The rise and fall of Silicon Valley Bank 🏦

How the Startup Bank collapsed threatening to take the whole economy with it

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 130k+ FinTech leaders:

We just had the biggest bank collapse in America since 2008. And it happened because of a bank run.

As an effect, social networks and media were fuelled by panic, fear, and the unknown. And it’s totally understandable - money is a sensitive topic, especially when your own funds are at stake. But let’s cut through the noise and focus on what really matters.

Below you will find a brief history that led to the current events, a simple breakdown of SVB’s collapse, data-driven takeaways + some thoughts for the future.

Some history

This is firstly an American problem, so we have to understand the context here.

Before March 26, 2020, the US financial system was based on fractional reserve banking allowing banks to only keep a certain portion of client deposits and basically do whatever they want with the rest in order to make a profit.

Yet, on March 26, 2020, the US banking system was changed to no reserve banking allowing banks to do whatever they want with all client deposits.

Over the pandemic, demand for loans obviously dropped, therefore banks needed different ways to make money. Hence, they started buying assets with client deposits.

The biggest issue with this approach is that asset prices are volatile, while deposit amounts are fixed. Decreases in asset prices could mean banks can't satisfy client withdrawal requests.

A bank run happens when a large number of clients start withdrawing their deposits very quickly. Since banks don't hold enough deposits, they can't handle a large influx of withdrawals. This leads to banks not being able to satisfy short-term liabilities (client withdrawals).

And this now brings us to the Silicon Valley Bank.

SVB, the Startup Bank 🏦

We must remember that founded in 1983, Silicon Valley Bank was on the list of largest banks in the United States, and it was the biggest bank in Silicon Valley based on local deposits.

Silicon Valley Bank had 50% of US VC-backed startups as customers. To give you a perspective of how big this is, you must remember that there are over 130,000 VC-backed companies in the world, according to PitchBook. SVB was the key bank of 50% of them in the US. Hence, Matt Levine beautifully called it the Startup Bank.

I talked about this in greater detail last week, so below is just a quick summary that even a 5-year-old would understand:

Explicitly focusing on a thriving startup ecosystem, SVB got a lot of people's money in 2021.

Being a bank, it wanted to make more money off this money, so it bought some investments called mortgage-backed securities (MBS) with it.

This was supposed to be an easy win and make SVB more money in the future, but something unexpected happened - The Federal Reserve (Fed), which is the central bank of the United States, started raising interest rates.

This effectively made SVB's investments worth less than they used to be, so the bank lost some money.

As an effect, SVB had to sell some of its other investments to make up for the losses.

A lot of people got worried when they heard about this and started telling other people to take their money out of the bank. Social media made this spread like a wildfire causing a lot of people to panic.

This is very bad because if too many people take their money out at once, the bank might not have enough money to give everyone back their money. That’s called a bank run.

