There’s no way Revolut is worth $33B now 🙅🏽♂️; Shotgun wedding: UBS buys Credit Suisse for $3.2 billion 🤯; Bitcoin to hit $1 million in 3 months? 👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

FinTech giant Block tanks on the attack from short-seller Hindenburg 😳

The inverse relationship between economic stability and BNPL 📈

As for today, here are the 3 FinTech stories that were directly changing the world as we know it. This week was undoubtedly the most important week in Finance and FinTech since 2008, so make sure to check all the above stories.

There’s no way Revolut is worth $33B now 🙅🏽♂️

The news 🗞 Sifted recently asked whether Revolut is really worth $33B right now? (and did a very good writeup too). I already have an answer to that - there’s no way Revolut is worth $33 billion.

Let’s take a look and learn why.

The macro 📊 Let’s look at the macro environment first. As you all know, it’s not great. But let’s talk numbers.

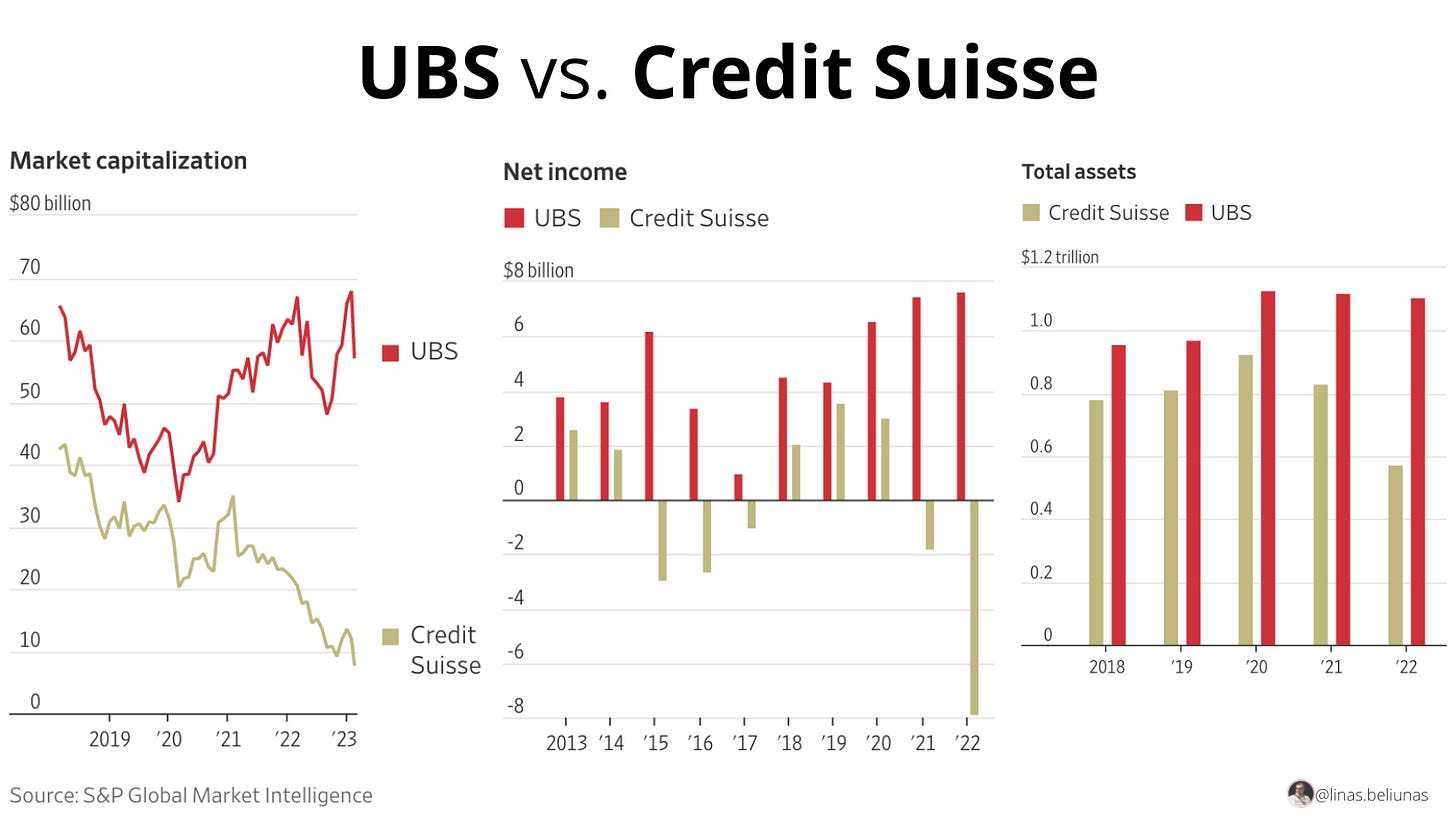

The biggest and most important deal that just took place was UBS acquiring its biggest rival Credit Suisse for $3.2 billion. Yes, it was a shotgun wedding that otherwise wouldn’t be deemed possible, yes CS 0.00%↑ has been struggling for years and was going from scandal to scandal. But there’s no way Revolut is worth 10X Credit Suisse, a bank with a 167-year-old brand, offices at premier locations around the world that alone are worth at least $1 billion, and $0.5 trillion of assets under management.

Let’s look at FinTechs now.

The most recent and biggest development here came from Stripe which raised $6.5 billion and almost halved its valuation from 2 years ago. It’s now valued at $50 billion. There’s no way one of the most important FinTechs in the Internet Era (with massive reach, scale, and projecting $1T in TPV in 2023) sees a ~50% correction and Revolut doesn’t. The same, by the way, goes for Adyen that’s currently worth similar to Stripe. No way!

P.S. Adyen is the fastest-growing global payments platform 🚀 [deep dive + 2 more reads]

An identical story is with other crown jewels of Europen FinTech. Back in December, payments FinTech Checkout.com had slashed its internal valuation to $11 billion. Less than a year ago, it was Europe’s most valuable FinTech with a whopping $40 billion valuation. Obviously, the craziest of them all is Klarna. In July 2022, the BNPL giant raised $800M and its valuation plunged by a whopping 85%. Less than a year ago it was Europe’s most valuable FinTech with a $46 billion price tag. Hence, there’s no way that the two “hottest” FinTechs in Europe are getting corrections of 72-85% while Revolut doesn’t move.

