A Wise pitch deck that led to London’s biggest and most successful direct listing ever

Wise is among Europe's most successful FinTechs currently worth over $11 billion in the public markets. This is the pitch deck that helped them raise $1 million in early 2011.

Wise (ex-TransferWise) is a name that goes way further than just the financial technology industry. Founded by Estonian entrepreneurs Kristo Käärmann and Taavet Hinrikus in early 2011, it has managed to build one of the most recognized and strongest brands in the international payments space.

Wise is an amazing European (FinTech) success story you just can’t ignore.

Started with a simple and compelling product, yet with global ambitions from day one. Always putting their customers first and sustaining a marathon-like focus.

Beginning with international transfers only, Wise now supports both personal and business (multicurrency) accounts, issues cards, does direct debits, soon will launch stock trading, among other things, which effectively puts them closer to a challenger bank.

The unusual thing about Wise though is that it has been profitable since 2017, while in 2021 it doubled profits to $42.7 million with revenues climbing 39% to hit $580 million. Their latest earnings published 2 weeks ago further solidify their performance showing almost 4 million customers and reporting revenue of $182.97M in the second quarter alone, a rise of 25% year-over-year.

The firm opted to list in London via a direct listing earlier this year, a rare method of going public pioneered by Spotify in 2018. At an $11 billion valuation, Wise became London’s biggest and most successful direct listing ever.

Having that in mind, I invite you to take a step back and a look at how everything started. Below is the breakdown of the original deck used by Kristo Käärmann and Taavet Hinrikus to raise $1,000,000 of seed capital in 2011 (Wise has raised over $1.3 billion in venture capital before going public).

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter if you haven’t done so yet (I’m talking about Premium here!👀). You will get a daily newsletter on all things where Finance meets Technology. It’s the only newsletter you need to connect the dots in FinTech, and more!

The Pitch Deck

According to Y Combinator, the ultimate goal of every pitch deck is that it has to be clear and concise. Therefore, the founders should always focus on the narrative and compelling story making it clear and simple as well as very brief so you could get the investors hooked instead of lost.

We can find it all in Wise’s pitch deck.

Title Slide

The purpose of the title slide is to outline the name of your company and give a one-line description of what it does. Moreover, this is the only place in the deck where you can only have 1 slide for what you need to show.

Wise checks all the boxes here. It has the company name along with the logo as well as a 3-word description of what it does.

As you can see, Wise’s original pitch was that it positioned itself as a peer-to-peer currency exchange. What’s even crazier here is that given Hinrikus' previous early role at Skype, the startup was even cleverly marketed as the Skype for currency exchange.

The P2P part was largely unchecked and the pitch clearly was selling.

The quick takeaway here: you can fake it until you pivot, but you have to be very careful and not comprise trust. Because trust is super crucial in the early days.

Problem & Solution

It is usually advised to have the problem and the solution on separate slides. Yet, when both the problem and the solution are clear, you can just cut to the chase.

This is exactly what Wise did on the 2nd slide.

It’s important to note though that back in 2011, people were mostly sending money abroad either via money transfer behemoths like Western Union or via their bank. It was exactly the latter that Wise had its focus on highlighting high fees and hefty margins imposed by the banks.

As a solution, Wise offered to exchange currency with peers at the mid-market rate and charge a simple flat-rate fee of £1.

Obviously, despite the fact that the message was good and simple, Hinrikus himself admitted it worked only while the startup capped transfers at £2,000. It has since been replaced by a low percentage fee, depending on the currency.

