Tether plans new US stablecoin & payment network 🪙; Shopify's new AI mandate signals huge industry shift 🤖; Trade War freezes FinTech IPO frenzy: Klarna, Circle, & eToro hit pause 🛑

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

AI Must-Reads: The Essential Guide to Winning in the Age of Intelligent Transformation 📚🤖 [360+ pages of must-read AI reports transforming today's leaders into tomorrow's visionaries]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

Wise aims to become "The Network for the World's Money" 🌐💸 [what it’s all about & why it’s a brilliant move + more bonus reads & deep dives inside]

The Ultimate Finance Toolkit Every CEO Must Have 📚 [unlock proven templates that empower strategic decision-making and amplify your business growth]

FinTech Growth vs. Compliance: Revolut's €3.5M fine again exposes industry challenges 😳🛡️ [what it’s all about, why it matters & what to expect next + more bonus reads about Revolut inside]

Ripple bets BIG with $1.25B Hidden Road deal to bridge traditional and crypto finance 😳💰 [why it makes sense, what’s next + more bonus reads inside]

WhatsApp remittance pioneer Félix secures $75M to revolutionize LatAm money transfers with stablecoins 🪙 [what’s the USP here, why it matters & what other FinTechs can learn from Félix + bonus dive into 110+ real-world use cases of stablecoins, a case study on Félix & more!]

The AWS of FinTech files for bankruptcy despite $81M in funding 😬🏦 [what happened here and what it means for the future of BaaS]

Stripe advances its banking ambitions 👀🏦 [what it’s all about, why it matters & what to expect next]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another huge week in the financial technology space, so make sure to check all the above stories.

Tether plans new US stablecoin and payment network 👀🪙

The news 🗞️ Tether, the issuer of the world's largest stablecoin USDT, is preparing to make a significant entrance into the US market with plans to launch a new stablecoin specifically designed for American consumers and businesses.

This strategic move comes as the Trump administration pushes for clearer stablecoin regulations expected by August 2025.

Let’s take a quick look at this.

More on this 👉 According to Tether CEO Paolo Ardoino, the company intends to establish a new U.S.-based entity that will issue a separate stablecoin from its international USDT token, which currently boasts a market capitalization exceeding $144 billion. This new stablecoin would be tailored for the U.S. regulatory environment and consumer needs.

"In the U.S., people would use a stablecoin as their checking account, while outside the U.S., people use USDT as their savings," Ardoino explained in recent interviews.

The company envisions a comprehensive blockchain-powered payment network that could potentially include a point-of-sale merchant service offering similar to Square but incorporating stablecoin capabilities. This would represent a significant expansion, as Tether currently does not offer its products to U.S. customers, according to its website.

Zoom out 🔎 Tether enters this endeavor from a position of considerable financial strength. The company reported profits of $13 billion in 2024 and claims to have $20 billion in undistributed profits that could fund rapid expansion.

"We can move at the speed of light," Ardoino stated, dismissing concerns about competition from Circle, the issuer of USDC stablecoin, which was preparing for a US IPO with a targeted $5 billion valuation until it was paused due to Trump’s tariff war.

With approximately 70% of the global stablecoin market, Tether's dominant position gives it substantial leverage as it eyes the U.S. market. The company has also been working to address longstanding transparency concerns by hiring a new CFO, Simon McWilliams, to lead efforts toward securing a full audit from a Big Four accounting firm.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Tether's planned entry into the U.S. market signals a potential watershed moment for mainstream stablecoin adoption. If successful, this move could fundamentally transform how Americans conduct everyday transactions, creating a bridge between traditional finance and blockchain technology. The timing also appears strategic, with the Trump administration demonstrating support for crypto innovation and pushing for regulatory clarity. This regulatory certainty could catalyze not only Tether's expansion but also trigger a wave of competition from both established financial institutions and fintech innovators. Looking at the bigger picture, Tether's payment network could disrupt traditional payment processors by offering faster, less expensive transaction options. Banks might face pressure to adapt or partner with stablecoin issuers as consumers potentially shift funds from traditional checking accounts to stablecoin wallets. The key challenge still remains consumer adoption – convincing Americans to hold digital currencies for everyday use and merchants to accept them. That said, Tether's success will likely depend on creating seamless user experiences and forming strategic partnerships with established retailers and financial institutions to build trust in its ecosystem.