And it’s not only me who thinks this way. According to Sifted, one of the world’s leading secondary brokers, Setter Capital, has Revolut holdings listed at a discount of more than 50%. Also, a number of Revolut’s existing shareholders reportedly have already marked it down internally.

Let’s look at more numbers and context and see why the $33B price tag for Revolut just doesn’t add up.

P.S. below you will also find deep dives into Revolut’s latest financials (very spicy!), and very detailed dives into Monzo, Klarna, Nubank, and PayPal.

Valuations in perspective 💸 First and foremost, Revolut is a challenger bank. At least that's how it started. So let’s take a look at how it compares to its European peers.

With over 28 million global retail customers, it by far trumps Monzo (7M) and Starling (3.5M), which are Revolut’s biggest competitors in the UK, its home market. Yet, what’s important here is that Revolut doesn’t have a banking license while both Monzo and Starling do.

Bonus: The Monzo Pivot, or how challenger bank transformed itself in just 2 years 🚀

But Revolut is more than just a neobank. In fact, it’s striving to become a global Super App. So let’s see how its valuation compares to other European FinTechs.

It’s clear that the British FinTech star is far ahead of Rapyd, Checkout.com, and SumUp. Although all of them have EMI licenses, they are mostly payment companies and hence are closer to Stripe than Revolut. But what stands out here is Klarna. It has over 150 million customers globally, is the closest to a Super App in Europe than any other FinTech out there and yet is worth only $6.7 billion. Hence, there’s no way we can justify Revolut’s $33B price tag.

Bonus: Klarna just lost $1 billion. But it's not bad! 🤑 [& what many people don’t understand about Klarna]

So what do we have left? Banks! At $33B, Revolut’s valuation is more akin to the incumbent UK retail banks, the same banks it was aiming to disrupt when it started out. According to Sifted, its valuation is third only to HSBC and Lloyds in the UK. But there’s a slight problem — it’s not able to lend or accrue interest on deposits. Because it doesn’t have a bank license (in the UK, while in EEA it has a license out of the Bank of Lithuania).