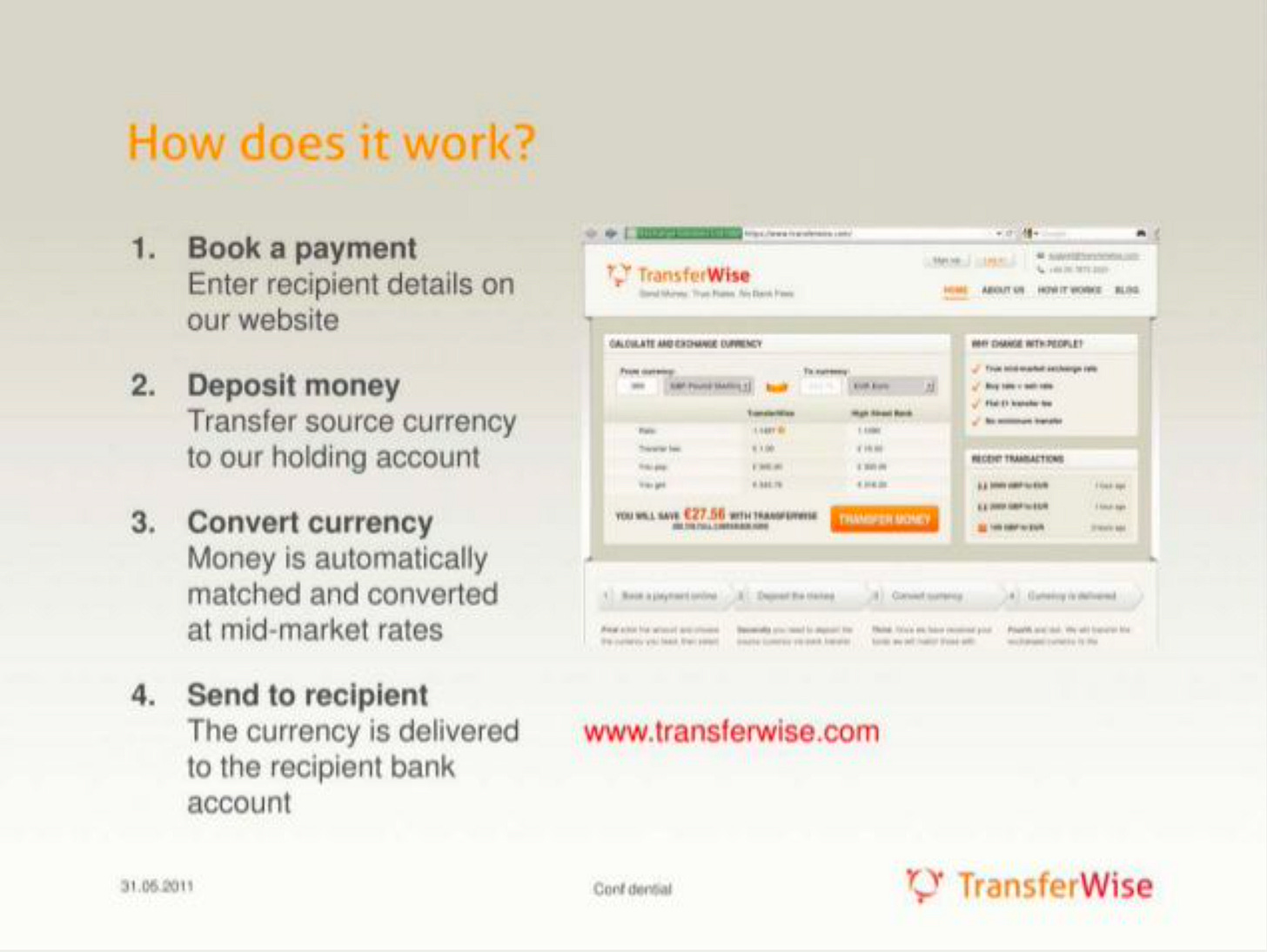

The Solution. Again.

To better explain how Wise works, slide 3 is used. In just 4 steps, it’s crystal clear what their product is all about.

More importantly, this slide showcases the actual product, which is a brilliant way to show that the company has a live and usable product already.

Something interesting to note here. In an interview, Hinrikus said that none of the processes were automated back then. Instead, every evening co-founder Kristo Kaarmann would record each pending transfer in a spreadsheet and move the funds manually.

"Yes we started off all manual and that is the right way to test if stuff works, obviously once you hit volumes you've got to be quick in automating," says Hinrikus.

So the big takeaway here is this: you should be doing unscalable things to scale.

Traction

It is very important to show off your traction if you have it. And if you do, you must make sure the numbers are clear and meaningful.

Wise does that very well in their 4th slide.

Over $1M sent via Wise in just a couple of months after the launch and 20% growth in new monthly paying users is a brilliant illustration of the product/market fit. More importantly, it has been achieved with $0 spent on marketing. And organic growth is always the best as it shows a real demand for the product.

Furthermore, considering that Wise was charging its customers from Day 1, the provided metrics become even more powerful, showing strong engagement and further solidifying the revenue potential.

Add it all up, and you have a classic FOMO (fear of missing out). And that’s exactly what every startup should strive for when it comes to fundraising.

Roadmap

Slide 5 TransferWise dedicated to the roadmap. While it’s not usually part of the traditional decks, having a roadmap shows that you have a clear vision and know-how to achieve it.

Having such traction while just scratching the surface is a subtle way to bring back FOMO and get investors excited. Again.

On a side note, it’s crazy that in mid-2021, Wise was already thinking about APIs…

Competition

It’s imperative to know who’s in the game with you, who is your competition.

There were quite a few players in 2011 already, while today the space is even more crowded. Yet, the incumbent banks still hold a large share of the money exchange market, not to mention the likes of Western Union or retail FX brokers. So the industry still remains ripe for disruption.

In front of all the competition, Wise has managed to build one of the best brands in the business. Despite it took them 9-10 years, it’s still a pretty impressive achievement.

Team

The team is critical. You should not only list your team members but also talk about what makes your team particularly well suited to solving the problem. Most importantly, this should be about the founders. Nobody cares about your advisors.

At the time of TransferWise's seed fundraising, the team was just six people. But they were already experienced and hence could be trusted to get the job done (which they did perfectly!).

