Morgan Stanley aims to revolutionize Wall Street research with AI 😳🤖; Revolut faces mounting pressure over fraud response 👀🦹♂️; AI stock picker outperforms the S&P 500 by nearly 50% 🤑🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Finix wants to challenge Stripe's payment processing dominance 😳💳 [a quick look at their latest fundraise, what it means & what’s next in payments + bonus deep dives into the biggest merchant acquirers]

JPMorgan maintains AI dominance in banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking + bonus reads on JPM & how they are crushing it here]

Western Union’s Q3 2024: digital acceleration signals turnaround, but transformation journey tests investor patience 🤷♂️📊 [breaking down the key numbers, what they mean & what’s next + a bonus dive into Wise]

LendingClub poised for continued growth as FinTech lending leader 😤💸 [breaking down the key numbers, what they mean & why LendingClub is worth your time and money in 2024 & beyond]

Wise reports strong growth in Q2 as global expansion accelerates 🚀💸 [a quick look at their accelerating global expansion & key numbers + more bonus reads inside]

Tide expands SME platform with strategic payroll acquisition 🤝💸 [what it’s all about, why it makes sense & what this tells us about the future of FinTech]

Apple & Goldman Sachs hit with $89M fine 😬💰 [a holistic overview of the case & what it means + more bonus reads on Apple Card]

Schwab's wealth management transformation signals a new growth chapter despite rate headwinds 📈💰 [breaking down the latest numbers, what they mean & whether this finance giant is worth your time and money in 2024 & beyond]

Another one: Green Dot launches Embedded Finance brand 😳💵 [what Green Dot’s Arc is all about & why it matters + more bonus reads on embedded finance and its importance]

As for today, here are the 3 incredible FinTech stories that were changing the world of financial technology as we know it. This was one of the craziest and most interesting weeks in 2024 so far, so make sure to check all the above stories.

Morgan Stanley aims to revolutionize Wall Street research with AI 😳🤖

The news 🗞️ Banking giant Morgan Stanley MS 0.00%↑ has just launched AskResearchGPT, a sophisticated generative AI assistant that transforms how investment banking, sales, trading, and research staff access and utilize the firm's vast research resources.

The system, powered by OpenAI's GPT-4 model, enables employees to efficiently analyze and synthesize insights from more than 70,000 annual proprietary research reports.

Let’s take a quick look at this and see why it matters.

More on this 👉 The platform represents a significant advancement in financial services technology integration, featuring one-click access within daily workflows and seamless integration with common productivity tools.

A standout feature includes automatically generating email drafts with hyperlinked citations, allowing staff to quickly customize and share insights with clients while maintaining access to source materials.

According to Morgan Stanley, this AI implementation has dramatically improved efficiency, with salespeople now responding to client inquiries in one-tenth of the traditional time. Not too surprising if you ask me… 🤷♂️

On top of that, the tool has seen adoption rates triple compared to previous AI solutions, indicating strong user acceptance and practical utility.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Morgan Stanley's early adoption of generative AI, particularly in institutional securities, sets a new standard for financial services technology. This could thus prompt accelerated AI adoption across Wall Street as competitors seek to maintain parity in service quality and efficiency. That said, if successful, this implementation could lead to the standardization of AI-assisted research analysis across financial institutions, increased focus on AI literacy among financial professionals, as well as the evolution of client expectations regarding response times and insight delivery. Looking ahead, it’s clear that it’s now only a matter of time until we see: (1) extension to multiple languages and information sources; (2) integration with real-time market data and analysis (think Perplexity or Bigdata.com); (3) development of more sophisticated client-facing AI tools; (4) enhanced personalization capabilities for different user groups. Zooming out and looking at the broader banking industry, this development will likely accelerate investments in similar capabilities, potentially leading to a new standard of AI-enhanced financial services. More importantly, this should result in more sophisticated, responsive, and data-driven client relationships across the sector. Win-win for all 👏

Morgan Stanley's resilience shines amidst market volatility 👏📈 [breaking down the latest Q3 2024 financials, what they tell us & what’s next + bonus deep dives into other financials behemoths inside]

Revolut faces mounting pressure over fraud response 👀🦹♂️

The news 🗞️ Over 100 Revolut customers have come forward to the BBC with accounts of substantial losses through sophisticated scams, raising serious questions about the FinTech giant's fraud prevention and customer support systems.

Let’s take a quick look at this.

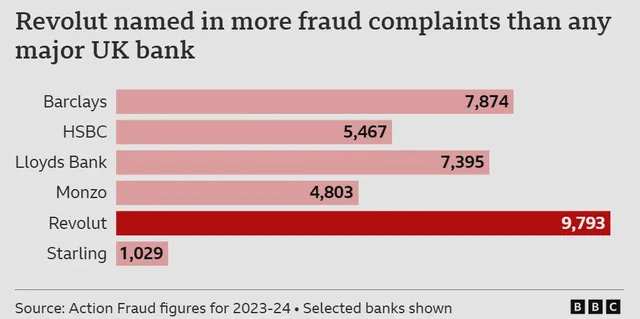

More on this 👉 Despite Revolut's impressive growth to 45 million global customers and record profits of £438m last year, the digital bank was named in more fraud complaints than any other major UK bank in 2023. This is pretty wild when you think about it…

Several high-profile cases have emerged, including an NHS consultant who lost £39,000 and a business account holder who lost £165,000, with victims consistently reporting difficulties in reaching immediate support during critical moments of fraud attempts. Ouch 🤕

Zoom out 🔎 While Revolut maintains it has reduced fraudulent transactions by 20% and prevented £475 million in potential fraud losses, critics point to the bank's limited customer support infrastructure, particularly the absence of an emergency phone helpline, as a significant vulnerability.

