Klarna enters mobile phone market 🛍️☎️; Revolut to launch AI Financial Assistant 🤖📈; JPMorgan breaks new ground with JPMD deposit token launch 🏦🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

9 Essential Artificial Intelligence Guides to Get the Most from AI 🤖 [unlock practical AI insights from industry leaders at OpenAI, Google, and Anthropic]

Senate stablecoin legislation triggers historic rally for Circle and Coinbase stocks 😤📈 [what happened & why this could be the watershed moment for the future of finance + bonus deep dives into Circle, Coinbase & co. AND the ultimate list of resources about stablecoins]

Coinbase's tokenized equity gambit: a strategic inflection point for financial markets 📈💸 [why it matters & why it’s potentially a watershed moment for finance + bonus deep dives into Coinbase & its biggest competitors]

Amazon and Walmart explore stablecoin launch to bypass Visa & Mastercard fees 😳🪙 [why this is huge & what it means for the future of Finance & FinTech + bonus list of the ultimate resources on stablecoins]

PayPal transforms digital advertising with Shoppable Storefront Ads 🛍️💳 [what it’s all about, why it matters & what it means for Agentic Commerce + bonus deep dive into PayPal & its quest to transform commerce AND the ultimate beginners guide to AI]

Visa expands stablecoin integration to drive cross-border payments in Africa 💸🌍 [what it’s all about & why it matters + bonus dives into other Finance & Tech giants venturing into stables & the ultimate list of resources about stablecoins]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

As for today, here are the 3 incredible FinTech stories that are changing the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Klarna enters mobile phone market 🛍️☎️

The news 🗞️ Swedish FinTech giant Klarna has announced its entry into the United States mobile phone market, launching an unlimited wireless plan priced at $40 per month.

The service provides unlimited 5G data, calls, and text messaging through AT&T's network infrastructure, positioning Klarna as the latest Mobile Virtual Network Operator in an increasingly competitive telecommunications landscape.

Let’s take a look at this.

More on this 👉 The mobile offering represents another strategic shift (or expansion) for the Buy Now Pay Later pioneer, which serves over 25 million users in the United States. Customers can now activate the service directly through the Klarna application using instant eSIM technology, eliminating traditional contracts and hidden fees that have historically complicated carrier switching processes.

This telecommunications venture forms part of Chief Executive Officer Sebastian Siemiatkowski's ambitious vision to transform Klarna into a comprehensive "super app" that extends beyond traditional payment services. The company plans to leverage artificial intelligence capabilities to monitor user spending patterns and automatically suggest more cost-effective service alternatives when customers are overpaying for telecommunications or other subscription services.

Klarna has partnered with Gigs, a telecommunications-as-a-service platform backed by Google, to facilitate this market entry. The collaboration enables Klarna to operate as an MVNO without requiring substantial infrastructure investments, following a business model that has gained popularity among fintech companies seeking revenue diversification.

Zoom out 🔎 The Swedish company joins a growing cohort of financial technology firms expanding into telecommunications, including British challenger bank Revolut, German neobank N26, and Brazilian digital bank Nubank.

This trend reflects the broader industry movement toward creating integrated financial ecosystems that address multiple consumer needs through single-platform experiences.

Following the United States launch, Klarna plans to introduce mobile services in the United Kingdom, Germany, and additional European markets throughout 2025. The company's international expansion strategy prioritizes markets where it has established significant user bases and regulatory relationships.

✈️ THE TAKEAWAY

What’s next? 🤔 Klarna's telco entry yet again signals a fundamental transformation within the FinTech sector, where traditional service boundaries continue to blur as companies pursue comprehensive customer relationships and one-stop-shop solutions. What interests me the most is the integration of artificial intelligence into telecommunications services as this represents a potentially disruptive innovation that could reshape how consumers manage recurring expenses. If successful, Klarna's AI-driven cost optimization features may pressure traditional carriers to increase pricing transparency and reduce customer acquisition costs, ultimately benefiting consumers through improved market competition. Speaking of Klarna specifically, this diversification strategy addresses critical revenue sustainability challenges facing BNPL providers. Recent regulatory scrutiny and changing consumer credit behaviors have pressured BNPL business models, making alternative revenue streams increasingly important for long-term viability. The telco sector thus offers recurring monthly revenue that could provide greater financial stability compared to transaction-dependent payment services. Looking ahead, Klarna's success in telco may determine whether the company can truly achieve its super app aspirations and successfully compete against established financial institutions expanding their digital capabilities. This will ultimately influence investor confidence in fintech diversification strategies and could have a solid effect on Klarna’s upcoming IPO.

