The FTX story is getting wilder and wilder 🤯; Genesis' fight for survival, or incoming Crypto Armageddon 😳; Over 50% of Bitcoin Addresses are now at a loss 😤

FinTech is Eating the World, 28 November

Hey Everyone,

And happy Monday! Today’s issue is super hot and full of spices 🌶 We’re looking at the FTX story that is getting wilder and wilder (again!), Genesis' fight for survival, or incoming Crypto Armageddon (this is very terrifying), and Bitcoin addresses where over 50% of them are now at a loss (& what this means + a super insightful bonus read) Let’s jump straight into the hot stuff:

The FTX story is getting wilder and wilder 🤯

More. And more… 🐇 The FTX story just never stops giving. It’s a maze and a rabbit hole at the same time but it’s too important to be left behind. Let’s take a look at some more shocking things that were recently discovered.

More on this 👉 Here’s what you need to know:

First, a gentle reminder - FTX’s Sam Bankman-Fried cashed out $300M personally during a $420.69M raise from 69 investors, as per WSJ. Just like that 🌪

Another refresher - in February 2022, the Chairman of the Federal Reserve, Jerome Powell met with Sam Bankman-Fried in an hour-long meeting. I guess they discussed interest rates? :)

Sam Bankman-Fried and FTX executives donated $70M to US politicians for midterm elections, weeks before filing for bankruptcy, Bloomberg reports.

Here’s an informative chart showing the global distribution of FTX customers (interestingly, only 2% of them were from the US):

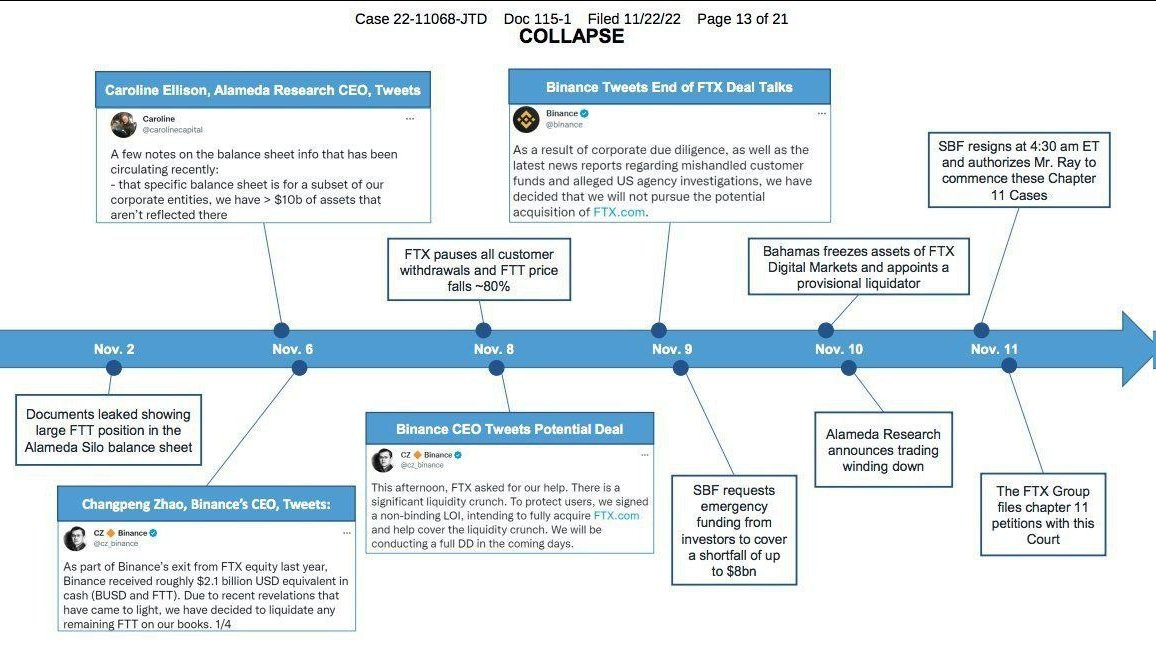

A chronological roadmap of the FTX collapse (it took only 9 days!):

Golden State Warriors face a class-action lawsuit from non-US customers for promoting FTX. An FTX customer who claimed he lost $750,000 after the exchange went bankrupt has filed a lawsuit against the NBA's GSW based on the team promoting the allegedly fraudulent crypto exchange, according to a Reuters report. Even NBA advertised it:

Alameda withdrew over $1.5B from FTX from October 20 to November 2. What’s more, Alameda reportedly withdrew $204M ahead of bankruptcy filing (as per Arkham Intelligence). It seems almost as if they knew what was coming…

8 congressmen tried to stop the SEC’s inquiry into FTX back in March. 5 out of 8 received donations from SBF and FTX from $2,900 to $11,600. Their name and signatures:

CEO of Alameda Research, Caroline Ellison has fled from Hong Kong🇭🇰 to Dubai🇦🇪. I wonder why… :)

Gabe Bankman-Fried — younger brother of SBF — purchased a $3.3M Capitol Hill townhouse in April. The deal was made through Gabe's nonprofit, Guarding Against Pandemics. The organization, aimed at preventing another pandemic, was partly funded by SBF. The move to the US capital was meant to send the message that the FTX founder "and his network were in DC to stay," according to a report from Puck. Just one week before FTX's collapse, Guarding Against Pandemics hosted back-to-back cocktail parties for high-ranking Democrats and Republicans, the New York Post reported. This is the house:

But this is where things get really wild - FTX owned an $11.5M stake in a tiny rural bank in Washington state with just 3 employees. Farmington State Bank in the state of Washington (Farmington is a town of just 146 people), now renamed Moonstone, is the 26th smallest bank in the US — with a single branch and three employees. This is the bank:

FTX invested in the rural bank through its now-bankrupt sister company, Alameda, with an investment of $11.5M (for 10% of the bank) in its parent company FBH in March 2022. The Alameda investment was more than double the bank’s value of $5.7M, reported The New York Times. To put this into perspective - FTX’s investment valued the bank at $115M. Yet, it only had $10M in customer deposits 😳

Why did they do that? 🤔 Well, FTX’s ownership in Moonstone was mainly because they could bypass the requirements of owning a banking license in the US, which is actually a super complex task. That said, money laundering appears to have been FTX’s actual stock in trade 💸

With the bankruptcy procedures in place, Moonstone will continue to operate with its own team, but FTX’s 10% bank will be included in the bankruptcy proceedings and will likely be sold to another party to pay back FTX creditors.

✈️ THE TAKEAWAY

FTX Bad^2 🥶 FTX was supposedly worth $32 billion, it was backed by top-tier venture capital firms and grew into one of the biggest exchanges in the world. Yet, now it’s clear that it was nothing more than a Ponzi. What is worrying is that Tether, the biggest stablecoin issuer, is also somehow connected to the tiny little bank FTX invested in. The fact that regulators allowed this to happen is a complete failure of the oversight mechanism. More importantly, the trust and integrity (as much as it had such a thing) of the crypto industry has been severely comprised.

In case you missed it: FTX is much worse than anyone imagined 🤯🤯🤯

The aftermath of the FTX collapse could be bigger than the earthquake 🌋

Contagion of contagion, or how Genesis could cause Crypto Armageddon 😳