ICYMI: Stablecoins surge: market reaches $225 billion as DeFi & institutional adoption transform digital finance 📈🪙 [how DeFi & institutional adoption is transforming digital finance + more reads inside]

AI or Step Aside: Shopify's new workforce mandate signals huge industry shift 🤖🛍️

The news 🗞️ Shopify SHOP 0.00%↑ CEO Tobi Lütke has established what may be the technology industry's boldest stance on artificial intelligence adoption to date.

In a recently leaked internal memo, Lütke declared that "reflexive AI usage" is now a baseline expectation for all employees at the e-commerce & FinTech giant.

Let’s take a quick look at this, see why it matters, and what to expect next.

More on this 👉 The memo outlines several significant policy changes that formalize AI as a core competency rather than an optional skill. Most notably, teams must now demonstrate why they cannot accomplish tasks using AI before requesting additional headcount or resources. This requirement essentially positions AI as the default solution, with human hiring as a fallback option that requires justification.

"Using AI effectively is now a fundamental expectation of everyone at Shopify," Lütke wrote. "I don't think it's feasible to opt out of learning the skill of applying AI in your craft; you are welcome to try, but I want to be honest I cannot see this working out today, and definitely not tomorrow."

The policy extends beyond hiring decisions.

AI usage will now be factored into performance reviews and peer evaluations. Product designers are specifically expected to use AI tools for all platform feature prototypes, with Lütke noting the results are "more exploratory and faster to produce and share."

To support this transition, Shopify has invested in AI infrastructure, providing employees with access to tools, including GitHub Copilot, Cursor, and Claude Code. Lütke frames the mandate not merely as a productivity initiative but as an existential necessity, stating that "stagnation is slow-motion failure."

The directive comes amid Shopify's efforts to streamline costs. The company's headcount fell from 8,300 to 8,100 at the end of 2024, following workforce reductions of 14% in 2022 and 20% in 2023.

At a recent investor event, CFO Jeff Hoffmeister indicated that while headcount may remain "relatively flat," costs could rise due to hiring specialized AI engineers.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Shopify's AI-first approach represents a significant inflection point that will likely reverberate throughout the FinTech and broader business ecosystem. By institutionalizing AI proficiency as a job requirement across all roles, Shopify is fundamentally redefining workplace expectations in ways comparable to the adoption of email or basic computer skills decades ago. Speaking about FinTech specifically, this shift signals an acceleration in the race toward AI-augmented operations. Financial services companies that have approached AI cautiously or departmentally may find themselves at a competitive disadvantage against organizations that, like Shopify, embed AI capabilities throughout their entire workforce. More importantly, this mandate may also reshape talent development and acquisition strategies. As more companies follow Shopify's lead, educational institutions and professional development programs will likely reorient toward ensuring AI literacy becomes a foundational skill rather than a specialized capability. Zooming out, the most far-reaching implication may be in how organizations conceptualize their workforce planning. Rather than viewing AI as a tool that eliminates certain jobs, Shopify's approach suggests a future where AI transforms every role, creating a hybrid model where human judgment and creativity are augmented by AI capabilities. Companies that fail to cultivate this synergy may find themselves with neither the cost advantages of automation nor the innovation benefits of human-AI collaboration. Looking ahead, what remains to be seen is how effectively Shopify will implement this transition and whether the productivity gains will justify the cultural disruption. If successful, Lütke's bold mandate may well establish a new standard for how companies navigate the AI revolution - not by resisting it or relegating it to specialized departments, but by embedding it into the fabric of organizational capability. AI or step aside 🤖

ICYMI: Shopify’s Q4 2024: a commerce & FinTech powerhouse is hitting its profitable stride while maintaining hypergrowth 😤🛍️ [deep dive into their latest financials, breaking down key numbers, what they mean & why you should be bullish on Shopify in 2025]

Also, you can read the whole AI Memo here.

Trade War freezes FinTech IPO frenzy: Klarna, Circle, and eToro hit pause amid market meltdown 🛑🔔

The news 🗞️ Swedish payment giant Klarna has postponed its highly anticipated initial public offering (IPO) on the New York Stock Exchange, as global markets reel from the impact of President Donald Trump's sweeping import tariffs.

The Buy Now, Pay Later FinTech company, which was targeting a $15 billion valuation, had been preparing to launch its investor roadshow next week but has shelved those plans indefinitely.

Let’s take a look at this, see why it matters, and what can come next.

More on this 👉 Most importantly, Klarna is not alone in this sudden retreat.

Several high-profile companies have similarly paused their IPO ambitions, including ticket marketplace StubHub, trading platform eToro, medical supplier Medline Industries (which had been seeking a valuation of up to $50 billion), and, reportedly, stablecoin issuer Circle.

All had confidentially filed plans to list shares in recent months and were preparing for investor roadshows this quarter. Not anymore, it seems…

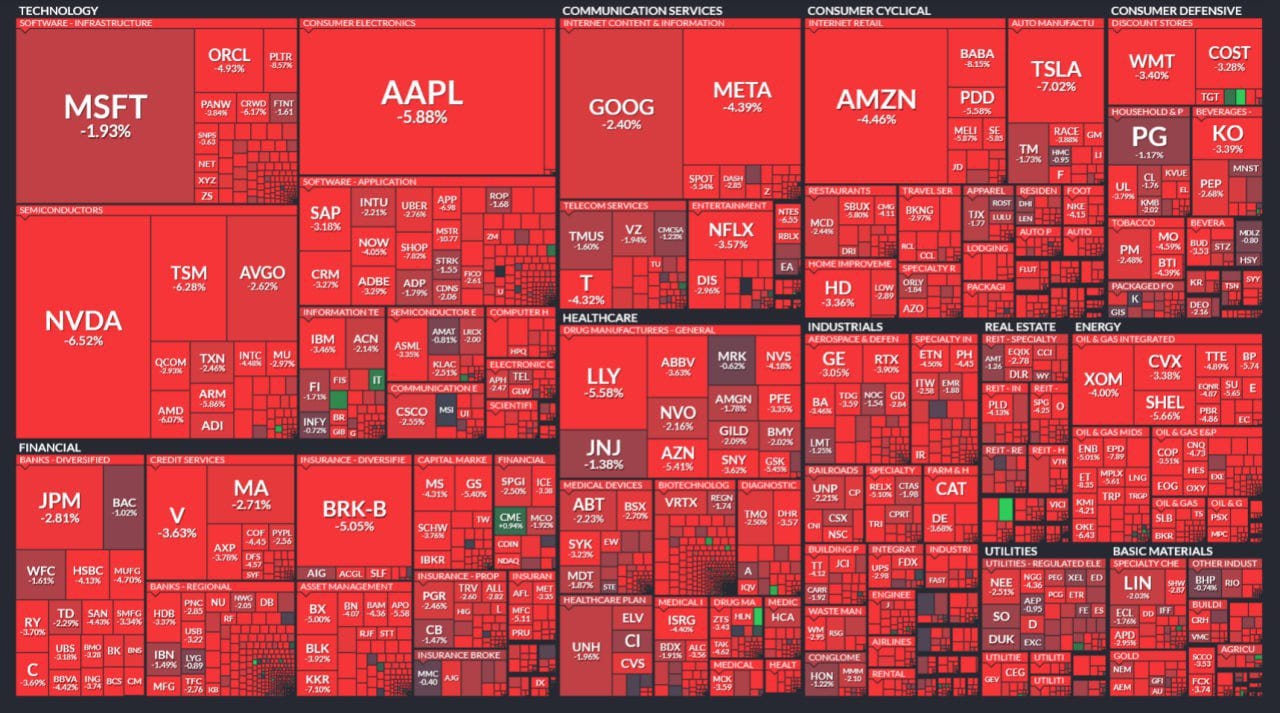

Zoom out 🔎 The market turmoil follows Trump's announcement of extensive tariffs on foreign goods, which China quickly countered with retaliatory measures. The resulting uncertainty triggered a massive sell-off, with the S&P 500 plunging 6% on Friday, April 4 - its worst day since the onset of the COVID-19 pandemic.