Oh, and HSBC reported a $17.5B profit in its last financial results while Revolut’s stood at $48M in its latest (for 2021). And even those numbers were heavily questioned by the auditors… 😬

Remember: Revolut revenue drama 🎭 [red flags, things that don’t add up & why it’s a big deal]

Show me the multiples 🤑 Finally, let’s look at the multiples. They will tell us all you need to know.

I'd argue that Revolut’s closest competitor is probably Nubank NU 0.00%↑. Although it's LatAm-based (on the other hand, Revolut is also primarily a European play), Nu has over 70 million customers (with a lot of active ones), recently hit profitability and keeps improving it, and yet is only trading at 10x revenue multiple. Revolut is at 43x. That just doesn't make any sense.

More here: The future is purple. Nubank Purple 💜

We can also look at PayPal. Although founded back in 1998, it offers a similar suite of products to Revolut, it's operating globally and also has Super App ambitions. Again, Revolut's revenue multiple is more than 4 times bigger than the payment giant PayPal's. This just doesn't add up.

More here: PayPal's solid results and why it's one of the strongest companies in the digital money space 💸

Finally, HSBC that’s aimed to be disrupted, the closest home rival Monzo, or even a Super App wannabe Klarna are all fairly priced. Revolut isn’t and the gap is just nuts.

✈️ THE TAKEAWAY

So what does this tell us? 🤔 Although Revolut is a FinTech that’s not easy to evaluate, one thing is very clear - there’s no way it’s currently worth $33 billion. As you saw in the analysis above, the current price tag just doesn’t stack up against either its peers or other similar companies. Hence, I’m pretty confident we should see a solid correlation (30-50%) if Revolut raises anytime soon.

Shotgun wedding: UBS buys Credit Suisse for $3.2 billion 🤯

A lot can happen over a weekend 😳 IT finally happened. UBS UBS 0.00%↑ agreed to take over its longtime rival Credit Suisse for more than $3 billion marking the biggest banking deal in years as regulators were eager to halt a dangerous decline in confidence in the global banking system.

Credit Suisse ended Friday with a market value of around $8 billion. This means that its biggest rival is valuing its equity at a whopping 62% discount 😳 A lot can happen over a weekend…

A refresher ♻️ For the perspective, back in 2007, Switzerland's second-biggest bank had a market cap of over $90 billion and was even bigger than Apple.

Initially, Credit Suisse was offered $1 billion and has obviously pushed back as it believed the offer was too low and it would hurt shareholders and employees who have deferred stock. Then the offer was increased to $2 billion while the final price tag was agreed to be at over $3 billion. Still a solid discount! 👀

Now comes the crazy part.

Swiss authorities had to change the country’s laws to bypass the usual 6-week shareholder vote on the transaction as they rushed to finalize a deal before Monday.

It's a classical example of a shotgun wedding, and it just shows how bad the situation is.

More on this 👉 The deal between the two Swiss finance giants is the first megamerger of systemically important global banks since the 2008 financial crisis.

As part of the deal, the Swiss government will also provide more than $9 billion to backstop some losses that UBS may incur by taking over Credit Suisse. The Swiss National Bank also provided more than $100 billion of liquidity to UBS to help facilitate the deal.

Swiss authorities were under massive pressure to make the deal happen before Asian markets opened for the week since a regulator-led winddown of Credit Suisse could have proven more prolonged and painful for the financial system. First the Europan one, then - the global one. And nobody wanted that.

By the way, here’s something interesting: UBS calls this deal an “acquisition” while Credit Suisse calls it a “merger” 🤷♂️

