Two ultra-fast delivery startups shut down in one week. Lessons for FinTechs 🧠

"It's good to learn from your mistakes. It's better to learn from other people's mistakes",- Warren Buffett

Startups get launched, pivoted, relaunched, and inevitably - bust almost every day in every country on the planet. And despite the odds are severely against the entrepreneurs (as much as 90% of all the upstarts fail), this doesn’t seem to bother the risk-takers while entrepreneurship nowadays is booming like never before.

But this story is still pretty shocking.

Two startups operating in the same industry, in the same country, and even - the same city shut down in a single week. Let’s take a brief look at them focusing on the reasons for failure and more importantly - see what lessons could financial technology startups learn from their misfortune.

The startups

As you have already noticed, this is about the ultra-fast delivery market and the startups in question are Fridge No More & Buyk.

Both of them were shut down earlier this month. In the same week.

Fridge No More, a startup that offered fast delivery with no fee regardless of size order, told employees during the 2nd week of March that it was shutting down after a deal with a potential buyer fell through while and no extra funding was attracted. Founded in 2020, the company has raised almost $17 million in venture capital before shutting shop.

Buyk, which touted 15-minute grocery deliveries in New York City and Chicago with no minimum order or fees, confirmed to CNN Business that its 870 employees were laid off on Friday the same week. The startup had furloughed the vast majority of its employees, as well as its CEO, due to challenges over Russia sanctions. Buyk's Russian founders had been providing bridge financing until the company closed its next financing round. That round never reached the daylight. Founded in 2021, the company has raised a whopping $46 million from VCs before hitting the wall.

Reasons for failure

There are many reasons why startups fail. Although every business case is unique, these two failures that happened almost in parallel indicate potentially sector-specific issues or challenges as well lessons that could be applied to FinTech companies too.

But let’s start with Fridge No More & Buyk, and why they failed.

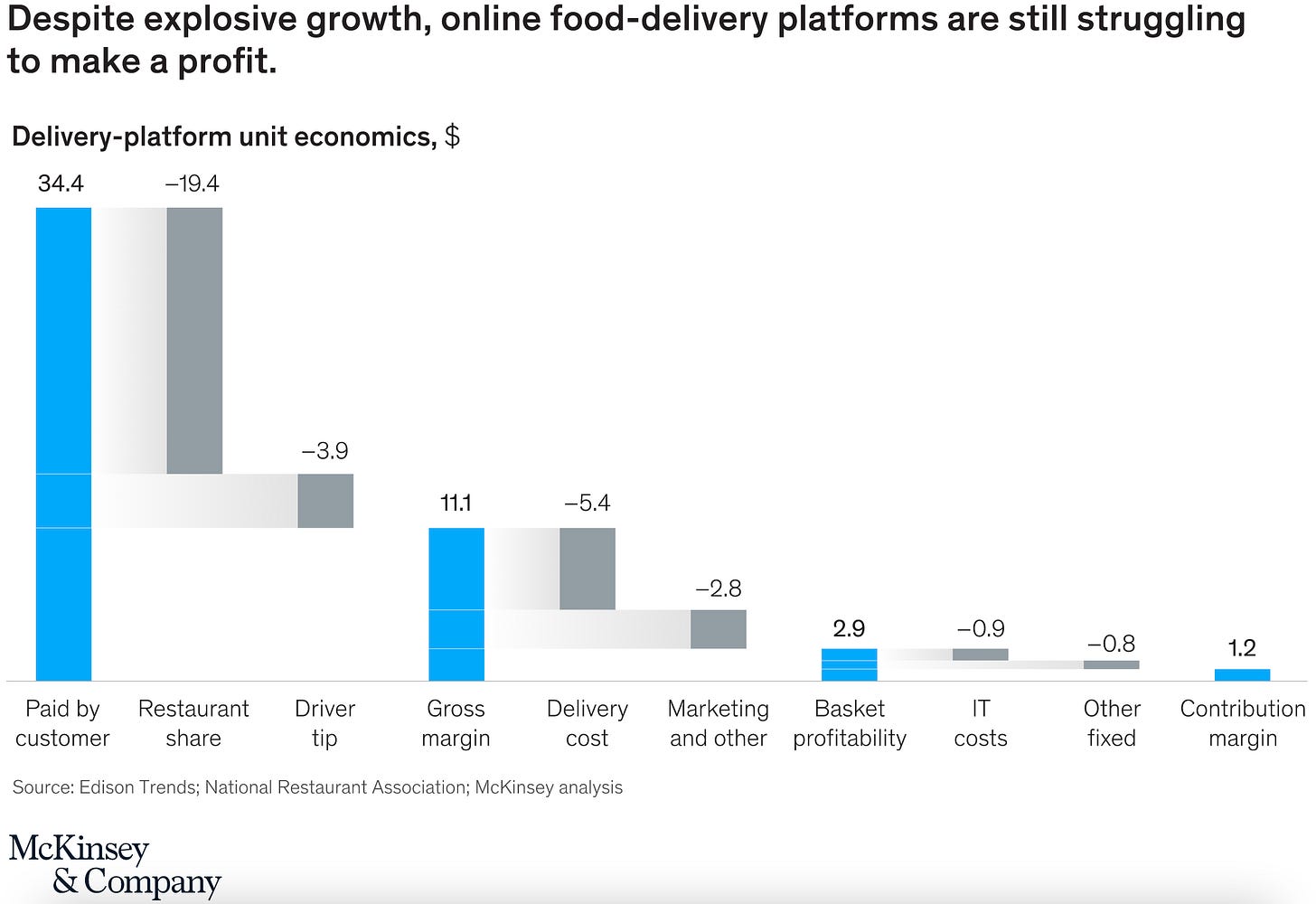

Unsustainable business model. Fundamentally, ultra-fast grocery delivery is hardly a sustainable business model at its core. In fact, it might be the worst business model ever created. Looking at their unit economics is enough:

But that could change if new technologies like autonomous delivery robots would be used at scale (something Uber has been waiting for ages), improved routing, the ability to batch or “stack” multiple orders, etc.

This brings us to a second reason which is Heavy reliance on VC money & growth at all costs. Because these startups had unit economics against them from the get-go as well as lacked a clear path to profitability, they were heavily reliant on venture capital funding (to boost their growth & marketing efforts and hence attract new users and/or sustain current ones with discount offer and best deals). In fact, it could have been the only reason they were able to exist.

Crowded market. The pandemic has surcharged the growth of on-demand delivery startups (as well as they became a lifeline for many people globally), but the market became increasingly crowded, especially when it comes to New York City with lots of startups offering ultra-fast deliveries. Fridge No More launched in October 2020, followed by competitors Jokr, Gorillas, and Buyk, which came in September 2021. A month later, Philadelphia-based GoPuff entered the city, followed by Istanbul-based Getir in December. This effectively made them all fight for consumers bringing in rich discounts and splashy marketing, but the long-term potential of the business model was still questionable.

‘Nice to have’ problem. Who really needs an ultra-fast grocery delivery? No one. Okay, let’s not be that harsh here - ultra-fast delivery is cool, but you will probably be equally satisfied if you get your greens delivered the next day. Hence, it’s hard to build a sustainable business if the problem you’re solving is just nice to have and not a must-have. And that’s exactly what Fridge No More & Buyk were doing.

TLDR:

To put everything in a nutshell, Fridge No More & Buyk failed because ultra-fast delivery isn’t a sustainable business at its very core. Given they are solving a "nice to have" problem, there’s no real need and thus no key competitive advantage. Operating in an increasingly competitive market, it's just a money grave for VCs pouring hundreds of millions of $$$ trying to gain market share in a business that has negative unit economics.

Lessons for FinTechs

But what does this have to do with FinTech? Although it might sound counterintuitive first, ultra-fast delivery startups have quite a few things in common with financial technology startups, especially those operating in red-hot verticals.

But more on that maybe next time. Now, let us see what FinTechs could learn from the failure of Fridge No More & Buyk.

Biz model is super important. If you don’t have a sustainable business model or at least a clear path to profitability, sooner or later you will get into trouble. We can take Robinhood as an example here. Cheering the individual trader while in the back focusing primarily on selling its order flow to big market makers, once on top Robinhood is now in big trouble. The GameStop saga not only compromised the company’s reputation, but it also seems that it has lost its momentum since then. Once valued at ~$60N, now the $HOOD is worth less than $12B. You can read more about the grim outlook and why it can become a takeover target soon here.

VC money & growth at all costs isn’t sustainable in the long-run. If you are not able to make money from your customers to cover your costs, you’re having a huge dependency on venture capital to subsidize your growth and hence risk it all if the money tap runs dry. This is exactly what happened to Australian neobanks Xinja and 86 400 not that long ago. Zooming out, we could probably say that this applies to most consumer FinTechs, especially challenger banks or neobanks, where ARPU (average revenue per user) rarely covers the CAC (customer acquisition cost).

Crowder market. Most FinTech companies out there, again - primarily the direct-to-consumer ones, are operating in very crowded verticals and doing pretty much the same thing (i.e. Buy Now, Pay Later aka BNPL is a good example here). That said, it’s not only very hard to build loyalty (because customers can easily switch from one provider to another) but also makes your competitive environment even more fierce. Also, once innovative, more and more features can now be easily replicated by incumbents that have lots of virtually free cash, which further challenges your chances of success in an already jammed market.

TLDR:

As Warren Buffett has once put it, it's good to learn from your mistakes. But it's even better to learn from other people's mistakes. Here’s what you should take away from these two stories:

Spend some serious time thinking about your business model. It has to be sustainable, or at least you should have an idea about the path to profitability.

If you can make money from Day 1, don’t look for VCs. Because the best form of financing is your customers paying for your product/services.

If you’re operating in a crowded market, you have to be unique to build up loyalty. So even if there’s only one thing you do incredibly well, don’t look back, do it and go all in. Some examples from the red hot corporate spend market, which I covered today, can be found here.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