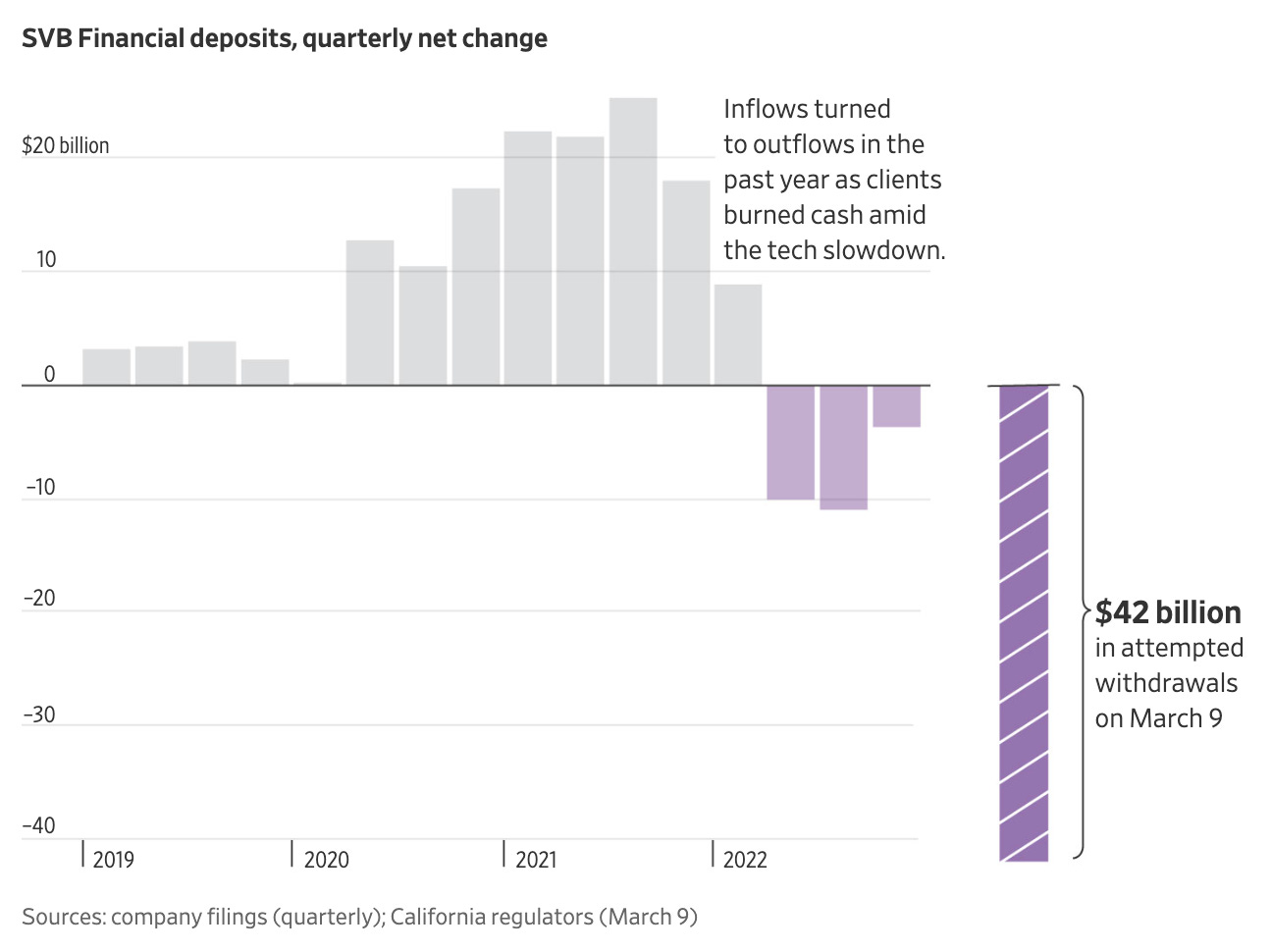

Unfortunately, that’s exactly what happened with SVB. On March 10th, $42 billion in deposits left the bank and led to a bank collapse. SVB was taken over by FDIC in the second-largest bank failure in American financial history.

Why worry? 🤔

First and foremost, one of the biggest problems was that SVB holds cash deposits of both enormous amounts of startups and some large tech companies. Here’s a recent list of companies that have disclosed exposure with Silicon Valley Bank:

As you can see, Roku, for instance, has $487 million stuck with SVB, or 26% of its cash. If this cash isn’t accessible for a long time, companies like Roku wouldn’t be able to meet short-term liabilities of their own. And this could lead to ripple effects across various industries.

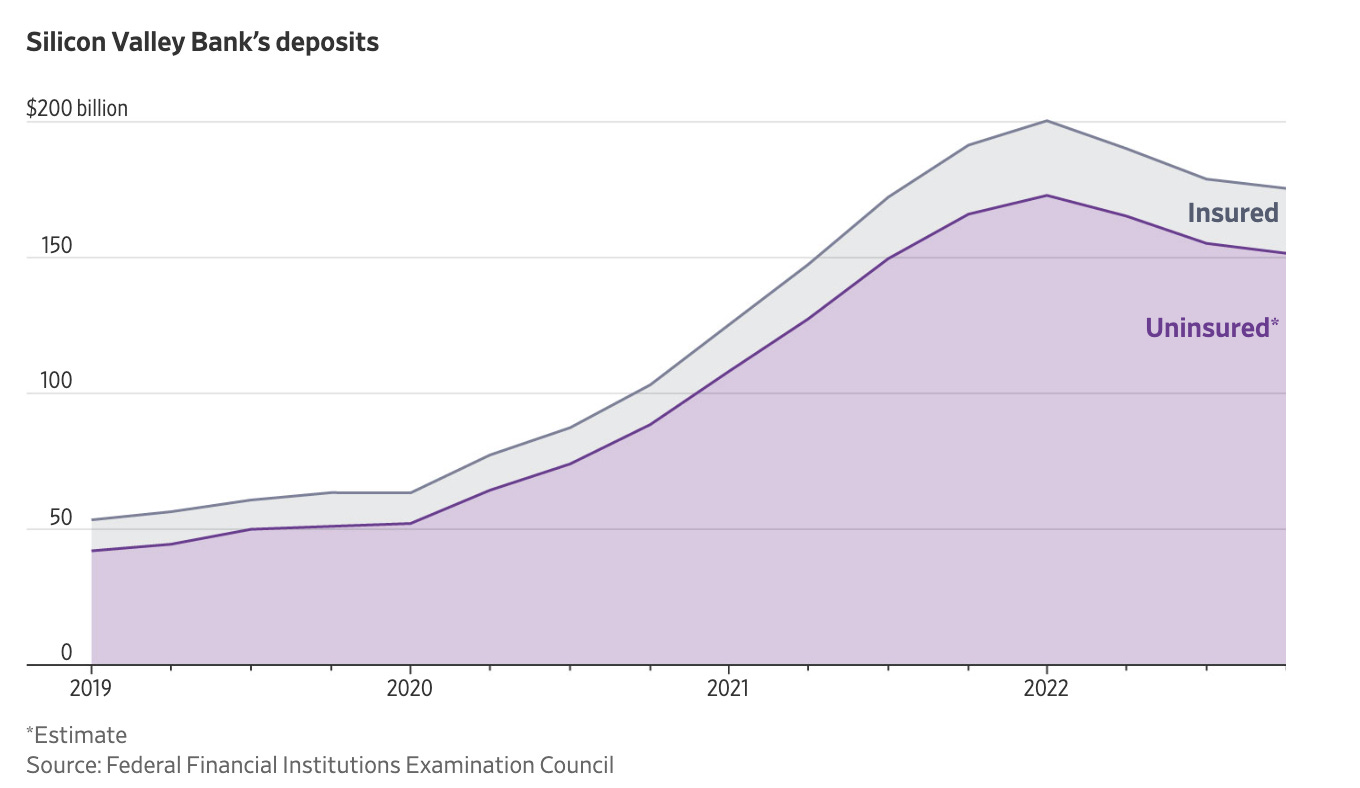

On top of that, we must remember that SVB had 50% of all the US VC-backed startups as customers and nearly $200 billion in deposits. 97% of those deposits are above the $250,000 FDIC limit. And that’s why everyone started to lose their minds.

Companies holding more than $250,000 with SVB were worried they won't be able to access their cash until a future date. And this was definitely problematic as it could have led to liquidations of business assets to pay creditors, bankruptcies, and job losses.

One company defaulting on its liabilities leads to a chain of events, and you can have widespread losses and contagion in no time 🌪