✈️ THE TAKEAWAY

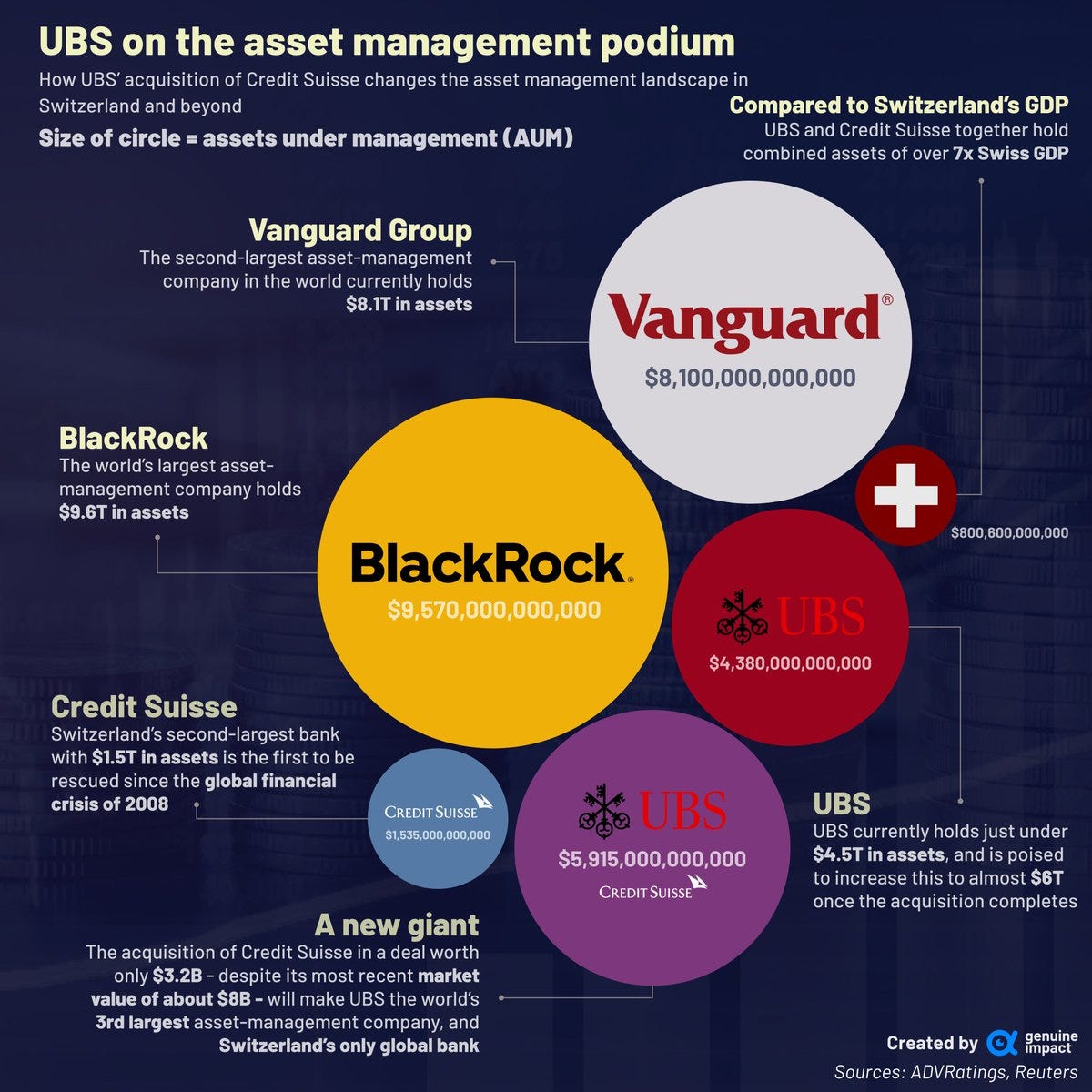

Now what? 🤔 Let’s be clear - a forced marriage of the two titans of Swiss banking was something UBS had never wanted. Yet, it happened and potentially stopped the banking contagion that was initiated by the collapse of Silicon Valley Bank. So who are the winners and losers? The most obvious and biggest winner in all of this will definitely be UBS. Credit Suisse had a $0.5 trillion balance sheet and around 50,000 employees at the end of 2022. After swallowing Credit Suisse, UBS’s balance sheet will hence rival Goldman Sachs Group and Deutsche Bank in asset size. That’s solid!

And that’s it. Now come the losers, and there are quite a few of them. First comes the shareholders - the biggest one is Saudi National Bank (SNB) which already lost $1.5 billion in the last 15 weeks alone. Then, there are AT1 bondholders as all of them have been written to zero in the deal. We must note that the total write-down marked the biggest loss yet for Europe’s $275 billion AT1 market. Finally, regulators lost here too. Finma became the first financial regulator to watch a bank considered systemically important have to be rescued since the financial crisis. The most crucial question then becomes will it be the last one?

