Doomed to fail? Revolut goes live in Brazil 🇧🇷; ChatGPT is now outperforming investment funds 😳; Coinbase goes international 🌍

FinTech is Eating the World, 2 May

Hey Everyone,

Good morning! Today’s issue is the best one yet 😎 We’re looking at Revolut going live in Brazil (what’s the rationale behind & why I don’t think it will succeed there + deep dives into Revolut), ChatGPT which is now outperforming investment funds (this is just the beginning + 4 more reads on AI + Finance), and Coinbase going internationally (what’s the risk here?). Let’s jump straight into the hot stuff 🌶

Doomed to fail? Revolut goes live in Brazil 🇧🇷

The launch 🚀 British challenger bank and super app wannabe Revolut has launched in its first country in Latin America, offering a multi-currency account and crypto investments in Brazil, Altfi reported.

We can remember that back in March last year, the neobank made its first steps into the region after hiring Glauber Mota as its Brazil business's CEO and opening a waitlist. This waitlist will now be expanded with existing names being added in a phased rollout.

Why Brazil? 🇧🇷 Brazil is LatAm’s largest market for financial services, a key corridor for the large remittances market, as well as an increasingly digital population. Back in 2021, research indicated it came out on top in adults using an app-only bank, with just over 32%. That’s a lot!

Following the launch, Revolut's global account is not offering locals foreign exchange and remittance capabilities in 27 currencies, in addition to having a card that is accepted in more than 150 countries.

Brazil is an exciting market for Revolut and holds enormous potential for our global expansion. Our mission is to unlock a borderless economy with financial products that are accessible and easy to use and that allow our customers to use their money efficiently. We will start with the global account and crypto investments, but this is just the beginning.

(Nik Storonsky, co-founder and CEO of Revolut).

✈️ THE TAKEAWAY

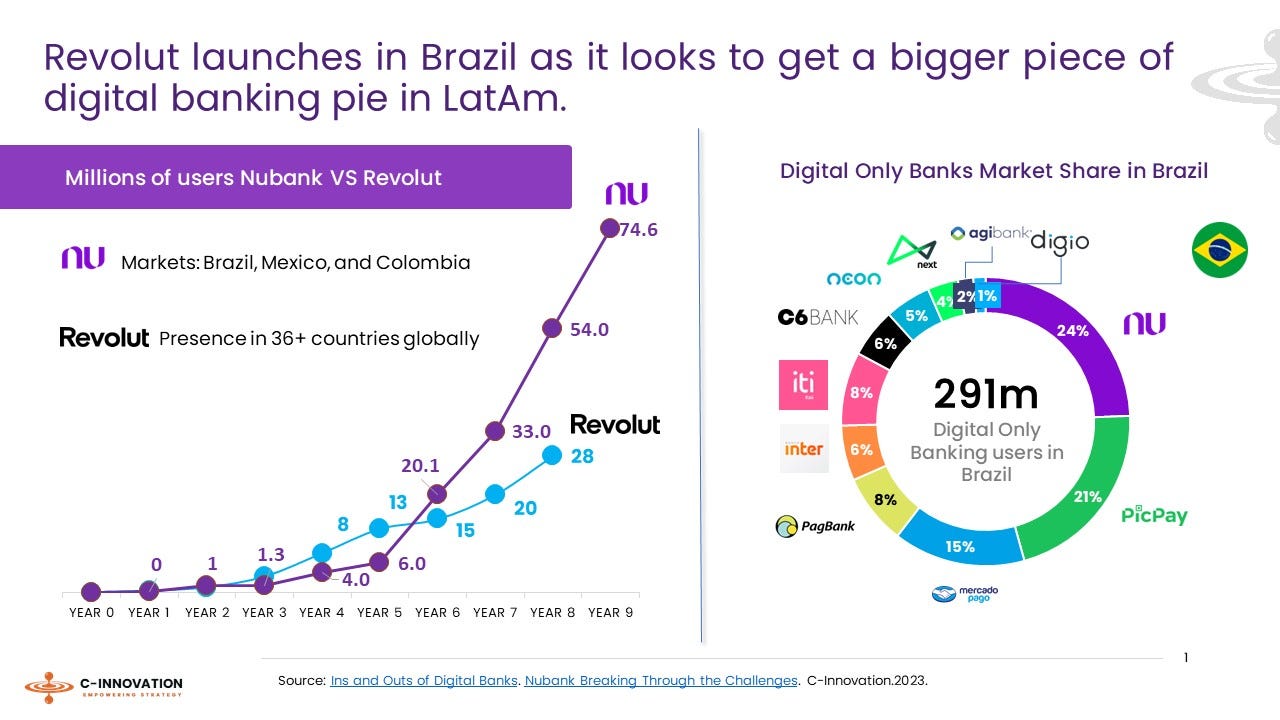

Seems impossible 😶🌫️ Revolut is entering a thriving FinTech arena in Latin America's largest market, joining local giants such as Nubank, Neon, Ebanx, C6, and Creditas. Nubank will obviously be the biggest headache for Revolut trying to make a difference in Brazil and later - in Mexico and/or Colombia.

With over 80M customers, a first-mover advantage, a super-strong brand, and local know-how, Nu NU 0.00%↑ will be a nearly impossible nut to crack for Revolut. Not to mention the fact that no foreign challenger has made it big in LatAm. On the other hand, it’s pretty clear why Revolut is doing what it’s doing right now. In its core markets (UK & Europe) the growth has probably plateaued, hence, FinTech is looking for new areas of growth, hence, aggressive plans for LatAm, India, and the US. More importantly, it also has to justify its $33 billion valuation somehow (it doesn't make any sense, by the way!) 🤷♂️ Thus, this Revolut’s endeavor seems to be doomed to fail right from the start… But time will show us really who’s who.