Top FinTech stories of 2022, a year like no other 🌊

"You can't connect the dots looking forward. You can only connect them looking backward" - Steve Jobs

👋 Hey, Linas here! Welcome to the first of several special issues of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 100k+ FinTech leaders:

The financial technology industry is constantly evolving and throughout the years it has definitely changed the world and the way we interact with banks, consume, spend our money and do business. 2022 has undoubtedly been a year like no other, and we could argue that it’s not FinTech that changed the world but the world that has transformed FinTech.

Was it for the better or worse? I invite you to read this reflection of mine and connect the dots yourself.

Below are the top FinTech stories of 2022, the moments that define the whole year. Looking back at the highlights and lowlights of the world of finance and technology provides you with lots of lessons and food for thought. This year, I learned a lot. I hope you did (or will - after reading this) too.

#1 FTX fraud

FTX story is far from over. It’s still happening and new things are being revealed almost every other day. But what is clear by now is that FTX is probably the biggest fraud case we have ever seen that pushes even Enron and Bernie Maddoff to the sidelines. The implications of this will definitely be felt even in 2023. Go deeper and learn more here:

The FTX story just keeps getting crazier 😳 (followed by 5+ bonus reads)

#2 The rise and fall of Klarna

Swedish🇸🇪 Buy Now, Pay Later aka BNPL pioneer Klarna going from $46 billion to $6.5 billion is probably the biggest valuation collapse (discounting the FTX going to $0 since it was a fraud from Day 1) the private markets have ever seen and the ultimate illustration of how brutal 2022 was for startups. This serves as a cautionary tale for all startups with inflated valuations, weak fundamentals, and questionable strategies. It's time to reassess and prepare for the hard times ahead. 2023 might not be easy. Go deeper and learn more here:

Klarnageddon begins as Klarna will lose 85% of its valuation with the fresh funding 🤯

Will becoming a Super App save Klarna? 🤔

#3 The Fast Failure of Fast

One-click checkout provider Fast is undoubtedly one of the most insane FinTech stories in Silicon Valley to date. In fact, it might be one of the craziest startup stories in the whole world, surpassed only by Elizabeth Holmes-led Theranos.

Despite having raised a whopping $125 million in just 3 years from a number of prominent VCs, including FinTech giant Stripe (which led both their Series A & Series B), being one of the hottest FinTech startups in payments, and even standing close to becoming a unicorn, Fast failed miserably. Go deeper and learn more here:

Too fast, too luxurious: lessons from the failure of Stripe-backed Fast

The Faster You Rise, the Faster you Fail: Fast's Pitch Deck Teardown 💳

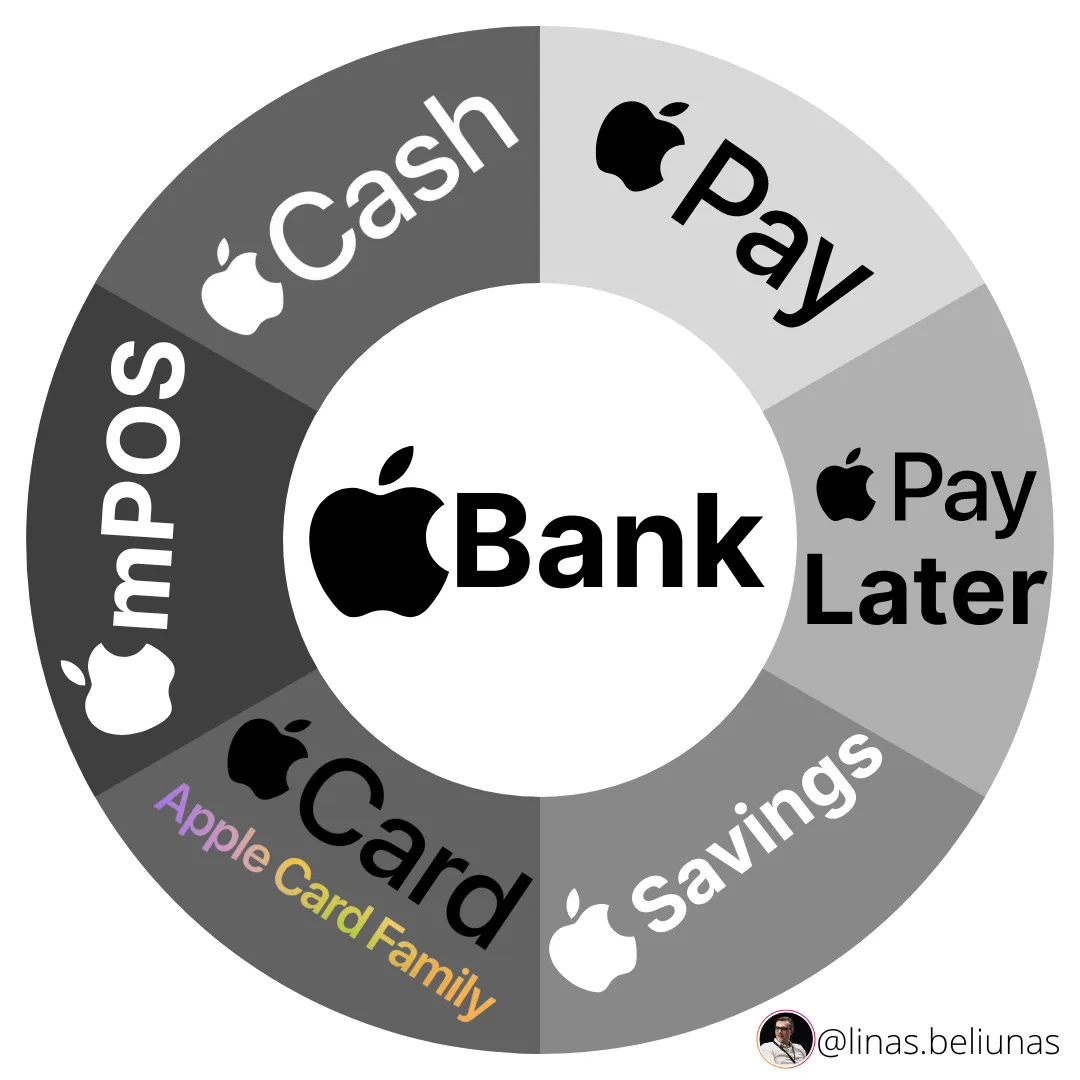

#4 Apple Bank

The tech giant announced a new account for the Apple Card that will allow users to save and grow their rewards in a Savings account from Goldman Sachs GS 0.00%↑. This move is yet another stepping stone for Apple AAPL 0.00%↑ on its way to becoming the largest bank in the world. While it might not become a bank in the conventional sense of the term just yet, it’s clear that the tech heavyweight wants you to get your everyday banking from Apple, NOT your bank. Go deeper and learn more here:

Welcome to Apple Bank - your everyday Banking from Apple, NOT a Bank 🍎🏦 (+1 bonus read)

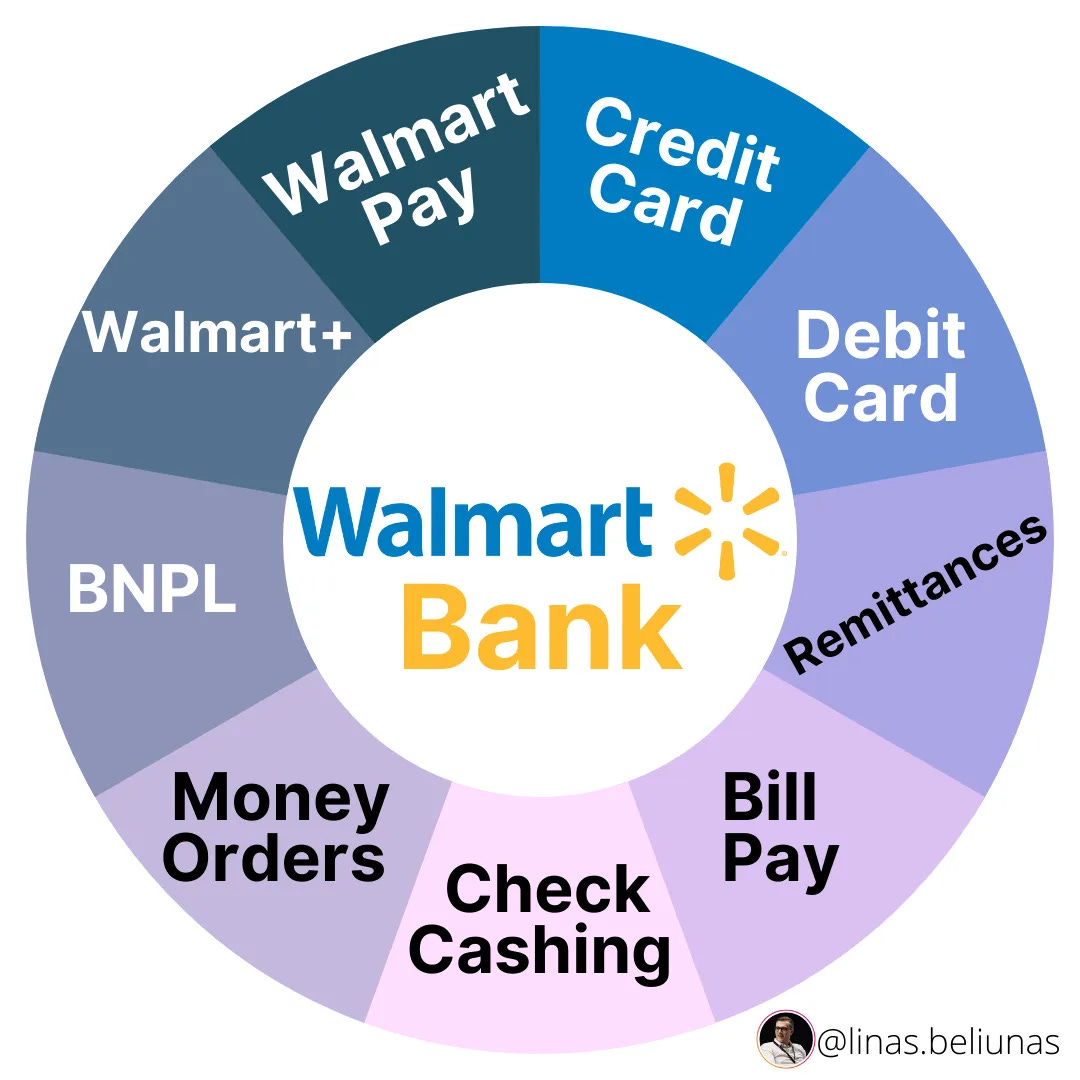

#5 Walmart Bank

Retail giant Walmart WMT 0.00%↑ is going deeper into FinTech and bringing its Buy Now, Pay Later (BNPL) product in-house. This development not only allows the retail giant to bring more revenues from its BNPL (=lending) activities, grab a bigger market share and capitalize on the growing BNPL interest. More importantly, it ties in very nicely with their long-term vision - the Walmart Bank 🏦 The most interesting thing? This seems to be only one part of the story as Walmart’s ultimate goal is to build a Super App. Given the retail giant has everything to build the first Super App of the West, it’s definitely one of the things we should be watching in 2023 and beyond. Go deeper and learn more here:

Walmart is building a Super App than can change FinTech forever 📲 (+1 bonus read)

#6 Softbank collapse

Softbank, which once was one of the most active FinTech investors, lost at least ~$50 billion this year. All their gains since 2017 have now been wiped out. That said, SoftBank is probably the largest example of companies struggling with the economic downturn after flourishing in 2021. More importantly, given how widespread its tentacles are, it’s a good illustration of the market itself. The market cycle has changed and it took SoftBank with it. Go deeper and learn more here:

SoftBank is an elephant that keeps falling over 🐘

#7 JPMorgan dominating FinTech

If you’re an active reader of my newsletter, you know that US banking giant J.P. Morgan JPM 0.00%↑ just this week has acquired 48.5% of Greece-based FinTech startup Viva Wallet for $800+ million after a lengthy procedure that lasted months. But it’s only the tip of the iceberg. JPMorgan’s FinTech strategy has been pretty badass. In fact, we could argue that the banking giant is winning the innovation game in financial services. Go deeper and learn more here:

