Wall Street might cut 200,000 jobs due to AI 😳🤖; Japanese financial giant takes control of Solaris 🇯🇵🏦; Dave faces expanded DOJ lawsuit 🫣🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The ultimate list of resources for building and scaling billion-dollar companies 🦄 [1,500+ pages of knowledge, data, and advice to launch & scale your next unicorn startup in 2025]

AI 100: Top Artificial Intelligence Startups of 2024 🤖💸 [these companies raised $28B already. Find whose backing them, unlock their exclusive pitch decks & learn from the best]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

230+ Non-VC Funding Sources for Startup Founders & Entrepreneurs 💸 [shatter the funding barriers and unlock more than 200 non-venture capital resources to scale faster & farther]

Adyen launches AI-powered payment platform 🤖💳 [what it’s all about & why it matters + a bonus deep dive into Adyen and why you should be bullish on them in 2025]

Crypto investment products saw unprecedented growth in 2024, setting the stage for market evolution 📈💸 [a quick look at historic crypto numbers & why they matter + bonus dives & reads on crypto et al.]

The BNPL Shakeout: Sezzle's struggles signal industry consolidation 👀📉 [what it’s all about, what this means for the future of FinTech + bonus read with deep dives into top FinTech stocks from 2024]

JPMorgan sues Viva Wallet in €916 million lawsuit 😳💸 [what it’s all about & why it matters]

Bitcoin mining firms stockpile crypto amid industry transformation ⛏️🪙 [what this tells us & what can we expect next]

Credit card debt sees historic drop 📉💳 [what this tells us & what to expect next]

Corporate Bitcoin adoption is gaining momentum 📈🪙 [why it matters & what’s next]

The Ultimate List of Resources to Promote Your Startup for FREE 🚀 [380+ free places to post your project or startup to maximize exposure & accelerate growth ]

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This was yet another awesome week in the Finance 2.0 space so make sure to check all the above stories.

Wall Street might cut 200,000 jobs due to AI 😳🤖

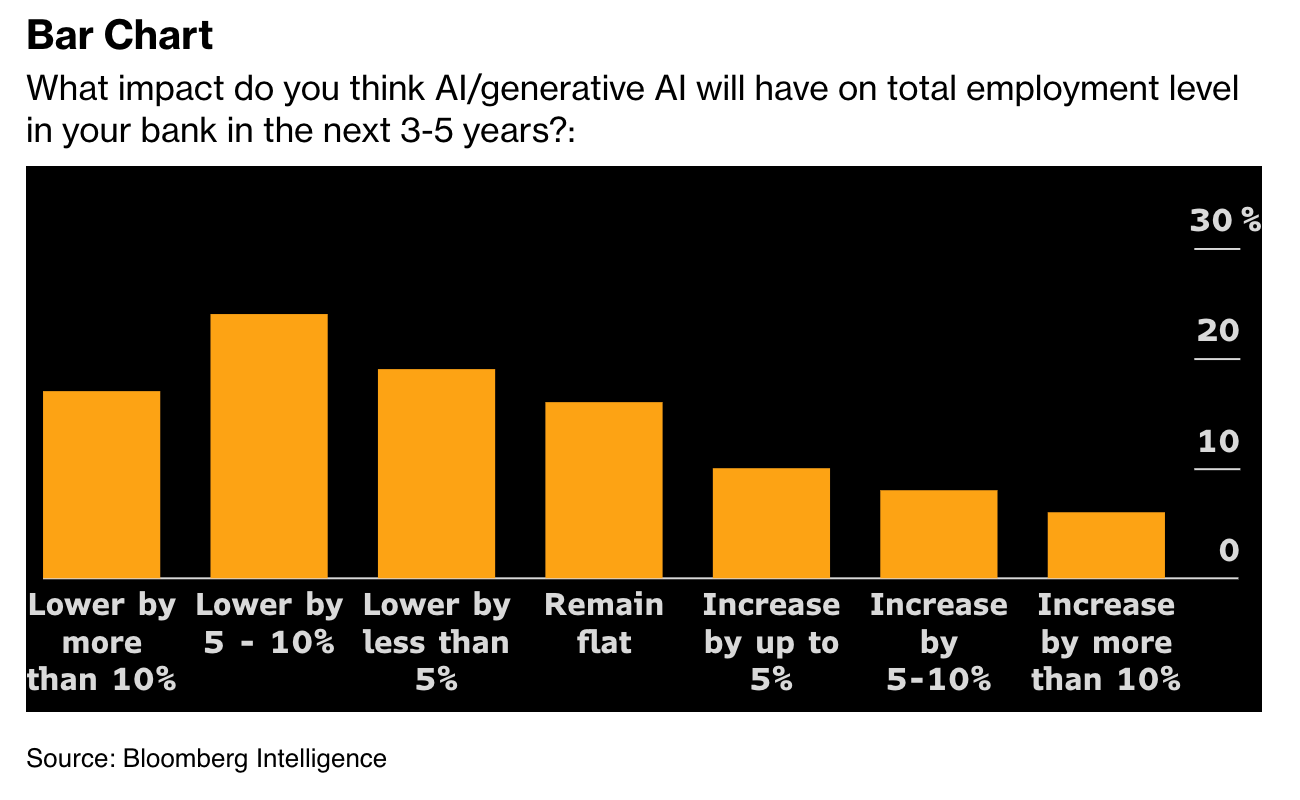

The news 🗞️ A new Bloomberg Intelligence report reveals that artificial intelligence could lead to approximately 200,000 job cuts in global banks over the next three to five years, marking a significant transformation in the financial services sector. Ouch 😳

Let’s take a look at this, see what it’s all about, and what to expect next.

More on this 👉 The survey of chief information and technology officers from 93 major financial institutions, including JPMorgan JPM 0.00%↑, Citigroup C 0.00%↑, and Goldman Sachs GS 0.00%↑, indicates an average workforce reduction of 3%, with some executives projecting cuts of up to 10%.

The impact of this technological shift appears particularly concentrated in specific areas of banking operations. Back office, middle office, and operational roles involving routine tasks face the highest risk of disruption.

In other words, the more simple your job is, the easier it is for AI to replace it. That’s just the reality of the situation 🤷♂️

That said, customer service functions and know-your-customer (KYC) duties are also vulnerable to automation through AI systems. However, on a more positive note, rather than complete elimination, many positions are expected to undergo transformation as AI technology augments human capabilities.

Zoom out 🔎 Looking at the bigger picture, the financial implications of this transition are substantial. Banks could see their pretax profits increase by 12% to 17% by 2027, potentially adding $180 billion to their combined bottom line.

Notably, 80% of surveyed executives expect generative AI to boost productivity and revenue generation by at least 5% within the next three to five years. Not too shabby! 🤑

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this transformation signals a pivotal moment in the financial services industry. The integration of AI technologies is therefore likely to accelerate several key trends. First, we can expect a significant shift in workforce composition. While routine tasks may be automated, new roles focusing on AI oversight, ethical considerations, and strategic implementation will likely emerge. Financial institutions will therefore need to invest heavily in reskilling programs to prepare their workforce for this evolution. Second, the competitive landscape in financial services may change dramatically. Banks that successfully integrate AI systems could gain significant advantages in operational efficiency and customer service delivery (just like what Klarna & JPMorgan are doing today). This in turn could lead to increased consolidation in the industry as organizations strive to maintain a competitive edge through technological investment. Looking ahead, it’s pretty clear that we should see the emergence of hybrid banking models where AI handles routine operations while human expertise focuses on complex decision-making, relationship management, and strategic planning. Of course, the success of financial institutions will increasingly depend on their ability to effectively balance technological automation with human insight and creativity.

ICYMI: Klarna says it stopped hiring thanks to AI 😳🤖 [what’s the real story here & what can we learn from Klarna + bonus list of top AI companies & their pitch decks]

Klarna's return to profitability sets stage for landmark US IPO 💸🇺🇸 [quick look at their latest numbers, what they mean & what’s next + bonus dive into Klarna’s biggest public competitor & why we should start thinking more about M&As]

JPMorgan maintains AI dominance in banking sector 💪🤖 [a quick overview of the current state of affairs when it comes to AI in Banking]

JPMorgan expands small-town presence, bucking branch closure trend 🏠👋 [what it’s all about and why it matters + a bonus deep dive into JPM & how it’s crushing it in AI + Finance]

Japanese financial giant takes control of Solaris in €150M deal 🇯🇵🏦

The news 🗞️ In a significant development in the European FinTech sector, Japan's SBI Holdings has agreed to acquire a majority stake exceeding 70% in German banking technology provider Solaris.

The deal, valued at approximately €150 million, includes a direct €100 million investment from SBI and additional funding from Boerse Stuttgart Group and existing investors.

Let’s take a look at this and see why it matters.

More on this 👉 The transaction marks a crucial turning point for Solaris, which has faced considerable challenges in recent times. The company, previously valued at $1.6 billion in 2021, has experienced a substantial valuation decline amid broader pressures on the German FinTech sector.

These challenges stem from increased regulatory scrutiny, rising interest rates, and diminished investor support, as highlighted in a September KPMG report.

At the core, Solaris has encountered several operational hurdles, including an ongoing dispute with German financial regulator BaFin, writedowns on an acquisition, and costs associated with integrating ADAC's credit card portfolio. In response, the company has implemented significant cost-reduction measures, including reducing its workforce from over 700 to approximately 450 employees.

The funding package, which includes new AT1 bonds, is therefore designed to sustain Solaris until it achieves profitability, expected within two years. This follows SBI's previous investment of €96 million in March, demonstrating the Japanese firm's continued confidence in Solaris's potential.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, the injection of significant capital and strategic support from SBI should help Solaris resolve its regulatory challenges with BaFin and strengthen its position in the European market. Second, this deal may trigger further consolidation in the FinTech industry, particularly among companies facing similar pressures. As regulatory requirements and capital needs increase, smaller players may seek strategic partnerships or acquisitions to remain competitive. Looking ahead, Solaris's transformation under SBI's leadership could serve as a model for other struggling FinTechs. The focus on achieving profitability while maintaining regulatory compliance might shift the industry's emphasis further from rapid growth to sustainable operations. This could lead to a more mature, stable BaaS sector that better serves traditional financial institutions seeking to modernize their tech.

ICYMI:

What’s inside: Unlock the tools top companies use to ensure successful mergers and acquisitions 🔓

Dave faces expanded DOJ lawsuit over hidden fees 🫣🏦

The news 🗞️ The Department of Justice has intensified its legal action against fintech company Dave DAVE 0.00%↑ by filing an amended complaint targeting both the company and its CEO Jason Wilk.

The expanded lawsuit, which originated from an FTC complaint in November, centers on allegations of deceptive fee practices and misleading advertising.

Let’s take a quick look at this.

More on this 👉 The DOJ's complaint alleges that Dave engaged in misleading practices through its ExtraCash advance payment service, particularly concerning "instant" transfer claims that actually took multiple business days unless customers paid additional express fees ranging from $3 to $25.

The lawsuit also highlights concerns about Dave's tipping system, which allegedly defaulted to 15% through a "Thank You" button mechanism that many consumers reportedly believed was mandatory.

In response to these allegations, Dave has implemented significant changes to its fee structure. The company has eliminated optional tips and express fees for its ExtraCash product, with new members onboarded after December 4, 2024, already transitioning to the revised structure. Dave maintains that the lawsuit represents "government overreach" and contains "numerous allegations based on various inaccuracies."

The amended complaint specifically addresses CEO Jason Wilk's role, noting his 60% voting power over executive stock and his direct involvement in the company's operational decisions. Internal documents cited in the complaint suggest that Dave's leadership was aware of discrepancies between promised and delivered services, with one presentation explicitly acknowledging that "[w]hat we promised [to consumers] is not what they see."

✈️ THE TAKEAWAY

What’s next? 🤔 This case could have far-reaching implications for the FinTech industry. The DOJ's aggressive stance signals increased regulatory scrutiny of FinTech fee structures and transparency practices. Companies in this space may need to preemptively review and adjust their fee disclosure policies and user interface designs to ensure complete transparency. Dave's proactive fee structure changes might therefore become a model for other fintech companies looking to avoid similar regulatory challenges. Looking ahead, we can expect (1) enhanced regulatory focus on fintech user interfaces and fee disclosure practices; (2) industry-wide moves toward more transparent fee structures; and (3) an increased emphasis on consumer protection in digital financial services Despite these challenges, Dave's strong financial performance (41% revenue growth to $92.5 million in Q3) suggests that fintech companies can maintain profitability while adapting to stricter regulatory requirements.

ICYMI: Dave's remarkable turnaround 🐻 [how it flipped even NVIDIA & what can we expect next + bonus dives into Dave & co]

🔎 What else I’m watching

dLocal Secures UK Licence for Expanded Payment Services 🇬🇧 Latin American cross-border payments platform dLocal DLO 0.00%↑ has obtained an authorized payment institution license from the UK's Financial Conduct Authority (FCA). This license allows dLocal to offer regulated payment solutions to UK-based merchants, including seamless pay-ins and payouts, cross-border transactions, and fraud controls. The platform specializes in connecting global merchants to emerging markets, enabling clients to accept payments, send payouts, and settle funds globally without managing separate processors or local entities. ICYMI: Emerging markets payments pioneer dLocal shows resilience amid growing pains 💪💳 [unpacking the most important numbers, what they mean & what’s next for dLocal]

Standard Chartered Launches Crypto Services in Europe 🌐 Standard Chartered has launched its crypto services in Europe after securing a digital asset license under the MiCA framework. The bank has established a new entity in Luxembourg to serve as its regulatory entry point for delivering secure crypto and digital asset custody solutions. Initially, the services will be limited to Bitcoin (BTC) and Ether (ETH), with plans to expand to more assets in 2025. The launch is part of Standard Chartered's broader digital asset strategy, aiming to provide high-security crypto custody offerings globally. The bank has been exploring crypto trading services since 2021 and is committed to adhering to regulatory requirements.

One in Five Consumers Fell Victim to Scams in 2024 🚨 New research from Barclays Bank reveals that 20% of consumers lost money to scammers in 2024, with 93% of these incidents occurring online. The study, conducted by Censuswide, also found that 40% of consumers were targeted but managed to avoid falling victim. Investment scams were particularly prevalent in January, with an average claim of £15,564, accounting for a significant portion of reported losses. Purchase scams were the most commonly reported, making up 75% of claims but only 24% of the total value. Social media and tech platforms were the primary sources of these scams.

💸 Following the Money

FalconX, a leading digital asset prime broker, acquired Arbelos Markets, a trading firm specializing in crypto derivatives.

JeelPay, a Saudi BNPL FinTech company, raised $6.6M in a Pre-Series A investment round to further advance its expansion strategy.

Verifiable AI firm Rena Labs raises $3.3M in pre-seed funding.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

I wonder of those 200,000 jobs were needed in the first place or were just over-hires due to easy money?

This is awesome - than you for putting this out. Missed it already!