The company has recently joined the 159 short-code phone service and called for greater cooperation from social media platforms in addressing fraud.

✈️ THE TAKEAWAY

What’s next? 🤔 While it’s hard to say how much of this could have been prevented and there indeed are problems with fraud prevention at Revolut, one thing is clear - this signals broader challenges for the FinTech industry. Here’s what we should be thinking about:

Regulatory pressure: this situation will likely trigger increased regulatory scrutiny of digital banks' security measures (first locally, then - globally) and customer support infrastructure, potentially leading to new compliance requirements.

Industry-wide changes: traditional banks may thus leverage this moment to emphasize their more comprehensive security measures, while FinTech companies might need to reevaluate the balance between user convenience and security.

Customer support evolution: digital banks will likely be forced to enhance their customer support systems, potentially moving away from chat-only support to include emergency phone lines and faster response times.

Zooming out, this crisis could mark a turning point in the digital banking sector, pushing companies to prioritize security and customer support alongside innovation and convenience. For Revolut specifically, their response to these challenges could determine their future market position and regulatory standing in the increasingly competitive digital banking landscape.

ICYMI:

AI stock picker outperforms the S&P 500 by nearly 50% 🤑🤖

The news 🗞️ Investing.com's AI-powered stock picking tool ProPicks has demonstrated solid success, achieving returns that surpassed the S&P 500 by 46.24% over the past year.

This performance gap represents a substantial achievement in the democratization of sophisticated investment tools for individual investors.

Let’s take a quick look at this.

More on this 👉 The platform, which leverages Google Vertex AI technology, analyzes over 100 financial metrics to identify potentially outperforming stocks.

During a period when the S&P 500 posted gains of 38.39%, ProPicks-guided investments yielded impressive returns of up to 84.62%. Nice!

Available to premium subscribers at $15.99 monthly, the tool aims to level the playing field between retail and institutional investors. More importantly, the performance data suggests that AI-driven investment tools may be reaching a turning point in their ability to generate alpha.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this is all about the democratization of advanced trading tools. The availability of institutional-grade AI technology to retail investors at accessible price points could fundamentally reshape market participation patterns. This democratization may thus lead to more sophisticated retail trading strategies and potentially more efficient markets. In relation to that, the significant outperformance suggests that AI systems are becoming increasingly capable of identifying market opportunities. This could lead to (1) greater adoption of AI-assisted investment tools across all investor segments; (2) evolution of more sophisticated AI models incorporating additional data sources; and (3) potential changes in market dynamics as AI-driven trading becomes more prevalent. On the other hand, as these tools become more widely adopted, we should start thinking about the potential for diminishing returns as more investors utilize similar AI-driven strategies and question the market efficiency and whether such outperformance can be sustained. Looking ahead, one thing is clear - we can expect to see increased competition in the AI-powered investment tools space, likely leading to more sophisticated offerings and potentially lower costs for retail investors. However, it will be crucial to monitor whether such tools can maintain their edge as they scale and as markets adapt to their presence.

ICYMI: JPMorgan maintains AI dominance in the banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking + bonus reads on JPM & how they are crushing it here]

🔎 What else I’m watching

AI Patents at BofA Increase 94% Since 2022 🤖📈 Bank of America's BAC 0.00%↑ push into artificial intelligence has led to a 94% increase in AI and machine learning patents and pending applications since 2022. The bank now holds nearly 1,100 AI and ML patents, with over half already granted. Additionally, patents have been granted in information security, online and mobile banking, payments, data analytics, and augmented and virtual reality. Overall, BofA has nearly 7,000 granted patents and pending applications, supported by over 7,500 inventors and a $12 billion annual tech budget, with $4B directed to new initiatives this year. AI is prominently used in Erica, BofA's virtual assistant serving over 45 million customers, as well as in data analytics for wealth management and the CashPro Chat service for 40,000 corporate and commercial clients. ICYMI: JPMorgan maintains AI dominance in the banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking + bonus reads on JPM & how they are crushing it here]

FCA Uses Criminal Powers in Latest Crackdown on 'Finfluencers' 🚨📱 The Financial Conduct Authority (FCA) is interviewing 20 'finfluencers' under caution for potentially illegal product promotions, extending its crackdown on financial product promotions via social media personalities. The FCA has also issued 38 alerts against social media accounts operated by finfluencers that may contain unlawful promotions. Research shows that nearly two-thirds (62%) of 18 to 29-year-olds follow social media influencers, with 74% trusting their advice and 9 in 10 being encouraged to change their financial behavior. A Barclays study revealed that half of Brits using social media for investment guidance are putting their confidence and money at risk by not verifying the reliability of influencers.

Lunar Launches GenAI Native Voice Assistant 🗣️🤖 Nordic challenger bank Lunar has launched a virtual assistant using GenAI Native Voice technology, a first in Europe. Powered by the GPT-4o model, the assistant promises instant, personalized, 24/7 support with no queue times, handling both simple and complex queries. Unlike traditional voice support systems, it uses a voice-native AI model, providing advanced conversational abilities such as handling interruptions, repeating information, and managing more natural dialogues. This creates a smoother, more intuitive experience. Currently in beta, Lunar expects the assistant to eventually handle around three-quarters of all customer calls.

💸 Following the Money

It’s official now - Stripe buys stablecoin platform for $1.1 billion.

Polish identity verification vendor Authologic has closed on an $8.2M Series A funding round.

British savings and investment app Moneybox has secured £70M in investment, mostly facilitated through a secondary share sale that will nearly double its valuation from two years ago to £550M.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Thank you for another great read!