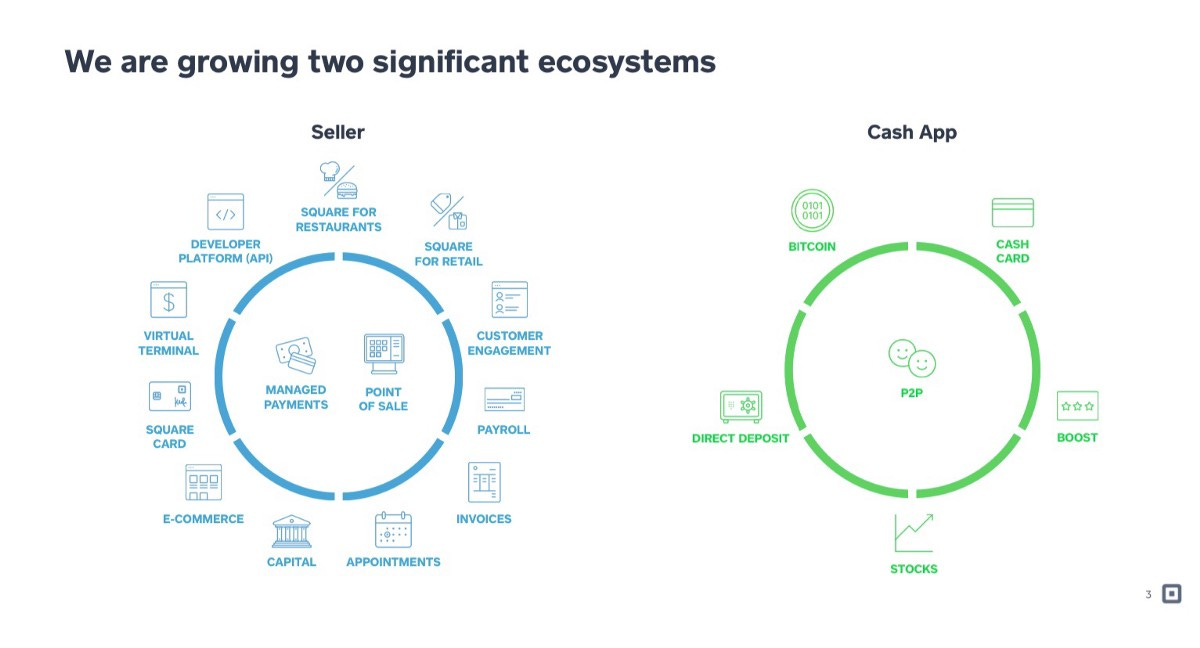

#8 Cash App and its massive potential

Block’s SQ 0.00%↑ Cash App is not only a perfect illustration of why ecosystems matter in FinTech. It is also one of those few FinTech gems that still has lots of potentials. And in 2022 they have been doubling down on it quite well. I expect much more from them in 2023. Go deeper and learn more here:

Cash App (NOT Revolut) could become the New PayPal 🚀 (+3 bonus reads)

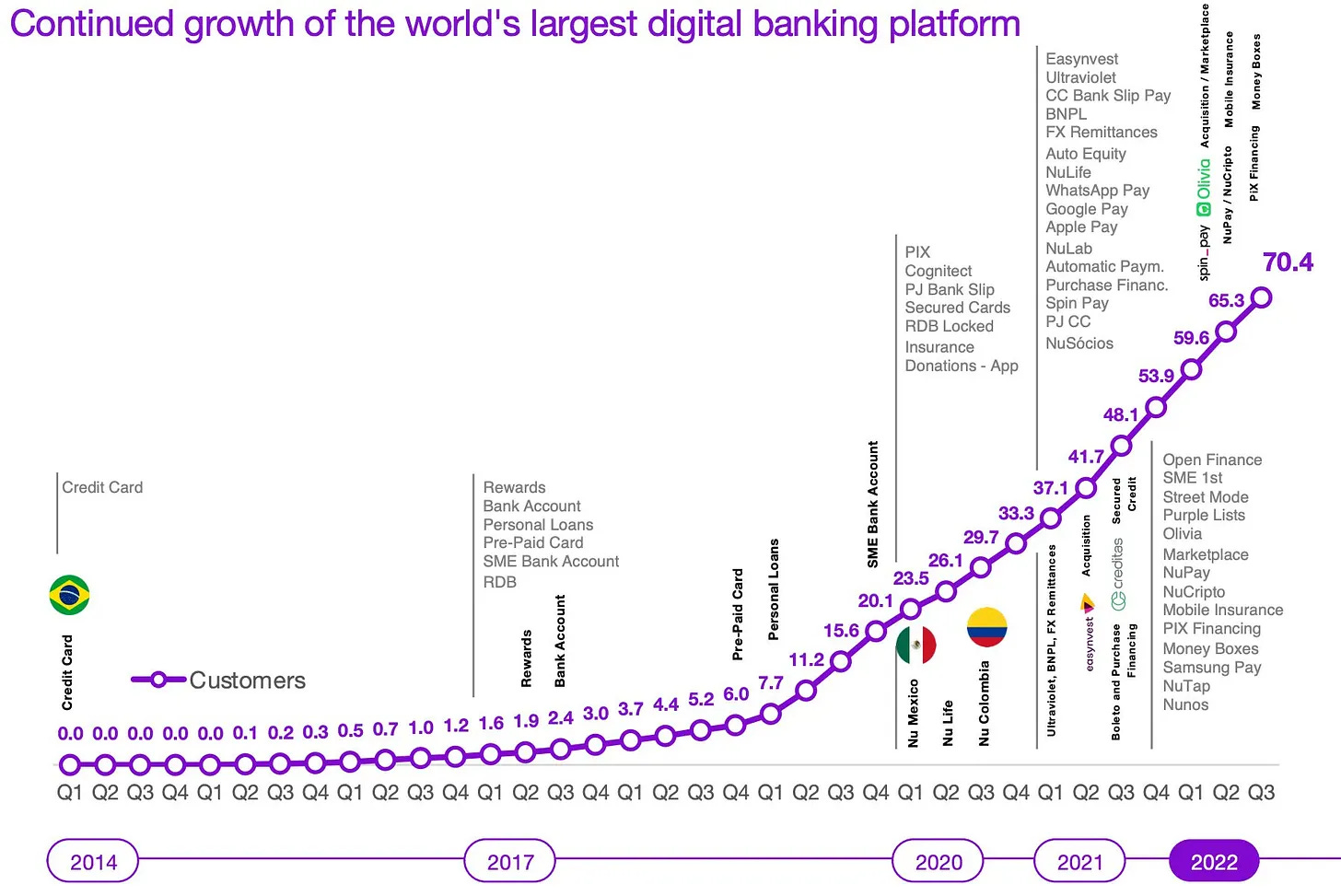

#9 Nubank that keeps crushing it

Brazilian FinTech gem Nubank NU 0.00%↑ recently posted another quarter of record-breaking revenues in Q3, helping the LatAm neobank reverse widening losses to turn a profit (which is still very rare in FinTech). Not only it's a brilliant illustration that Nubank found a perfect product/market fit and it found it very early. More importantly, it's a case study on how FinTech (and maybe soon - Super Apps?) should be done. Go deeper and learn more here:

The future is purple. Nubank Purple 💜 (+2 bonus reads)

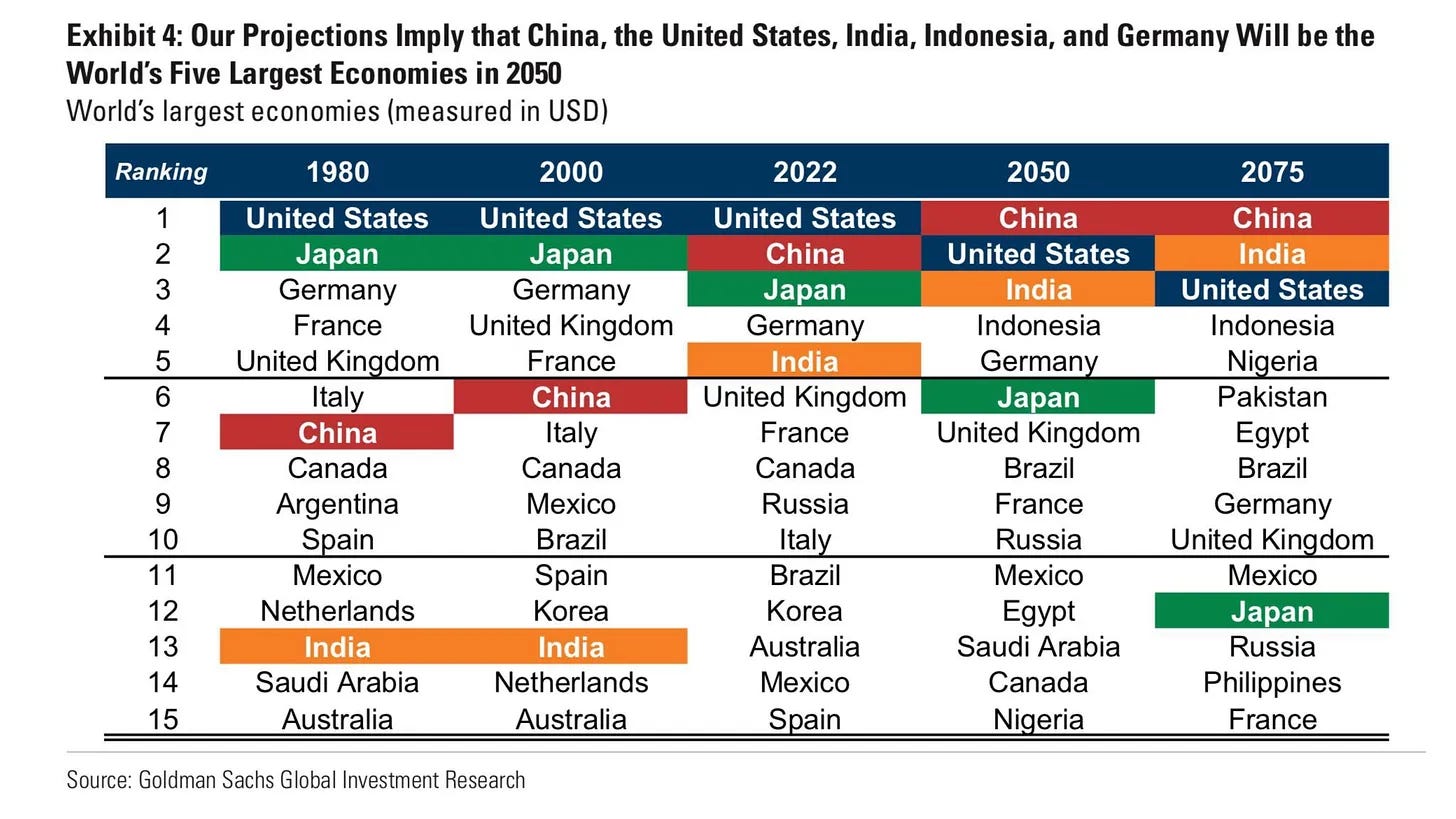

#10 Africa

I said this numerous times and I must repeat it again - Africa is the Next BIG thing. In FinTech and the world. Although still very few get this, Visa V 0.00%↑ which pledged to invest as much as $1 billion in Africa over the next 5 years to accelerate the deployment of digital payments across the continent, seems to be amongst those that fortunately do. If you aren’t doing this too, tomorrow might be too late. Go deeper and learn more here:

Visa knows that Africa is the world's next superpower. You should pay attention too💡

Africa will be the driving force for cryptocurrency adoption globally 🚀

And that’s a wrap. 2022 was a crazy year in FinTech. Let’s see what madness 2023 will bring 🥂

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

Nice summary, thanks!