Revolut expands into Argentina through Cetelem M&A 🏦🇦🇷; Worldline loses €500M in market value due to fraud cover-up allegations 🌪️🇪🇺; Wealthfront & PhonePe prepare to go public 📈🔔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

Elon Musk’s X to offer in-app investing & trading in a Super App push 😳💸 [what it’s all about, why it matters & what it means for the future of Finance & Tech + more bonus deep dives inside]

European FinTech giant Revolut is actively exploring the launch of its own stablecoin 📈🪙 [what’s the rationale behind & why it could be huge + lots of bonus reads & deep dives inside, including the ultimate resource list on stablecoins]

Fiserv enters the stablecoin market with FIUSD launch, targeting regional banks 🪙🏦 [what’s the rationale here & what it means for the future of FinServ & FinTech + bonus dives into other finance giants launching stables solutions & the ultimate list of stablecoin resources inside]

Kraken launches payments app to compete with Cash App & Venmo 😳💸 [what it’s all about & why it matters for the crypto platform + bonus dives into Kraken & its biggest competitor Coinbase]

Republic’s quest to democratize private market access 📈👀 [this could be your only chance to invest in Revolut, Stripe or SpaceX before they IPO]

Starling Bank eyes US market entry 👀🇺🇸 [why it’s a smart move & what’s next for Starling + bonus deep dive into Starling bank & how it’s leveraging AI today]

Kalshi hits $2B valuation 😤💸 [what’s the bigger picture here & why it matters]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

🚀 The Ultimate Startup Growth Toolkit 🚀 [fundraising templates, PMF frameworks, tech guides, and growth playbooks used by billion-dollar companies - now in your hands]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another solid week in the financial technology space, so make sure to check all the above stories.

Revolut expands into Argentina through Cetelem acquisition 🏦🇦🇷

The news 🗞️ European FinTech giant Revolut just announced its acquisition of Banco Cetelem, a small Argentine lending institution owned by French financial services giant BNP Paribas.

This strategic move represents the London-based digital bank's inaugural entry into South America's second-largest economy and yet again underscores its aggressive global expansion strategy.

Let’s take a look at this.

More on this 👉 The transaction, subject to regulatory approval from Argentina's monetary authority, involves the transfer of Cetelem's banking license along with approximately $6.4 million in assets. While the financial terms remain undisclosed (they are probably more than reasonable), the acquisition provides Revolut with immediate market access through an established regulatory framework rather than pursuing the lengthier process of obtaining a new banking permit.

We can remember that Revolut has already initiated operational preparations, appointing Agustin Danza as chief executive officer for its Argentine operations and beginning the regulatory approval process. The company reportedly participated in a competitive bidding process against other interested parties, including Southern Cross Group and brokerage firm Criteria, ultimately securing the deal.

Zoom out 🔎 This expansion comes at a particularly opportune moment for Argentina's financial sector. President Javier Milei's libertarian economic reforms have fundamentally transformed the banking landscape, implementing measures such as lifting capital controls, halting money printing, and reducing fiscal spending. These changes have triggered a significant credit boom, with private sector credit expanding by 53% in real terms last year - the strongest growth in over three decades. Not too shabby!

Additionally, the timing aligns with Revolut's broader Latin American strategy, as the company already maintains operations in Brazil, Mexico, and Colombia.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Revolut securing a banking license through acquisition represents a more efficient market entry strategy than traditional regulatory applications, which can take years to complete. This approach may serve as a template for future expansions into regulated markets where acquisition opportunities exist. Looking at the bigger picture, the Argentine market presents unique opportunities driven by economic transformation under the Milei administration. Rising real wages, renewed consumer lending activity, and a recovering mortgage market create favorable conditions for FinTech expansion. However, Revolut will face substantial competition from established regional players, including MercadoLibre's Mercado Pago MELI 0.00%↑ platform and local FinTech Uala, both of which have strong consumer adoption for digital payments and financial services. But given Argentina's historical economic volatility and residents' preference for dollar-denominated assets, Revolut's multi-currency capabilities and foreign exchange services may provide significant competitive advantages. Looking ahead, this move positions Revolut to capitalize on Argentina's ongoing financial sector modernization while establishing a strategic foothold for potential expansion into neighboring markets. Bullish.

ICYMI: European FinTech giant Revolut is actively exploring the launch of its own stablecoin 📈🪙 [what’s the rationale behind & why it could be huge + lots of bonus reads & deep dives inside, including the ultimate resource list on stablecoins]

MercadoLibre accelerates growth while expanding profit margins 📈💸 [unpacking their latest numbers, why they matter, and what’s next for MELI 0.00%↑]

Worldline loses €500M in market value as fraud cover-up allegations threaten European payments giant 🌪️🇪🇺

The news 🗞️ France’s payments giant Worldline just suffered a devastating 38% stock collapse yesterday, erasing approximately €500 million in market value after coordinated investigative reports alleged the European payment processor systematically covered up customer fraud to protect revenue streams. Ups 🤕

The crisis threatens to reshape competitive dynamics in European FinTech while raising fundamental questions about industry compliance standards.

Let’s take a quick look at this, understand what happened and what to expect next.

More on this 👉 The allegations, published simultaneously by the European Investigative Collaborations network across Dutch, Swedish, and German outlets, detail a pattern of institutional risk management failures. Reports claim Worldline ignored internal warnings about high-risk clients, moved problematic customers between subsidiaries to evade detection, and maintained lucrative relationships with prohibited merchants despite legal obligations for thorough due diligence. Wirecard vibes, anyone? 👀

Chief Executive Pierre-Antoine Vacheron's combative response - characterizing the reports as an "orchestrated media campaign" and threatening legal action - contrasts sharply with the measured compliance rhetoric typically expected during such crises. This defensive posture, combined with his claim that "there's nothing new" in the allegations, suggests management may be underestimating the severity of stakeholder concerns.

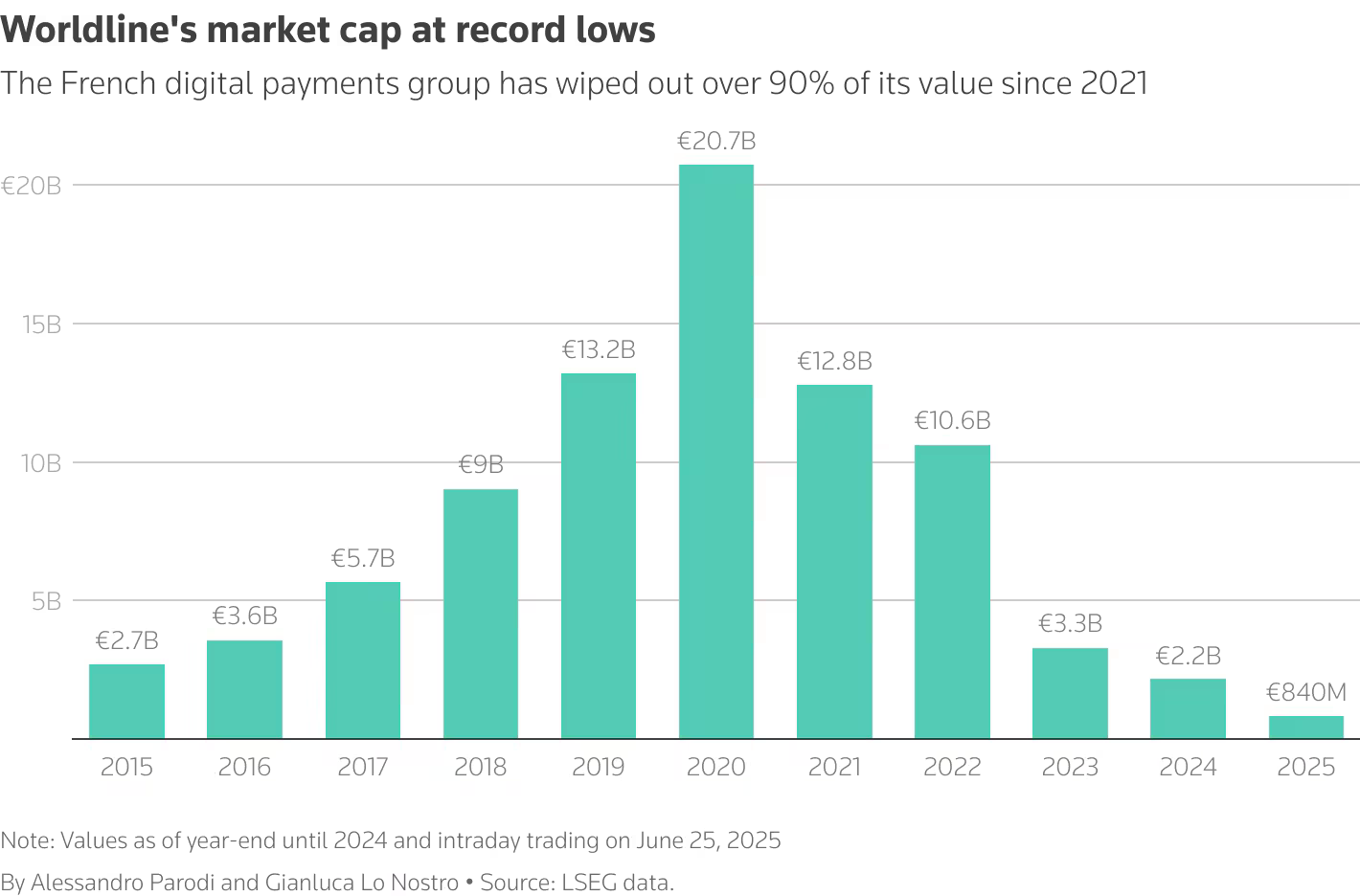

And both the stakeholders & shareholders should be very concerned as Worldline has been on a freefall for years:

Zoom out 🔎 The immediate ramifications extend beyond Worldline's boundaries. Credit Agricole employees are now questioning their bank's 2024 decision to acquire a 7% stake in Worldline, with employee representatives demanding explanations about due diligence procedures. This internal scrutiny at a major institutional partner signals broader partnership vulnerabilities across the European payments ecosystem.

The timing proves particularly damaging given Worldline's precarious market position. Already down 96% from 2021 peaks and struggling with economic headwinds affecting consumer spending, the company now faces potential regulatory investigations, customer attrition, and partnership reassessments.

The crisis occurs just months into Vacheron's tenure as CEO, undermining turnaround efforts before they could gain momentum.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, these developments raise uncomfortable parallels to the 2020 Wirecard collapse, which exposed systemic compliance failures and regulatory blind spots (and we all know how it ended). More importantly, the coordinated nature of the investigative reporting suggests journalists uncovered substantial evidence, making Worldline’s swift dismissal of the allegations increasingly untenable. It will thus be very interesting to follow how once a payment giant will react to this going forward. Looking ahead, competitors including Adyen and Stripe clearly stand to benefit from any market share redistribution, while regulators face renewed pressure to strengthen oversight frameworks. This crisis yet again underscores how legacy payment processors, despite handling hundreds of billions in annual transactions, remain vulnerable to compliance failures that newer, technology-focused competitors have largely avoided thanks to different business models & new, compliance-first tech stack. Idea: Elon Musk should acquire Worldline in cash and integrate it into X Payments. It would very cheaply give them a massive boost for X Money in Europe 🇪🇺

ICYMI: Elon Musk’s X to offer in-app investing & trading in a Super App push 😳💸 [what it’s all about, why it matters & what it means for the future of Finance & Tech + more bonus deep dives inside]

FinTech IPO wave builds momentum as Wealthfront & PhonePe prepare to go public 📈🔔

The news 🗞️ The financial technology sector is experiencing a notable resurgence in public market activity, with two major players across different continents preparing for significant initial public offerings.

Wealthfront, the prominent US-based robo-advisory platform, has filed confidentially for a public offering, while PhonePe, India's leading digital payments provider backed by Walmart, is reportedly preparing to raise up to $1.5 billion through its own market debut.

Let’s take a look at this.

More on this 👉 Wealthfront's decision to pursue an IPO represents a strategic shift after a failed acquisition attempt by UBS Group in 2022. The Swiss banking giant had valued the company at $1.4 billion before abandoning the deal due to regulatory concerns and alleged shareholder pushback. Since then, Wealthfront has demonstrated strong financial performance, with revenue growing from $200 million in 2023 to $290 million the following year while maintaining net income profitability. Nice!

The Palo Alto-based company has established itself as a leader in automated wealth management, particularly among younger demographics seeking accessible investment solutions. Beyond its core robo-advisory services, Wealthfront has expanded its offerings to include high-yield savings accounts, exchange-traded fund investing, and artificial intelligence-enhanced financial planning tools. The company's business model, which relies on assets under management rather than transaction frequency, has proven resilient amid market volatility.

Meanwhile, PhonePe's planned IPO represents one of the largest FinTech offerings in Indian market history.

The company, which Walmart majority-owns, has built a dominant position in India's digital payments ecosystem through the country's Unified Payments Interface system. With over 610 million registered users and daily transaction volumes exceeding 310 million across 40 million merchants, PhonePe has achieved remarkable scale since its 2015 launch.

The timing of PhonePe's public offering follows a successful funding round in 2023 that valued the company at $12 billion. The anticipated $15 billion valuation for the IPO reflects the company's continued growth trajectory and expanding service portfolio, which recently included the launch of device tokenization solutions for enhanced payment security.

Zoom out 🔎 Both companies are entering public markets during a period of renewed investor confidence in FinTech offerings. The broader IPO landscape has shown signs of recovery, with US companies raising $9.22 billion in the first quarter, representing a 7% increase from the previous year. This improvement comes after a challenging period marked by trade policy uncertainties and market volatility that had previously deterred many companies from pursuing public offerings.

The FinTech sector specifically has witnessed several successful debuts, including Chime Financial's recent $864 million raise and Circle's substantial $1.1 billion offering earlier this year. These transactions have helped restore investor appetite for digital financial services companies and established favorable precedents for upcoming offerings.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the pursuit of public offerings by both Wealthfront and PhonePe signals broader confidence in the FinTech sector's long-term prospects. For Wealthfront, an IPO provides capital for expansion while validating the direct-to-consumer wealth management model that some private investors had questioned. The company's focus on steady, long-term investors aligns well with public market expectations for sustainable revenue growth. Meanwhile, PhonePe's offering represents a significant milestone for Indian FinTech companies and could pave the way for other regional players to access global capital markets. The company's dominant market position and Walmart's backing provide substantial credibility with institutional investors, while its expansion into adjacent financial services creates multiple growth avenues. The success of these offerings will definitely influence other major FinTech companies considering public debuts, including Klarna and Plaid, both of which have indicated readiness for IPO processes. FinTech IPOs are finally back!

ICYMI:

🔎 What else I’m watching

EPI and EuroPA Unite for EU Payments Sovereignty 💳 The European Payments Alliance (EuroPA) and European Payments Initiative (EPI) are collaborating to enhance seamless cross-border payments in Europe, aiming to reduce reliance on US card schemes and Big Tech. EPI's Wero digital wallet, launched last year, leverages account-to-account payments to compete with Visa and Mastercard. EuroPA, comprising Bancomat, Bizum, MB Way/Sibs, and others, enables 50M users to send and receive money instantly via mobile numbers. The alliance now includes Blik, Iris, and Vipps MobilePay. Together, EPI and EuroPA are exploring a joint offering to cover all payment use cases across 15 European countries, representing 382M people. ICYMI: Visa expands stablecoin integration to drive cross-border payments in Africa 💸🌍 [what it’s all about & why it matters + bonus dives into other Finance & Tech giants venturing into stables & the ultimate list of resources about stablecoins]

South Korean Banks Plan Won-Backed Stablecoin 🏦 South Korea's major banks, including KB Kookmin, Shinhan, and Woori, are forming a consortium to launch a Won-backed stablecoin by late 2025 or early 2026. This initiative aims to reduce reliance on dollar-denominated stablecoins like USDT and USDC. The consortium is exploring trust-based and deposit-linked models for the stablecoin. Collaborating with OBDIA and KFTC, the banks seek to enhance financial sovereignty amid a volatile geopolitical climate. South Korean lawmakers are also advancing legislation to regulate digital assets. ICYMI:

Chase UK Launches Credit Card 💳 Chase UK introduces its first credit card, featuring 0% interest on purchases for up to 15 months, no annual or FX fees, and competitive exchange rates. The card offers real-time balance updates, instant purchase notifications, and in-app tools for card management. Like Chase's debit card, it is numberless, with details stored securely in the app. Since its 2021 launch, Chase UK has attracted around two million customers and £20 billion in deposits, winning Best British Bank at the 2023 and 2024 British Bank Awards. ICYMI: Chase dethrones Monzo and Starling as UK's most recommended bank 🏦🇬🇧 [why this matters & what it tells us about the future of FinTech + bonus deep dives into JPMorgan & co]

💸 Following the Money

Fundbox has bolstered its embedded capital infrastructure for small businesses by acquihiring the founders of Vaya Technologies.

GoKwik, Asia’s leading e-commerce enabler, announced it has closed a $13M growth round for European expansion.

Barclays and Citi have co-led a $7M seed funding round in deal intelligence platform Claira.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is my favourite week of the month - thank you for another fabulous read.