SaaS functionality, host for super cheap, and get basically 90%+ functionality. (2) Klarna is giving yet another masterclass on how to get free marketing ahead of their upcoming IPO. AI is the talk of the town now, and they are riding this wave with ease. First, by automating CS and now by replacing their enterprise SaaS stack. Masterful execution on both fronts 👏

ICYMI:

Klarna's AI Revolution: efficiency gains, halving workforce and path to IPO 🤑🤖; Apple in talks to invest in OpenAI 😳💸; PayPal & Fiserv expand partnership to streamline digital payments 🤝💳

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

Brazil's Pix instant payments set to dethrone credit cards by 2025 😳💳

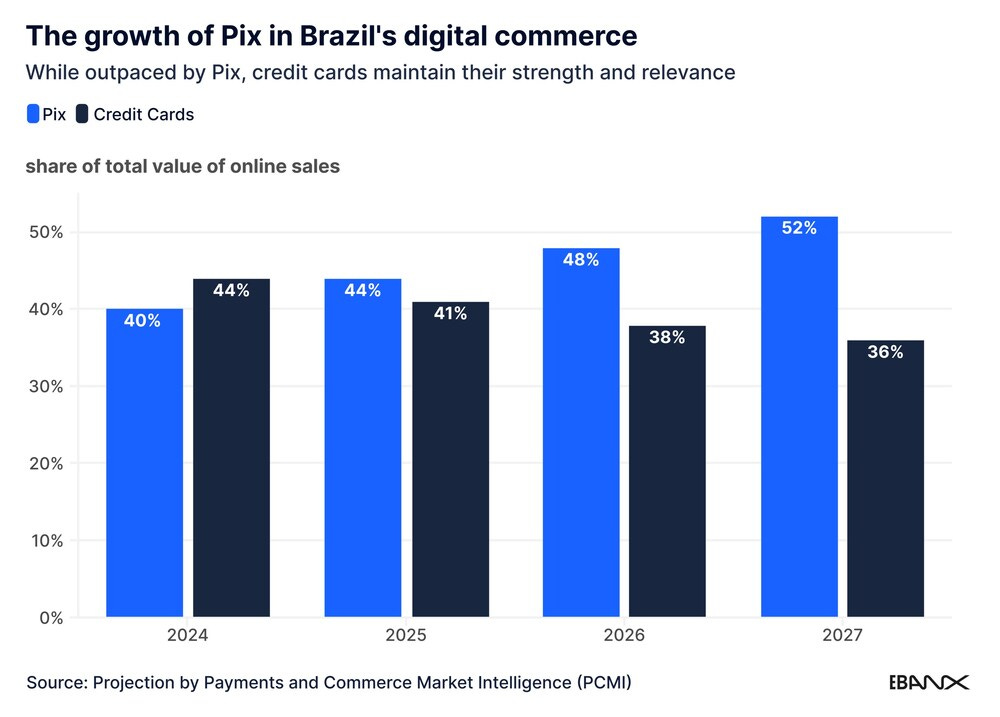

The news 🗞️ Brazil's instant payment system Pix is poised to overtake credit cards as the leading payment method for online purchases in the country by 2025, according to recent analyses by EBANX and other financial intelligence firms.

This rapid ascension, faster than previously anticipated, marks a significant shift in Brazil's digital commerce landscape.

Let’s take a quick look at this.

More on this 👉 Launched in late 2020 by Brazil's central bank, Pix has quickly become a cornerstone of the country's financial ecosystem. With over 168 million users, it now accounts for 14% of all instant payments worldwide.

By 2025, Pix is projected to handle 44% of all value transacted in online purchases in Brazil, surpassing credit cards at 41%. Not too shabby!

The system's growth has been particularly strong in the retail and travel sectors, which are expected to see annual growth rates of 31% and 20% respectively over the next three years. Gaming and delivery apps have also contributed significantly to Pix's acceleration.

Zoom out 🔎 But Pix's success extends beyond convenience; it's driving financial inclusion in Brazil. In its first two years, Pix brought 71.5 million users into the financial system. Wow!

For many, it serves as a gateway to digital commerce, with 95% of first-time buyers at EBANX partner stores choosing Pix as their payment method. Nice!

We must note that despite Pix's rise, credit cards remain important in Brazil's financial landscape. Card issuance has increased by 130% in four years, and the value transacted via credit cards in digital commerce is expected to grow by 21% annually over the next three years.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, Pix's rapid adoption and projected dominance signal a transformative shift in Brazil's financial services sector. And this trend is likely to have far-reaching implications. Here are the most important ones to think about:

Financial Inclusion: Pix's accessibility could further accelerate financial inclusion, bringing more Brazilians into the formal economy and digital marketplace.

Innovation Catalyst: the success of Pix may spur the development of new features and services. The central bank is already working on additions like Auto Pix for recurring payments and Pix Garantido for installment payments, which could further disrupt traditional banking services. And these could be massive catalysts for change.

Regional Influence: Brazil's success with Pix is inspiring similar initiatives across Latin America, with ten countries pursuing or launching instant payment methods. This could lead to a region-wide shift in payment preferences and financial technology.

Competition & Adaptation: traditional financial institutions and credit card companies will likely need to innovate and adapt their offerings to remain competitive. This could lead to improved services and lower fees for consumers.

E-commerce Growth: the ease and popularity of Pix could further accelerate e-commerce adoption in Brazil, potentially opening up new markets and opportunities for both domestic and international businesses.

Therefore, the rise of Pix represents more than just a change in payment methods; it's a fundamental shift in how Brazilians interact with money and the digital economy. As this trend continues, we can expect to see further innovations in financial services, increased competition among providers, and potentially, a reimagining of the role of traditional banks in the digital age. The success of Pix may also serve as a model for other emerging markets looking to modernize their payment systems and boost financial inclusion. And all of this makes a very fertile ground for LatAm’s digital companies to thrive 🚀

ICYMI: Nubank 2Q 2024: Latin America's digital banking juggernaut continues profitable expansion 😤💜 [analyzing the most important numbers, uncovering what they mean so you can see why NU is just too good to be ignored + lots of bonus dives inside]

Latin America's e-commerce giant MercadoLibre is uniquely poised for continued dominance 😤🚀 [breaking down their key numbers, understanding what they mean so you can see why you just can’t ignore this FinTech giant in 2024]

PayPal's offline payments push 👋📱

The news 🗞️ Digital payments giant PayPal PYPL 0.00%↑ is making a strategic move to expand its presence in the physical retail space.

Under the leadership of CEO Alex Chriss, the company is rolling out initiatives aimed at encouraging users to use PayPal for in-store purchases, marking a significant shift from its traditional online focus.

Let’s take a quick look at this and see why it matters.

More on this 👉 At the heart of this strategy is an enhanced cashback rewards program. PayPal has observed an uptick in rewards claimed for everyday purchases like groceries and gas since the program's recent expansion.

To promote this new offering, the company has launched a high-profile advertising campaign featuring comedian Will Ferrell, emphasizing the versatility of PayPal for payments "everywhere."

The company is also focusing on its peer-to-peer payment platform, Venmo, aiming to increase its use for in-person transactions. This includes promoting a Venmo debit card and positioning the service as a convenient payment method for local service providers like dog walkers and babysitters.

PayPal's offline strategy extends to partnerships with tech giants Apple AAPL 0.00%↑ and Google GOOGL 0.00%↑, integrating PayPal's tools into their digital wallets. The company is also exploring near-field communication (NFC) technology to further expand its omnichannel payment capabilities, with plans to test this feature in Europe before a potential U.S. rollout.

These initiatives are part of a broader overhaul at PayPal under Chriss's leadership, which has included management changes and a revamped business strategy.

The goal is clear: to make PayPal a ubiquitous payment option both online and offline, encouraging habitual use across various settings.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, PayPal's move reflects the growing trend of integrating online and offline payment experiences. This could thus further accelerate the adoption of digital payment methods in traditional brick-and-mortar settings. Furthermore, by offering cashback rewards and expanding into everyday purchases, PayPal is positioning itself as a more direct competitor to traditional banking services and credit card companies. Finally, as PayPal gains more visibility into users' offline spending habits, it could leverage this data to offer more personalized financial services and targeted marketing opportunities. Of course, the success here will depend on PayPal's ability to change consumer habits and convince merchants to adopt its payment solutions at scale. Looking ahead, we can expect to see PayPal continue to refine its offline strategy, potentially through further partnerships, technological enhancements, or even acquisitions in the point-of-sale space. Other digital payment providers may follow suit, leading to increased competition and innovation in the sector. Good move!

ICYMI: Another one: PayPal expands partnership with Shopify 🤝💳 [what it’s all about & how to make sense of it + bonus deep dives into PayPal, Shopify & more]

🔎 What else I’m watching

Goldman Sachs to Cut Hundreds of Jobs: Reports 🏢 Goldman Sachs GS 0.00%↑ plans to cut between 1,300 and 1,800 employees, or 3% to 4% of its workforce, as part of its annual performance reviews, according to The Wall Street Journal. The bank currently employs around 45,300 people. A Goldman spokesperson disputed the accuracy of the reported numbers. The annual reviews, which typically result in a 1% to 5% staff reduction, were restored in 2022 after being paused during the COVID-19 pandemic. Goldman expects to have more employees in 2024 than in 2023. Last year, the bank prepared to cut at least 450 staff in September, marking its fourth round of layoffs in 12 months. One variable in the layoff process includes in-office attendance, with Goldman pushing for a five-day office workweek since 2021. The layoffs come amid an upturn in Goldman's investment banking fees and asset management revenues. ICYMI: Goldman Sachs in Q2 2024: Wall Street giant navigates choppy waters with resilience, but headwinds persist 🌊💸 [unpacking the Wall Street giant’s most important numbers, understanding what they mean & what’s next + some bonus deep dives inside]

Revolut’s Storonsky Sells $300 Million in Company Stock 💰 Revolut founder and CEO Nik Storonsky has reportedly sold shares worth up to $300 million (£230 million) in the company. In June 2024, Revolut was in talks with Morgan Stanley to sell $500 million in shares, valuing the company at $40 billion. Last month, Storonsky sold 40-60% of his Revolut stock in a secondary share sale led by D1 Capital Partners, Tiger Global, and Coatue, which valued the company at $45 billion. The sale aimed to provide employee liquidity. In July 2024, Revolut secured its UK banking license after three years of regulatory compliance efforts. ICYMI: Revolut is aggressively expanding its B2B offerings 💸🚀 [what’s the latest B2B push is all about & why it matters + some bonus dives into Revolut inside]

A2A Payments to Surge from 60B in 2024 to 186B by 2029 📈 Juniper Research predicts that A2A payments will rise by 209% from 60 billion in 2024 to 186 billion by 2029. These direct bank transfers are gaining popularity due to instant settlements and lower transaction fees. Open Banking advancements, such as Variable Recurring Payments (VRPs), are driving this growth. The introduction of instant payment systems like FedNow, with an average transaction fee of 4 cents, is also boosting A2A payments, even in card-dominated markets like the US. The study analyzes data from 60 countries and explores regional trends, providing valuable insights for industry stakeholders.

💸 Following the Money

London-based Palm, a cash management platform for enterprise treasury, raised €5.5M in seed funding.

B2B buy now, pay later platform PastPay has raised €12M in a Series A funding round led by Platina Capital and supported by several financial institutions.

FlexiLoans, an innovator in India's digital lending space, has announced a successful equity raise of $34.5M in its latest Series C funding round.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Thanks for an another gem! Really enjoyed the latest issue.