Go deeper & discover more here: History in the making: UBS could acquire Credit Suisse 🤯🇨🇭[+2 more deeper dives]

Bitcoin to hit $1 million in 3 months? 👀

The surge 🫡 Bitcoin's price has soared by 28% in the past week, surpassing $28,500, despite the banking crisis causing instability in the global markets.

More on this 👉 This rise in value has outperformed major altcoins, indicating Bitcoin's overall dominance. Some analysts believe this rally is unique because Bitcoin is now serving as a safe haven asset, responding to the instability of the traditional banking system and unpredictable central bank monetary policy.

Meanwhile, regulators are grappling with growing panic about the financial sector as Credit Suisse is being acquired by UBS in a cut-price deal to prevent further contagion 🤷♂️

When $1M? 😎 Here comes the fun part. Former Coinbase COIN 0.00%↑ CTO Balaji Srinivasan predicted on Friday that bitcoin's value would soar to $1 million in just a matter of 3 months, driven by a rapid depreciation of the U.S. dollar 👀

To put his money where his mouth is, Srinivasan placed a $1 million bet with Twitter commentator James Medlock and another unidentified individual, promising to pay each $1 million in Circle's USDC stablecoin if bitcoin fails to achieve the price level.

Why? Well, Srinivasan anticipates that the U.S. dollar will experience rapid hyperinflation, leading the global economy to adopt bitcoin as a digital gold standard 👀

✈️ THE TAKEAWAY

Moon soon? 🌝 While nobody knows what can happen in the future, this bet seems pretty unrealistic, at least in the given timeline. The current crypto rally is due to a reset in the risk profile of assets. Sure, uninsured deposits of cash are no longer seen as the safe haven they once were, but it’s naive to believe that everyone would park their deposits in BTC just instantly (that should drive the demand and price of BTC quite a bit). Also, we have to remember that Balaji has a lot of BTC in his possession, so there’s a huge self-interest and benefit for the BTC price to rise (pretty much like every Bitcoin maxi out there). Zooming out, we must say that Srinivasan is not the only person to predict a $1 million bitcoin price. Cathie Wood's ARK Invest has projected that bitcoin could exceed $1 million, but the firm predicts this to happen by 2030. Which makes much more sense. Oh, and recently introduced Bard, Google’s AI chatbot, gives a 10% probability for Balaji's bet working out:

🔎 What else I’m watching

Amazon & Payments 👋 Fast food giant Panera Bread is piloting palm reading technology from Amazon AMZN 0.00%↑ that lets customers pay and access the chain's loyalty programme. The bakery-café is testing the Amazon One technology at two of its 2100 locations, with more to follow in the coming months. Customers that choose to enroll in Amazon One and link their MyPanera account hover their palm over the Amazon One device to make payments and access the MyPanera loyalty programme, which has 52 million members. Amazon says its tech addresses a major pain point for the restaurant and retail industries: customers sometimes choose to skip loyalty programmes because they prefer to get in and out with their purchase, rather than deal with the sign-up and redemption processes. Reread this: Amazon is now in the payments business too. And it could be huge 🤯

It’s a bargain! 👀 Ziglu, a UK-based cryptocurrency business that once commanded a $170M price tag, is looking to raise £2M to stay afloat at a massively discounted £10M valuation. FCA-approved Ziglu lets Brits buy and sell eleven cryptocurrencies, earn yield via its ‘Boost’ products, pay using a debit card, and move and spend money. We can remember that last year, the company was on the verge of securing a $170M sale to Robinhood HOOD 0.00%↑. But with market valuations plunging across the sector, Robinhood returned with a watered-down $60M offer, leading to the abandonment of the deal and the ultimate resignation of founder Mark Hipperson. Remember: Tinder date doesn't guarantee a relationship: Robinhood kisses goodbye to Ziglu 😢

💸 Following the Money

API-first embedded finance workflows startup Monite has raised another $5M, doubling its seed funding round to $10M.

Parker, a startup offering a corporate credit card for e-commerce businesses, has launched with $157M in equity and debt funding, much of which closed in 2022.

Kredivo, which offers BNPL and credit services to underbanked consumers in Indonesia and Vietnam, has raised $270M in a Series D funding round led by Japan's Mizuho Bank.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: