Square's coming for your BNPL business in UK🇬🇧. Here's why it matters 💸; Web3 credit scores can supercharge DeFi 🚀; Malaysia's first Super App could be the most revolutionary app in the region 📲

Good Morning FinTech, 25 August

Good day Everyone,

And happy Thursday! Yesterday’s issue was hot but today’s is probably the most impactful one this month so far. We will be looking at Square which is coming for your BNPL business in the UK (& why ecosystems and BNPL strategy is a must in FinTech), Web3 credit scores that can supercharge DeFi (it can be a game changer!), and Malaysia's first Super App which might be the most revolutionary app in the region (we haven’t seen this ever before). So let’s jump straight into the hot stuff:

Square is coming for your BNPL business in the UK🇬🇧. Here's why it matters 💸

The launch 🚀 After launching in the US and Australia, Blocks’s SQ 0.00%↑ Square is bringing BNPL to the UK across all platforms.

More on this 👉 A year on from its acquisition of Clearpay (known as Afterpay outside the UK and Europe), Square is launching its first integration: Buy Now, Pay Later.

In a massive move for the company since the UK will be the first market to launch BNPL across all platforms, both online and in stores, at the same time, and it can be integrated by Square’s developers and partners.

The USP 🥊 Customers making payments through Square will now be able to pay in four interest-free instalments over a six-week period while merchants still get paid in full, upfront.

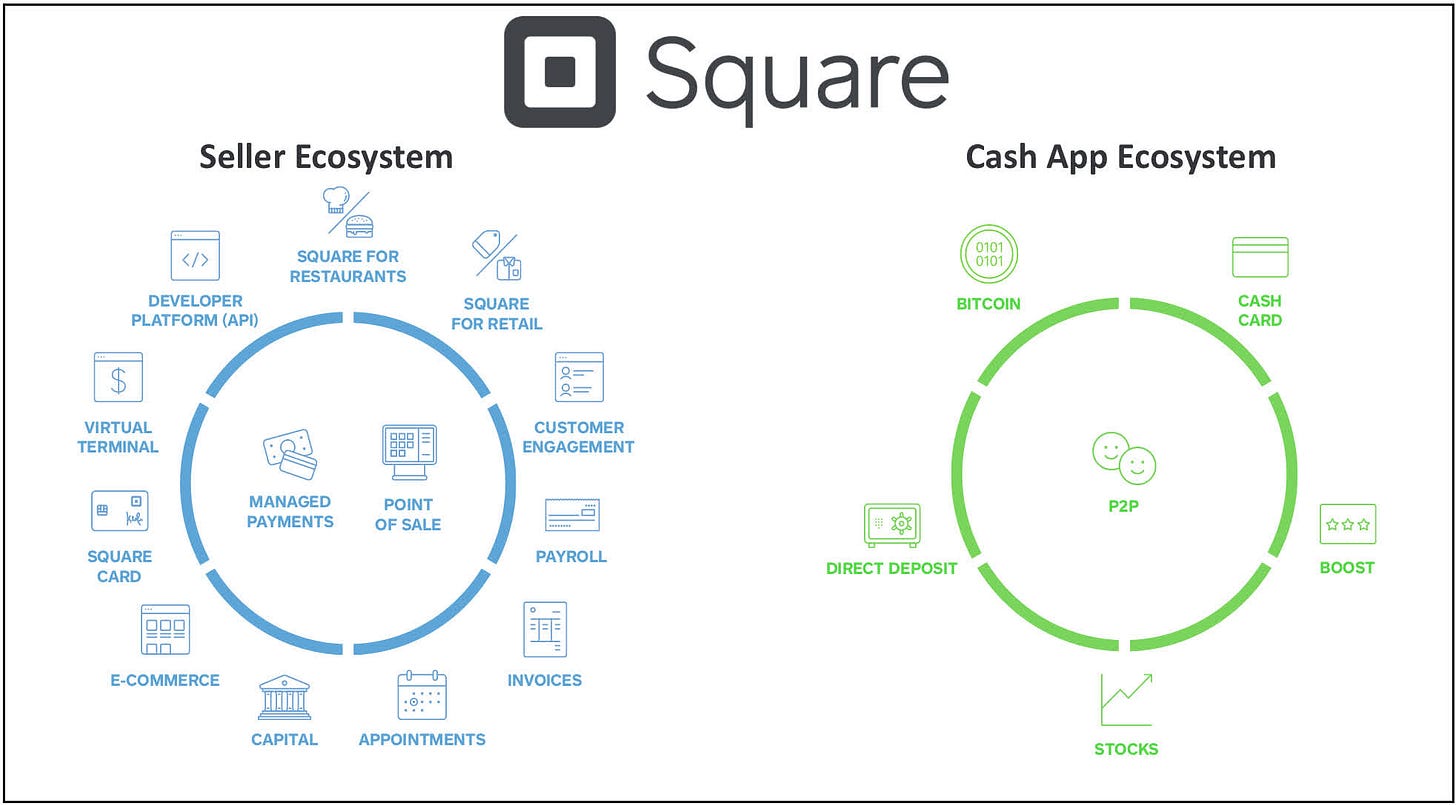

Why is this important? 🤔 It’s yet another reminder about the importance of ecosystems in FinTech and yet another nudge that every FinTech must have a BNPL strategy. But there’s more to that, so here’s the takeaway: