The ripple effects of Silicon Valley Bank collapse 🌊; The push for BNPL regulation is just one click away👨🏻⚖️; Web3 Super App? 🤨

FinTech is Eating the World, 14 March

Hey Everyone,

Happy Wednesday! After a short break we’re back with a bang 💥 Today’s issue is the best one yet as we’re looking at the ripple effects of the Silicon Valley Bank collapse (biggest winners & losers, lessons to learn & what’s next), BNPL regulation, which is just one click away (what it means and which one company can win big time here), and a new (first?) Web3 Super App (WTF is it?). Let’s jump straight into the hot stuff 🌶

The ripple effects of Silicon Valley Bank collapse 🌊

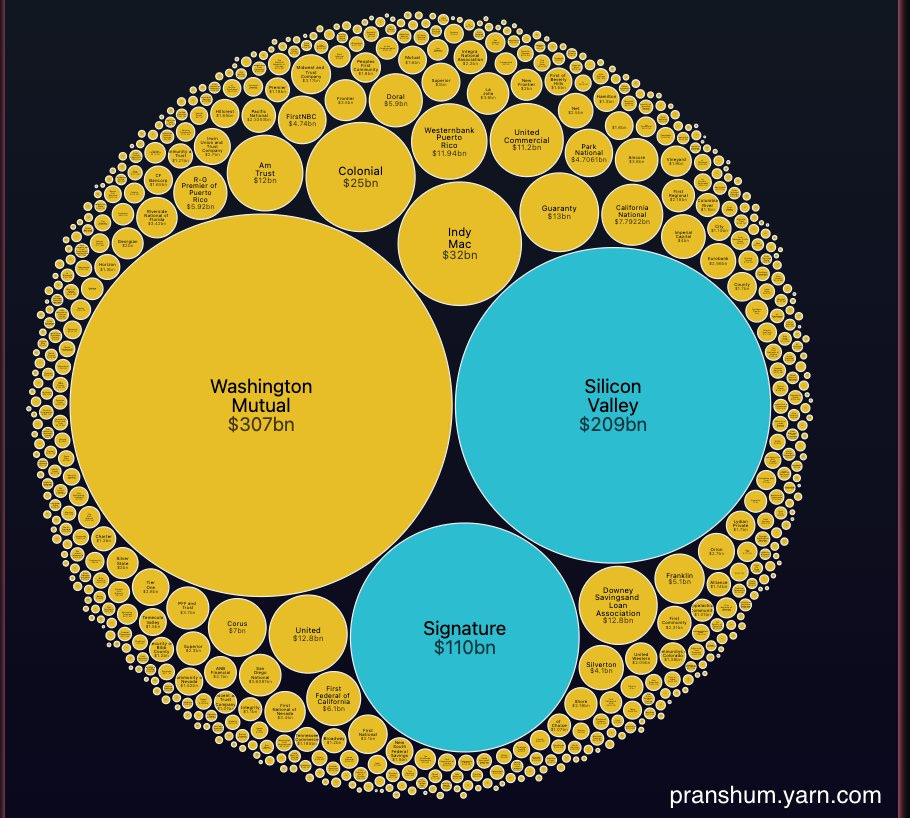

What a ride🎢 The last few weeks have been absolutely nuts for everyone in FinTech and the broader finance industry. It all began somewhat slowly with Silvergate and then everything hit at once - just over the weekend we saw the 2nd and 3rd biggest bank collapse in America since 2008. Damn 😳

Because of its size and massive impact on both startup and venture capital communities, the collapse of Silicon Valley Bank undoubtedly caused the most panic and worry. Although the regulators made the right decisions to resolve this situation, the ripple effects of SVB going under have been felt immediately and the worst part is that it might only be the very beginning.

Let’s take a look.

In case you missed it: The rise and fall of Silicon Valley Bank 🏦

Post-bail 💸 The Federal Reserve (Fed), Treasury Department, and Federal Deposit Insurance Corporation (FDIC) late Sunday rolled out emergency assistance for banks and said depositors would be made whole after the failures of Silicon Valley Bank and Signature Bank. The move was intended to calm customers worried about the safety of their uninsured deposits (remember - >90% of them were about the FDIC threshold) following the collapse of SVB.

From the first glace, that didn’t seem to work at all as on Monday, investors were still worried that some banks could experience runs like SVB. First Republic, a bank that caters to the wealthy with large account balances, closed down nearly 62% after earlier falling as much as 75% (its largest decrease on record). The KBW index also fell roughly 12%, marking its biggest drop since March 2020.

But it all changed on Tuesday. The sharpest rebounds were seen among regional banks that suffered the worst declines in recent days. First Republic shares, which crashed on Monday, rose more than 30% Tuesday. PacWest Bancorp jumped 36%, and Western Alliance was up 14%. Other regional banks posted more modest gains or turned lower in volatile afternoon trading.

The biggest banks also rose, with Wells Fargo about 3% higher and Citi up 5%. The gains helped the broader KBW Nasdaq index of commercial banks rise 2%, while the SPDR S&P Regional Banking ETF was up 3%. Both logged their worst performance since 2020 on Monday.

Zooming out 🔎 In order to really understand how big the ripple effects of this debacle are, let’s zoom out. Let’s take a look at the winners and losers of the Silicon Valley Bank collapse, outline the lessons to learn, and see what might be up next.