ICYMI: Klarna expands banking ambitions with debit card launch 💳🏦 [why it makes sense & what does this indicate about the future of FinTech + bonus deep dive into Klarna & PayPal]

Revolut to launch AI Financial Assistant 🤖📈

The news 🗞️ European FinTech powerhouse Revolut is positioning itself at the forefront of artificial intelligence adoption in financial services with the imminent launch of its AI-powered financial assistant.

According to UK CEO Francesca Carlesi, the technology remains in experimental phases but will become available to customers soon, representing a central strategic objective for the challenger bank in 2025.

Let’s take a quick look at this, understand why it could be huge, and what’s next.

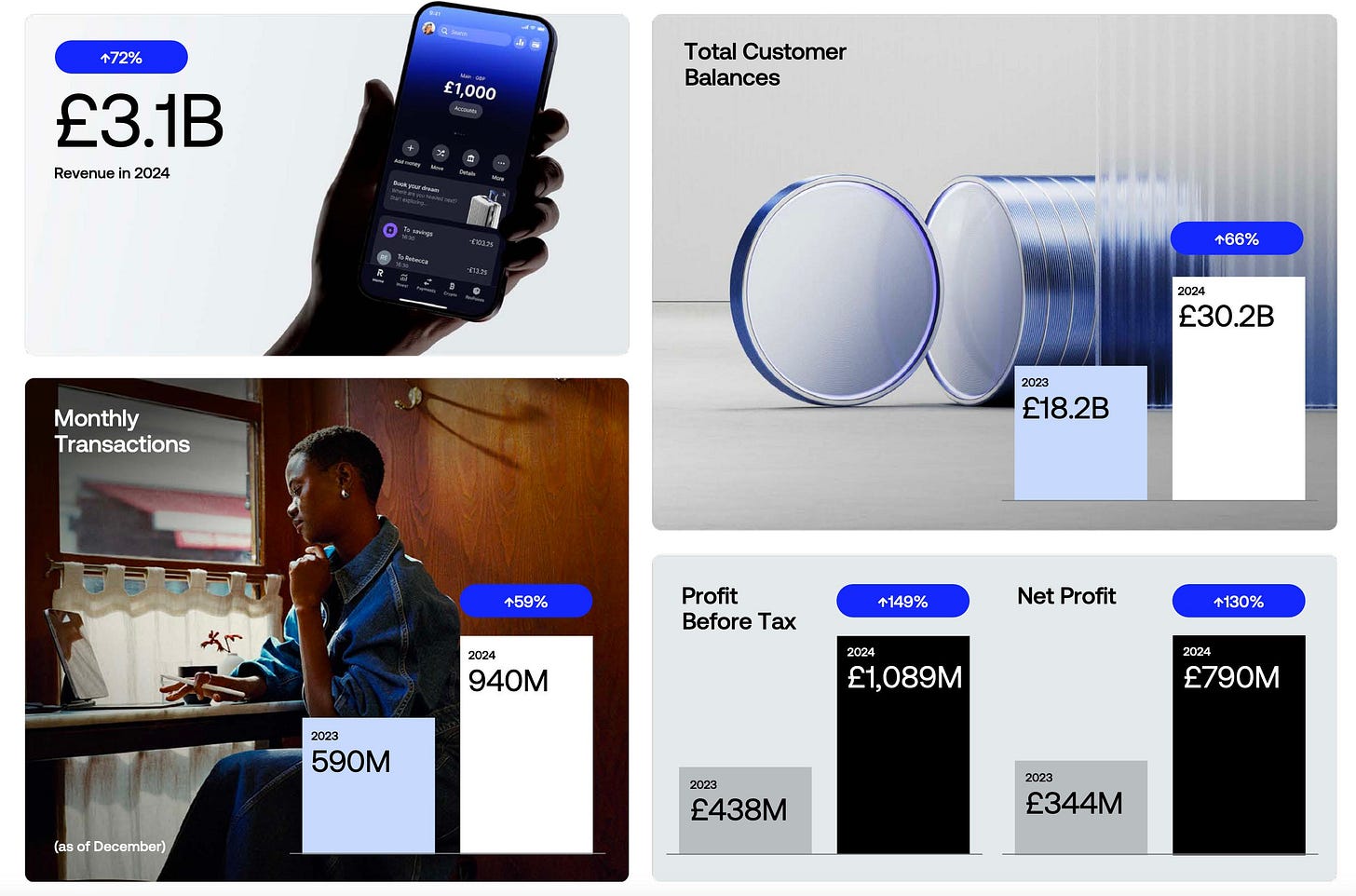

More on this 👉 The announcement comes amid remarkable growth for the London-headquartered company, which now serves 52.5 million customers globally and reported a substantial 72% revenue increase to £3.1 billion in the previous year.

