It's Been Two Massive Weeks for Bitcoin. What's Next?

Bitcoin has been breaking records and making big waves in the last 2 weeks. The crucial question is what's going to happen next?

Bitcoin, the oldest and most popular cryptocurrency, has been making big waves recently. Over the last two weeks alone, it has increased by circa +50%, and at the point of writing it is changing hands at around $24,400 per 1 BTC.

It’s not surprising at all as there have been a lot of breaking news and market-moving developments that went hand-in-hand with the skyrocketing Bitcoin price.

Below are 6 key developments you absolutely must know. Let us briefly take a look at each of them, try to make sense of them, and most importantly comprehend what might happen next.

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter. You will get 2 newsletters every week, 2 monthly digests in FinTech and Blockchain & Cryptocurrency, and more!

MicroStrategy Completed $650M Bond Sale to Finance Bitcoin Purchase

MicroStrategy, a business intelligence firm founded back in 1989, on 11 December has raised $650 million worth of convertible bonds to finance more Bitcoin purchases, strengthening their CEO Michael Saylor’s conviction in the flagship digital asset.

$650 million worth of convertible senior notes were sold at a rate of 0.75% due in 2025. The interest rate is payable semi-annually on June 15 and December 15 beginning in 2021.

This move makes MicroStrategy the largest corporate Bitcoin holder. What’s interesting here is that since announcing their first BTC purchase, MicroStrategy stock (MSTR) is up by +120%. On the other hand, Bitcoin has grown nearly X2 times during the same period.

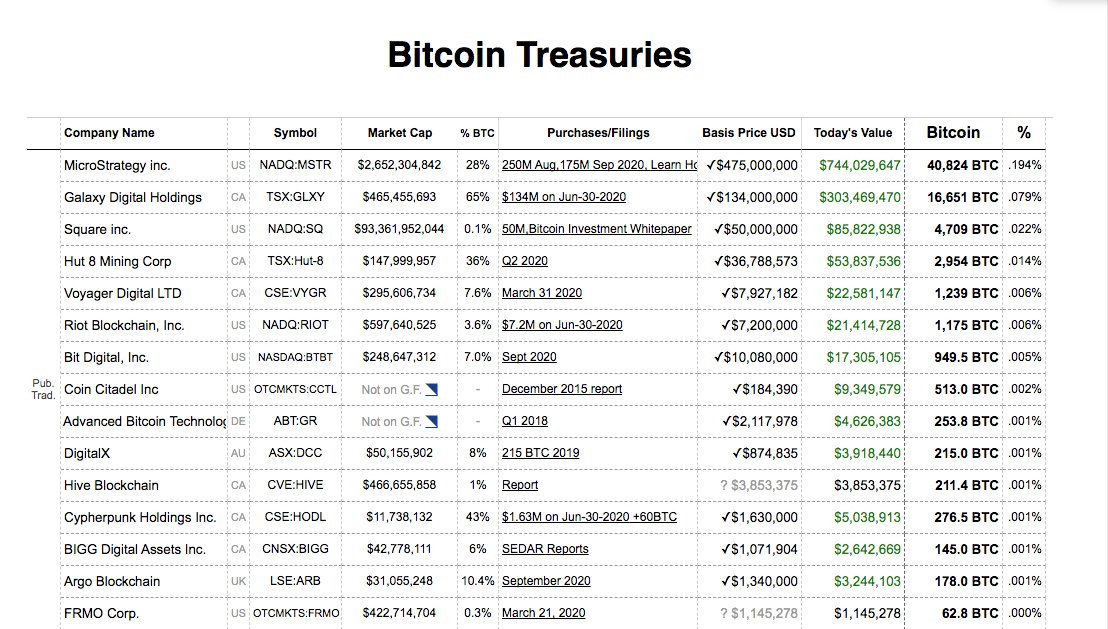

Note: the above data is not up-to-date, but provides a good perspective nevertheless.

169-Year-Old MassMutual Invests $100M in Bitcoin

The Massachusetts Mutual Life Insurance Company aka MassMutual has purchased $100 million in Bitcoin for its general investment fund. The news was announced on 10 December.

Founded in 1851, the American mutual life insurance company is serving 5 million clients with a general investment account of nearly $235 billion. The investment in Bitcoin will represent 0.04% of their portfolio.

MassMutual is the latest mainstream firm to dabble in digital assets. Additionally, the mutual insurer also acquired a $5 million minority equity stake in NYDIG, a subsidiary of Stone Ridge that provides cryptocurrency services to institutions, according to a statement. NYDIG, which already keeps more than $2.3 billion in crypto assets for clients, will provide custody services for MassMutual’s Bitcoins.

The recent move by the 169-year-old insurer indicates several things. First, it illustrates the widening adoption of cryptocurrency, primarily - Bitcoin. Second, it shows that Bitcoin is moving from family offices and tech-savvy whales to insurance firms. Finally, it could bring more financial incumbents to the table.

Ruffer Investment Confirms Massive Bitcoin Buy of $744M

UK-based Ruffer Management, a circa $27 billion asset manager, has bought $750 million of Bitcoin, which equates to around 2.5% of their portfolio. This was confirmed on 16 December.

$750 million or roughly 45,000 BTC was allocated by Ruffer based on November 2020 prices.

The investment was "primarily a protective move for portfolios" to "act as a hedge" against "some of the risks that we see in a fragile monetary system and distorted financial markets", as per Ruffer’s memo.

The hedge has played out very well until now - Bitcoin is up by +50% since mid-November.

Global Equity Head at Jefferies Says the Investment Bank Will Buy Bitcoin & Reduce Exposure to Gold

Christopher Wood, the global head of equity at Jefferies, a global financial services company, said on 19 December that the firm will reduce exposure to gold in favor of Bitcoin.

He added that there are plans to increase the crypto component of Jefferies’ long-only global portfolio for U.S. dollar-denominated pension fund if and when the Bitcoin price drops from current levels.

As an effect, Wood amended his long-only asset allocation recommendation for pension funds cutting gold to 45% from 50% and initiating a 5% position in Bitcoin.

Jefferies is a traditional asset manager. Another one.

Guggenheim CIO Says Bitcoin ‘Should Be Worth’ $400,000

Guggenheim Partners, an asset manager with $270 billion worth of assets under management, is another traditional asset manager that is bullish on Bitcoin. Their Chief Investment Officer Scott Minerd shocked Bloomberg TV hosts on 16 December when he said his firm’s fundamental analysis shows bitcoin should be worth $400,000.

That sky-high price target is based on two things, according to Minerd: the asset's scarcity and its relative value to gold as a percentage of gross domestic product.

"Bitcoin has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions," Minerd told Bloomberg TV.

Guggenheim made the decision to start allocating to bitcoin when the leading cryptocurrency was trading around $10,000, Minerd said.

Minerd said allocating to bitcoin, given its current price above $20,000, is "a little more challenging."

This is an incredibly bullish position and move. Yet again coming from a traditional asset manager.

Coinbase Files for an IPO

Coinbase, one of the most well-known names in the cryptocurrency ecosystem, has filed for an initial public offering on 17 December. In a short blog post on its site, the San Francisco-based company stated that it had submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (SEC).

The Form S-1 will be made public after the SEC reviews and approves the statement. Raised nearly $550 million to date, Coibase is worth over $8 billion as per their last funding round in 2018.

With Bitcoin at all-time highs, the timing for an IPO couldn’t be any better. Especially for a company that is heavily reliant on the cryptocurrency industry. It’s a massive move as Coinbase is the first crypto-native firm to be listed on a major US stock exchange. Furthermore, it will set a precedent on how markets will value such firms.

So what’s next?

Bitcoin today is the hottest and arguably the most in-demand asset class out there. Its rising price illustrates that perfectly.

An important thing to note (or repeat, actually) here is that the recent Bitcoin bull run as opposed to the one that happened in 2017 is primarily driven by institutions rather than retail investors. And institutions are placing their bets on Bitcoin as a hedge against inflation and the current fragile economic system.

But what does that mean and what might come next?

Well, first, nobody knows that, and those who claim they do are simply liars. Period.

Furthermore, there’s obviously a lot of hype and FOMO right now, which is really worrying. Correction should be inevitable and the small players will be the ones to be hit the hardest.

Finally, Elon put a final nail in the coffin:

Wherever you invest, invest responsibly. Merry Christmas everyone!🎅🏾

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