FTX Drama goes Big 🤯; How to build a Super App the Korean Way🇰🇷; Core Scientific is a perfect mirror for crypto in 2022🪞

FinTech is Eating the World, 23 December

Hey Everyone,

Happy Friday & welcome to the last daily newsletter issue in 2022! I’m taking the rest of the year off but don’t worry - there will be some special issues coming out until we meet again in the first week of 2023 🥂 Here’s one you might have missed already:

Top FinTech stories of 2022, a year like no other 🌊

And for today, there’s something really juicy! We’re looking at the FTX Drama that goes Big (I can’t believe it, honestly), see how to build a Super App the Korean Way (the greatest pivot in FinTech history?), and Core Scientific, which is a perfect mirror for crypto in 2022 (a perfect wrap 🌯). Let’s jump straight into the awesome stuff:

FTX Drama goes Big 🤯

The news 🗞 Just when I thought we were done with the FTX and there will be no new major developments this year, it hit us again. So let’s take a final recap of the latest moves in the FTX drama.

More on this 👉 Here are the key new revelations you must know and cannot miss:

It’s all connected 🕸 Alameda Research had invested a total of $400M into a company called Modulo Capital. Though this amounted to one of Bankman-Fried’s largest venture capital bets, Modulo’s identity was a mystery. It now appears it was a multi-strategy hedge fund founded early this year by 2 former Jane Street traders and one developer, a person familiar with the matter told CoinDesk. For context, Jane Street is a New York-based proprietary trading firm where Bankman-Fried and Ellison worked prior to making it big in the crypto industry. Bankman-Fried was known to hire former Jane Street employees as executives or employees, including former FTX US President Brett Harrison. The crazy part? Modulo was based in the Bahamas and operated from Albany, the same luxury condominium where SNF, FTX, and Alameda employees resided. You can’t make this up 🤦

Cash-rich? 🤑 FTX’s new management told a procedural hearing on Tuesday that it had over $1B in assets identified. The company located about $720M in cash assets, which the exchange has yet to consolidate, in U.S. financial institutions authorized to hold funds by the U.S. Department of Justice. Another nearly $500M is already being held in U.S. institutions. Well, at least some creditors will be paid back…

Fake money 👀 FTX used its own token, FTT, to fund the $84M purchase of a majority stake in the trading platform Blockfolio in 2020, Bloomberg reported. Around 94% of the amount was in the token invented by FTX, according to the report, which cited financial documents. The deal gave FTX a 52% stake in the trading platform. That tells all you need to know about this Ponzi 🤡

Guilty 🫡 Two of SBF's closest business associates have pleaded guilty to federal fraud charges — and are now cooperating with the Department of Justice's investigation. Caroline Ellison is the former CEO of Alameda Research — FTX's sister trading firm — which has been accused of misusing billions of dollars in customer funds. And Gary Wang is the co-founder of the now-bankrupt exchange. Ellison has pleaded guilty to two counts of wire fraud — as well as five counts of conspiracy to commit wire fraud, securities fraud, and commodities fraud. The total maximum sentence she could face for these charges is 110 years in prison. Wang has pleaded guilty to one count of wire fraud and three counts of conspiracy to commit wire fraud, securities fraud, and commodities fraud — all of which could carry a total maximum sentence of 50 years. Both have signed a document pledging to "truthfully and completely disclose all information concerning all matters" to the U.S. attorney, the FBI, and agencies. The U.S. Securities and Exchange Commission has also charged Ellison and Wang for their roles in a "multi-year scheme to defraud equity investors in FTX."

Walking away again? 🤯 SBF was extradited from the Bahamas and appeared in U.S. federal court in New York on Thursday. Just while everyone was thinking justice will finally be served…

the former CEO of FTX was told he can live with his parents on $250 million bail secured by their Palo Alto house 🤷♂️ It’s important to note that neither Bankman-Fried nor his parents were required to put up the full amount of the bond. It is sufficient to secure a bond with assets amounting to 10% of the total bond amount. Nevertheless, $25M is still a solid sum. Could be returned to defrauded customers…

What’s interesting here is that Stanford is listed as an owner of the house pledged for SBF's $250M bond. I guess everyone has to work for the common good, right?

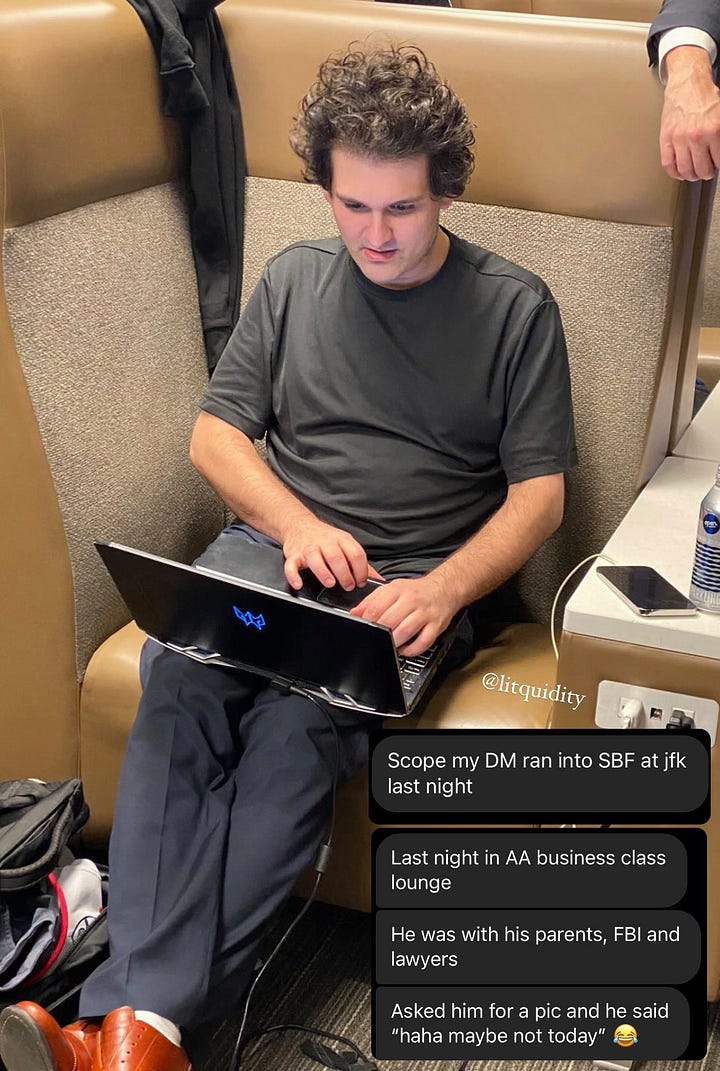

Flying home for Christmas🎄 Shortly after that, SBF was spotted at JFK airport last night in the AA Business Class lounge:

And now he’s flying home for Christmas first class after stealing $10 billion. SBF is the ultimate Crypto Grinch.

✈️ THE TAKEAWAY

Will this ever end? 🤔 It’s hard to say anything else beyond all that was said already. 2022 will definitely go down in history as the year of fraud (remember Terra, Celcius, 3AC…), and FTX will be the king of it all. What’s happening with SBF right now does not make any sense but I do believe that justice will be served. It has to be.

Go deeper and learn more: The FTX story just keeps getting crazier 😳 (+5 bonus reads)