ICYMI: Revolut’s profit machine reaches escape velocity with 72% revenue surge and 149% profit growth in 2024 🤯🚀 [deep dive into their 2024 annual report, breaking down the most important numbers, what they mean & why you should be bullish on Revolut + lots of bonus reads inside]

This customer base has surpassed that of established institutions such as HSBC, demonstrating the rapid transformation occurring within the financial services sector.

Revolut's AI initiative follows closely behind competitor Starling Bank, which recently introduced its own AI-powered banking tool designed to help customers analyze their spending patterns. This perfectly illustrates the intensifying race among neobanks to leverage artificial intelligence for enhanced customer experiences.

ICYMI:

While specific details about Revolut's AI assistant remain limited, the company has indicated the tool will focus on guiding users toward improved financial decision-making and smarter money management practices.

Zoom out 🔎 The development occurs within a broader context of aggressive expansion for Revolut. The company has committed €1 billion to its French operations while pursuing local banking licenses and establishing its Western European headquarters in Paris. Additionally, Revolut maintains ten banking permit applications across various global markets, demonstrating its ambition to become a truly international financial institution while retaining its London-based global headquarters.

UK CEO Carlesi has noted that the competitive landscape is driving convergence between traditional banking institutions and FinTech innovators, with established players and scaled FinTech companies now operating as peers rather than in distinct categories.

This evolution reflects the maturation of the FinTech industry beyond its startup origins.

✈️ THE TAKEAWAY

What’s next? 🤔 Revolut + AI isn’t about tracking your coffee spend - this is way bigger. Here's why: (1) Timing is strategic: The FCA just partnered with NVIDIA for a cutting-edge AI sandbox. Revolut isn't waiting - they want to be the first in AI; (2) Advice, not insights: Imagine AI proactively tweaking your investments before your broker even notices the market moved. This alone could be a huge revenue driver for the FinTech heavyweight; (3) Your side-account's secret agenda: Revolut is still considered by most to be your secondary bank account, and that’s exactly why it wants to see ALL your financial life, not just the occasional coffee swipe. And then - control it 😤 That said, Revolut x AI is NOT about spending. It's about dominance. AI isn't just another feature for the FinTech giant - it's THE killer product:

↳ Into becoming your main bank.

↳ Into your go-to investment platform.

↳ Into the financial OS powering your entire money life.

Traditional banks are playing catch-up defence. Meanwhile, Revolut is redefining the rules, with AI as the ultimate wedge now. Tomorrow? They’ll own the entire game. And that, fellow FinTech friends, could be really, really huge.

ICYMI:

JPMorgan breaks new ground with JPMD deposit token launch 🏦🪙

The news 🗞️ Banking giant JPMorgan Chase JPM 0.00%↑ is making a landmark move into public blockchain infrastructure with the launch of JPMD, a deposit token representing a significant evolution in how traditional banks approach digital assets.

The world's largest bank plans to pilot this token on Coinbase's Base network, marking the first time a major commercial bank has deployed deposit-based products on a public blockchain. Let that sink in 🚰

Let’s take a closer look at this, understand why it could be huge, and what’s next.

More on this 👉 Unlike traditional stablecoins that are backed one-to-one by securities or cash equivalents, JPMD operates as a "deposit token" backed by fractional banking reserves. According to the bank, "from an institutional standpoint, deposit tokens are a superior alternative to stablecoins" due to their scalability through fractional banking.

The key advantages of JPMD over stablecoins include the potential for interest-bearing capabilities and coverage by deposit insurance, features that major stablecoins currently lack.

This simply positions JPMD as a bridge between traditional banking services and blockchain technology. Smart.

The pilot program will begin with JPMorgan transferring a fixed amount of JPMD to Coinbase within days of the announcement. Initially, the token will be available exclusively to JPMorgan's institutional clients through a permissioned system. The pilot is expected to run for several months before potentially expanding to additional users and currency denominations, pending regulatory approval.

We must note that JPMorgan selected Base, Coinbase's Ethereum Layer 2 blockchain, for its low transaction fees and fast settlement speeds. Base has emerged as the leading Ethereum Layer 2 by total value locked, with nearly $4 billion secured across more than 536 protocols. Not too shabby!

Zoom out 🔎 This initiative represents a significant expansion of JPMorgan's blockchain efforts beyond its internal Kinexys Digital Payments network, which currently processes over $2 billion in daily transactions - still a fraction of the bank's overall $10 trillion daily payment volume.

But more importantly, the move comes during a period of regulatory thaw toward cryptocurrency under the Trump administration and coincides with the Senate's passage of stablecoin legislation.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, JPMorgan's entry into public blockchain infrastructure with JPMD signals a transformative shift in the financial services landscape. This move yet again legitimizes public blockchains for institutional banking applications and could further accelerate adoption across the traditional finance sector. As other major banks like Banco Santander and Deutsche Bank experiment with digital assets, JPMorgan's success with JPMD could catalyze industry-wide adoption of deposit tokens. Looking at the bigger picture, deposit tokens could fundamentally reshape cross-border payments and settlement systems, offering 24/7 availability and near-instant transactions while maintaining regulatory compliance and deposit insurance protections. This technology bridges the gap between decentralized finance innovations and traditional banking infrastructure. Looking ahead, the success of this pilot could prompt JPMorgan to expand JPMD across multiple currencies and blockchain networks, potentially establishing a new standard for bank-issued digital assets. Other financial institutions will likely monitor this initiative closely, with successful implementation potentially triggering widespread adoption of similar deposit token programs across the banking sector. But most importantly, the intersection of traditional banking with public blockchain infrastructure represents a pivotal moment that could redefine how financial institutions approach digital transformation in the coming decade. Slowly, then suddenly.

ICYMI:

JPMorgan's Crypto Pivot: Jamie Dimon finally embraces Bitcoin despite long-standing skepticism 😳📈 [what it’s all about & what it means for the industry as such + bonus deep dive into JPM’s latest financials & 110+ real-world stablecoin use cases]

Senate stablecoin legislation triggers historic rally for Circle and Coinbase stocks 😤📈 [what happened & why this could be the watershed moment for the future of finance + bonus deep dives into Circle, Coinbase & co. AND the ultimate list of resources about stablecoins]

Amazon and Walmart explore stablecoin launch to bypass Visa & Mastercard fees 😳🪙 [why this is huge & what it means for the future of Finance & FinTech + bonus list of the ultimate resources on stablecoins]

🔎 What else I’m watching

Klarna Launches AI Avatar Hotline for Customer Feedback 🤖 Klarna has introduced a hotline featuring an AI avatar of CEO Sebastian Siemiatkowski, allowing customers to provide feedback on products and services. The avatar, trained on Siemiatkowski's voice and insights, initially debuted at Klarna's results presentation. Rolling out first in the U.S. and Sweden, the hotline offers a conversational link between customers and the AI clone, which can also answer questions about Klarna's vision and history. Each interaction generates a transcript and summary, analyzed by a large language model to provide actionable insights for Klarna's teams. Klarna's existing AI chatbot handles around 1.3 million customer interactions monthly, reducing repeat inquiries by 25% and resolution times from 12 minutes to under two minutes. ICYMI: Klarna expands banking ambitions with debit card launch 💳🏦 [why it makes sense & what does this indicate about the future of FinTech + bonus deep dive into Klarna & PayPal]

Frich Launches AI Tool to Estimate Salaries from Instagram Posts 💰 Frich, a Gen Z-focused social finance app, has introduced "Frich Scoop," an AI-powered feature that estimates individuals' earnings based on their Instagram profiles. Users can upload screenshots of LinkedIn and Instagram profiles to receive a speculative "scoop" detailing estimated income, lifestyle costs, and financial indicators. The tool uses AI image analysis to combine professional and personal online personas, presenting the information in a shareable, Spotify Wrapped-style format. Frich aims to address the disconnect between social media appearances and financial reality, promoting healthier money conversations. The company assures that it only analyzes publicly available information and does not store personal data or screenshots. ICYMI:

Finmo Unveils AI Co-Pilot 🤖 Finmo has launched MO AI Co-Pilot, an AI assistant designed to streamline treasury operations. This tool offers real-time cash visibility, forecasting, and global payment management through natural language interactions. MO AI can handle complex workflows, retrieve account balances, initiate transactions, and generate reports, providing contextual responses. Built on a custom architecture, it combines real-time data integration, financial understanding, and secure transaction execution. Unlike generic AI, MO AI is trained on financial transaction data, offering domain-specific intelligence. It aims to automate tasks like payment approvals and forecasting, enhancing treasury workflows. Finmo envisions MO AI as a step towards intelligent finance, with future plans for predictive capabilities and adaptive learning. ICYMI:

💸 Following the Money

Expense management startup Ramp is in discussions to raise around $200M in a round of funding that would lift its valuation to about $16B.

Tensec, a startup founded by ex-Rapyd, Meta, and Goldman Sachs executives, has raised $12M in Seed funding to take on the $190T B2B cross-border payments market.

London-based RegTech Cube has acquired operational risk AI and technology provider Acin. Financial terms were not disclosed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Wow this is so good it shouldn't be free - thank you sir for this one