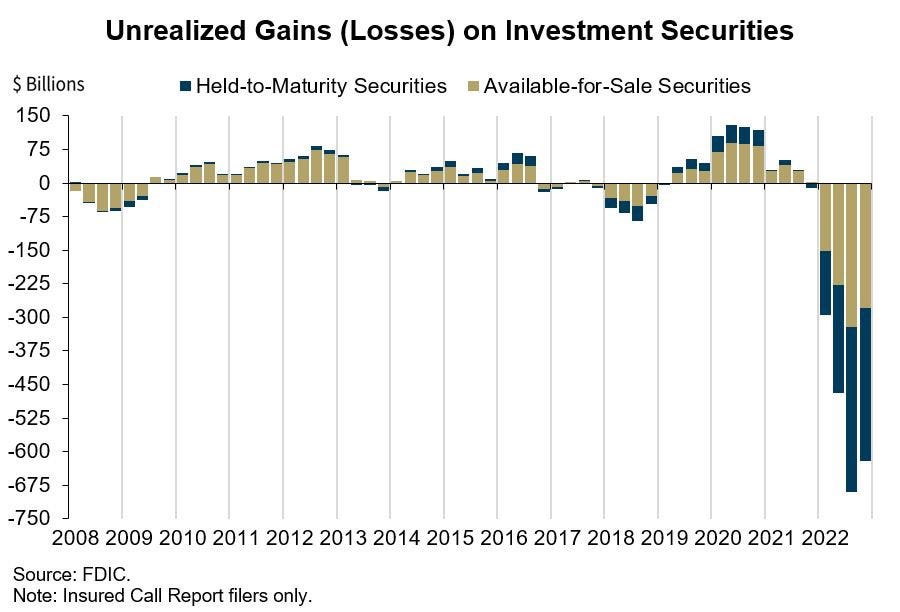

The second reason why the SVB’s collapse got a lot of people in panic mode was because this situation wasn’t unique to SVB only. The US banking industry has $620 billion of unrealized losses on securities holdings due to rising interest rates, according to the Federal Deposit Insurance Corporation. That’s a lot.

That’s exactly why the decline of SVB's share prices led to contagion among other financial stocks, with the four biggest US banks - JPMorgan, Citigroup, Wells Fargo, and Bank of America - losing $47 billion of market value in just Thursday trading last week. Furthermore, the KBW Nasdaq Bank Index notched its biggest decline since the pandemic roiled the markets nearly 3 years ago. Ouch.

Why not worry 😌

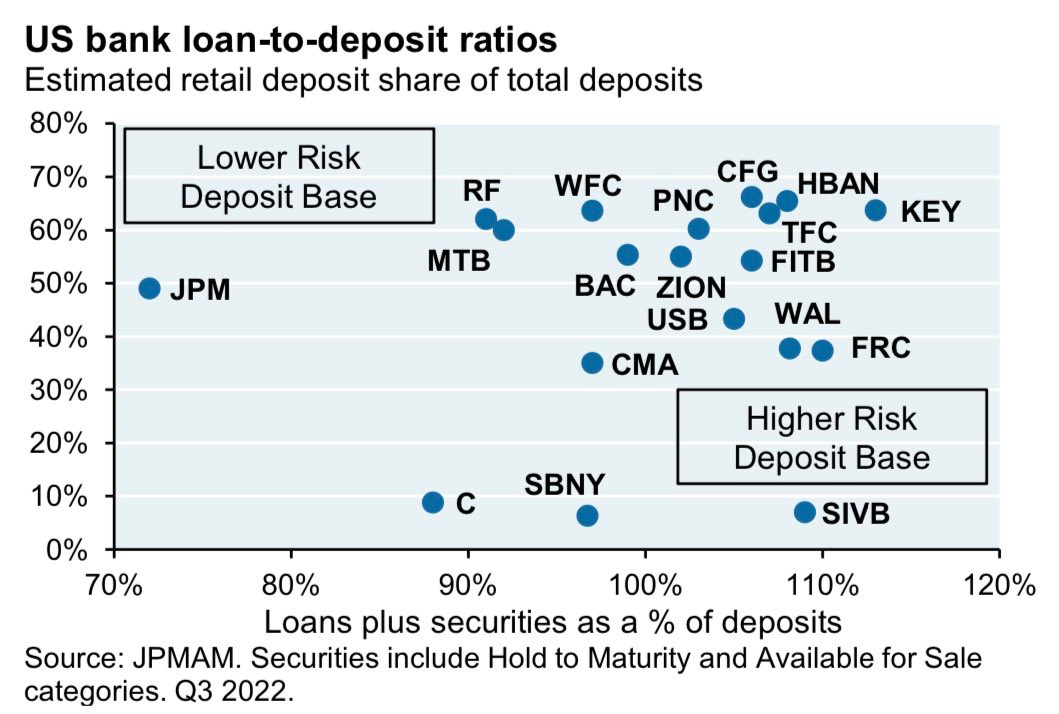

First, SVB was quite an outlier, and the key difference was in its business model. The bank had very few retail deposits, barely any branches, heavily relied on corporate accounts, and was the buyer not the originator of mortgages.

Hence, this run was more about the humans than the data. And the data rarely lies! That said, this helps to clarify who could be next 👀

In case you missed it, that’s exactly what happened. Just yesterday, state regulators closed New York-based Signature Bank, marking the third-largest failure in US banking history. This happened just two days after authorities shuttered Silicon Valley Bank in a collapse that stranded billions in deposits.

Furthermore, let’s briefly talk about The Federal Deposit Insurance Corporation aka FDIC. In case you aren’t aware, it’s a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. Although FDIC guarantees just $250,000 as deposit insurance, the Federal Reserve is able to extend liquidity to FDIC to meet its obligations. More importantly, the whole point of the FDIC is that your money is backed by the full faith & credit of a standing government that has existed for 200+ years. That’s why trust matters in finance a lot.

Finally, let’s remember that there have been 562 bank failures in the US since 2001. The FDIC has a browsable database of them all on its website:

In virtually every case, depositors were made whole by the acquiring bank in deals brokered by the FDIC. Hence, while this was presented as the beginning of an end by VCs and some other prominent investors, it probably was just another day for the FDIC.

The good ending ✅

In all this mess, US regulators have made the right decision which was announced later yesterday. The Biden administration has announced that customers of Silicon Valley Bank will have full access to their deposits fearing that the bank's collapse could lead to greater panic. Hence, SVB depositors will have access to all of their money on Monday, all depositors will be made whole while the Fed will make available additional funding to eligible depository institutions (see the above point again). In other words, the Fed is prepared to use its full range of tools to support households and businesses.

In the United Kingdom, meanwhile, the British Treasury and the Bank of England announced early Monday that they had facilitated the sale of Silicon Valley Bank UK to HSBC, Europe's biggest bank, The Associated Press reported.

Looking ahead 👀

In conclusion, the case of Silicon Valley Bank serves as a brilliant cautionary tale for banks, investors, and startups per se. SVB’s aggressive pursuit of higher yields through a complex and risky securities portfolio left it vulnerable to interest rate shocks and deposit outflows.

More importantly, the bank's management team and board members failed to recognize the risks and take appropriate action in a timely manner (remember that their Chief Administrative Officer was the CFO of Lehman Brothers before its collapse and it didn’t have a Chief Risk Officer for ~1 year), leading to significant losses and a loss of confidence among depositors.

Zooming out, the current contagion is another consequence of the Federal Reserve’s aggressive campaign to control inflation. Rising interest rates have caused the value of existing bonds with lower payouts to fall in value, which effectively led banks to sit on giant unrealized losses.

But how we really ended up here? Yet, the most important question is now this - who really caused the failure of the Startup Bank? The answer is very simple - The Fed. As Michael Green has put it out yesterday, by hiking rates in a totally unprecedented manner less than a year after guaranteeing market participants that they were not going to hike rates until 2024, the Fed created conditions that effectively led to the collapse of the second-largest bank in US history.

The crazy part? It’s not an opinion - it’s a fact. US Treasury Secretary Janet Yellen just admitted it. SVB’s issues weren’t due to banking tech. SVB’s issues were due to buying Treasuries:

That said, it seems that problems in the US banking system aren’t over. Quite the opposite - they might only be getting started. The only good thing now is that there’s some more time to prepare.

So don’t throw your popcorn away just yet 🍿 We might have a sequel very soon 📺

—

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

I appreciate your newsletter - thank you for this accessible rundown! Have a great day!