The two-day market rout has erased an estimated $5.4 trillion in market value. Ouch 😳

"The IPO window is as closed as it can be. Right now, you simply can't price a company," said Richard Goldman, chairman of the executive transaction group at investment firm Redeye. A senior executive in the IPO industry indicated that listings would likely be delayed for at least the next two weeks.

The turmoil extends beyond public offerings, affecting mergers and acquisitions globally. Several major deals have been delayed or abandoned, including KKR & Co. withdrawing from a consortium discussing a takeover of Gerresheimer AG and Rosebank Industries canceling a $2 billion acquisition of Electrical Components International.

✈️ THE TAKEAWAY

What’s next? 🤔 The current market disruption poses significant challenges for the financial technology sector, which had been anticipating a revival in public offerings after a three-year drought. Companies like Klarna, which had been working toward public debuts to secure growth capital and provide returns to early investors, now face difficult strategic decisions. Speaking about Klarna specifically, the delay could accelerate its need to demonstrate sustainable profitability - especially as competitor Affirm's AFRM 0.00%↑ shares have slumped 46% this year alone, with its market value sliding below Klarna's target IPO valuation. Circle's reported delay highlights additional regulatory challenges for crypto-focused financial services navigating uncertain market conditions. While sources indicate Klarna still aims to go public once markets stabilize, the timing remains highly uncertain. The broader implications for the FinTech industry could be substantial if capital markets remain constrained for an extended period. Companies may need to pursue alternative funding strategies, potentially leading to increased private equity involvement or strategic consolidations within the sector. Looking ahead, the eventual recovery of the IPO market will likely depend on how quickly global tensions resolve and whether central banks intervene to stabilize financial systems. For now, the FinTech sector's public market ambitions remain caught in what one source described as "the eye of the storm."

ICYMI:

Circle's IPO orbit: profitable stablecoin leader tethered to interest rates and stables regulation 🪙🏦 [unpacking their S-1, breaking down the latest financials, strategy & what’s next for Circle + a bunch of other extra reads & resources inside]

eToro’s IPO filing: from crypto winter to profit spring - a turnaround story with momentum 📈💸 [unpacking their IPO filing with latest financials & what’s next + bonus deep dives inside]

🔎 What else I’m watching

Nubank Launches Worker's Credit for Formal Contract Workers 💼 Nubank NU 0.00%↑ has introduced Worker’s Credit, a private payroll loan for workers with formal contracts under Brazil's CLT. This initiative allows 47 million eligible workers to access payroll loans digitally, with reduced interest rates and direct payroll discounts. Users can compare offers from multiple financial institutions and complete the process through the Nubank app. The new credit option aims to provide safer and more affordable borrowing options for private-sector employees, addressing high unsecured credit rates. Nubank continues to expand its financial services, recently adding new cryptocurrencies to its portfolio. ICYMI: Latin America's digital banking juggernaut Nubank combines explosive growth with industry-leading profitability 😤🚀 [breaking down their Q4 2024 financials, what they tell us & why you should be really bullish on Nubank]

Kraken and Mastercard Partner on Crypto Debit Cards 💳 Kraken and Mastercard MA 0.00%↑ are collaborating to launch physical and digital debit cards that allow users to spend their crypto and stablecoins at over 150 million merchants worldwide. This partnership aims to simplify real-world transactions using cryptocurrencies. The initiative builds on Kraken Pay, which has seen over 200,000 users activate their "Kraktag" for instant, borderless payments.

Block Fined $40M for AML Failures on Cash App 🚨 Block XYZ 0.00%↑ will pay a $40 million penalty to New York regulators for significant anti-money laundering (AML) failures on its Cash App platform. The investigation revealed critical gaps in Block's AML program, including inadequate customer due diligence, insufficient risk-based controls, and a backlog of transaction alerts. The company will also retain an independent monitor to evaluate its compliance and remediation efforts.

💸 Following the Money

Payment orchestration platform Juspay has secured $60M as part of its Series D funding round.

Turkish embedded finance fintech Sipay has raised $78M at a valuation of $875M.

Visa V 0.00%↑ has invested in Swedish spend management firm Mynt alongside an expanded reseller agreement across Europe.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is a gem like no other - thank you for the great stuff as usual.