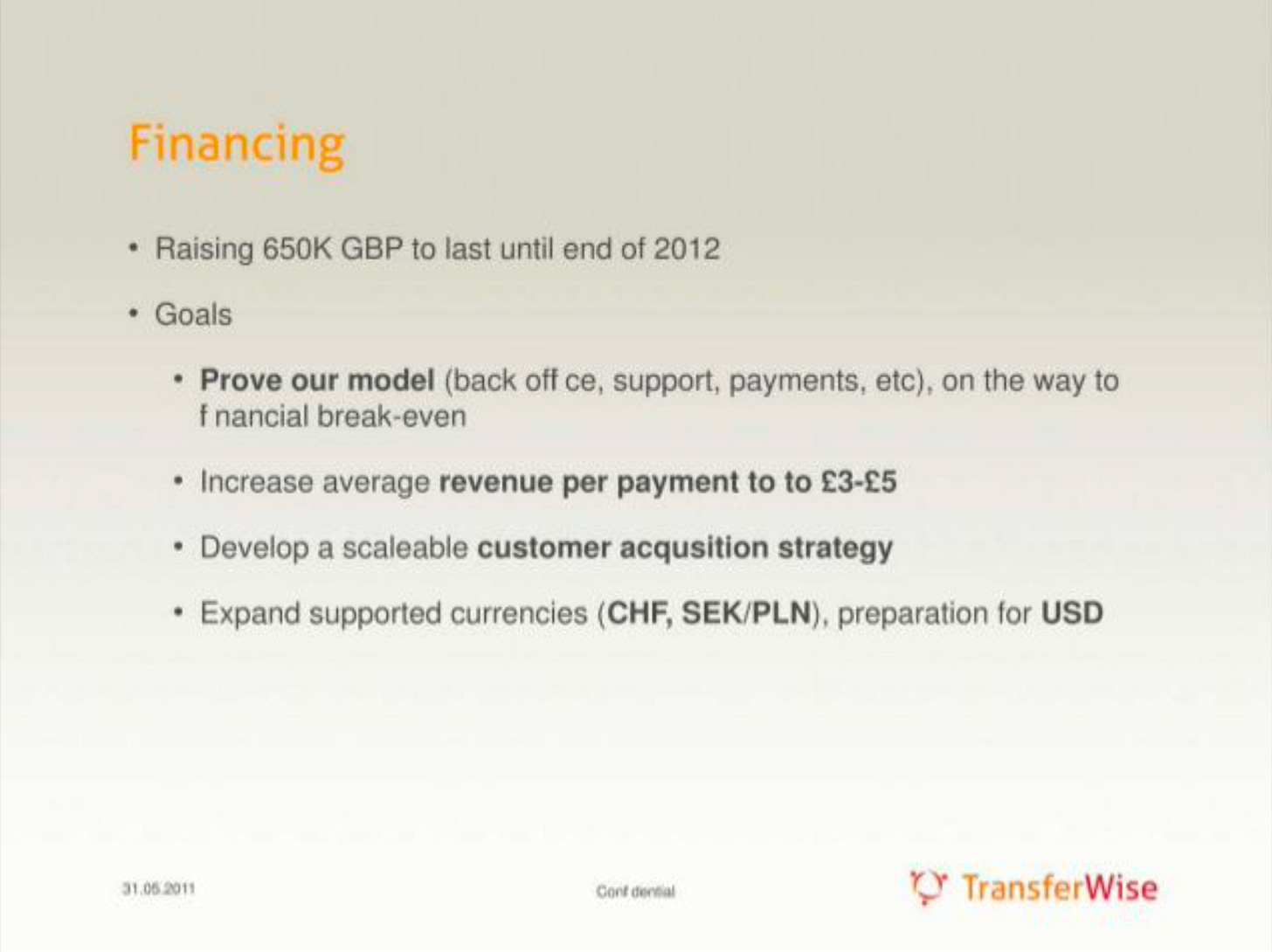

What do you need

One of the last slides in your pitch deck is often the Money Slide, aka telling the investors how much money you need, and what it gets you.

You will get bonus points if you can lay out where you’ll be inside of a year, which should make you Series A ready - and that’s super powerful (!).

It must be noted that TransferWise was targeting seed funding of around $1M based on the exchange rate of the day. Founders later admitted that this was on the high side and possibly contributed to the difficulty they had closing it.

Up until that point, the startup had been funded by about £25k of the co-founder’s own cash, and small pre-seed funding from Seedcamp, who were bullish on the burgeoning company (it definitely paid off later on).

Lessons

There’s a lot we can learn from Wise’s early pitch deck but these 5 things are arguably the most important ones:

First and foremost, pitch decks are all about the narrative. Focus on telling a compelling story and make it both clear and concise. Use analogies where possible and share numbers if you have them.

Understand your business model well, but don’t focus on it too much as you can always pivot.

Do unscalable things to scale.

Create FOMO so that investors would be so excited they couldn’t do anything else but invest in your business.

The Team is crucial. Focus not only on having the best team members possible but also on those that are particularly well suited to solving your problem.

It took Wise 10 years and $1.3 billion+ in venture capital to come to where it is today, which is one of the most recognized and strongest brands in the international payment space.

But everything started with a simple idea and an 8-page pitch deck.

Think about that for a second the next time you will be considering launching something yourself.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀

That was a very interesting read!

Awesome write up! Thanks.