Chime’s shares surge 37% in stellar public market debut 😤📈; Fiserv is readying for major stablecoin push 🚀🪙; Starling becomes first UK bank to deploy AI-powered spending analytics 💸🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

9 Essential Artificial Intelligence Guides to Get the Most from AI 🤖 [unlock practical AI insights from industry leaders at OpenAI, Google, and Anthropic]

Chime's $11 billion IPO, or a dramatic comedown from FinTech's peak valuations 🫧📉 [what it’s all about, who are the biggest winners & losers in the IPO + bonus deep dive into Chime’s S-1 & Circle’s first performance as a public company]

Stripe is accelerating the convergence of traditional & digital finance with the Privy acquisition 🤝💸 [what it’s all about & why it’s strategically important for Stripe + bonus deep dive into its biggest competitor Adyen]

UK’s strategic AI alliance with NVIDIA to transform financial services innovation 🤖💸 [why it could be huge & what it means for the future of FinServ + 9 artificial intelligence guides to get the most from AI]

Coinbase expands consumer reach through strategic American Express and Shopify partnerships 🛍️💳 [what it’s all about & why it matters + bonus deep dive into Coinbase’s recent financials + 110+ real-world stablecoin use cases]

Fiserv completes European expansion strategy with full acquisition of AIB 🤝🇪🇺 [what it’s all about, why it matters & what to expect next + bonus deep dive into Fiserv’s latest financials & other notable recent FinTech M&As]

Gemini exchange files for Wall Street IPO 😳📈 [why it matters & what it tells us about the future + bonus reads on Circle’s IPO debut]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

As for today, here are the 3 fascinating FinTech stories that are transforming the world of financial technology as we know it. This was yet another intense week in the financial technology space, so make sure to check all the above stories.

Chime’s shares surge 37% in a stellar public market debut 😤📈

The debut 🔔 Chime Financial's highly anticipated initial public offering delivered a resounding success on Thursday, with shares closing 37% above their offering price and providing a much-needed boost to the FinTech sector's public market aspirations. Finally! 🥳

The San Francisco-based challenger banking platform raised $864 million in its market debut, pricing shares at $27 each - above the expected range of $24 to $26 - and closing at $37.11 on Nasdaq under the ticker CHYM. Not too shabby!

Let’s take a closer look at this, see why it matters, and what’s next for Chime.

More on this 👉 The strong performance translated to a market capitalization of $13.5 billion, with a fully diluted valuation of approximately $15.8 billion when accounting for employee stock options and restricted units.

While impressive, this represents a significant markdown from Chime's peak private valuation of $25 billion achieved during the 2021 funding frenzy, reflecting the broader recalibration of technology company valuations following the pandemic-era investment boom.

ICYMI: Chime's $11 billion IPO, or a dramatic comedown from FinTech's peak valuations 🫧📉 [what it’s all about, who are the biggest winners & losers in the IPO + bonus deep dive into Chime’s S-1 & Circle’s first performance as a public company]

We can remember that Chime's business model centers on serving Americans earning less than $100,000 annually - a demographic the company argues remains underserved by traditional banking institutions. Unlike conventional banks that generate revenue through fees and lending spreads, Chime primarily earns income from interchange fees collected when customers use their branded debit or credit cards for purchases.

The company's financial performance demonstrates solid momentum, with first-quarter 2025 revenue reaching $518.7 million, a 32% increase year-over-year. Chime achieved $25 million in adjusted profitability during the quarter and maintains robust margins, including an 88% gross margin and 67% transaction margin.

However, growth comes at a significant cost, with the company investing $1.4 billion in marketing between 2022 and 2024 to acquire and retain customers. It will thus be interesting to see how this changes following the public market debut.

Zoom out 🔎 Chime's successful debut arrives at a pivotal moment for the IPO market, which experienced significant disruption following President Trump's tariff announcements in April that triggered widespread market volatility. The company, along with other high-profile candidates like Circle, eToro (both already public), StubHub, and Klarna, had delayed their public offerings during that period of uncertainty.

The recent stabilization of market conditions, with the VIX volatility index dropping from over 50 in early April to approximately 18 currently, has created a more favorable environment for new listings.

The FinTech sector has led this nascent IPO recovery, with several notable successes preceding Chime's debut. Circle Internet Group's shares surged 168% on their first trading day, while space and defense technology company Voyager Technologies closed up 82% following its offering.

These strong performances have thus generated renewed optimism about investor appetite for technology companies, particularly those in the financial services sector.

FinTech is back!? 😎

✈️ THE TAKEAWAY

What’s next? 🤔 Chime's market debut represents a critical inflection point for FinTech and the broader IPO landscape. The company's success validates fee-free banking models and demonstrates continued investor appetite for companies serving underbanked populations despite challenging macroeconomic conditions. Looking at the bigger picture, Chime's performance could catalyze public offerings from companies awaiting improved market conditions, with industry observers watching whether FinTech players like Klarna and cryptocurrency exchanges Gemini and Bullish will accelerate their IPO timelines. However, significant challenges remain. The substantial reduction from Chime's 2021 valuation peak emphasizes the importance of demonstrating consistent profitability and sustainable growth. The company's substantial marketing expenditures also raise questions about customer acquisition costs and long-term unit economics that public investors will scrutinize closely. Looking ahead, Chime's public market performance over the coming months will likely influence broader FinTech sector sentiment. Success in maintaining momentum and delivering consistent results could unlock significant industry capital and accelerate digital financial services innovation further. Conversely, volatility or underperformance could dampen FinTech IPO enthusiasm and force companies to delay public market aspirations. But most importantly, the debut signals a potential shift toward companies accepting modest valuations in exchange for public capital access. This pragmatic approach may become standard as companies prioritize liquidity and growth capital over maximizing initial valuations, potentially creating a more sustainable IPO environment. Bullish on FinTech.

ICYMI: Gemini exchange files for Wall Street IPO 😳📈 [why it matters & what it tells us about the future + bonus reads on Circle’s IPO debut]

Fiserv is readying for a major stablecoin push 🚀🪙

The news 🗞️ Payment processing giant Fiserv FI 0.00%↑ is making significant moves into the digital asset space, with newly appointed CEO Mike Lyons announcing the development of a comprehensive cryptocurrency infrastructure designed to enable merchant customers to accept stablecoin payments.

Speaking at the Baird Global Consumer, Technology and Services Conference in early June, Lyons revealed that the Milwaukee-based company is responding directly to merchant demand for alternative payment methods that could substantially reduce transaction costs.

Let’s take a look at this.

More on this 👉 The strategic initiative centers on stablecoins, which are digital currencies designed to maintain stable value by being pegged to traditional assets such as the US dollar. Unlike volatile cryptocurrencies like Bitcoin, stablecoins offer the potential benefits of digital transactions while minimizing price fluctuation risks. Lyons emphasized that merchants are particularly attracted to the prospect of avoiding traditional interchange fees associated with credit card processing, viewing stablecoins as a pathway to improved profit margins.

Fiserv's proactive approach also anticipates potential regulatory developments. The company is positioning itself to rapidly deploy cryptocurrency wallet capabilities should federal legislation, such as the pending GENIUS Act, establish formal stablecoin regulations. Lyons stressed the importance of preparedness, noting that regulatory requirements could mandate quick implementation timelines that would represent significant investments if the company were unprepared.

The CEO indicated that Fiserv would announce specific infrastructure details within weeks of his June presentation, though he provided limited technical specifics about the planned implementation.

The initiative will likely focus on enabling merchants to create and manage stablecoin wallets, facilitating seamless digital asset transactions within existing payment processing frameworks.

✈️ THE TAKEAWAY

What’s next? 🤔 This development marks another pivotal moment for both Fiserv and the broader financial technology ecosystem. As one of the largest payment processors globally, Fiserv's embrace of stablecoin infrastructure could accelerate mainstream adoption of digital currencies in retail and commercial transactions. The company's entry validates the growing legitimacy of stablecoins as practical payment instruments rather than speculative investments. Looking at the bigger picture, Fiserv's move signals that traditional payment processors recognize the disruptive potential of digital assets and are actively working to integrate rather than resist these technologies. This could thus prompt competitors to accelerate their own cryptocurrency initiatives, potentially triggering an industry-wide transformation in payment processing capabilities. And the timing is particularly significant given the evolving regulatory environment. Should Congress pass stablecoin legislation, early adopters like Fiserv will likely gain competitive advantages through established infrastructure and operational expertise. Are you bullish enough?

ICYMI:

Starling Bank becomes first UK digital bank to deploy AI-powered spending analytics 💸🤖

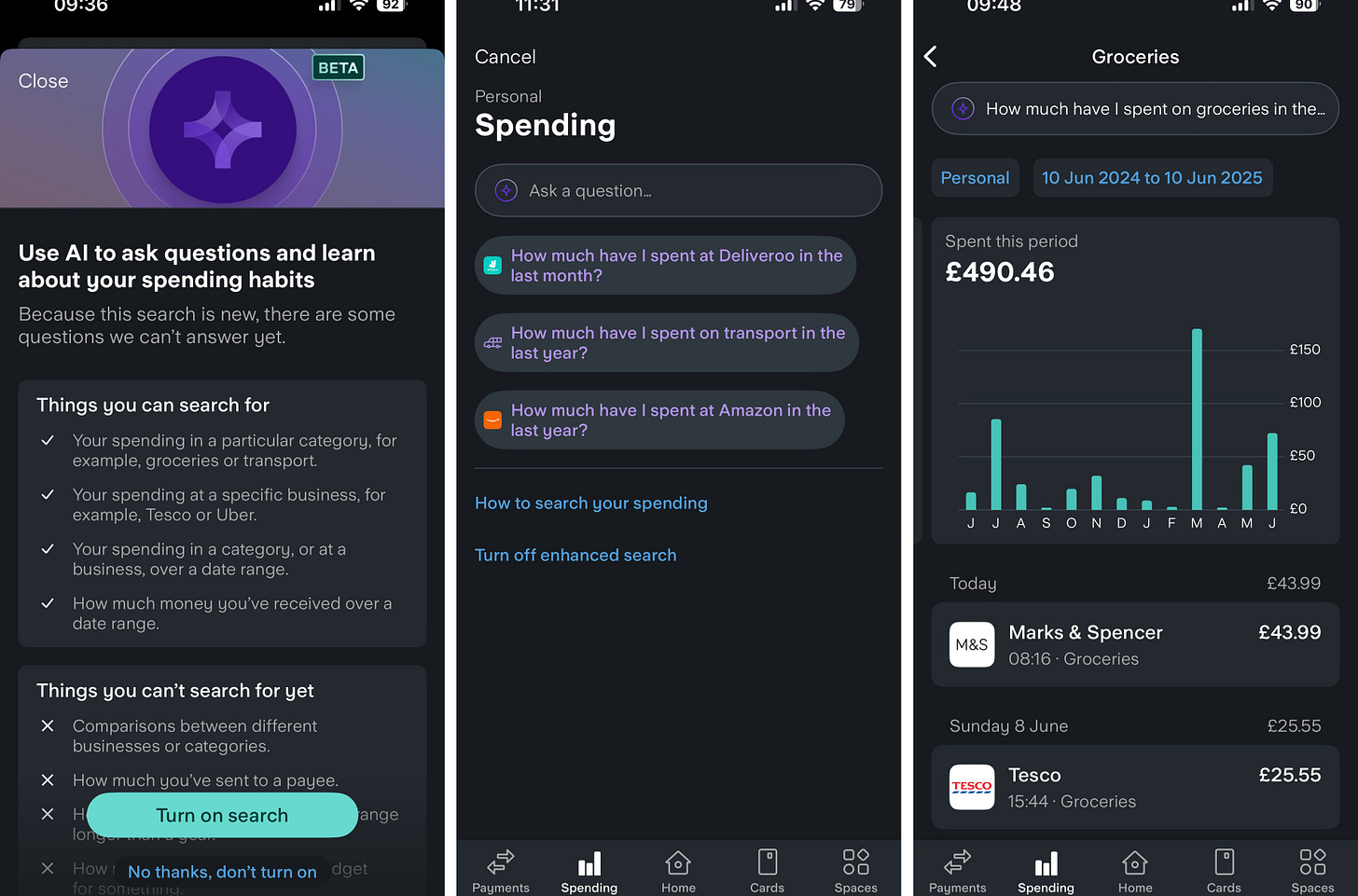

The news 🗞️ Starling Bank just launched "Spending Intelligence," the first AI-powered chatbot integrated directly into a British bank's mobile application.

This tool, built on Google's Gemini large language model, enables customers to interact with their financial data using natural language queries.

Let’s take a quick look at this.

More on this 👉 The feature operates through a search interface within Starling's existing spending section, allowing customers to ask specific questions about their financial habits either through text or voice commands.

Users can pose queries such as "How much did I spend on groceries last week?" or "What did I donate to charity last year?" and receive instant analytical responses complete with graphs and detailed breakdowns across more than fifty customizable spending categories.

The tool aims to make financial engagement feel natural while empowering customers to make informed budgeting decisions. The feature is available at no additional cost to all Starling customers, including both personal and business account holders, and operates on an opt-in basis with robust privacy protections ensuring that customer data cannot be used to train Google's broader AI models.

Starling's position as the first UK bank to place generative AI directly into customer hands represents the initial phase of a broader organizational AI strategy. The bank plans to expand its engineering workforce by 400 professionals this year to accelerate AI development across various customer touchpoints.

✈️ THE TAKEAWAY

What’s next? 🤔 This launch positions Starling Bank at the forefront of AI adoption in UK financial services, potentially creating competitive advantages in the crowded digital banking market where it competes against larger rivals Monzo and Revolut. The successful implementation of conversational AI for financial insights could fundamentally reshape customer expectations regarding digital banking interfaces, moving beyond traditional menu-driven applications toward more intuitive, dialogue-based interactions. Looking at the bigger picture, Starling's initiative demonstrates the practical application of large language models in regulated financial environments, addressing critical concerns around data privacy and regulatory compliance. This could thus accelerate adoption across the industry as other institutions observe customer response and regulatory acceptance. More importantly, the technology's evolution toward predictive financial guidance and automated savings recommendations represents a natural progression that could transform personal financial management. Future developments may include sophisticated fraud detection capabilities, streamlined customer onboarding processes, and personalized financial advisory services that democratize access to wealth management insights previously available only to high-net-worth clients. Looking ahead, as AI capabilities mature, traditional banks will definitely face increased pressure to modernize their technological infrastructure or risk losing market share to more agile digital competitors who can rapidly implement customer-centric AI solutions. Kudos to Starling for being the first mover here!

ICYMI: Starling's Engine roars, but will it be enough? 🤔🏦 [diving deep into Starling’s 2025 annual report, breaking down the most important numbers, what they mean & what’s next + bonus deep dives into its biggest competitors Monzo & Revolut]

🔎 What else I’m watching

Marqeta to Power New Klarna Card 💳 Marqeta has partnered with Klarna to enable the Klarna Card, a new debit card powered by Visa Flexible Credential (VFC). This card allows users to choose between immediate payment and flexible payment options. Marqeta, the first U.S. issuer processor certified for VFC, has been collaborating with Klarna since 2018, powering its virtual cards. The Klarna Card is currently in a trial phase in the U.S., with a broader rollout expected later this year. ICYMI: Klarna expands banking ambitions with debit card launch 💳🏦 [why it makes sense & what does this indicate about the future of FinTech + bonus deep dive into Klarna & PayPal]

Barclays Launches London Innovation Hub with Microsoft and Nvidia 🏢 Barclays has opened a new innovation hub in London, collaborating with tech giants Microsoft and Nvidia, along with other industry partners. The hub aims to foster the growth of startups in AI, deep tech, and the innovation economy by providing collaborative workspaces for 150 tech businesses in Shoreditch. It offers access to events, workshops, growth programs, and networking opportunities with core partners and Barclays' innovation banking team. This initiative follows Barclays' shutdown of its fintech accelerator program, Rise, in January, reflecting the evolution of fintechs into mainstream players with ample opportunities in the financial sector. ICYMI: UK’s strategic AI alliance with NVIDIA to transform financial services innovation 🤖💸 [why it could be huge & what it means for the future of FinServ + 9 artificial intelligence guides to get the most from AI]

South Korea's Ruling Party Backs Stablecoin Issuance 🇰🇷 South Korea's ruling Democratic Party, led by President Lee Jae-Myung, has proposed the Digital Asset Basic Act to enable local companies to issue stablecoins. The act aims to increase transparency and competition in the crypto sector, requiring issuers to have a minimum equity capital of $367,876 and ensure refunds through reserves. Stablecoins must be approved by the Financial Services Commission. Despite the central bank's opposition, citing potential impacts on monetary policy, the government seeks to advance stablecoin adoption. Earlier in 2025, South Korea considered relaxing restrictions on institutional crypto trading and introducing crypto-related financial products, reflecting its supportive stance on the digital asset industry. ICYMI:

💸 Following the Money

Tether has announced its investment in Orionx to advance financial inclusion and optimise digital payment channels across emerging markets, including Latin America.

Investbanq, the AI-powered wealth operating system for family offices, asset managers, and banks, has secured $3M in Pre-Series A funding.

A former Adyen executive and an ex-UBS analyst have become the latest entrants into the increasingly crowded stablecoin infrastructure market, raising $22M in seed funding for their startup, Noah.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Another brilliant read to end the week - tks