Crypto hits mainstream: record activity & infra advances mark industry maturity 😎📈; Klarna's valuation doubles to $14.6B ahead of 2025 IPO 😳🔔; Bitstamp secures landmark EU crypto license 😳🇪🇺

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Visa’s digital payment dominance drives double-digit growth, but regulatory headwinds intensify 🫣📈 [breaking down their latest numbers, what they mean & what’s next + bonus reads on Visa & co inside]

Mastercard’s Q3 2024: digital payments giant shows resilience amid rising competition 😤💳 [uncovering the most important Q3 2024 numbers, what they mean, and what’s next + bonus dives on Visa, Mastercard & more]

PayPal’s Q3 2024: profitable evolution from growth story to value play 💰📊 [breaking down the most important Q3 2024 numbers, what they mean & what’s next + bonus reads on PayPal & co]

Coinbase is solidly diversifying beyond just trading but valuation demands growth acceleration 👀📊 [unpacking the key facts and figures from Q3 2024, what they mean, what to look out for next & whether Coinbase is worth your time & money in 2024 and beyond]

Robinhood's mixed Q3: growing pains cloud near-term outlook 💸📈 [unpacking the most important numbers & what they mean & how growing pains cloud trading giant’s near-term outlook]

SoFi’s Q3 2024: emerging digital banking powerhouse shows strong execution 👏🏦 [how emerging digital banking powerhouse shows strong execution & what to look out for next]

Global Payments is set for margin expansion, but near-term growth headwinds warrant caution 👀📈 [breaking down their latest financials, what they mean, and whether Global Payments is worth your time and money in the years to come + more bonus reads inside]

As for today, here are the 3 fascinating FinTech stories that were transforming the world of financial technology as we know it. This was one of the wildest and most intense weeks in 2024 so far, so make sure to check all the above stories.

Crypto hits mainstream: record activity and infrastructure advances mark industry maturity 😎📈

Following the money 💸 Unprecedented user activity, major infrastructure improvements, and growing political significance show that the cryptocurrency industry has never been more alive.

More importantly, the sector's evolution from a niche technology to a mainstream financial force is becoming increasingly evident, as seen in the a16z's latest State of Crypto report.

Let’s take a look at the most important insights, what they mean, and what’s next.

More on this 👉 The 55-page+ report is full of good insights and data but the following trends and themes caught most of my attention:

Record-breaking usage and global adoption 📈

The crypto ecosystem has witnessed extraordinary growth, with active monthly addresses surging to 220 million in September, more than triple the figure from late 2023.

Solana leads this expansion with approximately 100 million active addresses, followed by NEAR (31 million) and Coinbase's Base network (22 million).

Mobile crypto wallet users reached an all-time high of 29 million in June 2024, with the United States representing 12% of users, though its share is declining as global adoption increases.

Infrastructure improvements drive efficiency 🌐

Significant technological advances have dramatically reduced transaction costs and increased network capacity. Blockchain networks now process over 50 times more transactions per second compared to four years ago. Let that sink in 😳

The implementation of Ethereum's Dencun upgrade in March 2024 has substantially decreased fees for Layer 2 networks while maintaining growing activity levels.

These improvements have made practical applications more viable, particularly in areas like stablecoins and DeFi.

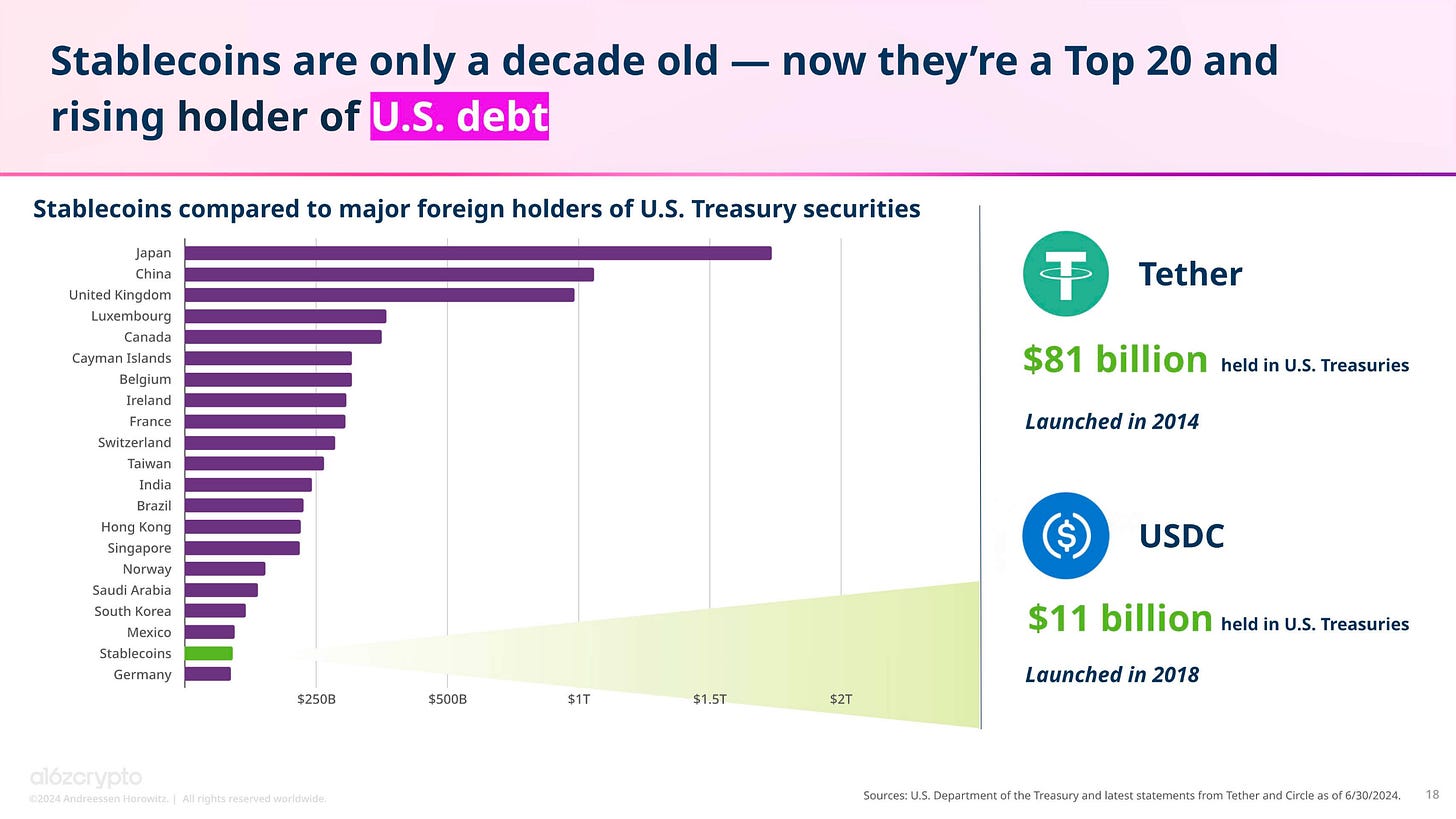

Stablecoins: a proven use case 🪙

Stablecoins have emerged as one of crypto's most successful applications, processing $8.5 trillion in transaction volume across 1.1 billion transactions in Q2 2024 – more than double Visa's V 0.00%↑ $3.9 trillion during the same period. Wild 😳

Transaction costs have plummeted, with USDC transfers on the Base network costing less than a cent, compared to average international wire transfer fees of $44.

Political landscape and regulatory progress 🧑🏻⚖️

Crypto has become a significant political issue ahead of the U.S. election, with swing states showing varying levels of interest. The approval of Bitcoin and Ethereum ETPs, holding $65 billion in combined assets, marks a major regulatory milestone.

Bipartisan support for crypto legislation is growing, exemplified by the House's passage of the FIT21 Act.

✈️ THE TAKEAWAY

What’s next? 🤔 All in all, it’s clear that the crypto industry appears to be entering a new phase of maturity and practical utility. Looking ahead, we can expect the following:

Institutional integration: the success of crypto ETPs and growing stablecoin adoption suggests accelerated institutional acceptance, potentially leading to more traditional financial products incorporating crypto assets.

Infrastructure evolution: continued improvements in scalability and efficiency may enable new applications previously constrained by technical limitations. The dramatic reduction in transaction costs could spark innovation in consumer-facing applications.

Regulatory framework development: the growing political attention and bipartisan support for crypto legislation suggests a more defined regulatory environment is emerging, which could provide clarity for businesses and investors.

Global financial impact: stablecoins' rising prominence, particularly in the USD denomination, could significantly influence international money movement and potentially affect traditional banking systems.

AI Integration: the increasing overlap between crypto and AI communities, with 34% of crypto projects incorporating AI, suggests potential synergies in addressing challenges like computational resource democratization and content attribution.

Zooming out, these developments clearly indicate that crypto is transitioning from speculative investment to practical financial infrastructure. More importantly, the industry's focus on solving real-world problems through improved efficiency, reduced costs, and innovative applications suggests a more sustainable growth trajectory. As infrastructure continues to mature and regulatory frameworks solidify, we may see accelerated adoption across both institutional and retail sectors, potentially reshaping significant aspects of the global financial system. Bullish.

ICYMI: Coinbase is solidly diversifying beyond just trading but valuation demands growth acceleration 👀📊 [unpacking the key facts and figures from Q3 2024, what they mean, what to look out for next & whether Coinbase is worth your time & money in 2024 and beyond]

Klarna's valuation doubles to $14.6B as IPO preparations heat up for 2025 😳🔔

The news 🗞️ BNPL pioneer Klarna's implied valuation has just surged to a whopping $14.6 billion, marking a dramatic recovery from its 2022 low point. This latest valuation boost comes from Chrysalis Investments, which has increased the value of its stake from £100.3 million to £120.6 million, reflecting growing confidence in the FinTech giant's prospects ahead of its anticipated 2025 IPO.

Let’s take a quick look at this.

More on this 👉 The valuation increase represents more than double the $6.7 billion price tag Klarna secured during its 2022 funding round, though it remains significantly below its peak 2021 valuation of $46 billion.

Chrysalis attributes this upward revision to the strong performance of other BNPL providers in the public markets, with companies like Affirm AFRM 0.00%↑ and PayPal PYPL 0.00%↑ seeing their shares climb by 145% and 59% respectively over the past year.

This positive momentum comes despite recent boardroom tensions, which saw shareholders vote to remove board member Mikael Walther following conflicts with Chairman Mike Moritz and CEO Sebastian Siemiatkowski.

Despite these challenges, Klarna appears to be steadily advancing toward its public debut, with sources suggesting it may seek a valuation of around $20 billion in its IPO.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the surge in Klarna's valuation signals a broader revival in the FinTech sector, particularly for BNPL services. This recovery suggests several interesting developments for the industry. First, market maturation. The BNPL sector is showing signs of evolving from a high-growth, high-risk investment to a more stable financial services category. This maturation could attract more institutional investors who previously viewed the sector as too volatile. Second, we might anticipate some industry consolidation. As Klarna prepares for its IPO, we may see increased consolidation in the BNPL space as smaller players might seek strategic partnerships or exits, while larger financial institutions could look to acquire BNPL capabilities. Finally, the renewed investor confidence will likely fuel another wave of innovation in payment solutions. Klarna and its competitors have already expanded beyond traditional BNPL offerings to capture more of the digital payments ecosystem in a bid to dominate all things commerce. Looking ahead, Klarna's planned IPO in the first half of 2025 could serve as a crucial benchmark for the entire FinTech sector. A successful public debut would not only validate the BNPL business model but could also pave the way for other FinTech companies considering public listings. Great times ahead 🍿

ICYMI:

Bitstamp secures landmark EU crypto derivatives license 😳🇪🇺

The news 🗞️ In a significant development for the cryptocurrency trading landscape, crypto exchange and pioneer Bitstamp has obtained a MiFID Multilateral Trading Facility (MTF) license from Slovenia's Securities Market Agency.

This regulatory milestone positions the exchange to expand its offerings significantly within the European Union's regulated financial framework.

Let’s take a quick look at this.

More on this 👉 The license enables Bitstamp to offer sophisticated crypto derivatives products, including perpetual swaps, to both retail and institutional clients. This expansion moves beyond the exchange's traditional spot trading services, allowing traders to speculate on cryptocurrency price movements without directly holding the assets.

More importantly, the MTF license also opens doors for Bitstamp to potentially offer trading in stocks, bonds, commodities, and structured products.

Zoom out 🔎 This regulatory achievement comes at a pivotal time for Bitstamp, as the exchange is set to be acquired by U.S.-based Robinhood HOOD 0.00%↑ in a $200 million deal expected to close in early 2025. The acquisition aims to strengthen Robinhood's presence in key markets, particularly in Asia, the UK, and the European Union.

The timing is particularly noteworthy as it coincides with broader regulatory developments in the EU crypto space, including Bitstamp's recent platform adaptations to comply with MiCA (Markets in Crypto-Assets) regulations.

This positions the exchange among a select few cryptocurrency platforms authorized under the MiFID framework, which traditionally oversees conventional financial markets in the European Union.

✈️ THE TAKEAWAY

What’s next? 🤔 This development carries several important implications for the cryptocurrency industry. First and foremost, the MTF license could accelerate institutional adoption of crypto derivatives in Europe. As one of the first exchanges to secure this authorization, Bitstamp is positioned to capture a growing market for regulated crypto derivatives products. Furthermore, the license establishes a framework for how traditional financial market regulations can be applied to crypto platforms. This could thus influence how other exchanges approach regulatory compliance in the EU and globally. Lastly, we must think about Robinhood and its strategic position. Despite facing regulatory challenges in the U.S., including a recent SEC Wells notice, Robinhood's acquisition of a regulated EU crypto platform could help the company diversify its regulatory exposure and expand its global footprint. Looking ahead, we can expect other major cryptocurrency exchanges pursuing similar licenses to remain competitive in the European market. More importantly, the combination of Bitstamp's regulatory compliance and Robinhood's retail trading expertise could lead to innovative regulated crypto products. This could thus spark a trend toward greater integration between traditional financial services and cryptocurrency markets, particularly in regulated derivatives trading.

ICYMI: Robinhood's mixed Q3: growing pains cloud near-term outlook 💸📈 [unpacking the most important numbers & what they mean & how growing pains cloud trading giant’s near-term outlook]

🔎 What else I’m watching

Visa to Cut 1,400 Jobs by 2024 📉 Visa V 0.00%↑ plans to lay off nearly 1,400 employees and contractors by the end of 2024 to simplify its international business. Around 1,000 cuts will be in technology, merchant sales, and global digital partnership roles. Some layoffs have already begun, with affected individuals encouraged to apply for open positions. Visa aims to evolve its operational model to support growth, despite recent legal issues, including a US Justice Department lawsuit alleging monopolization of the debit card market. ICYMI: Visa’s digital payment dominance drives double-digit growth, but regulatory headwinds intensify 🫣📈 [breaking down their latest numbers, what they mean & what’s next + bonus reads on Visa & co inside]

FCA Fines Wise CEO Käärmann £350,000 for Breach of Senior Manager Conduct 🚨💰 Wise CEO Kristo Käärmann has been fined £350,000 by the Financial Conduct Authority (FCA) for failing to immediately report a default on his tax bill. In February 2021, Käärmann was fined £365,651 by HM Revenue & Customs (HMRC) for deliberately not notifying the tax office of a capital gains tax liability after selling shares worth £10 million in 2017. HMRC added Käärmann to their public tax defaulters list in September 2021, and his name was removed in 2022. The FCA fined Käärmann for waiting seven months before notifying the regulator of the tax issues, breaching Senior Management Conduct Rule 4, which requires disclosing relevant information. ICYMI: Wise reports strong growth in Q2 as global expansion accelerates 🚀💸 [a quick look at their accelerating global expansion & key numbers + more bonus reads inside]

SEC Fines JP Morgan Affiliates $151M 🏛️ The SEC has charged JP Morgan Securities JPM 0.00%↑ and JP Morgan Investment Management Inc. for misleading disclosures and undisclosed financial incentives, subjecting investors to market risks. The firms neither admitted nor denied guilt but agreed to pay $151 million in penalties. Additionally, JPMIM was charged with conducting prohibited transactions worth billions. The SEC's enforcement director emphasized holding JP Morgan accountable for regulatory failures across multiple business lines. ICYMI: JPMorgan maintains AI dominance in banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking + bonus reads on JPM & how they are crushing it here]

💸 Following the Money

Lending-as-a-service infrastructure provider Finfra has raised $2.5M in the funding round, aimed at boosting embedded lending for Indonesian SMEs.

Peter Thiel's Founders Fund invests in Infinex's Patron NFT sale as the total amount raised hits $67.7M.

Deutsche Bank's Corporate Venture Capital (CVC) group has made a strategic investment in identity security firm Akeyless. Terms were not disclosed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Good read - thanks for such a massive issue full of gems.